Post-Winter Acceleration Needed

Written by Rick Paterson, Managing Director, Loop Capital Markets

Winter is always a challenge for the railroads, but the one we’ve just had was at least milder than normal. Apart from being the warmest on record, it included just one Arctic Blast vs. two the prior year, and Union Pacific and BNSF also benefited from an additional easy YoY comp as they lapped an unusually wet and snowy March 2023.

Despite these advantages, none of the networks covered themselves in operational glory as they stumbled into the spring. We’ve focused on BNSF in recent weeks, and have another update below, but BNSF is hardly alone. CSX is second on our watch list as it continues a multi-month glide path of lower speed and higher terminal dwell. UP and CN also exited winter running slower than we would have expected.

Remember the big picture here: After the 2022 Service Crisis, the U.S. railroads need to establish a track record of service consistency with customers, and muddling through an easier-than-normal winter isn’t helping. This track record is a pre-requisite for meaningful future volume growth.

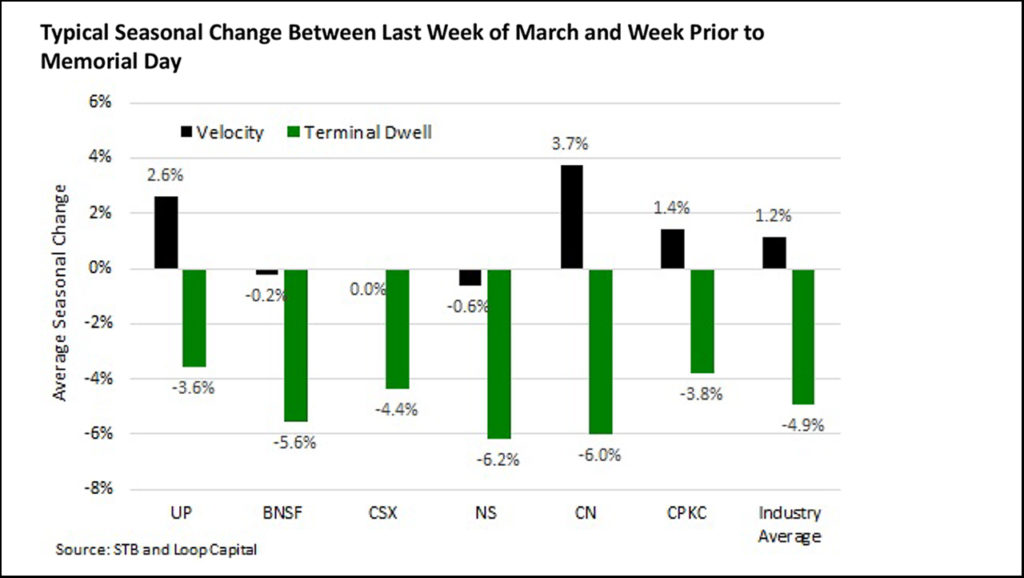

Our next hope is that seasonality rides to the rescue and gets them back on track. As we noted at the start of winter, the cold weather has a cumulative braking effect, but that should now be inflecting to network acceleration. April and May are the months where this typically occurs, and we’ve quantified the seasonalities in the chart below.

For each network we show the average increase in speed and reduction in terminal dwell between the last week of March and the week in May just prior to Memorial Day (when volume pressure comes off and the networks further accelerate). The chart captures the past 10 years, but we’ve selectively removed some that include atypical events, such as 2014 with the big polar vortex, and of course 2022 for the four U.S. networks. What we’re left with is an expectation that the industry will see a 1.2% improvement in speed and almost 5% reduction in terminal dwell between now and Memorial Day. We’d argue the former (velocity) needs to be materially better than the historic 1.2% if the U.S. railroads want to keep the “track record” dream alive.

BNSF Recovery Update

On Febr. 27, the Smokehouse Creek wildfire in the Texas panhandle cut BNSF’s Transcon for 38 hours and generated a single-track bottleneck for a subsequent 47 hours. It set off a chain of events that bottomed network velocity at 24.8 mph in the week ending March 8—the lowest since June 2022. We’re now three weeks out from that in terms of the data and continue to, at least, be in good shape directionally, with network velocity a little better in each sequential week. We’re also now running faster than where speed bottomed during January’s Arctic Blast.

In last week’s data we got a nasty surprise in the form of trains holding for crews jumping from 28 to 44 per day in the week ending March 22. Thankfully, that appears to be a one-week blip, and reverted to 26 last week. Trains holding for power continues to look much better; dropping by one per day sequentially to 11, and trains per day holding for all other reasons improved from 64 to 54 per day, sequentially.

We’ve been closely tracking cars-on-line in the context of rolling stock congestion after BNSF’s industrial customers, primarily, put more equipment on its manifest network on the back of the Arctic Blast and Transcon wildfire slowdowns (i.e., the magnet effect). This pushed the active car fleet to a four-year high of 263,326 a month ago. Like network velocity, we then saw three modest sequential improvements since: 262,851; 262,213; and 261,257. We also saw a welcome decline in the proportion of cars-on-line that sat idle for 48 hours or more last week, from 5.2% to a six-week low of 4.7%.

Over the past few weeks, we’ve discussed the likelihood of BNSF’s rebound in network velocity and presumably on-time performance will be be drawn out and slow due to high cars-on-line and stubborn terminal dwell. The latter went the wrong way again in the week ending March 29; in fact, dwell hit a 14-month high last week if you exclude January’s Arctic Blast. Intermodal velocity put in a bigger sequential gain in the week ending March 29 (+0.7 mph) as BNSF continues to dig out from the Transcon wildfire hole. There is still a ways to go. Interestingly, total trains holding in the intermodal network (crews, power and other) fell to six per day last week, which is an 11-week low and a leading indicator for better speed, which should come through next week.

Realistic Time Frame for BNSF Service Restoration

Despite strong volumes and some associated volume pressure, we expect BNSF’s intermodal network to continue to lead the recovery, and if the current trajectory holds, should look materially better a month from now. The grain network also continues to heal on the back of some train crew transfers (to Western Montana, for example), and service improvement there remains on track.

BNSF’s manifest network is unfortunately the more intractable affair, as high car inventory and dwell (due to excess cars clogging up hump yards) requires a change in customer confidence that BNSF is on the mend, and subsequently customer behavior (we’ll reduce inventory on the system as a result). This is frustratingly slow, and based on our observations of Class I’s in similar situations over the years it feels like Memorial Day weekend might be a realistic target to restore manifest network health. Ideally, the slingshot effect on the back of that long weekend would be the recovery icing on the cake. This forecast of course goes out the window if there’s another significant natural disaster, so let’s hope for a relatively clear weather runway near-term.

BNSF is the biggest railroad, so the industry can’t do well unless BNSF does well, which of course goes back to our service track record point earlier, and why we give it so much attention.