Alstom Sells North American ‘Conventional Signaling’ Business to Knorr-Bremse AG

Written by William C. Vantuono, Editor-in-Chief

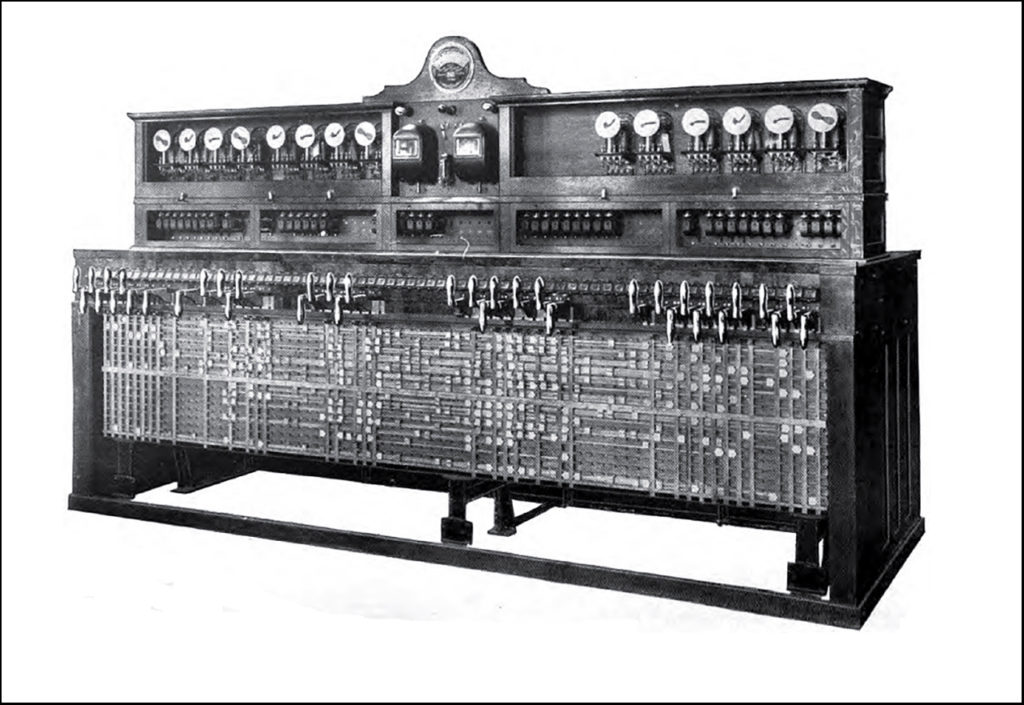

Control box of a restored Alstom Signaling Inc.-predecessor General Railway Signal semaphore signal, Northern Pacific Railway Depot, Washington St. & Railroad Ave, Ritzville, Wash. Photo by Joe Mabel/Wikimedia Commons.

Alstom, in an effort to reduce its debt load and negative cash flow position, on April 19 formalized a binding agreement with Knorr-Bremse AG, parent company of New York Air Brake (NYAB), to sell its Alstom Signaling Inc. North American conventional signaling business for a purchase price of approximately $674.1 million. Alstom said the company’s proceeds at closing, net of expected tax and transaction costs, are expected to reach $664.4 million. Closing of the transaction is subject to customary conditions, including regulatory approval, and is expected to take place as soon as Summer 2024.

Crédit Agricole CIB acted as Alstom’s financial advisor, White & Case LLP as legal advisor, Cleary Gottlieb Steen & Hamilton LLP as antitrust advisor, and Accuracy as financial due diligence provider.

Alstom said the transaction is part of a “comprehensive company action plan” announced Nov. 15, 2023 when the company reported its half-year 2023-2024 results. “Although Alstom achieved [global] sales of $9 billion, a book-to-bill ratio of 1.0, an order backlog of $96.4 billion, adjusted EBIT of $468.7 million and an adjusted net profit of $186.2 million for the first half of 2023-2024, it had negative free cash flow of $1.2 billion,” Railway Age sister publication International Railway Journal Consulting Editor and Associate Publisher David Bringinshaw reported. “This compares with negative free cash flow of just $48.2 million for first-half 2022-2023.”

“The negative free cash flow of Alstom during this first half is a clear call for change,” said Alstom Chairman and CEO Henri Poupart-Lafarge in November. “While demand remains sustained, despite some volatility, our commercial performance has been soft. The Bombardier Transportation integration continues to progress. However, the delivery of the Aventra [electric multiple-unit trainset] program has been more complex than anticipated. Production and sales growth is accelerating. We are undertaking a comprehensive action plan to maintain our investment grade rating and secure our mid-term objectives. Confident in the strength of our backlog and on the solid business foundations of Alstom, I’m fully committed to take up this challenge.”

Bloomberg reported April 15 that, in addition to Knorr-Bremse, Siemens, Wabtec and Fortress Investment Group were among the bidders in the final stage of the auction for Alstom’s North American rail signaling business. “The bidders valued the unit at approximately $600 million,” according to the report. “Alstom CEO Henri Poupart-Lafarge is seeking to raise as much as $1.1 billion from asset sales in an effort to cut the company’s debt load and reduce cash burn, and has said the company also may raise fresh equity to bolster its balance sheet.” As such, Knorr-Bremse, the winning bidder, paid approximately $74 million higher than what Alstom’s business unit was valued at.

