For February Rail Traffic, ‘Pockets of Real Strength’

Written by Marybeth Luczak, Executive Editor

“U.S. rail traffic had big year-over-year gains in February largely because severe winter storms held volumes back last February,” AAR Senior Vice President John T. Gray reported on March 2.

“That said, there were pockets of real strength last month,” Gray noted in the just-released Association of American Railroads’ (AAR) rail traffic report covering February 2022 and the week ending Feb. 26, 2022. “For example, carloads of chemicals set a new monthly record last month, carloads of coal were the highest in five months and carloads of lumber were the most in eight months.”

In February 2022, 15 of the 20 carload commodity categories tracked by the AAR each month saw carload gains over the same month in 2021. These included: coal, up 47,238 carloads or 21.3%; chemicals, up 19,397 carloads or 16.4%; and crushed stone, sand and gravel, up 17,918 carloads or 36.3%. Commodities that saw declines in February 2022 from the previous-year period included: motor vehicles and parts, down 6,358 carloads or 11.4%; petroleum and petroleum products, down 3,191 carloads or 8%; and all other carloads, down 2,162 carloads or 9.3%.

Combined U.S. carload and intermodal originations in February 2022 were 1,945,646, gaining 5.7%, or 104,819 carloads and intermodal units from February 2021. This was based on 915,329 carloads—increasing 11%, or 90,525 carloads, from the same month last year—and 1,030,317 containers and trailers—rising 1.4%, or 14,294 units.

Excluding coal, carloads were up 43,287 carloads, or 7.2%, in February 2022 from February 2021. Excluding coal and grain, carloads were up 39,619 carloads, or 7.7%.

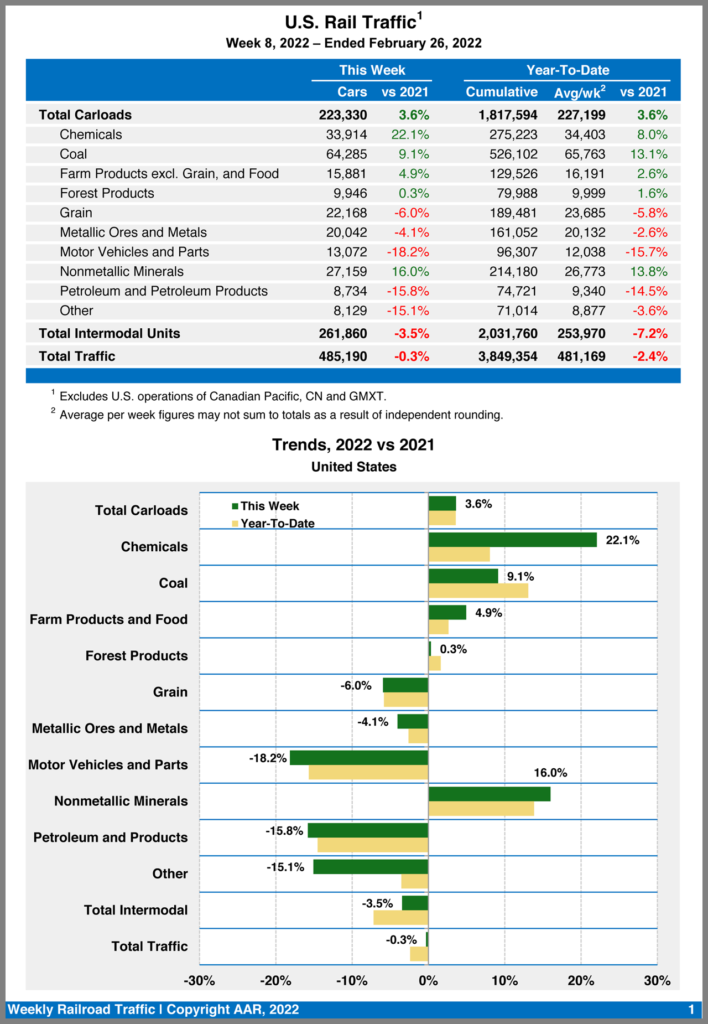

Total U.S. carload traffic for the first two months of 2022 came in at 1,817,594 carloads, a gain of 3.6%, or 62,664 carloads, from the same point last year; and 2,031,760 intermodal units, a fall-off of 7.2%, or 157,502 containers and trailers, from last year.

Total combined U.S. traffic for the first eight weeks of 2022 was 3,849,354 carloads and intermodal units, dropping 2.4% from the previous-year period.

(For January 2022 rail traffic details, read: “U.S. Rail Traffic Lags in January.”)

