CSX 1Q23: ‘An Encouraging Start to the Year’

Written by Carolina Worrell, Senior Editor

“CSX had an encouraging start to the year as the efforts of our dedicated railroaders resulted in strong earnings growth,” said President and CEO Joe Hinrichs during the Class I’s financial report on April 20.

“Our ONE CSX initiatives are driving positive engagement among our employees and customers, which is lifting our service performance and providing us with exciting opportunities to win business and move more freight while maintaining our fundamental commitment to safe operations,” Hinrichs added.

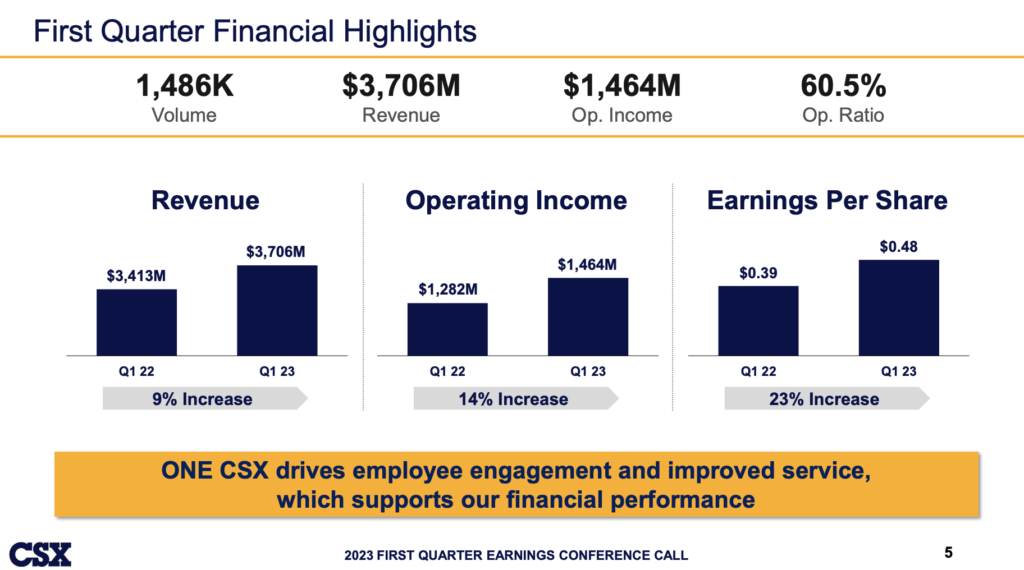

CSX reported first-quarter 2023 operating income of $1.46 billion compared to $1.28 billion in the prior year period; net earnings of $987 million, or $0.48 per share, compared to $859 million, or $0.39 per share, in the same period last year.

Among CSX’s first-quarter 2023 financial highlights:

- Revenue reached $3.71 billion for the quarter, increasing 9% year-over-year, driven by solid volume growth in merchandise and coal, higher fuel surcharge, and pricing gains.

- Operating income of $1.46 billion increased 14% compared to the prior year, with an operating ratio of 60.5%.

- Diluted EPS of $0.48 increased 23% from $0.39 for the first quarter of 2022.

DOWNLOAD THE QUARTERLY FINANCIAL REPORT BELOW:

TD Cowen Insight: ‘Substantially Improved Service Quality’

“CSX reported a top and bottom line beat as substantially improved service quality supported merchandise volumes and pricing while alleviating congestion-related costs,” reports TD Cowen Managing Director, Industrials and Railway Age Contributing Editor Jason Seidl. “While weakness in intermodal persists, improved service should enable accelerated cost takeouts and allow sequential OR improvements going forward. We raise our PT to $37 and reiterate Market Perform.

“CSX reported 1Q EPS of $0.48 above our estimate of $0.42 and consensus of $0.43 as robust pricing power offset volume weakness and drove 9% y/y top-line growth. Service improvements (including some impressive trip plan compliance numbers) led 1Q OR to 60.5% and beat our estimate of 62.9%. These figures continue to include impacts from the Quality Carriers acquisition.

“Improved service was the highlight on the call as operating metrics confirm that material improvements in network fluidity have finally arrived at CSX, as predicted in our quarterly shippers’ survey. Notable upticks in trip plan performance in 1Q (reaching 96% in intermodal and 86% for other carloads) is at company records and was credited for supporting 11% y/y yield growth this bid season. CSX called out $15MM-$20MM of congestion-related expenses being phased out in 1Q with cost takeouts projected to increase sequentially and intensify further in the back half. We expect these cost benefits to mitigate the impacts of increased labor costs resulting from paid sick leave agreements and general wage increases scheduled for July ’23. Mgmt. called out stable cost per employee in 2Q on a sequential basis.

“Carloadings were down 1% y/y, driven primarily by weak intermodal volumes (these typically account for half of CSX’s carloadings). Management pointed out that weakness is now evident on the domestic side in addition to international, likely due to competition from truck as UNP highlighted at their call. CSX lowered volume guidance, projecting low single-digit RTM growth for 2023 replacing previous GDP+ guidance, and we lower our 2023 volume assumptions to reflect this. We nonetheless believe improved service should mitigate the impacts of a demand drawdown and note that automotive, metals and minerals will continue to be pockets of strengths in 2023.

“Commentary suggests that service-related cost benefits have been pulled earlier in the year, and we improve our 2Q OR assumptions accordingly. CSX expressed confidence that OR should follow the typical seasonal cadence of improvement from 1Q to 2Q, though we expect this improvement to be less dramatic than in 2022 because 1) 2Q22 results included a $122MM real estate sale gain, and 2) sequential benefits to OR should be moderated by fuel headwind in 2Q as surcharge revenue declines, given QTD fuel trends.”