NS 2Q23: Profit Down on Derailment Response Charge (Updated, TD Cowen Insight)

Written by Marybeth Luczak, Executive Editor

Norfolk Southern (NS) on July 27 reported second-quarter 2023 financial results reflecting a $416 million charge associated with its ongoing response to the Feb 3 derailment in eastern Ohio. Including that charge, income from railway operations was $576 million, a 55% decline from second-quarter 2022’s $1.271 billion, and diluted earnings per share were $1.56, a decline of 55% from last year’s $3.45.

Adjusting for the charge, the Class I posted income from railway operations of $992 million—dropping 22% or $279 million—and diluted earnings per share of $2.95—falling 14% or $0.50—from second-quarter 2022.

Railway operating revenues came in at $2.98 billion, down 8%, or $270 million, from second-quarter 2022.

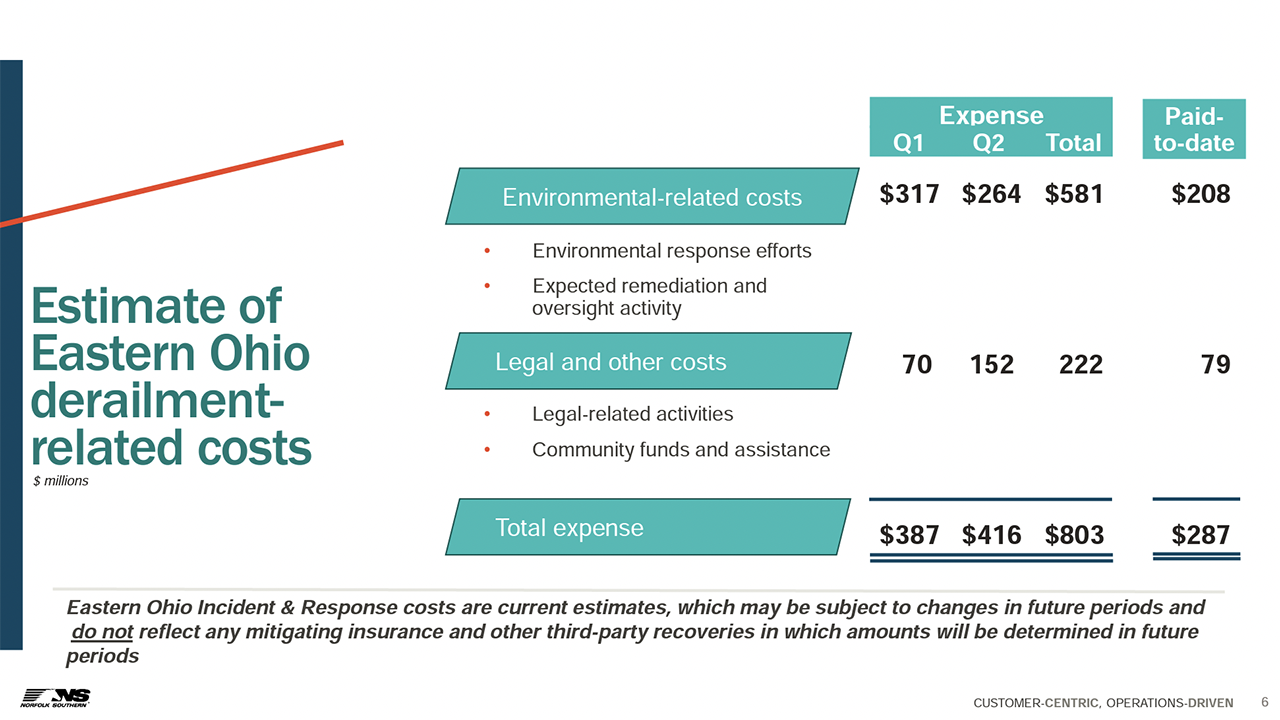

Like first-quarter 2023, NS said, “the results do not reflect any amounts potentially recoverable under the company’s insurance policies, or from other third parties, which would be reflected in future periods.”

