AAR: North American Rail Volume Down Through Week 2 (UPDATED with Larry Gross Commentary)

Written by Marybeth Luczak, Executive Editor

(Norfolk Southern Photograph)

Through the first two weeks of 2024 (ending Jan. 13), total North American carload and intermodal traffic dipped 1.5% from the same point last year, the Association of American Railroads (AAR) reported Jan. 17. The U.S. and Canada experienced declines, while Mexico saw a gain.

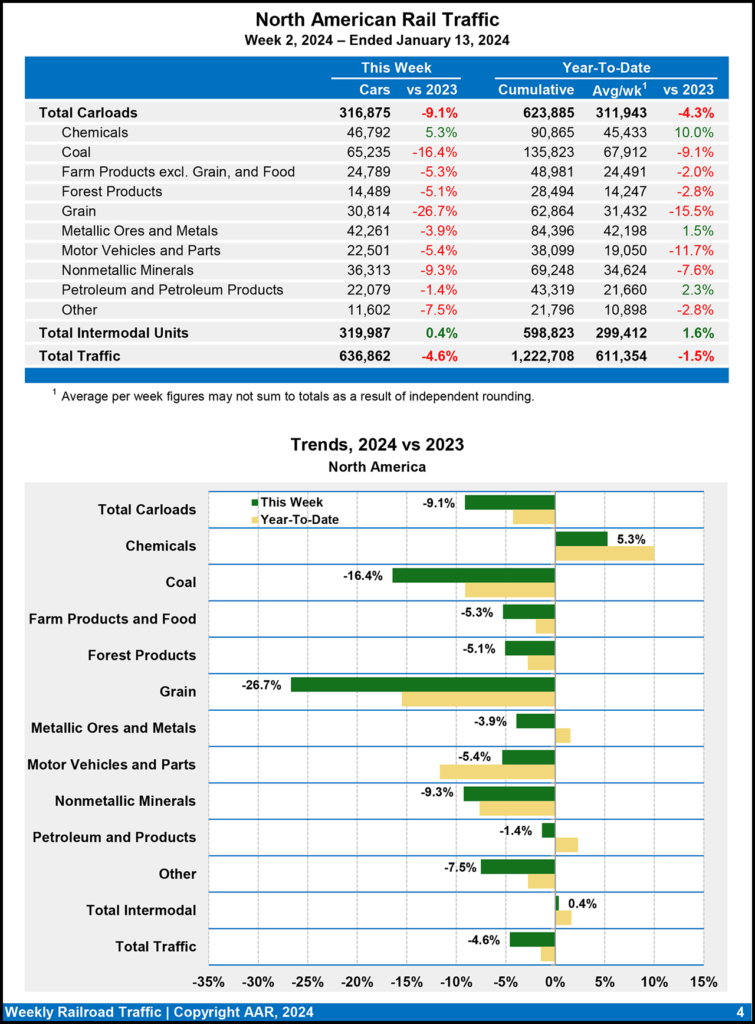

