Intermodal: March’s ‘Bright Spot,’ AAR Reports

Written by Marybeth Luczak, Executive Editor

(UP Photograph)

“The recent announcement by the Institute for Supply Management that its manufacturing sentiment index turned positive in March aligns with rail carloads, excluding coal, showing a healthy 2.9% growth,” AAR Chief Economist Rand Ghayad reported April 3. Intermodal, he added, was “a bright spot in March, reflecting stable consumer spending, increasing port activity, and a reduction in inventory destocking.”

According to Ghayad, “[l]arge swaths of rail traffic reflect broader economic changes.” Carload growth was “driven largely by chemicals, petroleum products, and autos, critical components of our economy,” he reported in the Association of American Railroads’ (AAR) Rail Traffic Report for March and the Week Ending March 30, 2024. “Conversely, coal volumes continue to decline due to ongoing shifts in electricity generation markets.”

In March 2024, 11 of the 20 carload commodity categories tracked by the AAR each month saw carload gains compared with March 2023. These included grain, up 8,475 carloads or 11.4%; chemicals, up 7,248 carloads or 5.7%; and petroleum and petroleum products, up 5,249 carloads or 15.0%. Commodities that saw declines included coal, down 49,315 carloads or 18.6%; crushed stone, sand and gravel, down 5,434 carloads or 6.7%; and metallic ores, down 1,573 carloads or 8.9%.

U.S. railroads originated 866,865 carloads in March 2024, down 3.5%, or 31,101 carloads, from March 2023. They also originated 1,022,321 containers and trailers last month, up 11.7%, or 106,903 units. Combined U.S. carload and intermodal originations in March 2024 were 1,889,186, up 4.2%, or 75,802 carloads and intermodal units, from March 2023.

Excluding coal, carloads were up 18,214, or 2.9%, in March 2024 from March 2023. Excluding coal and grain, carloads were up 9,739, or 1.7%.

In comparison, in February 2024 U.S. railroads originated 885,548 carloads, down 1.3%, or 11,410 carloads compared with February 2023, and 1,040,312 containers and trailers, up 10.9%, or 102,140 units, according to AAR data released March 6. Combined U.S. carload and intermodal originations in February 2024 were 1,925,860, up 4.9%, or 90,730 carloads and intermodal units, from February 2023. Rand Ghayad said in the AAR report at that time: “In February, U.S. rail traffic recovered from disruptions caused by severe winter weather in January. However, a closer look at February’s rail traffic data shows elements that inspire optimism and elements that call for caution. Intermodal volumes have consistently grown over the past six months, signaling increased confidence among consumers and retailers. At the same time, carloads of industrial products remain below levels from last spring and summer, reflecting ongoing challenges in the industrial sector. Looking ahead, we hope to see improvements in manufacturing output and consumer spending, which are key drivers of rail transportation. This comes as the goods-producing sector begins to rebound from the stagnation experienced in the sector following the post-COVID-19 period.”

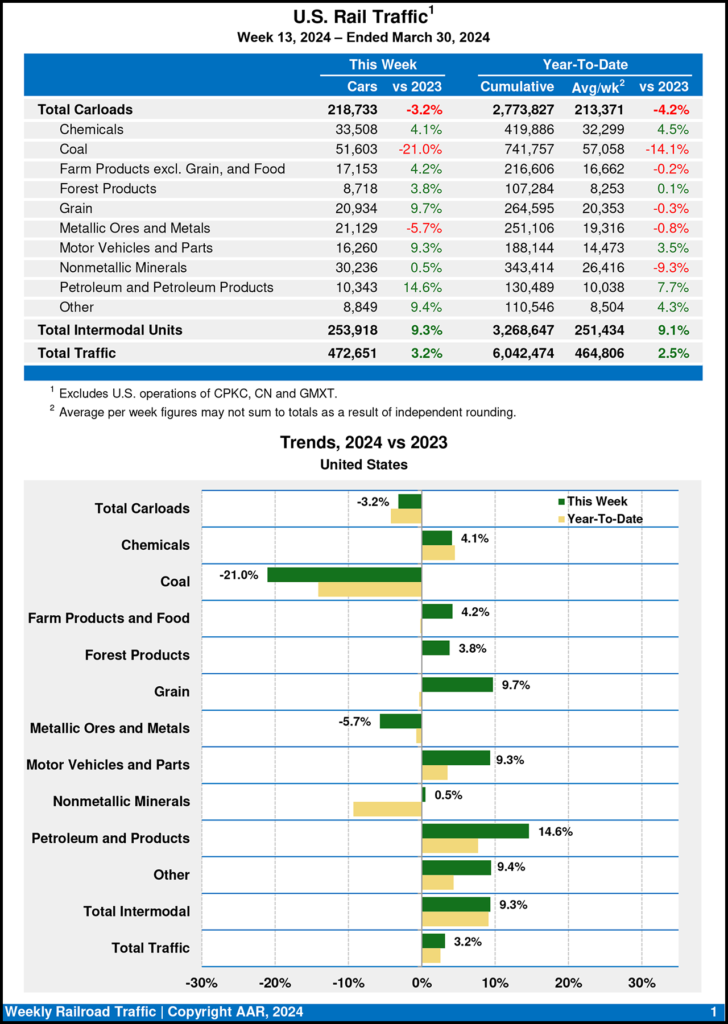

Total U.S. carload traffic for the first three months of this year was 2,773,827 carloads, down 4.2%, or 122,088 carloads, from the same period in 2023; and 3,268,647 intermodal units, up 9.1%, or 272,238 containers and trailers, from 2023.

