CSX 1Q24 ‘In Line with Our Expectations’ (Updated, TD Cowen Insight and Interview with Joe Hinrichs)

Written by William C. Vantuono, Editor-in-Chief

“Working together, the ONE CSX team delivered a good start to the year that was in-line with our expectations,” said President and CEO Joe Hinrichs. CSX photo.

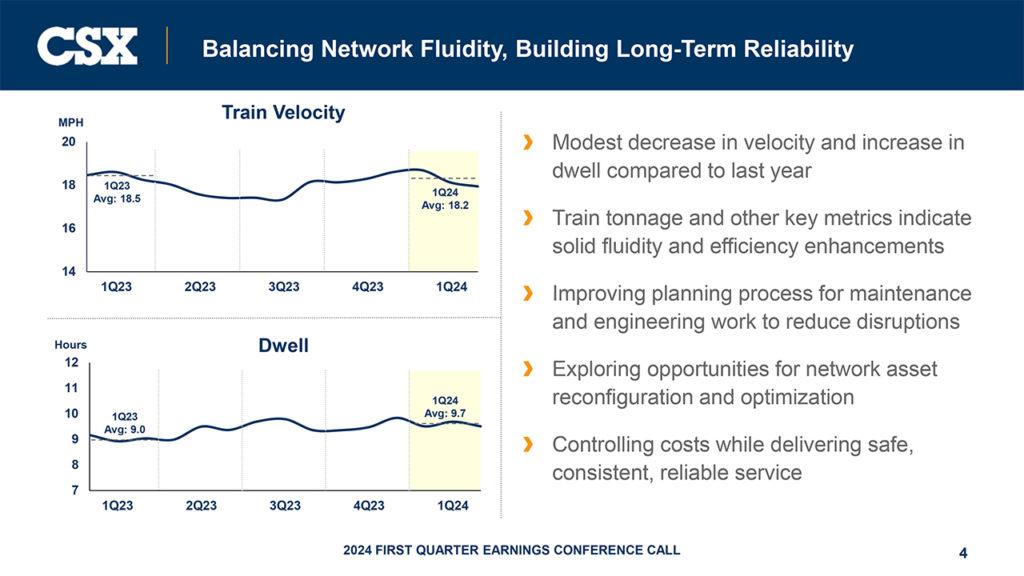

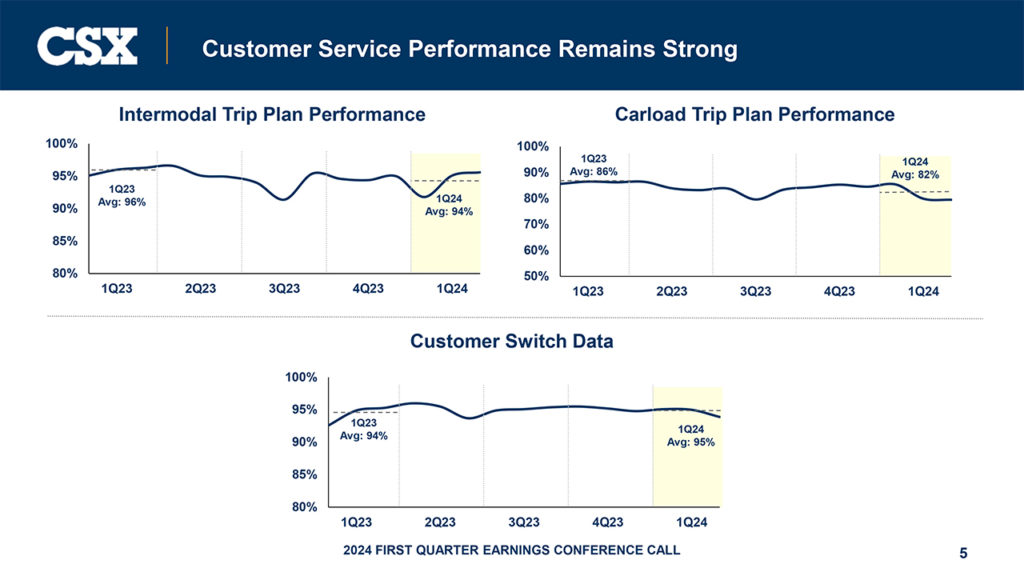

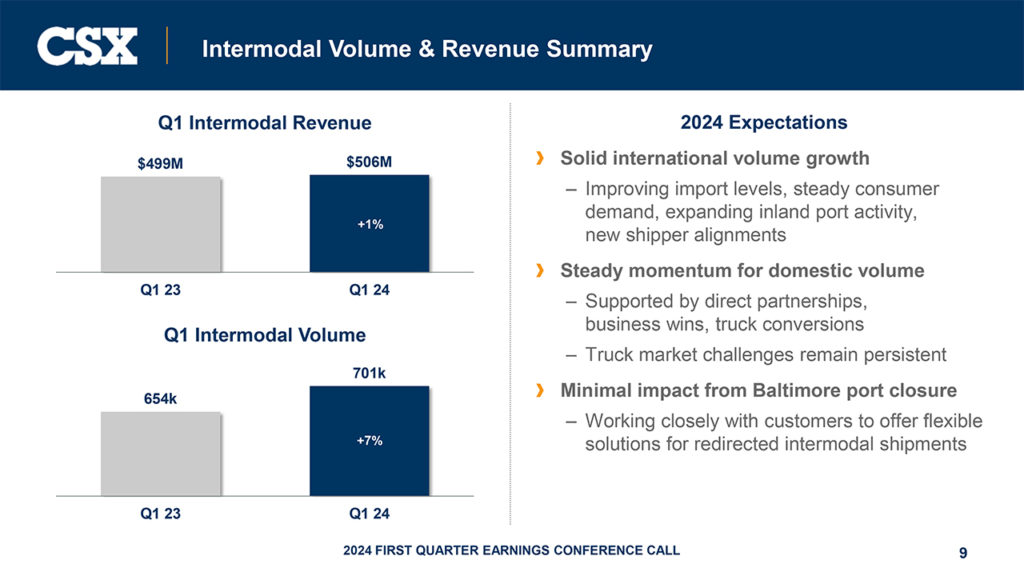

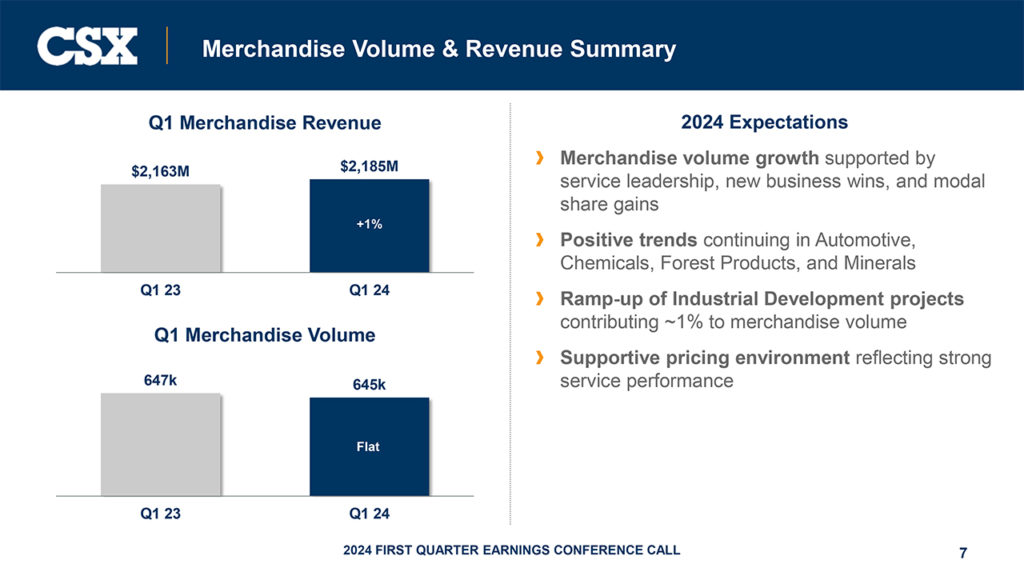

CSX, the first of the Class I’s out of the gate with financial results, reported for 2024’s first quarter slightly lower revenue and income compared to the prior-year quarter, but solid volume gains in some categories. Total volume of 1.53 million units for the quarter was 3% higher compared to first-quarter 2023, with intermodal volume up 7%, coal volume up 2%, and merchandise volume flat. Automotive and Chemicals saw increases of 9% and 4%, respectively. CSX’s operating