Bearing Down on Bearings

Written by Robert H. Cantwell, Contributing Editor

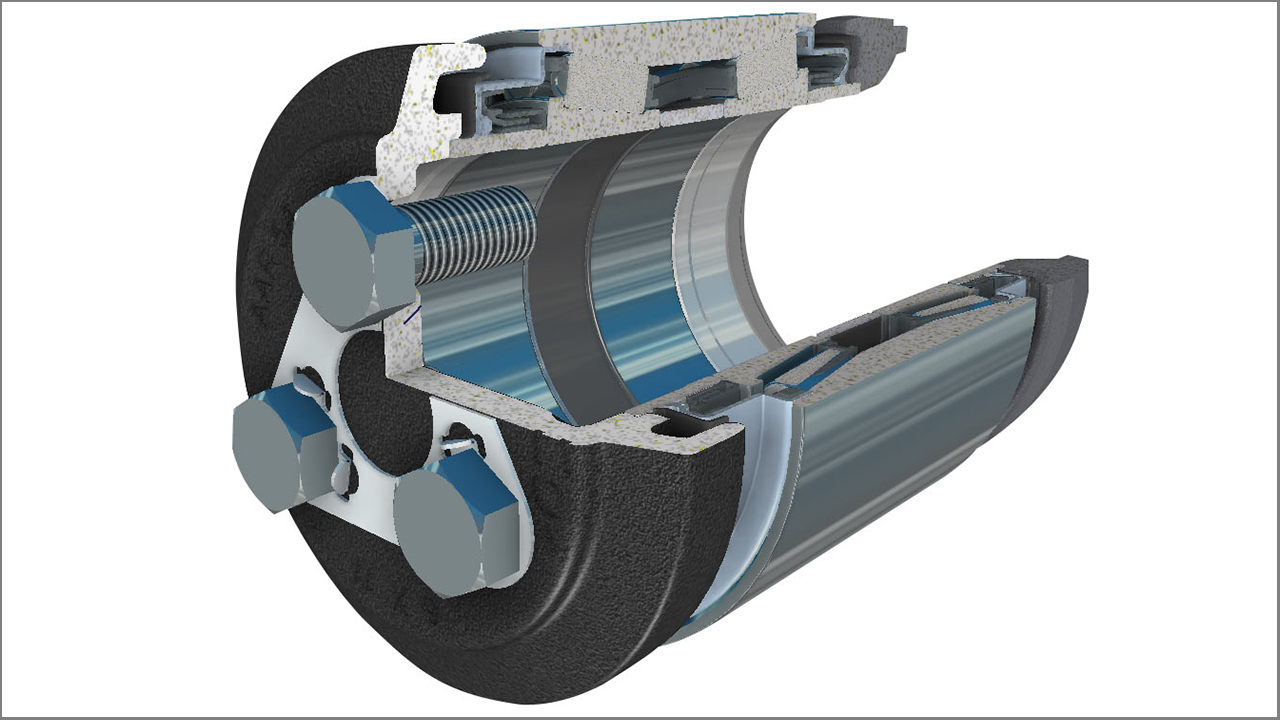

Amsted illustration.

The bearing related derailment that occurred in East Palestine Feb. 3, 2023 on a Norfolk Southern line was tragic in many ways. Following months of investigation, the NTSB held a hearing on June 22, 2023 where a lot of detail on the incident was shared.

Sadly, another overheated bearing-related derailment occurred on Nov. 23, 2023 near Livingston, Ky., on a CSX line. The two accidents are eerily similar: Both failures occurred about 20 miles past a detector that indicated elevated but not actionable temperatures and involved Class F bearings (East Palestine was reconditioned and Livingston likely reconditioned); and both derailments involved hazardous materials that resulted in evacuations.

We also know the East Palestine car’s failed bearing was installed in 2012, and the car had travelled 53,000 miles since then. Importantly, during those 11 years, the car sat idle twice for long periods of time (6 and 18 months). We also have learned through video forensics that the car traveled about 26 miles with the bearing “on fire” while passing through 3 HBDs (hot bearing detectors), the last of which sent a signal to the locomotive cab to stop.

