Trinity Set Up for 2H23 Growth, Says Savage

Written by Marybeth Luczak, Executive Editor

Trinity Industries President and CEO Jean Savage

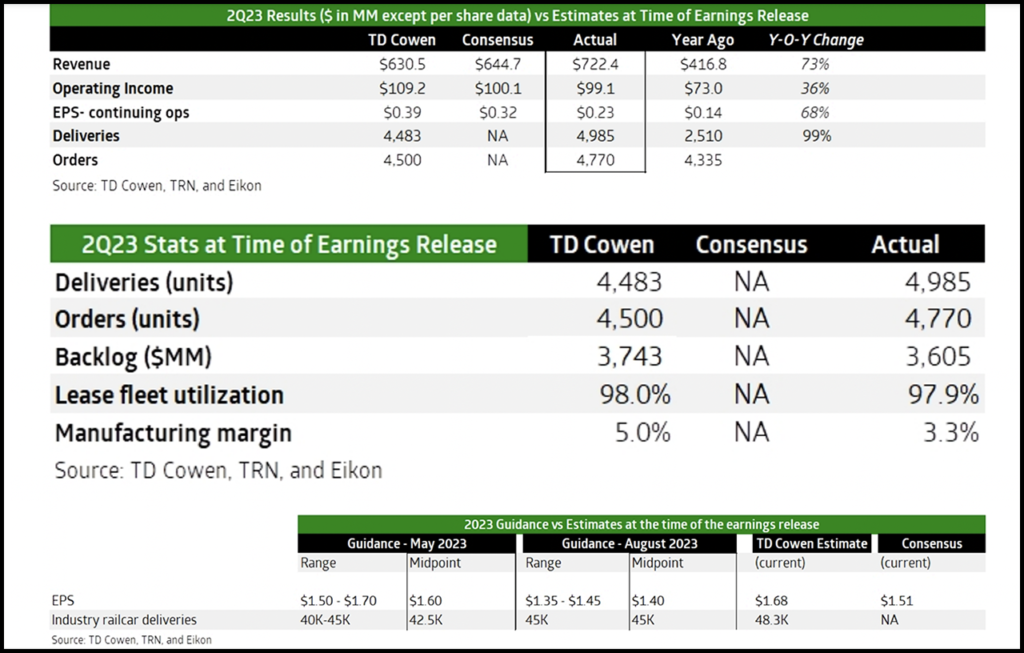

Trinity Industries’ second-quarter 2023 results “reflect a favorable operating environment and significant positive trends in our business,” President and CEO Jean Savage said during an Aug. 1 financial report. “We continue to see rising lease rates that reflect a balanced railcar fleet and railcar orders and deliveries to support replacement level demand, setting Trinity up for growth in the second half of the year.” TD Cowen weighs in.

High revenue and deliveries from Trinity’s Rail Products Group “reflect ramped up production,” reported Savage. “Margins increased year over year, but were negatively impacted by foreign exchange headwinds and, to a lesser extent, labor inefficiencies and higher line changeovers in the quarter. I am pleased with the progress we are making in improving operational performance.”

Trinity reported total company revenues of $722 million for the three months ending June 30, 2023, up 73% from the prior-year period’s $416.8 million. It attributed this to a “higher volume of external deliveries in the Rail Products Group.” Additionally, both quarterly GAAP and adjusted earnings from continuing operations were $0.23 per diluted share for second-quarter 2023. Operating profit was $99.1 million, up 36% from second-quarter 2022’s $73.0 million, reflecting “higher external deliveries in the Rail Products Group and improved lease rates in the Leasing Group, partially offset by increased employee-related and other operating costs,” the company said.

Rail Products Group revenues came in at $709.0 million in second-quarter 2023, rising 65% from $430.6 million in 2022. The company said this reflects a “higher volume of deliveries offset by the mix of railcars sold.” In the three months ending June 30, 2023, the Group delivered 4,985 railcars; received orders for 4,770 railcars, valued at $528.3 million; and had a backlog value of $3.6 billion. This compares with second-quarter 2022’s 2,510 railcars delivered; 4,335 railcars ordered, valued at $524.4 million; and a backlog value of $2.2 billion.

For the Railcar Leasing and Management Services Group, revenues were $223.2 million in second-quarter 2023, up 23% from the prior-year period’s $195.3 million. Lease fleet utilization came in at 97.9% vs. second-quarter 2022’s 97.2%.

“The Future Lease Rate Differential once again remained elevated at 29.5%, and we are seeing the higher lease rates flow through at the segment level, resulting in higher revenues in our Railcar Leasing and Management Services Group, a trend we expect to continue,” Savage said.

2023 Guidance

Looking ahead, Trinity offered the following guidance for the rest of the year:

- Industry deliveries of approximately 45,000 railcars.

- Net investment in the lease fleet of $250 million to $350 million.

- Manufacturing capital expenditures of $40 million to $50 million.

“We expect positive industry trends to continue in the back half of the year, with lease rate growth and consistent railcar deliveries driving up revenue,” Savage concluded. “Additionally, while we expect marked margin improvement in the second half of the year, this will be partially offset by the strength of the Mexican peso, higher interest expense, and slower recovery than expected in efficiency and supply chain. However, we still plan for significant growth year over year, and expect a full year EPS of $1.35 to $1.45.” (The EPS guidance, according to Trinity, excludes items outside of core business operations.)

More quarterly financial details can be found on Trinity Industries Investor Relations site.

TD Cowen Insight: ‘EPA Miss; Guidance Lowered’

“The quarter was an EPS miss compared to our and consensus estimates,” TD Cowen Freight Transportation Equipment Analyst Matt Elkott reported Aug. 1. “EPS guidance for FY23 was lowered to $1.35-$1.45 from previous guidance of $1.50-$1.70. Manufacturing margin was lower than our forecast (our estimate was 5% vs actual 3.3%). Deliveries and orders were solid, both above our estimates. Lease rate indicators remain positive.”