ratio for the quarter was 63.2%. Service metrics suffered slightly, largely attributable to weather impacts from Arctic Blasts in January and February.

CSX reported 1Q24 operating income of $1.35 billion compared to $1.46 billion in the prior-year period, an 8% decrease compared to the same period in 2023 but a 3% increase from 4Q23. Net earnings were $893 million, or $0.46 per diluted share, compared to $987 million, or $0.48 per diluted share, in the same period last year, a 4% decrease but a 2% increase compared to the previous quarter.

CSX’s operating margin was 36.8% for the quarter, declining 270 basis points year-over-year but increasing 90 basis points sequentially. Revenue totaled $3.68 billion for the quarter, declining 1% year-over-year as lower fuel surcharge, a decline in other revenue, weaker trucking revenue and reduced export coal prices offset gains in merchandise pricing and higher intermodal and coal volumes. First-quarter revenue was flat sequentially.

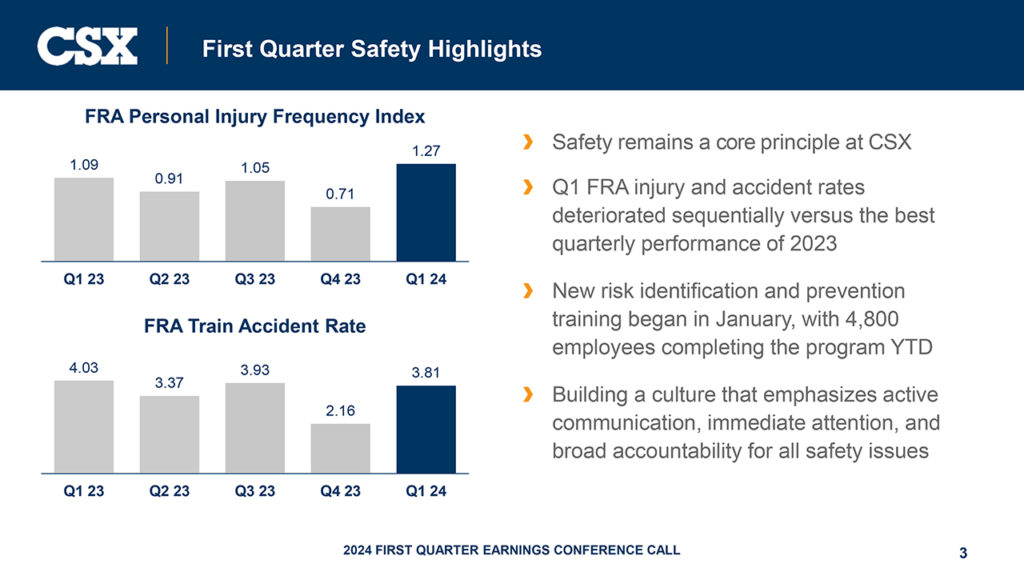

CSX’s FRA-reportable Personal Injury Frequency of 1.27 increased by 17% compared to the prior year. The FRA train accident rate of 3.81 decreased by 5% compared to the prior year. President and CEO Joe Hinrichs explained to Railway Age that there was in increase in slips, trips and falls resulting in minor (albeit reportable) injuries due mostly to winter weather conditions. There were 8 crew-transport-related automobile accidents also resulting in minor injuries. As well, an increase in m/w work including a blitz in January and February, produced some minor injuries. Hinrichs said that accident and personal injury rates dropped in March and April. Nevertheless, he said, “All injuries, regardless of severity, are unacceptable. We started a new risk identification and prevention training program in January. So far, nearly 5,000 employees have completed it.”

