Rail System Looking Good

Written by Rick Paterson, Managing Director, Loop Capital Markets

CSX photo

On Dec. 4, we highlighted the strong operational recovery that has taken hold at Union Pacific, and we’re now in a position where most of the industry is running well. At this point, it’s only Norfolk Southern that needs to rediscover its A-Game, but we believe the pieces are in place.

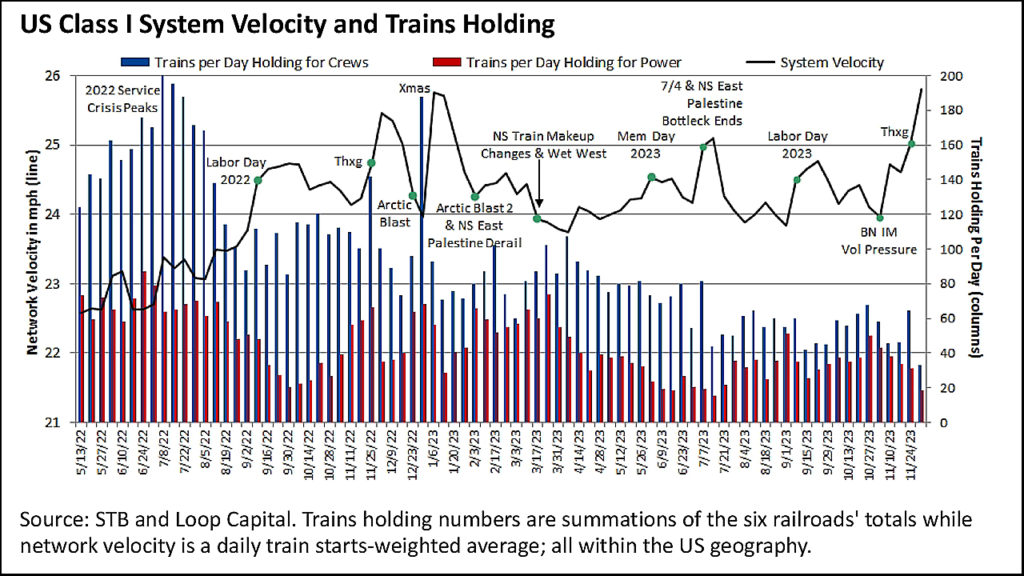

The industry also just received the last of its four big operational accelerators during the year, in the form of the volume-light Thanksgiving week (the others are Memorial Day, Fourth of July and Labor Day). The reprieve in volume pressure and associated ability to reposition power and crews will typically slingshot network velocity higher again in the following week, and that’s exactly what happened. In fact, it was this Thanksgiving slingshot effect last year that inflected UP’s operation and put it on the recovery path it just completed.

In the chart below you can see the impact on the U.S. Class I industry (black line, far right), with system velocity hitting a new post-Service Crisis high last week.

At the individual company level we’re now seeing new records set in most weeks, including current multi-year records for UP velocity, dwell, recrews and private car-miles per day; BNSF private car-miles per day, and CSX velocity and manifest and coal on-time performance. CN and CPKC also continue to run well, with their U.S. operations benefiting from the same dynamic.

The big caveat of course is that these holiday-related effects quickly wear off, and the trick is always to exploit the tailwind such that operations soften, but to a state that’s better than where it was prior to the holiday-impacted week. We expect some the railroads to do exactly that. They’re also going to need to with winter just around the corner.

Regardless, for the first time in a long time we’re starting to feel optimistic about this industry in the context of operations and service.

Famous last words?