Week 8 (Ending Feb. 26, 2022)

Total U.S. weekly rail traffic was 485,190 carloads and intermodal units, a 0.3% dip from the same week last year.

Total carloads for the week ending Feb. 26, 2022 came in at 223,330, a 3.6% rise compared with the same week in 2021, while U.S. weekly intermodal volume was 261,860 containers and trailers, a 3.5% drop vs. last year.

Five of the 10 carload commodity groups posted an increase compared with the same week in 2021. They included chemicals, up 6,132 carloads, to 33,914; coal, up 5,375 carloads, to 64,285; and nonmetallic minerals, up 3,744 carloads, to 27,159. Commodity groups that posted decreases included motor vehicles and parts, down 2,901 carloads, to 13,072; petroleum and petroleum products, down 1,640 carloads, to 8,734; and miscellaneous carloads, down 1,443 carloads, to 8,129.

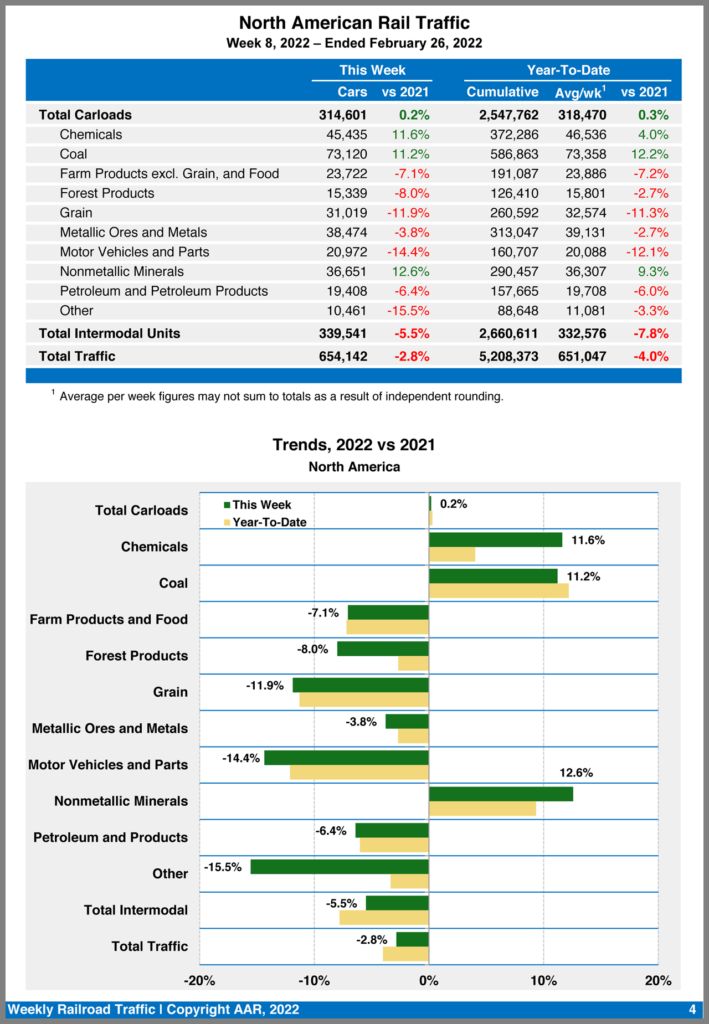

North American rail volume for the week ending Feb. 26, 2022, on 12 reporting U.S., Canadian and Mexican railroads totaled 314,601 carloads, up 0.2% from year-earlier period, and 339,541 intermodal units, down 5.5%. Total combined weekly rail traffic in North America was 654,142 carloads and intermodal units, down 2.8%. North American rail volume for the first eight weeks of 2022 was 5,208,373 carloads and intermodal units, down 4% compared with 2021.