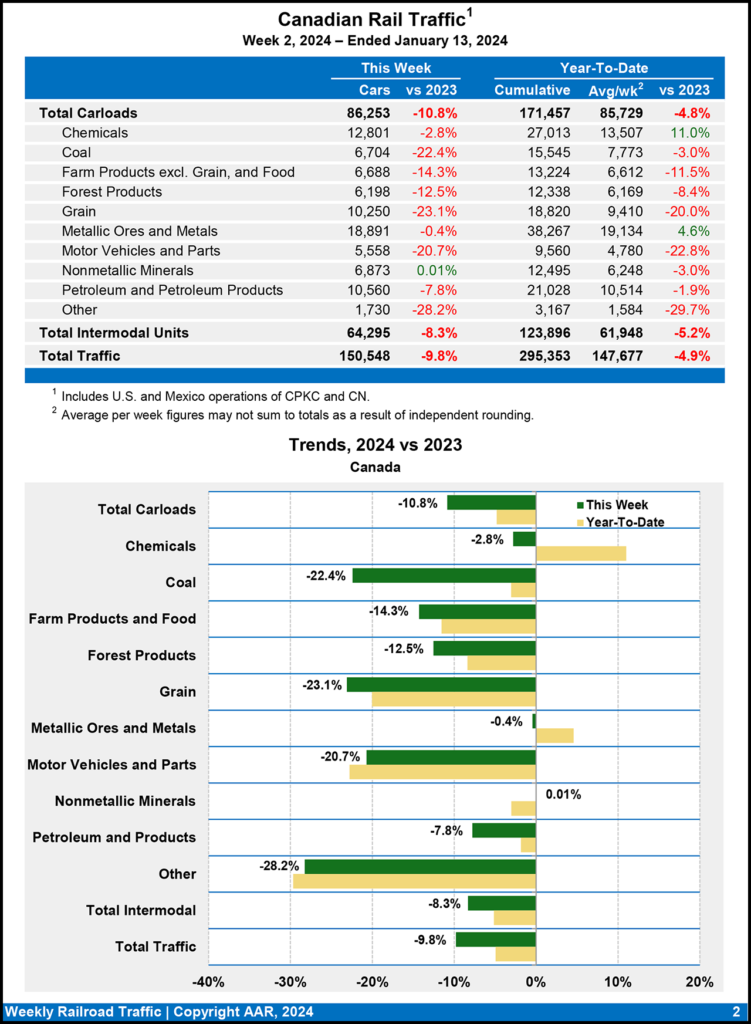

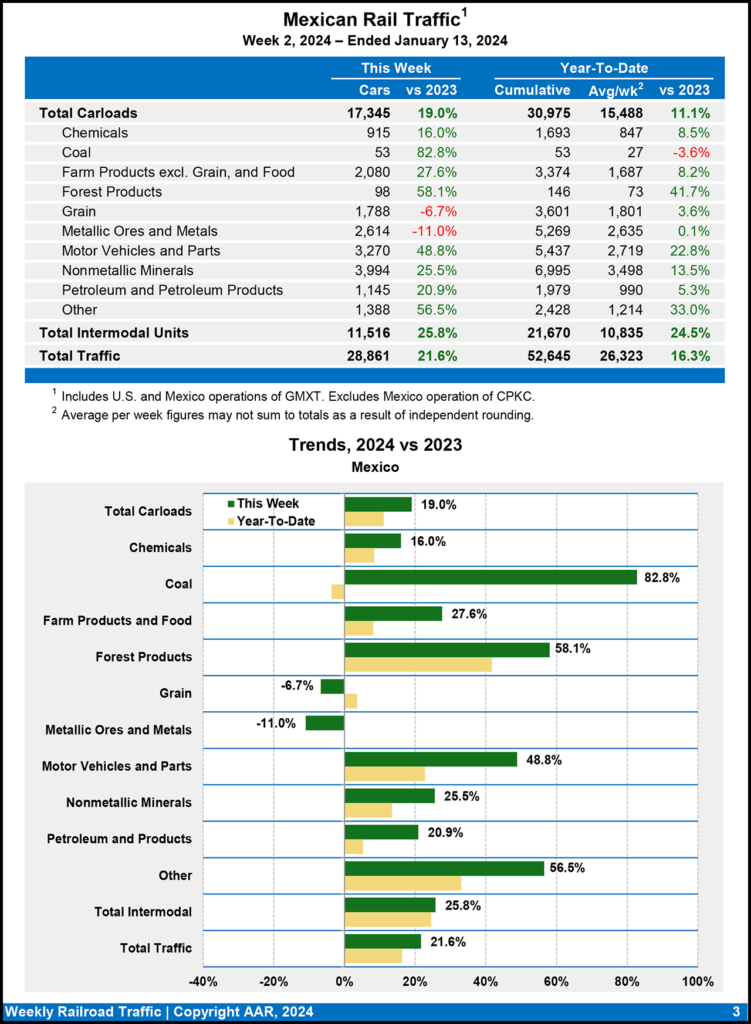

North American rail volume for the first two weeks of this year on 12 reporting U.S., Canadian and Mexican railroads came in at 1,222,708 carloads and intermodal containers and trailers. Cumulative volume in the U.S. was 874,710 carloads and intermodal units, down 1.1% from 2023; in Canada, 295,353 carloads and intermodal units, down 4.9%; and in Mexico, 52,645 carloads and intermodal units, up 16.3%.

