Improving Safety Through Telematics: Railway Age CEO Perspectives on Safety

Conversion of freight shipments from truck to rail, combined with recent developments in innovation, can benefit more than just shippers’ bottom line—and the broader public wins, too. The industry has done an

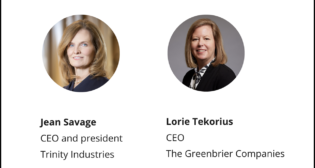

![“We are introducing 2024 EPS annual guidance of $1.30 to $1.50, which reflects improving margins in both our segments [Rail Products Group and Railcar Leasing and Management Services Group],” Trinity Industries President and CEO Jean Savage said on Feb. 22.](https://www.railwayage.com/wp-content/uploads/2024/02/Caterpillar_E_Jean_Savage-315x168.jpg)