‘Intermodal Seeks Solid Footing’ in 1Q23: IANA

Written by William C. Vantuono, Editor-in-Chief

BNSF priority intermodal train on the Needles Subdivision. Screenshot from a 510Trackside YouTube video. View the full video below.

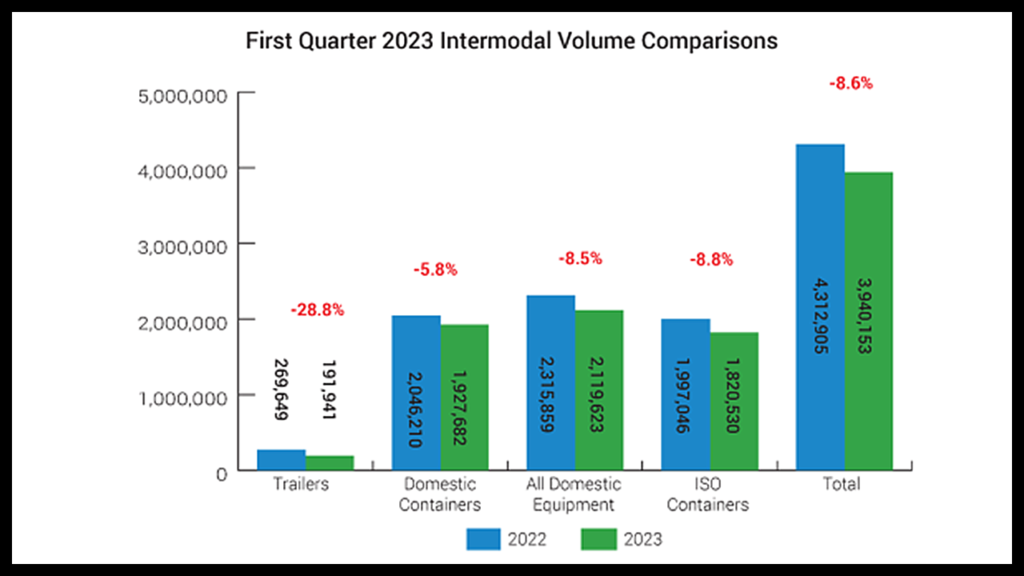

Low freight demand weakened intermodal volumes in 2023’s first quarter, as total volumes fell 8.6% year-over-year, according to the Intermodal Association of North America Intermodal Quarterly Report. All segments showed declines: domestic containers, –5.8%; international containers, –8.8%; and trailers, –28.8%.