CSX said its full-year 2024 guidance is “unchanged,” consisting of “low- to mid-single-digit total volume and revenue growth” driven by “solid momentum” across Merchandise, Intermodal and Export Coal; “profitability supported by solid pricing, improving efficiency, and lower cost inflation”; capex of approximately $2.5 billion consisting of safety investments, capacity/equipment additions, technology enhancements, the MNBR interchange with CPKC and “high-return growth projects”; and a “balanced approach to capital returns.”

“Working together, the ONE CSX team delivered a good start to the year that was in-line with our expectations,” said Hinrichs. “We were pleased to see our consistent customer service performance lead to volume growth, and we remain focused on improving the reliability and fluidity of our network. Looking ahead, with favorable trends across many of the markets we serve, we are eager to build on our momentum over the rest of the year and beyond.”

CSX Maintaining Momentum

By Jason Seidl, Managing Director, Industrials – Airfreight and Surface Transportation, TD Cown, and Railway Age Wall Street Contributing Editor

CSX’s 1Q24 came in above us and consensus and management reiterated full year guidance despite January weather challenges and the Baltimore bridge tragedy. Near-term challenges are posed to export coal given the situation, though management expects to begin to see some relief through May. CSX still sees sequential EBIT and margin growth in 2Q24. Our price target of $37 remains intact, reiterate Hold.

CSX reported 1Q EPS of $0.46, a penny above our and the Street estimates of $0.45. OR of 63.2% came in 20bps better than our estimate, despite severe weather early in the quarter and in line with 4Q23 guidance of sequential improvement.

The net revenue impact from the bridge collapse in Baltimore should be $25 million-$30 million per month, which will largely affect the railroad’s export coal business. CSX has taken steps to temporarily redirect a portion of these coal volumes to other locations. The revenue loss is similar to the impact Norfolk Southern called out of $50 million-$100 million expected in 2Q24. Coal RPUs should be negatively affected in 2Q24 with high single-digit declines given the situation. CSX expects effects of Baltimore to continue through May, and then will likely ramp in the coming months as more coal terminals restart normal services.