During the NTSB hearing, many issues surrounding bearings and bearing detection were brought to light, including the importance of mileage, bearing age, reconditioning practices, grease condition over time, and the impact of cars sitting idle. Wayside detectors, particularly HBDs and TADS® (Trackside Acoustic Bearing Detection System), were reviewed in detail as well.

The fallout from these derailments has been staggering, both in terms of financial and reputational cost. NS incurred a $1.1 billion write-off related to the East Palestine incident in its fiscal year 2023 earnings and is facing a class action lawsuit, while CSX incurred considerable cleanup costs from the Livingston derailment and is also facing a class action lawsuit. Importantly, East Palestine opened a hornet’s nest of criticism. Alan Shaw, CEO of NS, endured a congressional grilling that no one ever wishes to experience. The NTSB hearing, and the amount of preparation, communication and subsequent follow-up activities consumed enormous additional resources—all to better understand what led to the accident and what can be done to prevent it from happening again.

Further fallout from the accident resulted in an outcry for more regulation of the rail industry. The “Rail Safety Act” would impose a lot of new regulations on the industry but does little to prevent bearing failures.

The most immediate reaction to the incidents has been the scramble to install more detectors that will further decrease detector spacing.

Derailments in North America

According to the Federal Railroad Administration, there are an average of 1,100 derailments annually in North America—a statistic splashed all over the media. But within this number are mostly minor “yard related” derailments due to switching or coupling, and track-related derailments. Derailments and accidents attributable to overheated bearings average 19 annually (derived from FRA data).

The Detection Network

North American railroads have installed more than 6,000 HBDs and 19 TADS. HBDs are spaced 15-22 miles apart while TADS® are installed on high traffic routes—but as we’ve seen, bearing failures can happen very rapidly, and can occur in less than 3 minutes, according to a technical paper presented in 1996: EFFECTS OF CONE/AXLE RUBBING DUE TO ROLLER BEARING SEIZURE ON THE THERMOMECHANICAL BEHAVIOR OF A RAILROAD AXLE. Detectors can’t catch every failure.

While the detector network identifies thousands of “potentially problematic” bearings annually, the vast majority are triggered by reconditioned bearings, and many prove to have no defects and are considered “non verified.” In a 2015 ASME paper, TEMPERATURE PROFILES OF RAILROAD TAPERED ROLLER BEARINGS WITH DEFECTIVE INNER AND OUTER RINGS, by Dr. Constantine Tarawneh, University of Texas, Rio Grande Valley, concluded: “The findings of this study, in combination with the costly removal of a relatively large number of non-verified bearings from service, demonstrate that the current wayside detection methods of bearing condition monitoring are inadequate, as they tend to rely mainly on temperature data that does not seem to provide a clear distinction between faulty and healthy bearings.”

From TTCI (now MxV Rail): TTCI offers early bearing detection through TADS®—our Trackside Acoustic Detection System. TADS® is designed to monitor roller bearings and identify those with internal defects in freight and passenger cars as they pass at nominal operating speeds. TADS® can help find roller bearing flaws early in their growth cycle—before the bearings overheat, cause costly train stops, and/or fail. In 2002, the system went into production in North America and by 2013 TTCI had delivered TADS® to 18 sites.