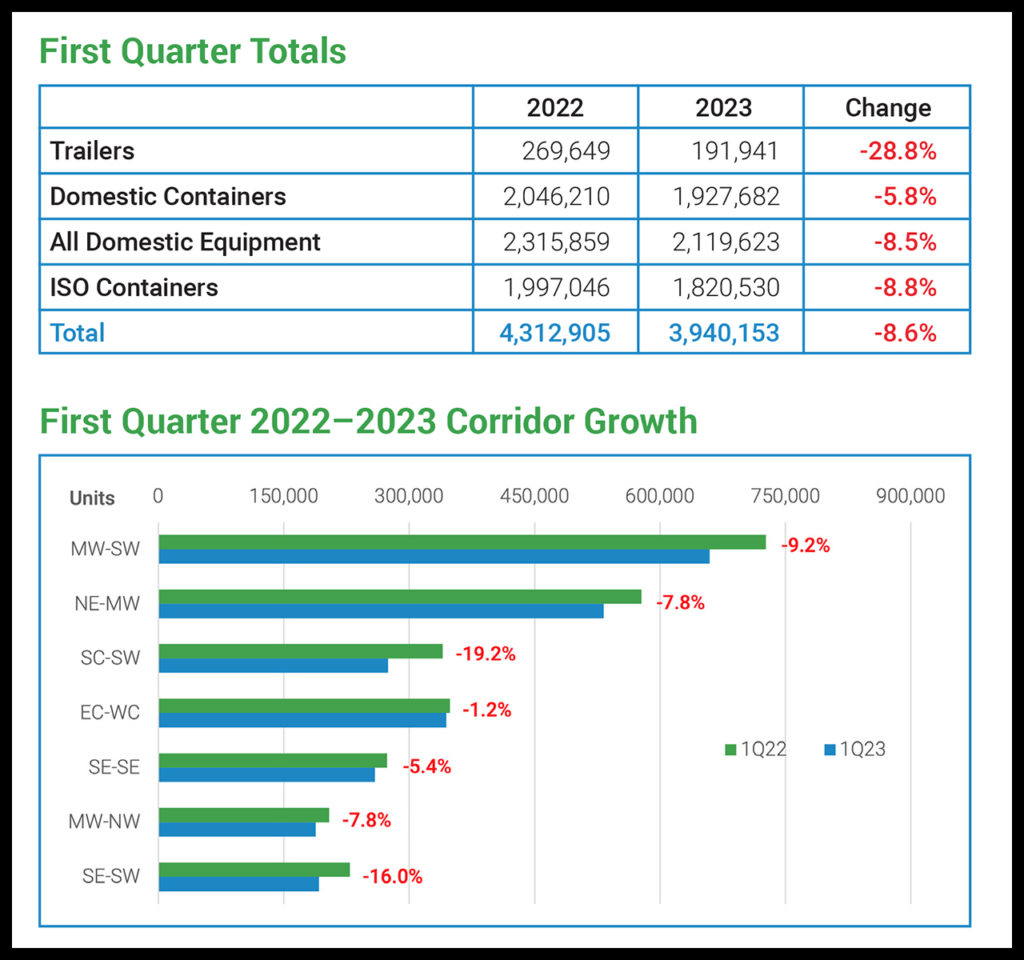

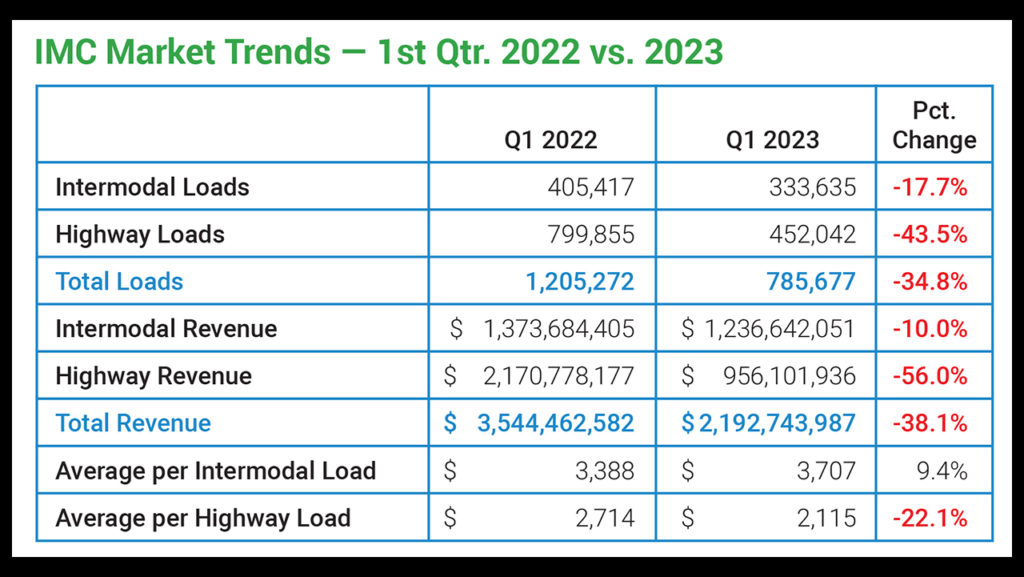

“The seven highest-density trade corridors, which collectively handled more than 60% of total volume, were all down in the first quarter,” IANA noted. The highest was the South Central-Southwest, with a 19.2% deficit, followed by the Southeast-Southwest at 16.0%. The Midwest-Southwest declined 9.2%; Midwest-Northwest 7.8%, and the Northeast-Midwest 7.8%. The Intra-Southeast came in 5.4% lower, while the Trans-Canada corridor held losses to 1.2%.Total IMC (intermodal marketing company) volume fell 34.8% year-over-year in 1Q23, with intermodal traffic down 17.7% and highway loads down 43.5%.