The sale to Knorr-Bremse represents a notable shift in the North American C&S market. For Alstom, the transaction concerns only the conventional part of its North American signaling business for railroads and rail transit—wayside color light signals, grade crossing warning devices, interlocking controllers, track circuits, switch machines and other legacy products whose history can be traced back 120 years. Alstom considered this business “a perimeter to be sold,” with revenues of approximately $321 million in FY 2023-2024. Alstom will continue to serve the North American C&S market with next-generation signaling and train control technology—“different segments, notably Communications-Based Train Control (CBTC) and European Train Control System (ETCS) solutions.”

Upon announcing the sale to Knorr-Bremse, Alstom said it will provide the details of its plan to “maintain a solid and sustainable investment grade rating and its $2.14 billion deleveraging target” when it reports its FY 2023/24 full-year results on May 8, 2024. Alstom added the company is “aiming at reinforcing its leadership position in the rail industry.”

For Knorr-Bremse/NYAB, which currently does not offer conventional signaling and train control products, the acquisition represents an opportunity to enter the global rail CCS (control, command and signaling) technology market with “a total addressable rail market volume increase of up to $21.4 billion in the medium term,” the company said. It also “underscores the clear plan for implementing our Group-wide ‘BOOST 2026’ strategy program. With this acquisition, Knorr-Bremse is successfully making an entry into the highly attractive CCS segment of the rail market. Alstom Signaling is a leading company in North America’s CCS market. For the Knorr-Bremse Rail Vehicle Systems division, the acquisition of this profitable business creates new prospects for profitable growth, technological competence and future digital business models.”

Knorr-Bremse remarked that the $674.1 million purchase price “includes a [high double-digit dollar] amount for additional expected and highly profitable project business, which should support revenue growth mid-term. Alstom Signaling in North America attained revenues of about $321 million and an EBIT margin of approximately 16% according to the preliminary results in the past fiscal year that ended on March 31, 2024. The acquisition is to be financed from available liquidity and debt and should not affect our credit rating.”

Knorr Bremse said it “believes the acquisition will be accretive right from the outset. The appeal of the CCS market comes from the market entry barriers, resulting from local approval and technology standards; a focus on safety in operation and availability, and large and continuous shares of the aftermarket. Knorr-Bremse has been intimately familiar with this market-specific environment for decades. This will be significant support for the integration of the company and future business development. Alstom Signaling in North America by far has the largest installed base of signal box technology, train detection, and rail crossings, especially in the freight segment, as well as a very large share of the aftermarket. In the future, Knorr-Bremse will be able to offer a CCS technology platform to operators and system providers in North America under one roof. Simultaneously, the acquisition strengthens the position of our Rail Vehicle Systems division in the digitalization business thanks to access to a large volume of infrastructure data that can be provided to operators as a data service or “software as a service” (SaaS).

“This acquisition is good for Knorr-Bremse and will furtehr drive our profitable growth,” said Knorr-Bremse AG CEO Marc Llistosella. “We are not just building on our highly profitable rail business. Rather, we will also become one of the U.S. market leaders in North America in the rail CCS segment. The transaction pursues a compelling industrial logic and is a very good match for our development and growth path … We are delighted that we will soon welcome new colleagues to the Knorr-Bremse team, too.”

“The acquisition is a significant step in the transformation from a supplier of vehicle systems to a supplier of systems for the entire rail ecosystem,” added Knorr-Bremse AG Executive Board Member Dr. Nicolas Lange, who is responsible for the Rail Vehicle Systems Division. “For Knorr-Bremse, the acquisition of Alstom Signaling in North America means a successful entry to the CCS segment. The CCS market is of approximately $21 billion globally, making it a highly attractive rail segment. For us as an international systems supplier, the transaction is a substantial step forward in electronics and digitalization in rail infrastructure. Brakes and signaling technology have a critical influence on the safety and capacity of rail transportation. The CCS segment fits into the DNA of the Knorr-Bremse Rail Systems Division amazingly.”

Alstom Signaling Inc. History

The company that in its final iteration became Alstom Signaling Inc. in 1998 was established in 1904 as General Railway Signal Company (GRS) in the Rochester, N.Y. area by a merger of Pneumatic Signal Company of Rochester, Taylor Signal Co. of Buffalo, N.Y. and Standard Railroad Signal Company of Arlington, N.J. (a suburb of Newark). In 1923, GRS acquired the Federal Signal Company of Albany, N.Y.

GRS was one of 30 stocks when the Dow Jones Industrial Average was expanded from a 20-stock average on Oct. 1, 1928. It was replaced in the DJIA by Liggett & Myers on July 18, 1930. In 1965, General Signal Corporation (GSX) was created with the intent to diversify into areas outside of railway signaling. GRS became a wholly owned subsidiary of GSX. In 1960, GRS opened General Railway Signal Company de Argentina (GRSA) in Buenos Aires to manufacture, install and provide technical support of GRS railroad signaling systems in that country. Some local railroads equipped with GRSA products were Belgrano Norte, Belgrano Sur, Urquiza and Sarmiento. This facility closed in the early 1980s, though much of the equipment remains installed and active. In 1986, GRS joined with China National Railway Signal & Communication Group Corporation (CRSC) to form Chinese-American Signal Company (CASCO) in Shanghai, China. In 1989, the Italian conglomerate Sasib acquired GRS, which joined the Sasib Railways division. In 1998, Alstom acquired Sasib Railways, and GRS renamed Alstom Signaling Inc.

From its founding in 1904 until 1993, GRS’s main office and manufacturing facilities were located at 801 West Avenue in Rochester. In 1993, the company moved to two new suburban facilities: administration and engineering to Sawgrass Drive in Brighton, N.Y., and manufacturing to John Street in West Henrietta, N.Y.