BNSF, GMXT to Run J.B. Hunt’s Intermodal Service Via Eagle Pass Border Gateway (Updated, Blaze Commentary)

Written by Marybeth Luczak, Executive Editor

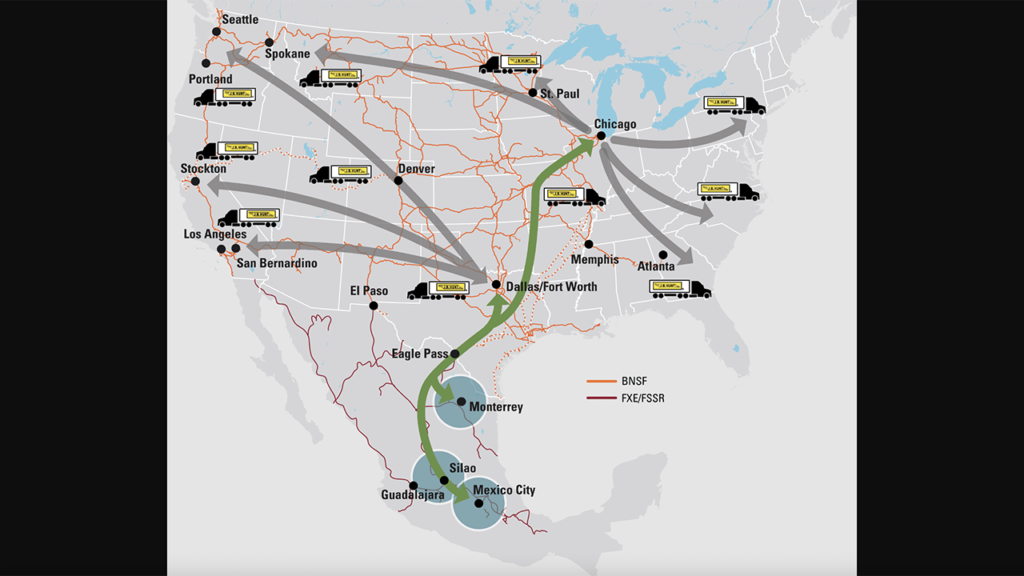

BNSF, Grupo Mexico’s (GMXT) Ferromex and J.B. Hunt Transport Services Inc. on Jan. 1, 2024, will launch a new intermodal service between the Monterrey, Silao-Bajio and Pantaco-Mexico City regions, key markets in Northern and Central Mexico, through the Eagle Pass, Tex., border gateway.

The service (see map below) will be one day faster than the existing Monterrey-to-Chicago service, the companies reported Nov. 13. They said that trains carrying intermodal containers will interchange at Piedras Negras, Mexico/Eagle Pass, Tex., to and from GMXT, which will operate the trains between the border crossing and Monterrey, Silao-Bajio and Pantaco-Mexico City six days per week. There will also be an alternative option over the Ciudad Juarez/El Paso, Tex., border gateway. This new intermodal service offers new opportunities for customers to grow in the expanding Mexico markets, they said.

BNSF, J.B. Hunt and GMTX said that the service offers these advantages:

- “Market Reach: Unparalleled coast-to-coast market access through J.B. Hunt’s North American reach.

- “Dedicated Support: Dedicated BNSF customer support team to track shipments from in-gate to out-gate to and from Mexico and the U.S. 24/7

- “Ease: Southbound shipments are moved in-bond (which means shipment documentation is handled at the final destination) to minimize Mexico Customs clearance delays. Once the shipments arrive at the destination ramp, customers can clear their cargo with the customs broker of their choice through Mexico Customs. Northbound shipments are pre-cleared with U.S. Customs by a customs broker of the customer’s choice.”

BNSF confirmed to Railway Age that the new offering involves some J.B. Hunt traffic shifting from Canadian Pacific Kansas City’s Mexican operations to GMXT. When asked for comment, CPKC referred to remarks made by Chief Marketing Officer John Brooks at the Nov. 14 Scotiabank conference: “John referenced CPKC doing what we said we would do—creating competition and that the best service wins. ‘We are going to create more competition,’ Brooks noted. ‘The better products we put in place, our competition is going to have to react and I think that is exactly what we have seen. At the end of the day, single-line haul, one-stop shop, fastest service in the industry matters. It usually wins … I feel really good about our changes to execute … ’”

J.B. Hunt will continue to use CPKC for U.S. Southeast-bound traffic interchanged with Norfolk Southern at the Meridian Speedway.

