Wabtec: ‘Strong’ 2Q23 Results, Full-Year Guidance Raised

Written by Marybeth Luczak, Executive Editor

“Looking ahead, we’re building momentum, and the pace of our commercial activity across segments and regions is growing,” Rafael Santana said July 27 during a second-quarter 2023 financial report.

Wabtec “delivered another strong quarter” for the three months ending June 30, 2023, with double-digit earnings per share growth, said President and CEO Rafael Santana, who noted during a July 27 financial report that the “orders pipeline is expected to strengthen” in second-half 2023. The company also raised its full-year 2023 guidance.

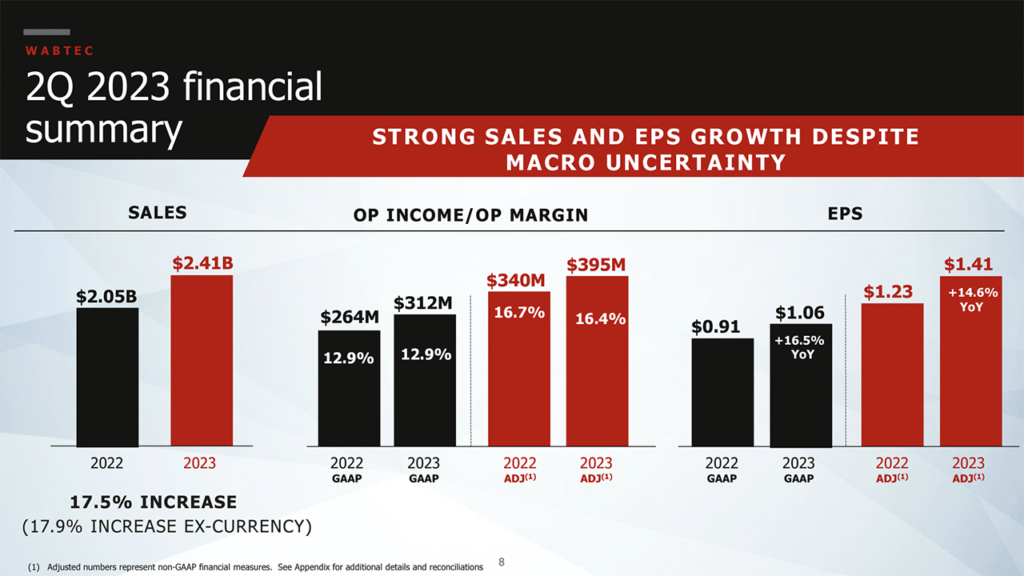

For second-quarter 2023, Wabtec GAAP earnings per diluted share of $1.06 were up 16.5% from second-quarter 2022; adjusted, they were $1.41, up 14.6% from 2022. “GAAP EPS and adjusted EPS increased from the year-ago quarter primarily due to higher sales, partially offset by higher interest expense,” Wabtec reported.

Sales came in at $2.407 billion for the three-months ended June 30, 2023, rising 17.5% from the same quarter in 2022. Among the key drivers, according to Wabtec:

- Equipment: “Higher international locomotives sales.”

- Components: “Higher due to improving OE railcar build and increased demand for industrial products.”

- Digital Intelligence: “Higher demand for next-gen on-board locomotive hardware, KinetiX systems, mining solutions, international PTC and acquisitions (12% year-over-year growth excluding acquisitions).”

- Services: “Increased sales from higher mods deliveries and increased parts sales.”

- Transit: “Strong OE and aftermarket sales; sales up 24.9% on constant currency basis.”

GAAP operating margin for second-quarter 2023 was flat with the prior year at 12.9%, and adjusted operating margin was slightly lower than the prior year at 16.4%, according to Wabtec. The company said both “benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption driven by higher sales, offset by unfavorable mix between and within segments.”

At June 30, 2023, the 12-month backlog was $654 million higher than at June 30, 2022, according to Wabtec, and the multi-year backlog was $796 million lower than June 30, 2022. The company said “excluding foreign currency exchange, the multi-year backlog decreased $965 million, down 4.2%.”

Freight segment sales for second-quarter 2023 were $1.71 billion, up 14.6% from $1.49 billion posted in second-quarter 2022. Sales were “up across all major product lines, with very strong growth in Components, Digital Intelligence and Services,” Wabtec reported. GAAP operating margin and adjusted operating margin, it noted, “benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption, offset by unfavorable mix.”