“Falling consumer demand for goods and related import declines have impacted intermodal volumes,” said Joni Casey, President and CEO of IANA. “Conversely, network fluidity and equipment availability continue to recover, so we are well-positioned for growth over the ensuing months.”

IANA’s Full Report

“Total intermodal volume contracted by 8.6% in the first quarter of 2023 compared to the first quarter in 2022. It was the seventh straight drop in quarterly output as well as the second largest decline of the seven. Just over 3.9 million intermodal moves were counted in the quarter vs. fourth quarter 2022 loadings of over 4.2 million.

“The downtrend was not specific to one intermodal equipment segment; all three showed losses. First quarter domestic container loadings fared the best, only falling 5.8% year-over-year. This was the second consecutive quarterly decline for domestic containers after increases in the first three quarters of 2022. Loadings of international containers dipped 8.8% after two quarters of slight gains. Trailer originations continued to fall, 28.8% year-over-year, its seventh quarter of double-digit volume declines. However, Q1 trailer volume amounted to only 4.9% of total intermodal loadings. (It was 7.0% in the fourth quarter of 2020.)

“The sluggish start to 2023 was a result of lower levels of domestic output and international imports. The intermodal network has seen improvements in terminal velocity, chassis supply, drayage availability and rail network fluidity. However, consumer spending on goods slowed, inventories remained elevated, and truckers added driver and equipment capacity.

“Total intermodal loadings declined in all but one of the ten IANA regions in the first quarter of 2023. Originations in Mexico improved 20.9%, its third consecutive quarter of over 20% growth. However, all the other IANA regions posted losses. Slowing imports impacted the Northwest, Southwest and Western Canada, which shrank 16.7%, 15.4% and 9.6%, respectively. Tougher competition from trucking resulted in a 13.0% contraction in the South Central region which was negatively affected by fewer marine containers in circulation. The same factors drove volume declines of 9.5% in the Northeast and 7.7% in the Southeast. The Midwest, the largest output region with over a million loadings in the quarter, fell back 6.6%. Finally, the Mountain Central, at 3.6%, and Eastern Canada, at 3.5%, posted the smallest losses.

“In terms of international containers, two of the ten North American regions produced more year-over-year traffic. For the third consecutive quarter, international container loadings in Mexico rose more than 30% as rail providers gained modal share over trucking. The Mountain Central region also increased 6.7%, though this was the quarter’s smallest volume region. On the downside, loadings of international containers fell 18.8% in the South Central region. Likewise, fewer imports weighed on volumes in the following regions: the Southwest region, off 17.1%; the Northwest, 15.8% to the negative; Western Canada, an 11.3% deficit; and the Northeast, which contracted 9.4%. The largest volume region and an important consumption center, the Midwest was down 8.6% in the quarter. Finally, traffic in the Southeast region fell 6.4%, as did Eastern Canada, by 5.3%.

“For domestic container traffic, only two of the ten North American regions, both smaller volume regions, had greater loadings in the first quarter of 2023 compared to 2022. Again, the largest increase was in Mexico, up 7.1%. Also in positive territory was Eastern Canada where volume moved up 1.1%. Traffic declined 14.8% in the Northwest and 12.0% in the Southwest as reduced imports impacted international-to-domestic transloading. For the South Central, off 7.8%, and the Southeast, off 7.3%, tougher competition from trucking was a major factor. Similar market conditions accounted for Western Canada, down 3.2%, and the Northeast, down 5.7%. The largest volume region, the Midwest, managed a 1.5% loss, while the smallest volume region, Mountain Central, declined the least, just 0.8%.

“The first quarter represented the first time that trailer loadings fell below the 200,000 mark as trailers converted to both the highway and domestic containers. All seven of the U.S. regions produced lower volumes with high rates of decline. The largest included the Northeast (35.2%), the South Central (34.6%), the Northwest (33.4%) and the Southwest (33.0%) regions. Not far behind were contracting originations of 28.0% in the Mountain Central region, 26.0% in the Midwest region, and 20.5% in the Southeast region. Trailer loadings are not common in Mexico or Canada – only 0.1% of North American moves originated outside of the U.S. in the quarter.

