Interest Rates, Recession Fears and Railroads

Written by Dr. William Huneke, Consulting Economist

Interest rates and Federal Reserve policy are prominent in the financial headlines. So, I have been looking at interest rates and possible impacts on railroad finances. I also looked at interest rates and the economy in general. Do interest rates have a material impact on railroad finances: Yes, but not as materially as they do for banks.

What is an interest rate? It is the investor’s compensation for waiting. Say, for example, the investor provides funds to a government or company by buying that entity’s bond. The bond may be to fund a private investment or meet current expenses. The company or government entity returns those funds with a bonus payment, the interest rate, which compensates the investor for waiting for the return of their money.

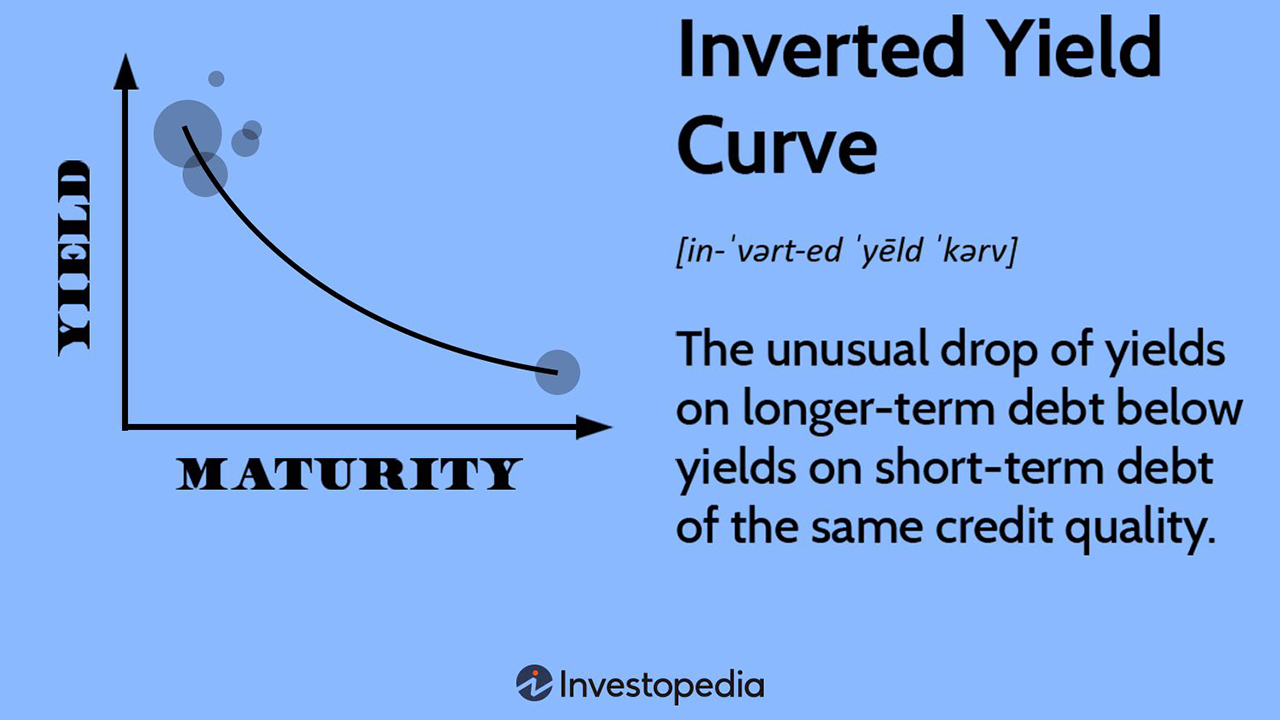

Normally, the longer the term of the bond, the higher the compensation rate. Most investors prefer to get their money back sooner. A longer time period can mean more things can go wrong, i.e., there’s more risk. That is why a normal yield curve is upward sloping.

Today, many firms have debt instruments coming due, for which they face substantially higher interest rates. Railroads, however, because they throw off so much cash (consider stock buybacks and dividend increases) and have balance sheets comprised largely of equity, are probably largely immune from a cash crunch—unlike what crushed some banks recently.