Total combined U.S. traffic for the first 13 weeks of 2024 came in at 6,042,474 carloads and intermodal units, a 2.5% gain over last year.

Week Ending March 30, 2024

Total U.S. rail traffic for the week ending March 30, 2024, was 472,651 carloads and intermodal units, increasing 3.2% from the same week last year. Total carloads came in at 218,733, down 3.2% from the same week in 2023, while U.S. weekly intermodal volume was 253,918 containers and trailers, up 9.3 % from 2023.

For the week ending March 30, 2024, eight of the 10 carload commodity groups posted an increase compared with the same week last year. They included grain, up 1,849 carloads, to 20,934; motor vehicles and parts, up 1,387 carloads, to 16,260; and chemicals, up 1,319 carloads, to 33,508. Commodity groups that posted decreases were coal, down 13,750 carloads, to 51,603; and metallic ores and metals, down 1,279 carloads, to 21,129.

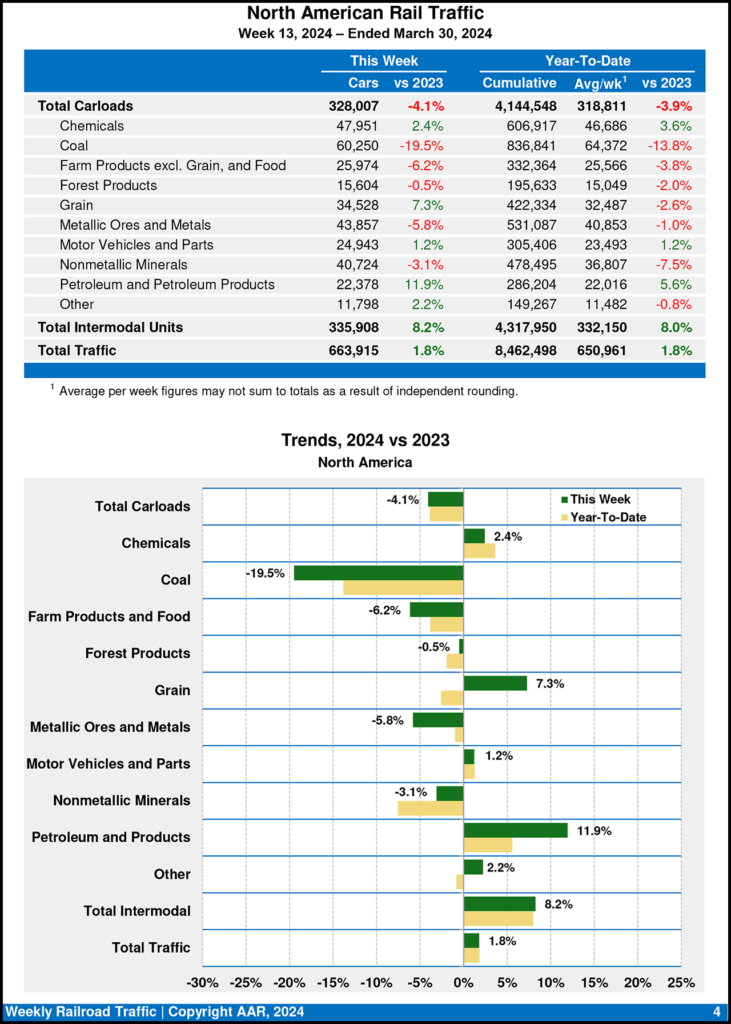

North American rail volume for the week ending March 30, 2024, on 10 reporting U.S., Canadian and Mexican railroads totaled 328,007 carloads, dipping 4.1% from the same week last year, and 335,908 intermodal units, rising 8.2% from last year. Total combined weekly rail traffic in North America was 663,915 carloads and intermodal units, up 1.8%. North American rail volume for the first 13 weeks of this year was 8,462,498 carloads and intermodal units, up 1.8% from 2023.