“Intermodal Marketing Company results are reported by participating IMCs. Intermodal loads for IMCs declined year-over-year in the first quarter, the fourth consecutive down quarter, this one by 17.7%. Highway loads slid 43.5%. Combined, total loads for IMCs dropped 34.8% in Q1 – the second quarter with contracting volume. Total intermodal revenue was off 10.0%, while highway revenue was down a much larger 56.0%. Total IMC revenue from both modes combined was 38.1% lower in the quarter.

“The freight outlook for full-year 2023 is relatively weak. Retail sales are holding up, but consumers are continuing to shift from spending on goods to spending on services. Retailers who were caught with low inventory levels during the pandemic have now stocked too many goods which must be worked down. The softer outlook for goods sales along with warehouses that are still full is putting downward pressure on domestic production as well as imports. With containerized imports falling, the outlook for international containers moving by rail is forecast to drop 8.8% for full-year 2023. Weak transload volume off of those imports, lower domestic production and more aggressive truck competition should cause a 1.0% decrease in domestic container volume for the year. Loose truck capacity and shipper conversions to containers should lead to 15.9% fewer trailer loadings. All combined, total North American intermodal volume is anticipated to decline 5.6% for full-year 2023.

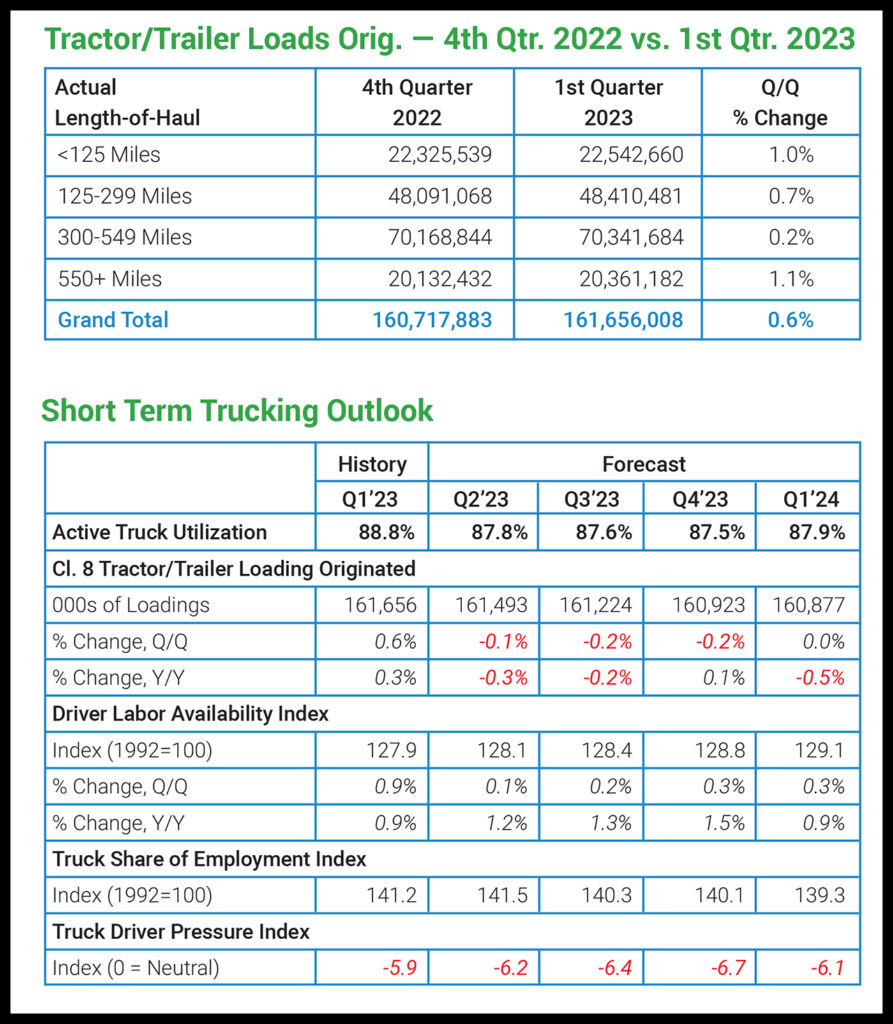

“For-hire trucking saw a first quarter in line with the fourth quarter of 2022, even as the freight rate environment continued to ease modestly. Tractor-trailer loadings were largely stable in the first quarter — at least on a seasonally adjusted basis — following a similar performance in the final quarter of 2022.