Banking is a more highly leveraged industry than railroading. A large part of bank earnings comes from the spread on their earnings on commercial and residential loans and the cost of their debt payments. Their capital ratio (debt to total assets) is generally more than 80%. Rising interest rates can stress bank earnings and reduce the value of any bonds or mortgages they hold in their portfolio. That can cause a banking crisis and lead to a serious recession like what developed in 2008.

The railroads’ capital structure is the opposite of banks: Railroads have more than 80% equity. I reviewed BNSF’s 2022 R-1 and found it has about a $9 billion cash flow after taxes and spent $3.5 billion on investment. BNSF is a cash machine. I do not see it getting crushed anytime soon by commercial paper rates.

However, interest rates do affect important aspects of railroading, much like railcar lease rates, as pointed out in the Railroad Financial Desk Book, in the October 2023 issue of Railway Age: “Using some loose estimates, a 1% [point] increase in interest rates on a railcar of $100 per car per month … [In October 2021] when the 10-year Treasury was about 1.5% [means] a typical railcar lease could be $300 [higher now] per car per month for each month of your lease.” (“Supply Inelasticity,” p. 12.) Except for coal cars, the author reports monthly car leases in high 3 figures to 4 figures. $300 is a significant change.

Besides initiating a banking crisis, higher interest rates can negatively impact housing, which often can bring on a recession. The Federal Reserve has been increasing short-term interest rates in an effort to reduce inflation and constrain economic activity. This has inverted the yield curve, meaning that instead of an upward sloping yield curve (shorter term rates that are lower than longer term rates), now, shorter term rates are higher than longer term rates. These interest rate moves have left housing sputtering. Rather than an outright decline, housing starts are basically flat. Potential home buyers might want to move but do not like current mortgage rates, so they do not enter the market.

The economy’s prospects are the key driver for BNSF and the other railroads right now, not interest rates. The inverted yield curve used to be a great recession indicator, but it has been inverted for a long time. I’m not sure we know when the next recession might occur. The most recent quarter’s GDP growth of 4.9% represents an impressive continuing expansion.

Maybe housing doldrums are foreshadowing a future of slow growth. Certainly, October rail carloadings were largely flat. The Economist, other pundits and publications have been raising alarms about the developed nations’ voracious appetite for debt. These fiscal demands could use up a lot of capital and constrain future investment for railroads and the private sector. That would mean extending the housing industry’s doldrums more broadly.

Increasing government deficits will mean U.S. Treasury issuance of bonds and notes. Increased bond supply will mean lower bond prices and higher interest rates, which move in the opposite direction of bond prices. Higher interest rates will make it harder for private firms to justify new investments. Slower growth in the long term is the likely result.

While railroads’ capital structure and cash position will protect them from a run on their cash, investors will probably demand that cash gets returned to them in the form of dividends and stock buybacks. Investors would do this because higher interest rates make government bonds more attractive, i.e., they will be inclined to sell their railroad stock and buy government bonds. Higher interest rates will thus constrain railroads’ ability to invest and support future growth from what might have been possible in a lower rate environment.

Dr. William Huneke is the former Director and Chief Economist at the Surface Transportation Board. He has more than 40 years’ experience in economics, transportation, railroad regulatory policy, management consulting, business analysis and teaching in the commercial and government sectors. He provides economic consulting on regulatory and arbitration matters. At the STB, Dr. Huneke led the Board’s analytical work and oversaw the collection of economic and financial data. Since leaving the STB, he has provided economic and litigation support to Class I railroads and other private-sector clients. He worked with the OECD (Organisation for Economic Co-operation and Development) to advise the Mexican government on its future rail regulatory policy. He represented the United States at an OECD conference on railroad industry structure. His private-sector experience included executive and management positions at UUNET, Freddie Mac and the Association of American Railroads. Dr. Huneke has taught graduate business courses at the University of Maryland, Robert H. Smith School of Business. He holds a doctorate from the University of Virginia and a B.A. from Swarthmore College.