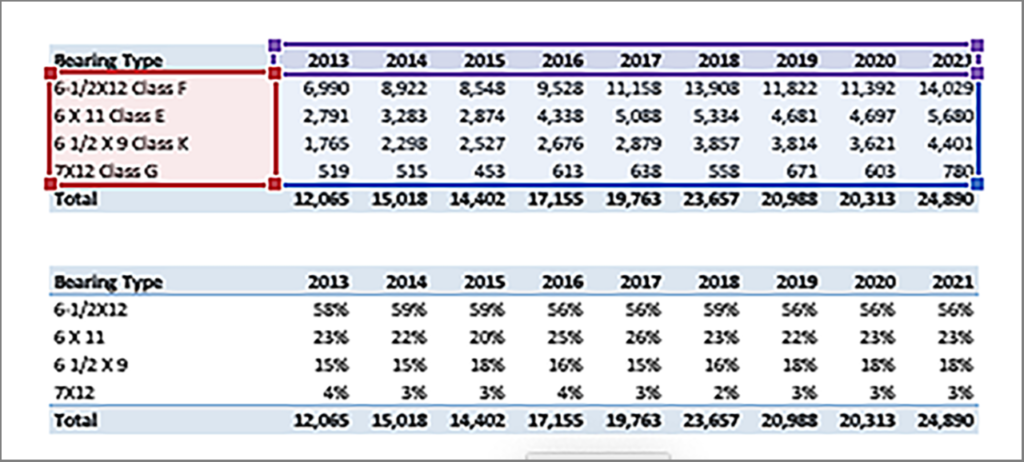

But there is a bigger story about the benefits of TADS®: There are more than 30,000 bearing “detections” annually from the vast detector network, of which more than 24,000 are detected by TADS®, and many of them lead to setouts whereby the car is removed from service and the wheelset is changed. Setouts are expensive, as they delay train movement and velocity, but they prevent accidents.

