Intermodal Briefs: Port of LA, FourKites/RCS Logistics

Written by Marybeth Luczak, Executive Editor

Aerial view of the San Pedro Bay Port Complex in California. (Photograph Courtesy of Port of Los Angeles)

The Port of Los Angeles starts 2023 with a 16% drop in TEUs (twenty-foot equivalent units), and expects a “soft” first quarter due to “extended Lunar New Year closures, well-stocked retailers and economic concerns.” Also, FourKites and RCS Logistics team to provide RCS customers with a “one-stop shop” for end-to-end visibility into their shipments across ocean, air, drayage, intermodal and over-the-road (OTR).

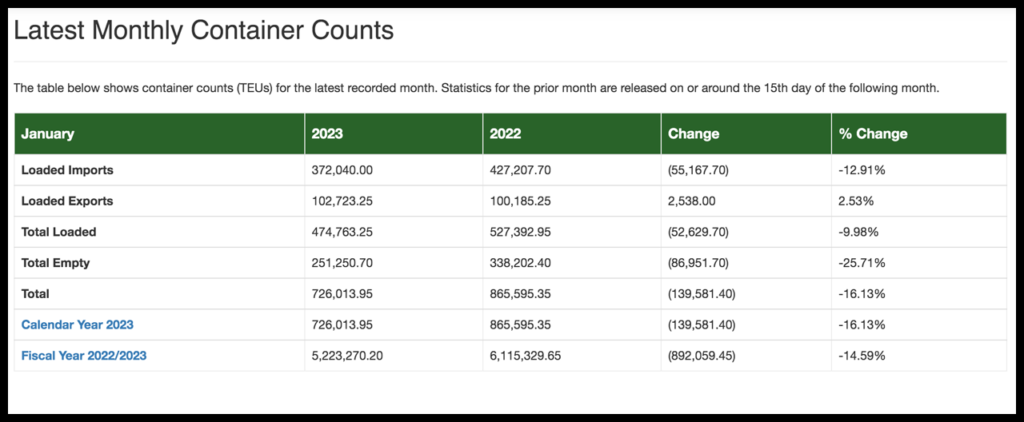

The Port of Los Angeles on Feb. 16 reported moving 726,014 TEUs in January, down 16% from the previous January’s “all-time record.”

For the first month of the year, loaded imports reached 372,040 TEUs, down 13% from the prior-year period. Loaded exports came in at 102,723 TEUs, up 2.5% from 2022. Empty containers landed at 251,251 TEUs, a 26% year-over-year decline, according to the port.

“We expect softer global trade throughout the first quarter, particularly compared to last year’s record-breaking start,” Port of Los Angeles Executive Director Gene Seroka said. “Many factories in Asia have had extended Lunar New Year closures, retailers continue to discount products to clear warehouses, and inflation-led economic concerns remain top of mind for Americans. With capacity on our docks today, we’re ready to unlock new levels of value and service at the Port of Los Angeles.”

Also contributing factors: labor troubles and West Coast congestion. “The International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) are still at a contract stalemate (which also impacts the Port of Los Angeles), and that has benefitted U.S. East and Gulf Coast ports,” wrote Railway Age Editor-in-Chief William C. Vantuono on Feb. 14. “Many shippers, it is believed, do not want to move their cargo back to the West Coast until a new union agreement is signed. As well, cargo moved away from the West Coast because of congestion. That congestion has been mitigated, but traffic has not returned to the West Coast.”

“The factors contributing to volume decline at LA/Long Beach are numerous and complex,” explained Railway Age Contributing Editor Jim Blaze on Feb. 14. “The logisticians that have supported U.S. importers over the past year decided to lower their risks from delayed inbound container cargo by accelerating the pattern change of China-Pacific Ocean to the U.S. West Coast via ships and then via U.S. railroad land-bridge stack trains to instead routing their containers through the Indian Ocean-Suez Canal-Mediterranean Sea-North Atlantic trade lane. Thus, a lot of Chinese cargo bound for the U.S. Midwest and Northeast/Southeast consumption markets now enters the U.S. via the Port of New York & New Jersey or Savannah or Norfolk, instead of LA/Long Beach. The full delivered price to a U.S. importing receiver is about the same, as is total transit time.

“This inbound receipt/distribution pattern is an insurance policy that offsets the disruption seen in LA/Long Beach throughout most of 2022. The impact on the U.S. railroads is a lower volume of containers to move between the West Coast ports and the Chicago/Memphis gateways and then further east. This is affecting Union Pacific and BNSF. Norfolk Southern and CSX might pick up some intermodal container movements between the Atlantic ports and the Ohio Valley/Chicago area. The shifting stack train pattern is not yet fully understood and too early to really measure. Bear in mind, also, that shorter-haul intermodal movements from the East inland are less profitable for railroads than long-distance moves like LA to Chicago.”

FourKites on Feb. 15 reported partnering with RCS Logistics. By leveraging FourKites’ real-time supply chain data, RCS’s internal teams and customers “are benefiting from automated, real-time visibility into the status and location of shipments in transit and at rest, all over the world,” according to FourKites, whose supply chain visibility platform is said to extend “visibility beyond transportation into yards, warehouses, stores and beyond,” and to track more than three million shipments daily across rail, road, ocean, air, parcel and last mile, reaching more than 200 countries and territories.

Since RCS in third-quarter 2022 deployed the FourKites platform, as well as its Dynamic Ocean® system, to track ocean, drayage and OTR shipments, it “has achieved 7x growth in its domestic transport services, while its ocean freight business has grown 12x,” according to FourKites.

Additionally, tracking processes are no longer manual for track-and-trace teams, drayage providers and warehouse staff, and RCS’s data analysts can use FourKites’ advanced analytics for insights into on-time performance, dwell and detention costs, tracking quality, and lane and mode performance, according to the company.