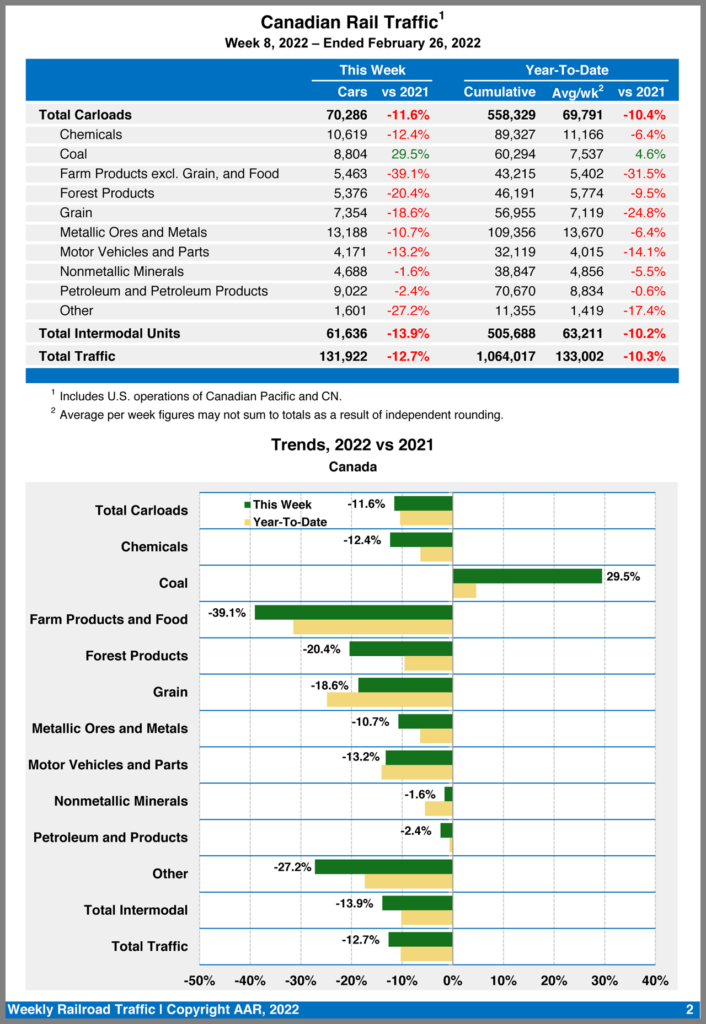

Canadian railroads reported 70,286 carloads for the week, decreasing 11.6%, and 61,636 intermodal units, falling 13.9% compared with the same week in 2021. For the first eight weeks of 2022, they reported cumulative rail traffic volume of 1,064,017 carloads, containers and trailers, down 10.3%.

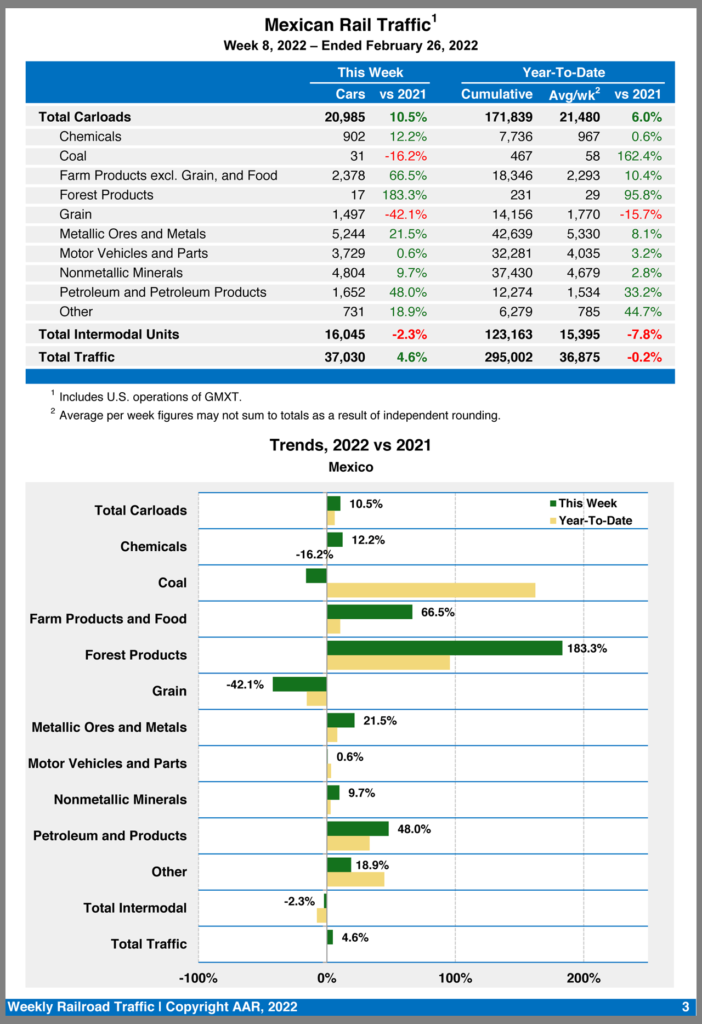

Mexican railroads reported 20,985 carloads for the week, a 10.5% boost from the same week last year, and 16,045 intermodal units, a 2.3% decline. Their cumulative volume for the first eight weeks of 2022 was 295,002 carloads and intermodal containers and trailers, decreasing 0.2% from the 2021 period.