Transit segment sales for second-quarter 2023 came in at $699 million, a 25.3% increase from the $558 million posted in the same quarter in 2022. Wabtec attributed this to “to strong OE and aftermarket sales.” Additionally, GAAP and adjusted operating margins were up “as a result of lower SG&A expense as a percentage of sales and Integration 2.0 savings,” according to the company.

During the second quarter, Wabtec completed the acquisition of L&M Radiator for $223 million, repurchased $75 million of shares and paid $31 million in dividends.

2023 Outlook

Wabtec reported updating its 2023 financial guidance, with sales expected to be in a range of $9.25 billion to $9.50 billion and adjusted earnings per diluted share to be in a range of $5.50 to $5.80. For full-year 2023, Wabtec said it anticipates cash flow generation with operating cash flow conversion of greater than 90%.

“Looking ahead, we’re building momentum, and the pace of our commercial activity across segments and regions is growing,” Rafael Santana said. “Meanwhile, our orders pipeline is expected to strengthen as we look out to the second half of 2023 and beyond. These factors, among others, gives us confidence to raise our full-year 2023 guidance. Our differentiated portfolio of offerings, expansive global installed base, and multi-year backlog bolsters our resiliency while driving long-term profitable growth for our shareholders.”

The Wabtec website provides more earnings details.

The TD Cowen Insight

“Wabtec reported a top-to-bottom beat to consensus,” TD Cowen Transportation OEM Analyst Matt Elkott said. “It raised FY23 EPS and revenue guidance. Twelve-month backlog was up 4.3% sequentially and up 10% year-over-year (y/y). Total backlog was up 0.4% sequentially, reversing a three-quarter trend of slight sequential declines (down 3.4% y/y). GM was slightly shy of expectations, but OM beat consensus.”

Key TD Cowen Takeaways:

- “2Q23 adjusted EPS of $1.41 was just a penny shy of our estimate but beat consensus of $1.33. Adjusted operating income of $394.7 million compared to our and consensus estimates of $391.9 million and $359.8 million, respectively.”

- “The company raised EPS guidance to $5.50 to $5.80, with a $5.65 midpoint, from a previous guidance range of $5.15 to 5.55, with a $5.35 midpoint (current consensus $5.40; TD Cowen $5.55). It also raised guidance for revenue to $9,250 million to $9,500 million, with a $9,375 million midpoint, from prior guidance of $8,700 million to $9,000 million, with an $8,850 million midpoint (current consensus $8,878 million; TD Cowen $8,849 million).”

- “The backlog remains strong. Twelve-month backlog in second-quarter 2023 was up 4.3% sequentially and up 10% y/y. The total backlog in second-quarter 2023 was up 0.4% sequentially but down 3.4% y/y. However, excluding unfavorable foreign currency exchange it was down 4.2% y/y.”

- “Wabtec noted freight segment sales for the second quarter were up across all major product lines, with very strong growth in Components, Digital Intelligence and Services. Adjusted operating margin benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption, offset by unfavorable mix.”

- “Wabtec noted transit segment sales for the second quarter were up 25.3% due to strong OE and aftermarket sales. Adjusted operating margins were up as a result of lower SG&A expense as a percentage of sales and Integration 2.0 savings.”

Wabtec Labor Update

The 1,400 members of UE Locals 506 and 618 who work for Wabtec in Erie, Pa., have been on strike since June 22. Ahead of Wabtec’s second-quarter 2023 earnings call, UE Local 506 President Scott Slawson released the following statement:

“Our employer, Wabtec, proclaims on its website they are ‘committed to sustainable transportation solutions.’ Yet their actions tell a different story.

“When UE Locals 506 and 618 began negotiations for a new collective bargaining agreement this year, we proposed that the company work with the union and the Environmental Protection Agency to encourage the railroads to purchase green locomotives, the company flat-out refused.

“Instead the company has provoked a lockout/strike among its 1,400 employees in Erie, PA, the most skilled locomotive-building workforce in the world. Our members want to work to build the green locomotives of the future, but our employer refuses to provide family-supporting wages and benefits, or to resolve problems on the shop floor. Our attempts to negotiate solutions to these problems through the collective bargaining process have been met with stonewalling.”