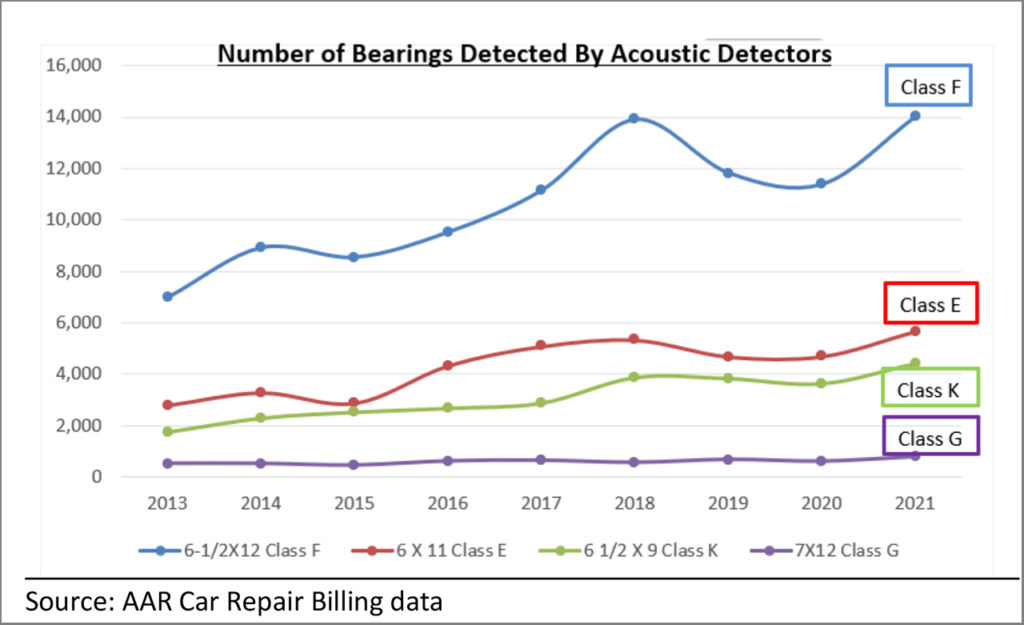

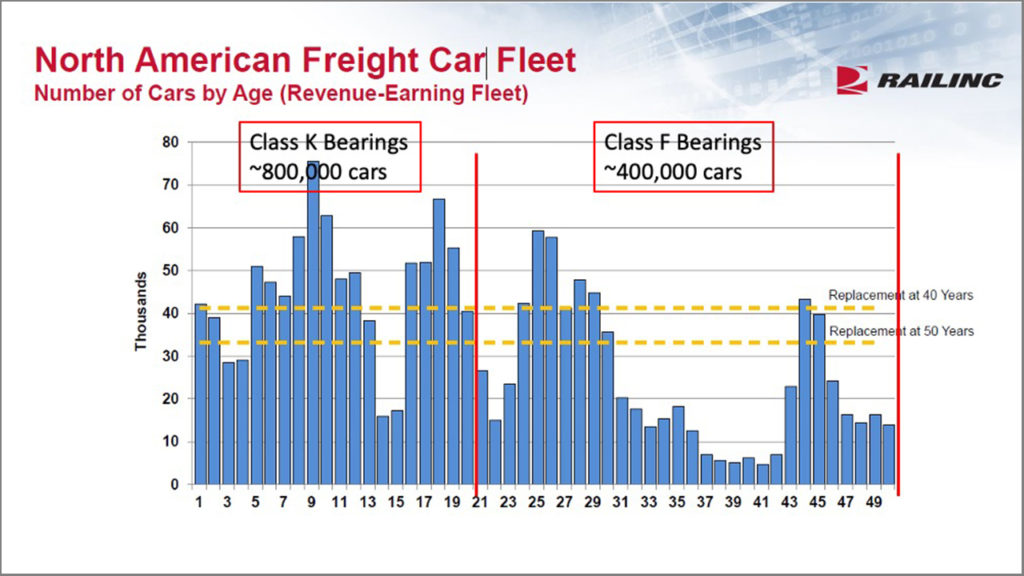

The number of bearings detected by TADS® reveals Class F removals represent 56% of the total, while Class F-equipped cars represent approximately 25% of the fleet, or about 400,000. 17% of bearings detected are Class K, while Class K-equipped cars represent 50% of the fleet, or around 800,000. In other words, Class F bearings are 3+ times more likely to have defects, or detections, than Class K bearings. On a per-capita basis, Class F bearings are more than 6 times as likely to be detected than Class K bearings—a testament to the efficacy of the design change in 2004.

On-Board Detection

While early, several companies are developing various solutions for on-board railcar bearing monitoring. Some focus on temperature and vibration, and some on acoustics. These emerging technologies are becoming increasingly sophisticated, and with the integration of vibration sensor technology, which has been proven to be the most reliable for comprehensive bearing health analysis, the options are many.

Imagine the cost and reputational benefit to the industry by detecting bearing defects early and taking preventative measures?

The Heavy Axle Load (HAL) Initiative

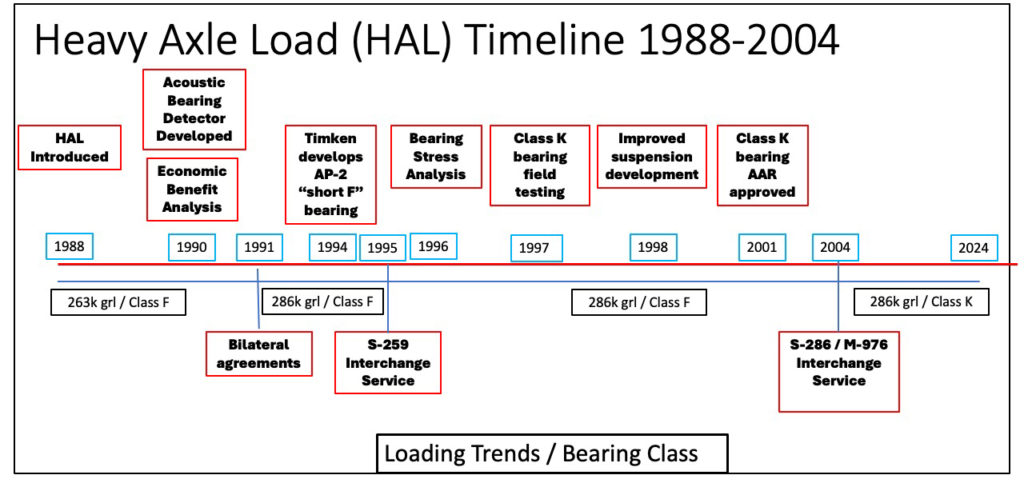

The Heavy Axle Load Initiative (HAL), initiated in 1988 and lasting through 2000, created a 5-step plan to increase GRL (gross rail load) from 263K to 286K. From 1991-1995, cars loaded to 286K GRL were run on selected captive routes through bilateral agreements. After considerable testing and economic impact evaluation, S-259 was introduced in 1995, allowing for interchange of cars loaded to 286K. Early evaluation focused on the railcar, wheel/rail interface, impact of accelerated wear on track and bridges, fuel consumption and capacity. As more railcars were loaded to 286K throughout the 1990s, research and testing revealed that increased loadings were elevating the “stress state” of the industry. A new suspension system was needed to reduce stresses imparted to track and wheels, leading to the introduction of S-286/M-976 standards in 2004, and a new bearing design, the Class K.