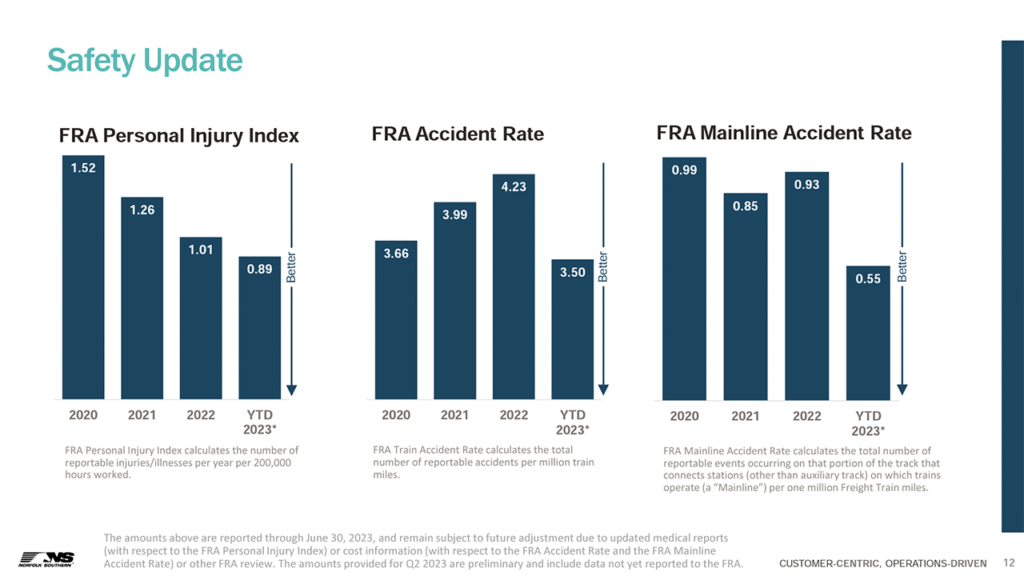

During its second-quarter 2023 presentation, NS provided the following results on service, productivity and safety:

“During the quarter, we delivered on our commitments to improve service, invest in safety and resiliency, and enhance the quality of life for our craft railroaders,” NS President and CEO Alan H. Shaw summed up. “Each of these are foundational to our strategy and position Norfolk Southern well for the future. We are committed to our long-term strategy and are positioning our franchise to take on volume growth and deliver for our customers.”

2023 Outlook

Looking ahead, NS reported that revenue will be down at least 3% in 2023, noting that first-half 2023 volume was “impacted by derailment-related service challenges as well as weaker demand”; a lower fuel surcharge will be “driven by moderating commodity price”; and there will be an “[a]ccelerated decline in accessorials.” The railroad said capex will reach approximately $2.2 billion, with an “[a]cceleration of safety and growth investments.”

The Class I pointed out that the electric vehicle supply chain is developing on its network. Of the more than $70 billion in announced investment for battery supply chains in North America in the past 18 months, nearly one-third will be located on the NS network, including the recent $3 billion for the GM/Samsung plant on NS in Indiana, the railroad said.

Additionally, NS provided the following update on its trainee pipeline for second-half 2023:

TD Cowen: “2H Hopes Pinned on Volume Improvement”

“Norfolk Southern missed estimates as derailment-related service impacts weighed on its top line and costs,” commented TD Cowen Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “Normalized service quality in July supports modest sequential volume growth and OR improvement ,though this hinges on uncertain consumer demand. Yield headwinds should persist in the second half. Derailment costs will continue to accrue over 2H23 and insurance recoveries are to be determined.

“2Q adjusted EPS of $2.95 missed our estimate of $3.04 and the consensus forecast of $3.11 on top line and cost pressures resulting from derailment-related service impacts. The quarter’s results exclude $416 million of derailment costs related to environmental cleanup and legal costs. The adjusted OR deteriorated 580bps y/y and missed our forecast by 120bps.

“Derailment-related costs are expected to persist in the near term. To date, NS has incurred $803 million in environmental and legal costs, with $287 million of these paid out. NS expects to pay out half of these accrued expenses over 2H23. Further, expenses related to establishment of an East Palestine health fund will also be incurred in 2H23. We remind investors that these accruals do not account for recoveries and insurance claims NS expects to receive, though management noted that claims will begin to be filed in 3Q23 and take some time to yield claims.

“Carloads were down 5.6% y/y driven by a 9% decline in intermodal volumes. Intermodal weakness was driven by a 14% decline in the domestic business that offset a 1% uptick in international volumes. While international volumes are anticipated to improve sequentially, the outlook for domestic volumes is unclear, given low peak season visibility that has emerged as a recurring theme this earnings season. management anticipates modest volume improvements in 2H23 in line with our peak season expectations and enabled by improved service, thus allowing gradual sequential OR improvement from the prevailing low base.

“2Q23 saw cost pressures remain flat at an elevated level over the prior year as service levels were in recovery mode following the derailment shock. NS called out $40-$45 million of service-related costs in 2Q23 that should begin to dissipate in 3Q23 with service quality reaching pre-pandemic levels in July. We expect overall cost takeout to be mitigated by a step up in labor costs as the Presidential Emergency Board recommended wage increase goes into effect in 3Q23. As we pointed out for UP yesterday, costs related to new work rules such as paid sick leave and work/rest also raise the structural cost profile for the company. Couple these expenses with anticipated headwinds from fuel, and we see near -erm margin pressure for NS.

“Revenue per carload was down 2.1% y/y in 2Q23, though excluding fuel, revenue per unit was up 1% and aided by a favorable mix. 2H yields should remain pressured as fuel surcharges and accessorials moderate. NS expects intermodal pricing to remain pressured, in line with our expectation that recovery is a 2024 story given expectations for a soft truckload rate recovery in 2H23. Average revenue per unit should also face headwinds from moderating coal pricing in the back half.

“Norfolk Southern has demonstrated an ability to achieve solid operating results and has invested heavily in expanding its intermodal network and increasing its productivity. With service metrics continuing to improve, it appears well positioned in the long term. This and valuation keep us constructive on NS shares. Our price target is $253, and we reiterate Outperform.”