Intermodal Briefs: SC Ports, Stonepeak/CenterPoint Properties

Written by Marybeth Luczak, Executive Editor

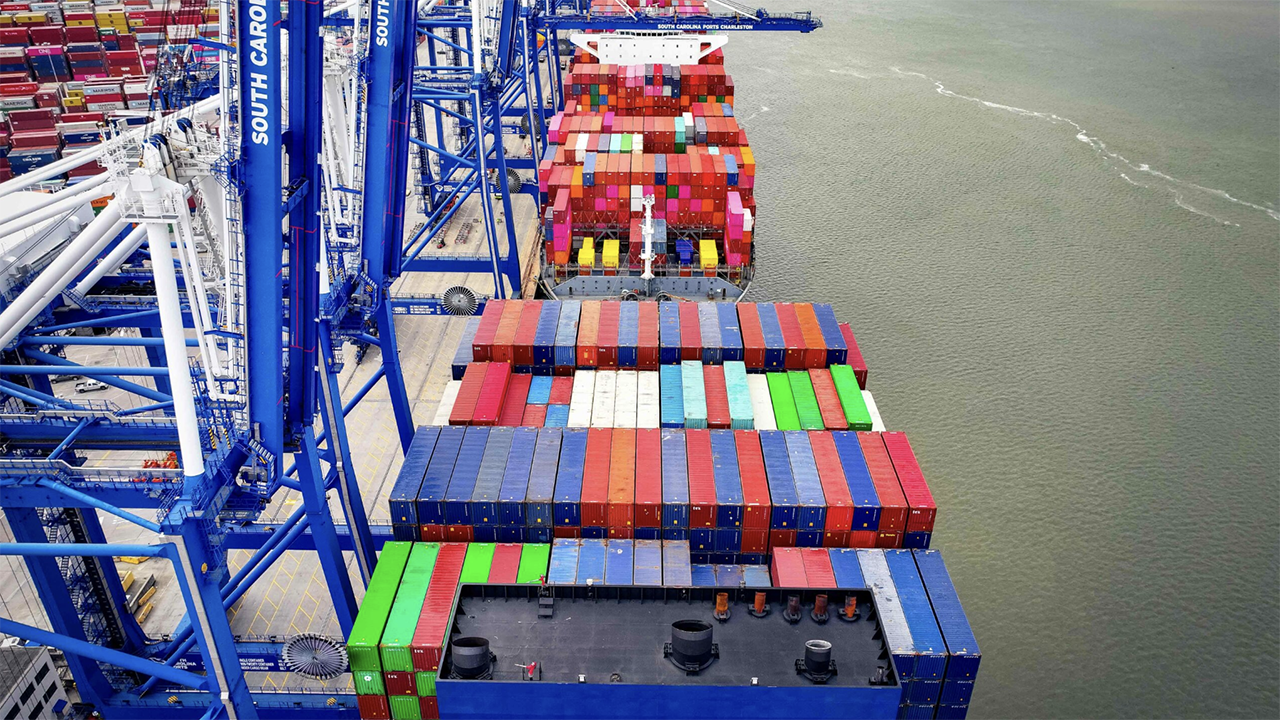

SC Ports in March handled 216,410 TEUs, up 12% year-over-year, and 118,481 pier containers, up 11% from last year. (Photo/SC Ports/Matthew Peacock)

South Carolina (SC) Ports marks its most significant container-volume uptick in 2024. Also, Stonepeak acquires a 1.7 million square-foot rail-served logistics portfolio in Chicago from CenterPoint Properties.

SC Ports

A 17% gain in loaded imports and “strong” intermodal cargo movements in March drove year-over-year container volume growth, according to SC Ports. This marked “the most significant uptick this year,” it said.

SC Ports handled 216,410 TEUs (twenty-foot equivalent units) in March, up 12% from the same month last year, and 118,481 pier containers, up 11% from last year. This container volume boost “points to signs of economic strength and a strong market,” it said.

Rail-served inland ports Greer (Norfolk Southern/NS) and Dillon (CSX) moved a combined 18,978 containers in March, an 8% gain over 2023. According to SC Ports, rail moves at Inland Port Greer were up 22% from the prior-year period, handling 16,088 containers “filled with goods for advanced manufacturers, solar panel makers, material producers and retailers.”

For the automotive sector, SC Ports said it moved 18,001 vehicles in March, a 15% increase from the same period last year.

“The U.S. East Coast is in high demand for cargo routings, and our strategic location in the booming Southeast positions us well for long-term growth,” SC Ports President and CEO Barbara Melvin said during the April 17 announcement. “Our inland ports are performing exceedingly well as we move more cargo by rail than ever before. The ongoing expansion of Inland Port Greer will provide more capacity and rail capabilities to swiftly move goods between the Port of Charleston and inland markets.”

The expansion of Inland Port Greer has already yielded more than 8,000 feet of additional rail track, and the container yard expansion is nearing completion, according to SC Ports. These terminal enhancements, it said, double Inland Port Greer’s cargo capacity.

“As South Carolina’s economy thrives, we are investing in modernizing our terminals, expanding cargo capacity and building the rail-served Navy Base Intermodal Facility to ensure excellent port service to the businesses that depend on us for efficient port operations,” Melvin added.

The Navy Base Intermodal Facility, which is slated to open in North Charleston in July 2025, will be equipped with six rail-mounted gantry cranes to move containers on and off CSX and NS trains.

Further Reading:

- Intermodal Briefs: GPA, SC Ports

- Intermodal Briefs: Port of Los Angeles, SC Ports

- Intermodal Briefs: SC Ports, Port of Los Angeles

- Intermodal Briefs: SC Ports, IANA

- Intermodal Briefs: SC Ports, Port Houston, Port Milwaukee

Stonepeak / CenterPoint Properties

New York-based investment firm Stonepeak has acquired a three-asset, 1.7 million square-foot rail-served logistics portfolio in Chicago from CenterPoint Properties. It is located at an inland port anchored by BNSF and Union Pacific (UP) intermodal terminals.

“The portfolio is directly adjacent to critical rail infrastructure and is a strong addition to our broader real estate strategy,” said Phill Solomond, Senior Managing Director and Head of Real Estate at Stonepeak, which in 2020 acquired TRAC Intermodal and its subsidiaries.

Simpson Thacher & Bartlett LLP served as legal counsel and Eastdil Secured served as financial advisor to Stonepeak.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)