Class F vs. Class K Bearings

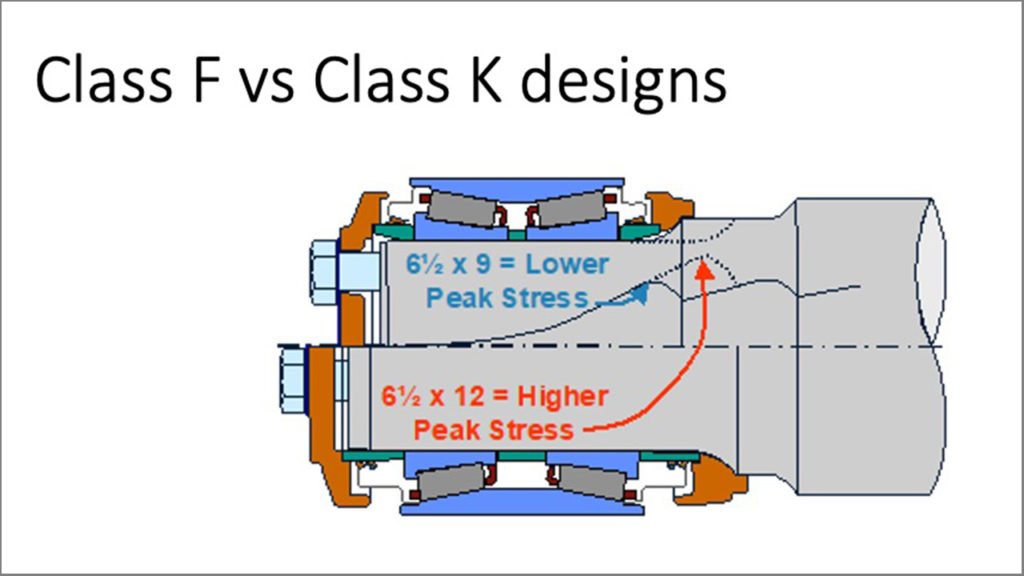

Significantly, with the introduction of M-976 suspensions in 2004, bearings and axles were redesigned, and the Class K bearing was designed 3 inches shorter than a Class F bearing to reduce the bending stresses imparted on the bearing and axle, especially under higher axle loads.

Since 2004, Class F bearings have gone from almost 75% of the total fleet to about 25% today, while Class K bearings have grown to 50% of the fleet and are growing steadily. As a result of this shift, very few new Class F bearings have been sold into the market over the past 20 years, resulting in greater reliance on older components to recondition Class F bearings. Today, the estimated size of the 263K and 286K GRL bearing population is ~3.2 million Class F (400,000 railcars), and ~6.4 million Class K bearings (800,000 railcars).

Source: Railinc, author.

Migration of Improved Products Into the Rail Industry

To smooth the financial burden of an industry-wide phaseout of Class F roller bearings, the industry need look no further than the migration path to heat-treated curved-plate wheels and the initial conversion from friction bearings to roller bearings.

The migration to curved-plate wheels was accomplished in multiple stages and from many angles. After extensive research at the AAR Chicago Technical Center, the AAR around April 1988 prohibited ordering of heat-treated straight-plate wheels from OEMs. Heat-treated curved-plate wheels were required on new cars, rebuilt cars, modified units, extended-service cars and increased gross rail load cars. Ultimately, straight-plate wheels were prohibited on interchange service effective July 1, 2014.

Railcar bearings were once all-bronze friction bearings. With the advent of the tapered roller bearing in the 1950s, the industry ultimately pivoted to all tapered roller bearings by 1994. Anecdotally, the introduction of the Class K bearing has achieved approximately 67% of the 263K/286K fleet during the past 20 years. With strong evidence of the benefits of the Class K bearing and Class K suspensions, we can likely expect accelerated conversions going forward.

Quality Systems: Detection vs Prevention

A train is only as good as its weakest link. In the case of East Palestine, the weakest link wasn’t a hazmat car, but rather a covered hopper car. The best way to enhance safety and reduce risk and cost is to address the root cause of a problem, which in this case is suspected to be an overheated bearing. Bearing defects are the root cause of the overheated bearing problem. More detection will identify more defects, but the defects are eliminated through better products, processes and applications.

