Intermodal Briefs: GPA, ITS Logistics

Written by Marybeth Luczak, Executive Editor

The Port of Savannah moved more than 3 million tons of cargo in March, while handling 154 vessels between Garden City and Ocean terminals, according to GPA. (Photograph Courtesy of GPA)

March was the third consecutive month of growth for the Georgia Ports Authority (GPA), with rail volumes up 22%. Also, ITS Logistics releases its April forecast, reporting that the collapse of Baltimore Key Bridge has resulted in a “‘severe’ rating for Atlantic Ocean Region.”

GPA

GPA in March handled 436,000 TEUs (twenty-foot equivalent container units), for an increase of 18.5% in trade compared with the same month last year, according to its April 10 report. This was the Port’s third consecutive month of growth.

GPA said total container trade was up 11% for the first three months of calendar year 2024. Intermodal rail cargo reached 44,902 containers at the Port of Savannah in March, up 22%; this was a 17% increase fiscal year-to-date.

“With double-digit growth in the first quarter, we’re excited about where we’re going and thankful for the continued trust our customers place in Georgia Ports,” GPA President and CEO Griff Lynch said. “GPA’s intermodal team and our partners, CSX and Norfolk Southern, are doing phenomenal work, with cargo reaching inland destinations only three days after crossing our docks. Cargo discharges from a vessel, arrives at inland destinations the next day and is available to customers by day three.”

Supporting GPA’s intermodal cargo expansion is the Mason Mega Rail Terminal. According to GPA, rail dwell is less than one day with daily rail departures carrying cargo to major markets such as Dallas, Memphis and Atlanta. The NS and CSX-served facility features 24 miles of track on 85 acres at the Port of Savannah’s Garden City Terminal. Its $220 million development increased the port’s rail capacity to 1 million containers per year, rerouted trains away from neighborhood highway/rail grade crossings, and brought rail switching onto the port, according to GPA. The expanded rail capacity speeds intermodal cargo handling and extends GPA’s inland service area.

“Growing rail infrastructure in Savannah and across the region extends port services to more customers, cuts transportation costs and reduces emissions,” GPA Board Chairman Kent Fountain said. “Mason Mega Rail, combined with rail hubs in Atlanta; our Appalachian Regional Port (in Murray County, Ga.); and the soon-coming Blue Ridge Connector help avoid traffic congestion by shifting containers from long-haul trucks to rail.”

The Blue Ridge Connector is under construction near Gainesville, Ga., along the manufacturing and logistics corridor of Interstate 85. It is slated to be GPA’s second operated inland network Georgia facility, linking Northeast Georgia with the Port of Savannah’s 37 global container ship services. The $134 million facility is expected to open in 2026.

Further Reading:

- For GPA, Container Volume Down in December, ‘Renewed Strength’ Expected in 2024

- GPA Approves $127MM for Blue Ridge Connector

- GPA Prepares for the Future, Adds Inland Rail Connectivity

- CSX, GPA Launch ‘Carolina Connector’ Service

- Georgia Ports Advances Inland Rail Hub Plan

ITS Logistics

The April forecast for ITS Logistics’ U.S. Port/Rail Ramp Freight Index “reflects the considerable demand shifts for the Ports of Norfolk, New York, and New Jersey due to the recent Francis Scott Key Bridge damage, effectively eliminating access to the inner harbor and closing the Port of Baltimore,” the Nevada-based third-party logistics (3PL) firm reported April 10.

“The eastern seaboard will see considerable container diversions as freight originally scheduled to arrive in Baltimore diverts to new destinations,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics, which provides drayage and intermodal services in 22 coastal ports and 30 rail ramps throughout North America. “This is the most immediate concern for shippers over the next couple of weeks. As we get further into April and May, new ports—primarily New York, New Jersey, and Norfolk—will become the North American entry point for Baltimore freight. Unplanned diversions to these ports will increase congestion, challenge operations at these locations, and drive dray trucking rates upward.”

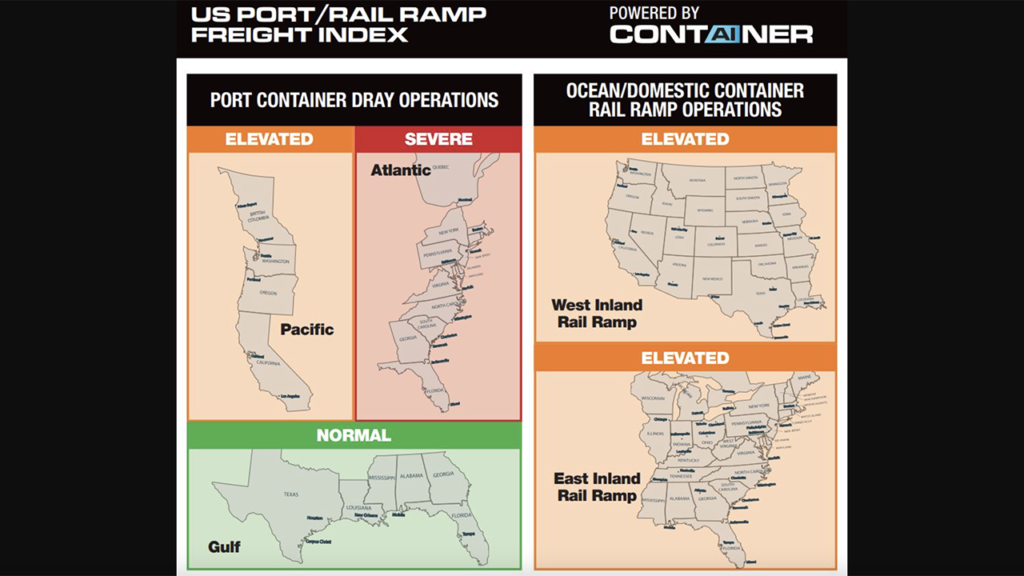

The 3PL firm each month releases the ITS Logistics U.S. Port/Rail Ramp Freight Index, which forecasts port container and dray operations for the Pacific, Atlantic and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions.

According to the April index, the long-term implications of the Francis Scott Key Bridge event could be a further migration of trans-Pacific freight to West Coast North American ports from the U.S. East Coast, a shift that shippers and logistics professionals need to be prepared for, according to ITS Logistics.

“On the U.S. West Coast, Los Angeles and Long Beach IPI Rail containers are still seeing significant dwell times as rail provider equipment is out of balance due to increased demand for East Coast freight arriving to the U.S. West Coast,” Brashier reported. “Shippers and operators in Vancouver are also reporting delays. These challenges are creating increases in dray-transload and one-way operations for low inventory SKUs.”

ITS Logistics said that in response to the challenges brought on by the bridge collapse, it has moved all rail regions and the Pacific Ocean region to “elevated concern.” The Atlantic Ocean region, it said, “will be moved to ‘severe’ due to shippers not having visibility of their freight being diverted to new ports and terminals throughout the U.S. East Coast, which increases the likelihood of demurrage with containers not booked to the door with ocean carriers.”

ITS is encouraging industry leaders “to implement a strategy that provides full visibility from port to door.” Focusing on visibility, it said, “will ensure companies have end-to-end container management and visibility, demurrage and detention insights, and accurate trends as well as analytics to help in navigating this current disruption as well as those that have yet to come.”

Further Reading:

- Watch: Salvors Remove First Containers From Dali

- USACE Targets End-of-May Restoration of full Port of Baltimore Access

- Bridge Collapse Shuts Down Port of Baltimore