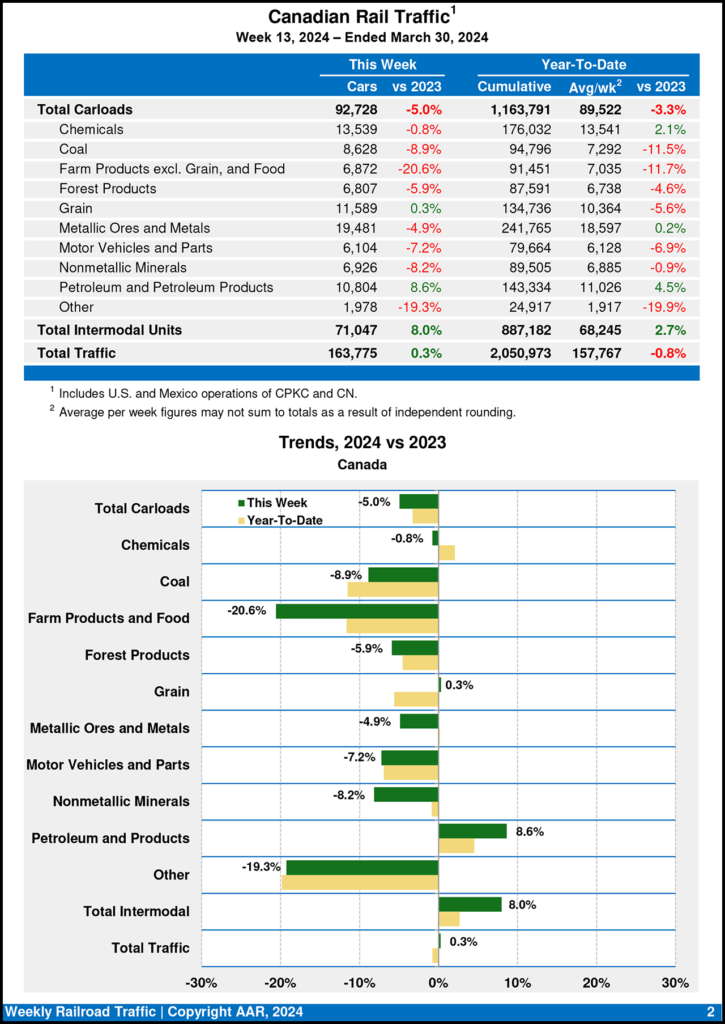

Canadian railroads reported 92,728 carloads for the week ending March 30, 2024, a 5.0% fall-off, and 71,047 intermodal units, an 8.0% increase from the same point last year. For the first 13 weeks of this year, they reported cumulative rail traffic volume of 2,050,973 carloads, containers and trailers, down 0.8%.

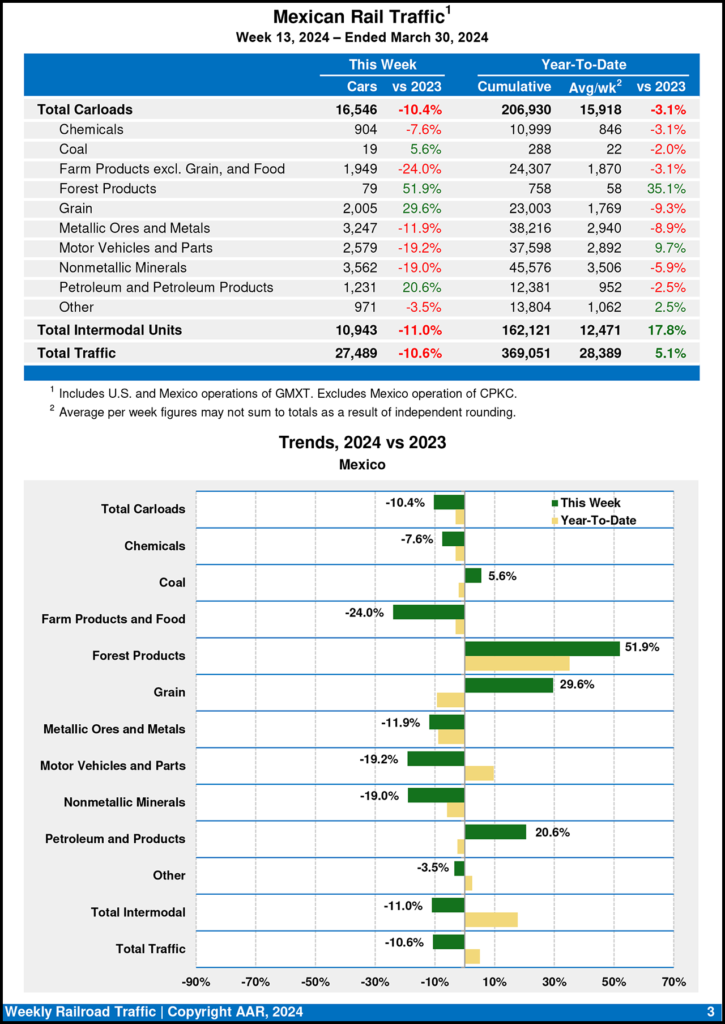

For the week ending March 30, 2024, Mexican railroads reported 16,546 carloads, dropping 10.4% from the same week last year, and 10,943 intermodal units, decreasing 11.0%. Their cumulative volume for the first 13 weeks of 2024 came in at 369,051 carloads and intermodal containers and trailers, rising 5.1% from the same point last year.