Reconditioning vs. New

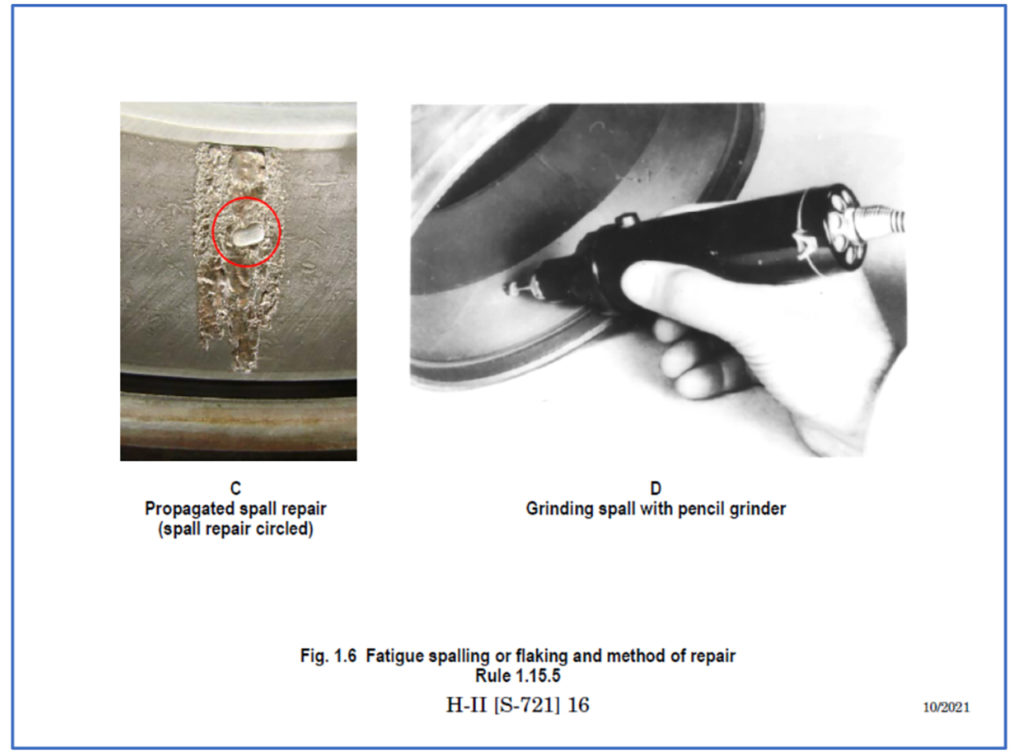

Every time a bearing is removed, it must be reconditioned or replaced with new. Bearings are removed whenever there is a wheel changeout or a bearing is detected due to elevated temperature, vibration or noise. The reconditioning process is governed by the AAR and specifically, the WABL (Wheels, Axles, Bearings and Lubrication) Committee, which oversee AAR MSRP (Manual of Standard Recommended Practices) H2 (Section H, Part II), Roller Bearing Shop Manual. MSRP H2 allows for the repair of defects, including spalls. Furthermore, WABL receives input from the RBMEC (Roller Bearing Manufacturers Engineering Committee).

During the NTSB East Palestine hearing, Dr. Tarawneh in his testimony indicated that “reconditioned bearings have a life of 50,000 to 250,000+ miles.” From CRB data, more than 80% of bearings applied are reconditioned. New bearings have a design (L10) life of 1 million miles, but since they are removed and reconditioned at the time of wheel change, they never make it to their ultimate life originally assembled. Given consistently higher average GRLs, and much higher costs associated with derailments and setouts, not to mention the reputational loss and threat of additional regulation, bearing reconditioning standards need to keep pace.

The North American Railcar Bearing Market

In a 45,000 carbuild year, there are 360,000 new bearings applied to new railcars at a cost of $144 million. Because bearings are required to be replaced each time a wheel is removed, there are 700-800,000 bearings applied. In total, there are approximately 730-830,000 aftermarket bearings sold, more than 80% of which are reconditioned, at a cost of $105-119 million. Should the industry accelerate the migration to Class K bearings and wheelsets, the incremental cost would be an additional $150-200 million, assuming 5% of the Class F fleet is converted to Class K annually. After 10 years of conversions, 50% of the Class F fleet will be changed out and the remainder of the fleet will be approaching its end-of-life. Railroads should begin to see immediate benefit from a retrofit program of this nature.

