It’s Not the Size of the Gift. It’s the Cost!

Written by David Nahass, Financial Editor

David Nahass, Railway Age Financial Editor

FINANCIAL EDGE, RAILWAY AGE DECEMBER 2023 ISSUE: Everyone’s Holidays are costing more in 2023. Heck, everything costs more in 2023. After three years of rising prices, it is taxing. “Financial Edge” has spilled plenty of ink regarding rising railcar costs. If some is good, perhaps more is, well, maybe not better but necessary.

Unlike today, in 1986 the Congress was able to pass legislation without resorting to Queensbury Rules or without representatives threatening to walk out or retire early protesting poor behavior. Under the Reagan Presidency, Congress passed the Tax Reform Act of 1986. For users and consumers of rail equipment, it was a foundational change in the tax law. The 1986 Act implemented the current form of tax depreciation used (or able to be used) by all owners of rail (and other equipment): the Modified Accelerated Cost Recovery System (MACRS). Rail Equipment (railcars and locomotives) are depreciated using what is known as seven-year MACRS (which is really eight years).

MACRS depreciation quickly became a value driver for investors in rail equipment. Tax depreciation is used to shelter taxable income from the IRS. This is registered on a tax return. (Tax depreciation should never be confused with book depreciation, which is registered on a company’s balance sheet.) Asset owners and investors are all able to, and have benefitted from, passing the value of that income tax deduction onto end users of equipment. Best of all, every time a railcar changes hands the depreciation clock resets itself, so an asset can be depreciated under the MACRS system numerous times.

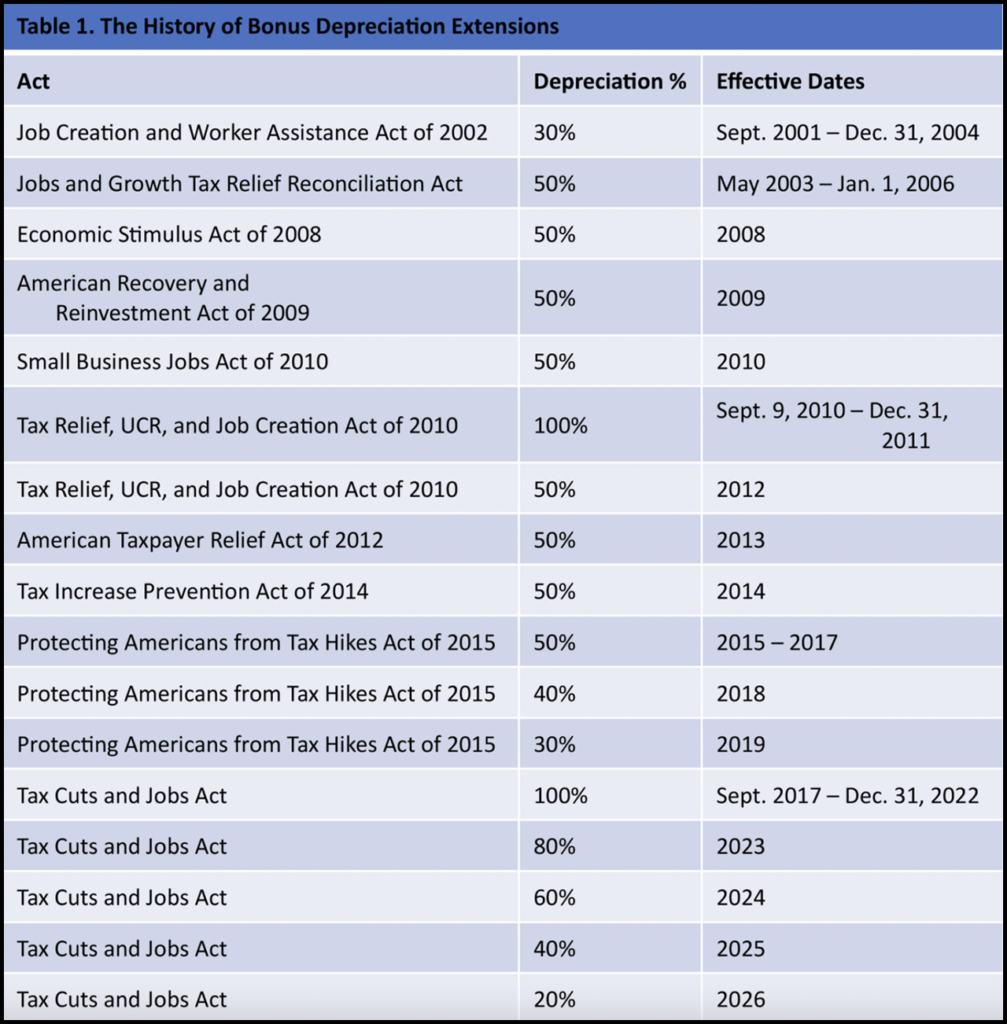

Fast forward to 2001. After the horror of Sept. 11, in early 2002 Congress passed the Job Creation and Worker Assistance Act of 2002. This began a lengthy period of what is known as “Bonus Depreciation” (BD). In addition to the MACRS depreciation already allocated to an asset, asset owners were able to depreciate a larger percentage of the equipment value in the first year of ownership (the Bonus).

BD has been a part of the landscape of equipment ownership since 2001. (See the table above for a history.) The challenge of BD has been, and continues to be, that asset owners are not always able to realize the value associated with the depreciation, and it goes unused or unvalued.

Why the history lesson? Starting in 2024, BD is heading to a tapering kind of close. But that is only part of the issue. What has happened is that the depreciation (both MACRS and BD), once a key impact factor in lowering lease costs to end users of rail equipment (railroad and shipper), is no longer being effectively monetized and passed through to the intended beneficiaries.

In this era of higher interest rates and inflation, this loss is one contributing factor to the increase in lease rates that are likely to remain in place for years to come.

Why has the value of MACRS and BD disappeared? Several key reasons:

- Private equity investors (significant investors in rail equipment in recent years) are not taxpayers in the traditional sense.

- Banking industry woes combined with rising interest rates have made many banks unable to consume the depreciation benefit.

- Companies are no longer placing a value on tax depreciation.

BD has been around for so long that it has become a yawn of a value driver. One key reason is in the Tax Cuts and Jobs Act of 2017, allowing investors to apply bonus depreciation to both new and used property. Prior to this, bonus was for new equipment. Essentially, every time a rail asset changes hands, BD is available. By creating so much BD, the 2017 Act devalued the benefit.

Fact: The value of BD or stand-alone MACRS, once it stops being passed along to the customer, will get consumed elsewhere in the financial food chain. At that consumption point, it will benefit whoever is capable and able to use it. In an inflationary world, prices generally come down slower than they go up. As BD tapers out of existence, don’t expect the value of MACRS to be passed through effectively in the future.

Happy Holidays! Remember it’s not the size of the gift. It’s the cost!

Got questions? Set them free at [email protected].