“The 0.6% increase in loadings, compared to the fourth quarter, came mostly in the non-van arena. Dry van and refrigerated each saw only a slight uptick in volume. Volume softness was centered within the long-haul (300 to 549 miles) segment, which posted barely any quarter-over-quarter growth in the first quarter.

“Although the truck freight environment weakened over the course of 2022, truck freight managed a marginal gain in the first quarter of 2023 when compared to the first quarter of 2022. Year-over-year comparisons for tractor-trailer loadings were less consistent across length of haul and trailer types, however. Short-haul (less than 125 miles) and long-haul saw notable gains, but medium-haul (125 to 299 miles) was down more than 2%. Refrigerated volume was up compared to the first quarter of last year, but dry van loadings eased slightly.

“Capacity-related data also points to continued normalization based on net revocations of authority (total revocations minus reinstatements). Most carriers that fail are very small and presumably operate mostly in the spot market, and the first quarter saw the largest number of carrier failures on record. However, the number of net revocations just barely exceeded the fourth quarter of 2022, which suggests some stabilization.

“Payroll employment in trucking, meanwhile, hit a seasonally adjusted record in March at more than 6% ahead of the pre-pandemic level. In general, monthly payroll employment figures are a proxy for the relative strength of contract volume because the data typically does not capture the smallest operations.

“Outlook

“An overall highly stable truck freight volume is forecast into 2024 with barely any quarter-over-quarter changes. The outlook is modestly stronger for the refrigerated freight and somewhat weaker for loadings other than dry van and refrigerated.

“The risks to that forecast are mostly — but not fully — to the downside. One of the key drivers of a stable outlook is goods consumption, which has remained stronger than many had anticipated. The first quarter of 2023 saw solid spending on a seasonally adjusted basis, but consumers continue to face higher interest rates and are saving less money each month than they did before the pandemic. While cash reserves from the 2020-2021 stimulus are still elevated, indicators of financial stress — household debt to disposable income and credit card delinquency rates — are as strong or stronger than they were before the pandemic.

“One major area to watch is automotive. As with overall goods spending, vehicle purchasing in the first quarter was strongest in January, but auto and light truck sales rates in February and March were still much higher than in most of 2022. If that strength continues, production of motor vehicles and parts likely will follow suit, resulting in stronger automotive-related loadings. That outcome would affect dry van and flatbed most directly. It would also indirectly tighten capacity for all trailer types that compete for the drivers who would be hauling automotive components.

“Meanwhile, the inventory situation has become more favorable to truck freight velocity in recent months. Excluding still-depleted automotive inventories, the ratio of retail inventories to sales is running at its lowest level in a year and well below the pre-pandemic norm — a situation that creates pressure for replenishment of goods.

“The swing in certain key sectors has been dramatic. In contrast to the wholesale sector, general merchandise stores, which include the big-box retailers, saw inventories swell in the first half of 2022 to their highest levels since just before the Great Recession. Since August, however, the inventories-to-sales ratio has plunged and is roughly back in line with pre-pandemic levels.

“In terms of the utilization environment, no big moves are expected, in either volume or driver capacity. A slight easing of active truck utilization is expected in the second quarter, but the current forecast has utilization holding in the range of 87% to 88% into 2024. The 10-year average for active truck utilization is 92%, so no upward pressure on either spot or contract rates is anticipated until late 2023 at the earliest.

“Intermodal implications

“With weak truck capacity utilization and freight rates and diesel prices at their lowest level since before Russia’s invasion of Ukraine, intermodal will continue to face a challenging competitive environment relative to truckload carriers. However, the news for intermodal is that the trucking market probably is close to bottoming out, so the months ahead should be incrementally less challenging.

“One wild card is the import environment — especially the shift in port market share that occurred in 2022. The all-water rerouting of containers to the East Coast and Gulf Coast ports also has moved some volume from rail intermodal to truck, which is more competitive in those shorter lanes. Pending a new West Coast labor agreement, at least a major portion of that freight should return to the West Coast and more intermodal-friendly lanes.