Path Forward

To enhance safety and efficiency, it is proposed the industry consider taking the following actions:

- Accelerate the migration from Class F to Class K bearings/axles, especially on cars loaded to 286K GRL.

- And while the industry migrates to more Class K wheelsets, implement tighter bearing reconditioning standards by: 1) strengthening current roller bearing reconditioning standards, especially with respect to the size, number and location of repairable spalls; 2) developing a time/mileage-based service life limitation for reconditioned roller bearings; 3) limiting the number of times a roller bearing may be reconditioned; 4) requiring 100% replacement of more OEM approved-parts at the time of reconditioning, regardless of used parts condition; 5) establishing criteria to check for raceway out-of-round and set allowable thresholds; and 6) checking for excessive lateral movement in AAR Field Manual Rule 36 anytime a sideframe is raised off the wheelset(s).

- Implementing bearing storage rules and regulations, including: 1) establishing an AAR mandatory time interval rotation of roller bearings in stored cars to prevent water ingress and grease deterioration; 2) establishing mandatory time-based rotation of roller bearings elsewhere in the supply chain on assembled wheelsets in wheel shop and repair facilities; and 3) establishing a mandatory shelf life for loose roller bearings in the supply chain (OEMs, reconditioners and wheel shops).

Given the significant performance improvements of Class K products vs. Class F products as evidenced from TADS® data, the industry will begin to see immediate benefit by accelerating the transition to Class K equipment. In addition, railcars converted from Class F to Class K will likely see higher residual values and greater probability of realizing their full 50-year life.

Summary

It was recognized in 1990 that increased GRLs from 263K to 286K would impart higher stress levels to railcars, track and bridges, but the economic benefit would outweigh the added cost to implement better track and stronger bridges to offset accelerated wear and tear. It was assumed at the time that the railcar suspension and bearings could absorb increased loadings without modification. As more railcars were loaded to 286K, it became clear that a new suspension system, along with changes to the railcar structure, were necessary. In 2004, significant standards changes were made to better-accommodate heavier railcar loadings that reduced rail and wheel wear, and reduced fuel consumption. The same design included a significantly better bearing/axle design—the Class K bearing.

Twenty years later we are seeing strong evidence of the merits of the design change that went into effect in 2004 to accommodate higher loads more safely and economically. Given the significant costs related to bearing issues, both in terms of derailment cost and bearing setout cost, railroads stand to benefit from accelerated retirement of the Class F suspension, especially under 286K railcars. A structured phaseout of Class F material would provide immediate safety and reliability benefits for all stakeholders.

Over the course of the past year, in response to East Palestine, the industry’s focus has been on increased detection through the installation of a lot more HBDs and TADS®. Although the addition of detectors has without question been beneficial for the industry, the opportunity exists to shift focus from detection to prevention. Now is an opportune time to accelerate the implementation of proven solutions that will drive down bearing defects, which in turn will reduce bearing failures and setouts.

These steps will go a long way toward enhancing safety and efficiency in the years to come. Since East Palestine, it seems that everyone has been bearing down on bearings. Don’t expect any letup anytime soon.

Principal of Rail Supply Chain Associates, Robert H. Cantwell spent more than 40 years in executive positions in the rail supply industry. He spent the first 26 years of his rail industry career growing a successful company, Hadady Corp., a designer and manufacturer of truck (bogie) components and systems for locomotives and transit railcars. Following the sale of his business, Bob helped transform Amsted Rail, holding various executive positions for 16 years. He has been active in the Rail Transportation Division of the ASME (American Society of Mechanical Engineers) and is past Chairman of the Division. Bob holds degrees in Mechanical Engineering from the Georgia Institute of Technology and an MBA from the University of Chicago. He possesses a unique perspective on the rail supply industry, combining his engineering experience along with robust economic and financial acumen. As an active investor in the rail industry, he has a vested interest in the success of the industry. He has also actively advocated with members of Congress in support of the rail and rail supply industry. The opinions expressed here are his own.