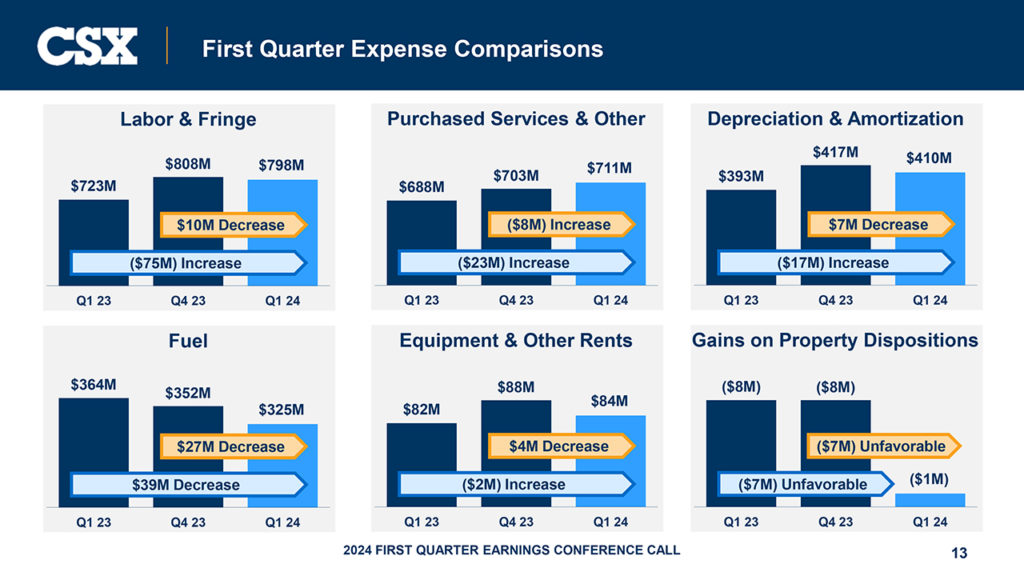

CSX expects stable headcount in 1H24 while leaning into attrition and called out a sequential decline in cost/employee in 2Q24. We remind investors that a 4.5% GWI goes into effect in 3Q24 and model accordingly. Service metrics stepped down slightly in 1Q24 largely due to weather though but still in good overall shape in our view. Commentary lines up with results of our proprietary shippers’ survey. CSX expects overall cost except fuel to decline sequentially in 2Q24 despite the Baltimore impacts detailed above and support sequential EBIT and EPS growth in the quarter, in line with our prior assumptions.

Intermodal carloads +7.2% y/y were driven by double-digit growth in international volumes and modest domestic growth (some of which likely came from NS shedding traffic in certain intermodal lanes). CSX sounded optimistic on continued volume growth as domestic volumes improve on eventual TL rate recovery. No impacts to intermodal are anticipated from the Baltimore outage. CSX has not seen significant freight shift to the West Coast but noted that such a shift could be a net positive given longer length of haul and OTR conversion potential.

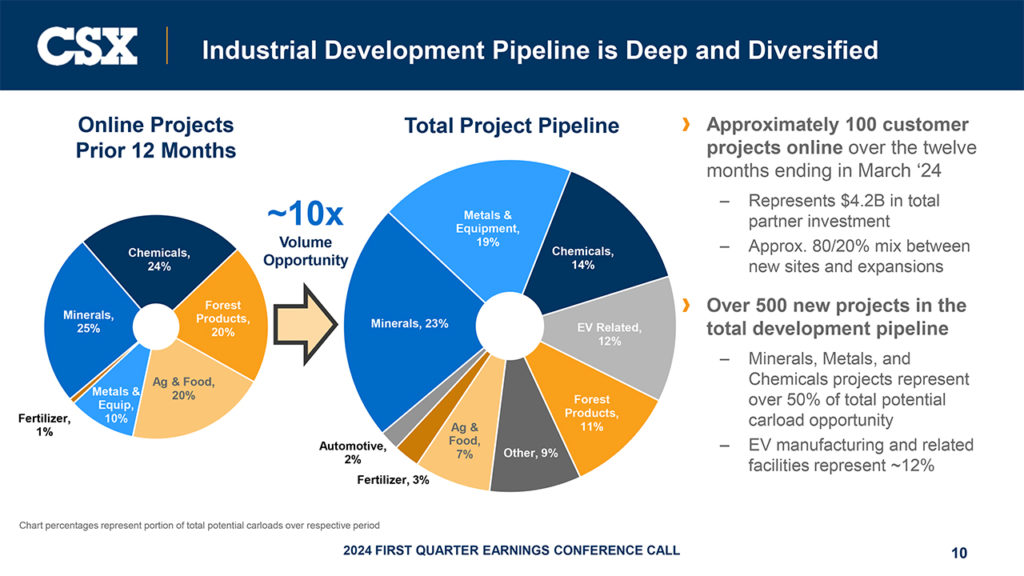

CSX has seen 100 industrial development facilities come on line during the past year, which represent $4.2 billion in capital investments. These new facilities add freight to such segments as chemicals, minerals and forest products. CSX stated it has 500 additional projects in the development pipeline.

We maintain our 2024 EPS estimate at $2.02 and our 2025 EPS estimate at $2.23. Continuing to use our 16.5x multiple, our $37 price target remains intact. Reiterate Hold. Forthcoming catalysts: Long-term intermodal growth to be driven by the ongoing shift from the highway as well as the expansion of some of the company’s hubs, and potential longer-term benefits from the ongoing operational turnaround plan.