The J.B. Hunt/BNSF announcement closely followed one the two companies made Nov. 7 that they are teaming on Quantum, an intermodal service that accommodates the “service-sensitive” highway freight needs of customer supply chains. According to the partners, Quantum provides “the consistency, agility and speed needed to transport service-sensitive highway freight using rail.” Solutions are customized specifically to each customer’s needs, considering service expectations, transit requirements and operational procedures. The Quantum team comprises both J.B. Hunt and BNSF operators housed together at a new Intermodal Innovation Center at BNSF headquarters in Fort Worth, Tex. The workflow, the companies said, is integrated at every step of the intermodal shipping process—from planning to execution and oversight to exception management.

“Our organizations are committed to growth in Mexico and this joint service offering is a direct reflection of that commitment,” BNSF President and CEO Katie Farmer saidn of the new intermodal service with GMXT and J.B. Hunt. “By utilizing the capacity and expertise of the largest intermodal railroad in the U.S., the largest railroad in Mexico, and the largest domestic intermodal carrier, this product will seamlessly connect the North American intermodal network.”

“This new service offering will provide resilient, cross-border solutions that give our customers optionality to support their growing supply chain needs in Mexico,” J.B. Hunt CEO John Roberts said. “The cost savings and sustainability benefits of intermodal service are proven, and we’re proud to collaborate with our rail providers BNSF and GMXT to bring this robust service offering to reality.”

“GMXT is ready to support the freight demand growth that nearshoring presents with North America by providing flexible and top-notch rail services to our customers,” added Fernando López, CEO of GMXT. “Eagle Pass is a strategic gateway, and we are committed to connecting México and the U.S. through smart and secure borders while helping our countries facilitate the trade.”

GMXT has also partnered with Union Pacific (UP) and CN; in April, they introduced the Mexico-U.S.-Canada “Falcon Premium” interline intermodal service for automotive parts, food, FAK (freight of all kinds), home appliances and temperature-controlled products.

Falcon Premium connects CN origin points within Canada, and at Detroit, to UP at two locations via CN’s former Elgin, Joliet & Eastern Chicago bypass, then to GMXT Mexican terminals at Monterrey and Silao, through Eagle Pass.

Commentary by Independent Railway Economist and Railway Age Contributing Editor Jim Blaze

The announcement by J.B. Hunt with the support of BNSF regarding a switch to a different joint intermodal train routing that relies on Ferromex might seem at first a bit surprising. But if we consider the complexity of competition among the various large intermodal parties, perhaps it’s less extraordinary.

But it is still strategically interesting.

The first question is: “Why Ferromex if the Monterrey to Central Texas rail route through Laredo over CPKC is somewhat shorter distance-wise?” Because congestion and through transit time is more important for premium service than is the physical distance.

In this case, even with a somewhat longer circuitous routing via Eagle Pass, the hours matter more than the miles running. Specifically, the recently announced Quantum premium service intermodal operation jointly managed by J.B. Hunt and BNSF values the time as its most important market characteristic. Taking 24 hours out of the service run thus becomes a pretty good enhancement.

Can CPKC respond to that service time reduction?

The Laredo route is more congested and can be subjected to traffic conflicts between Corpus Christi and the Houston region. Eagle Pass less so. Thus, if the Ferromex track sections and the BNSF use of trackage rights over UP to the northeast of Eagle Pass are robust and reliable capacity tracks, why not give it a market test?

Then there is the market view that perhaps CPKC was giving too much train service attention to J.B. Hunt’s primary truck/intermodal competitor, Schneider. Recall that back in April, Schneider and CPKC agreed to a new service plan. Perhaps that market dynamic led to a strategic partnering reassessment by J.B. Hunt?

And there is the matter of Ferromex itself deciding perhaps to increase its service capability in order to compete better with the new CPKC system. Ferromex leaders might be signaling that they intend to improve their market share position.

These just announced changes might simply be naturally evolving competitive market reactions among the different parties struggling for a critical market advantage.

There is another geographic point to be noted. Many of us focus upon Laredo or Eagle Pass and even Brownsville and El Paso as the hub of rail route decision-making. But in this instance, perhaps the footnote to think about is that BNSF seems to project that it’s the role of Alliance, Tex., that might be the most critical intermodal train movement hub—not Laredo, or Houston, or Austin. Jim Blaze translation is that the critical economic points of rail freight networks are not always found at the conventionally thought-of locations.

Here is what to look for come January 2024: Success of the Eagle Pass route might depend mostly upon the resources of crew districts and their reserves, plus track and locomotive power and well-positioned passing sidings along the Monterrey to Eagle Pass and then to San Antonio locations.

Jim Blaze has been in the railroad industry for more than 40 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)