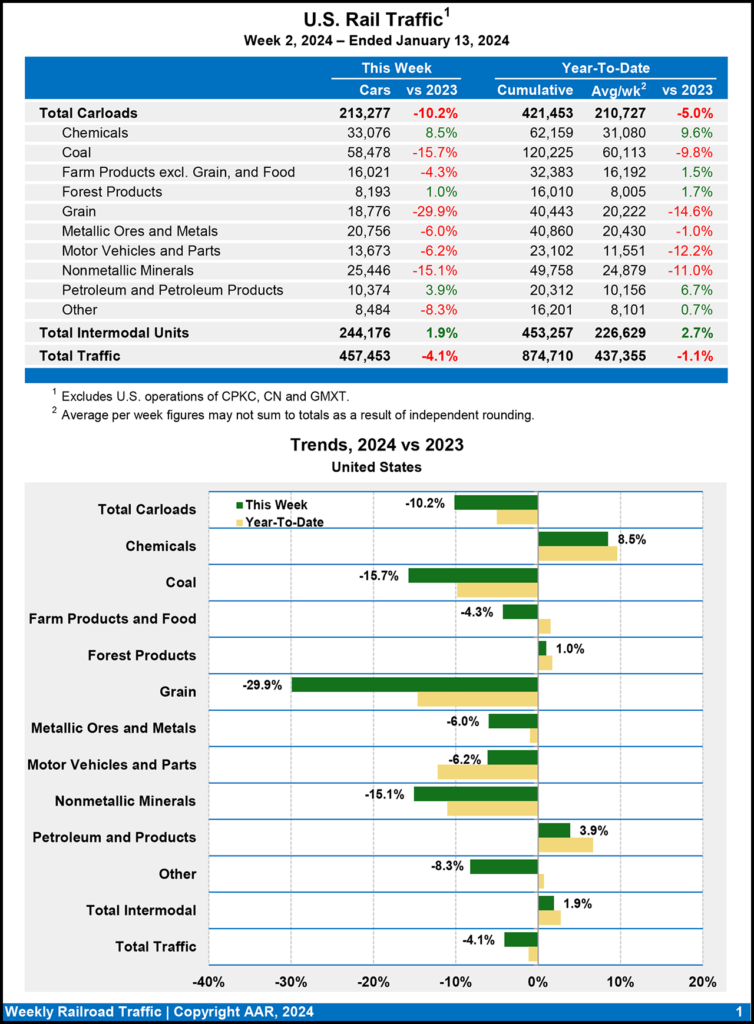

For the week ending Jan. 13, 2024, U.S. Class I railroads hauled a total of 457,453 carloads and intermodal units, falling 4.1% from the prior-year period, according to the AAR. This comprises 213,277 carloads, down 10.2% from 2023, and 244,176 containers and trailers, up 1.9% compared with last year.

Three of the 10 carload commodity groups posted an increase for the week ending Jan. 13, 2024, compared with the same week last year. They were chemicals, up 2,591 carloads, to 33,076; petroleum and petroleum products, up 389 carloads, to 10,374; and forest products, up 80 carloads, to 8,193. Commodity groups that posted decreases included coal, down 10,924 carloads, to 58,478; grain, down 8,017 carloads, to 18,776; and nonmetallic minerals, down 4,515 carloads, to 25,446.

U.S. railroads for the first two weeks of this year reported cumulative volume of 421,453 carloads, down 5.0% from the same point in 2023; and 453,257 intermodal units, up 2.7% from 2023.

North American rail volume for the week ending Jan. 13, 2024, on 12 reporting U.S., Canadian and Mexican railroads totaled 316,875 carloads, down 9.1% from the same week last year, and 319,987 intermodal units, up 0.4% from last year. Total combined weekly rail traffic in North America was 636,862 carloads and intermodal units, dropping 4.6%.

Canadian railroads reported 86,253 carloads for the week ending Jan. 13, 2024, a 10.8% fall-off, and 64,295 intermodal units, an 8.3% decrease compared with the prior-year period.

For the week ending Jan. 13, 2024, Mexican railroads reported 17,345 carloads, rising 19.0% from 2023, and 11,516 intermodal units, increasing 25.8%.

Larry Gross Insight

Intermodal expert and freight transportation analyst Larry Gross commented on the new AAR report via LinkedIn. “The latest AAR numbers just in show intermodal is off to a quiet start this year,” wrote Gross, who is President and Founder of Gross Transportation Consulting. “North American originations were up just a fraction of a point from 2023.

“As I previously mentioned, last week’s numbers were distorted by a glitch in the data reported by GMXT [Grupo Mexico Transportes]. This has now been corrected, with GMXT’s week 1 volume dropping to 9,019 units versus the previously reported 38,672. This brought the Week 1 y/y North American gain down to 3.1% versus the previously calculated 12.5%.

“Two weeks into 2024, we see four Class I’s running ahead of prior year YTD (BNSF, CSX, GMXT and NS) with three in the red (CN, CPKC and UP).

“I expect that we will see some strong gains in the west (both U.S. and Western Canada) in the coming weeks as the problems in both Panama and the Red Sea begin to bite. It will take some time for the routing decisions currently being made to show up in the import TEU numbers, but trans-Pacific into the west coast is sure looking good right now.

“One key determinant is ocean carrier pricing into the West Coast versus the East Coast. We are seeing some hefty increases on the trans-Pacific into the West Coast even though these voyages don’t pass through either of the problem areas. ‘Capacity issues’ are cited. Once again, the ocean carriers never are one to let a good crisis go to waste.”

![[Photo by Christopher Rosario U.S. Army Corps of Engineers, Baltimore District]](https://www.railwayage.com/wp-content/uploads/2024/05/dalibowcrush-315x168.jpg)