CPKC Finishes 2023 with ‘Strong’ 4Q Results (Updated)

Written by Carolina Worrell, Senior Editor

CPKC photo

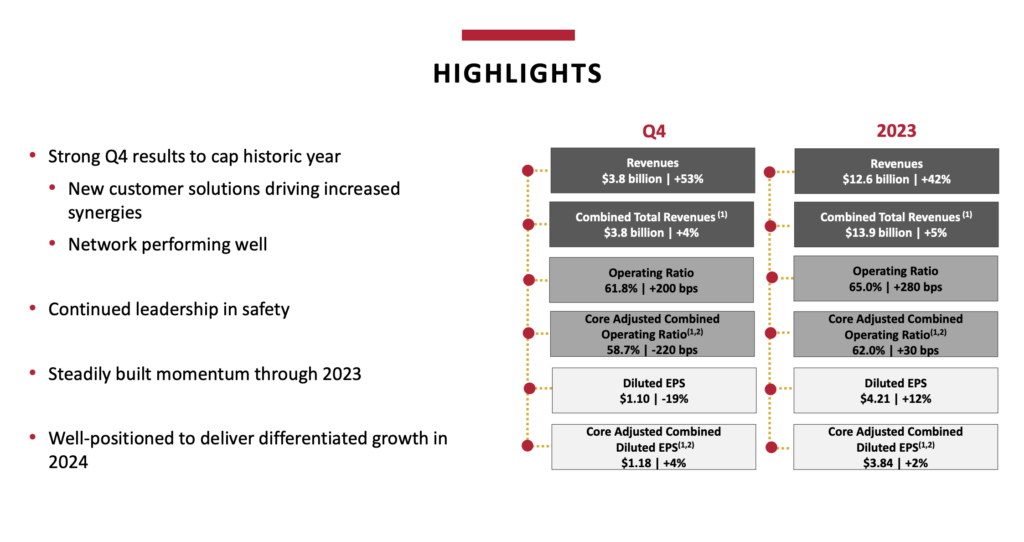

“I am proud of how our team of incredible railroaders finished this transformational year with a strong fourth quarter, allowing CPKC to deliver volume growth and best-in-class earnings growth in 2023,” reported CPKC President and CEO Keith Creel at the railroad’s Jan. 30 fourth-quarter and full-year 2023 earnings presentation.

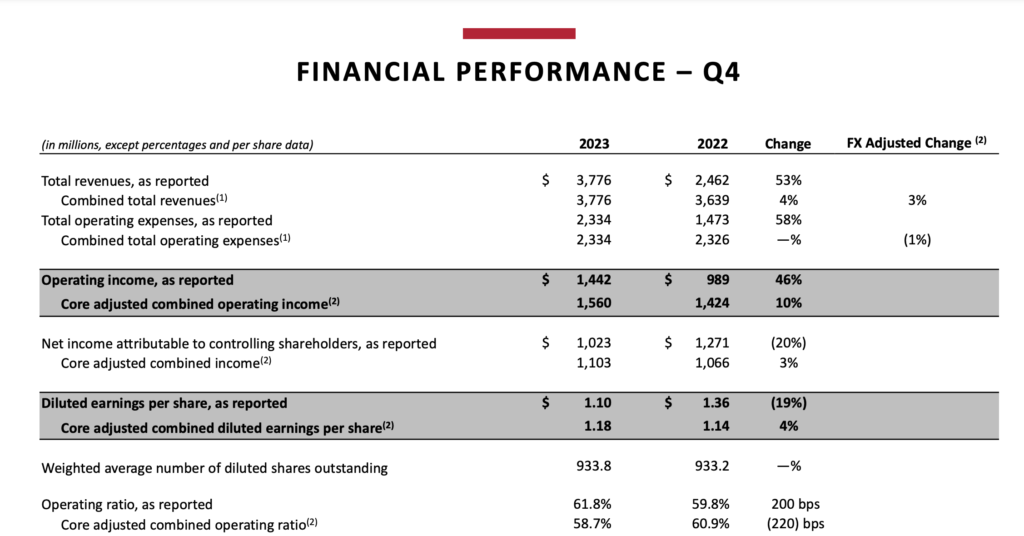

CPKC, named one of Alberta Province’s Top 80 Employers for the fifth consecutive year, reported revenues of $3.8 billion in fourth-quarter 2024; diluted earnings per share (EPS) decreased to $1.10 from $1.36 in 4Q22; and core adjusted combined diluted EPS increased to $1.18 from $1.14 in 4Q22.

Among CPKC’s other fourth-quarter 2023 highlights:

- Reported operating ratio (OR) increased by 200 basis points to 61.8% from 59.8% in 4Q22.

- Core adjusted combined OR2 decreased 220 basis points to 58.7% from 60.9% in 4Q22.

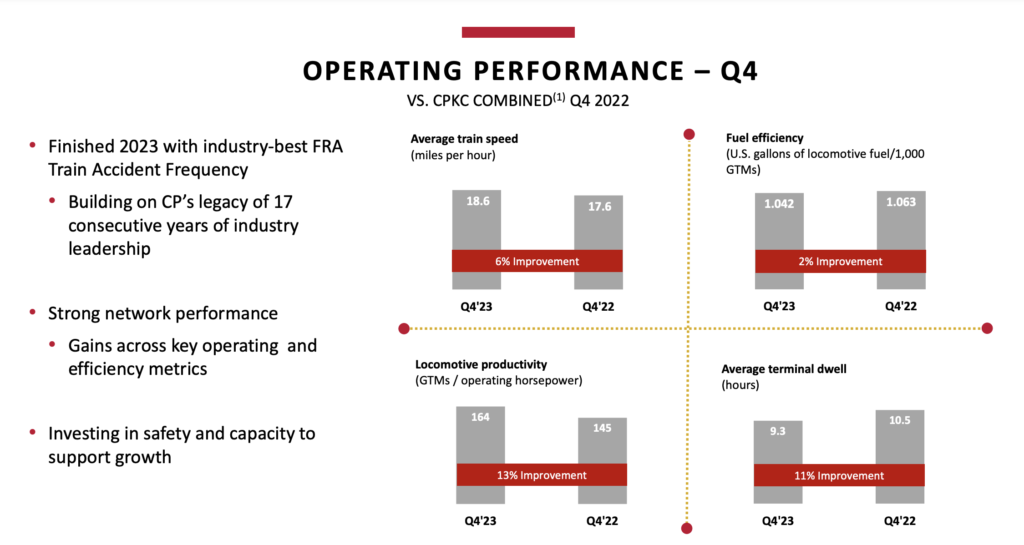

- Federal Railroad Administration (FRA)-reportable train accident frequency declined 23% to 1.08 from 1.40 in 4Q22 on a combined basis.

- FRA-reportable personal injury frequency declined 15% to 1.10 from 1.29 in 4Q22 on a combined basis.

“Since our historic combination in April 2023, our united CPKC team has steadily built momentum, bringing new competition to supply chains and creating more value for our customers, while remaining focused on service and safety,” Creel added.

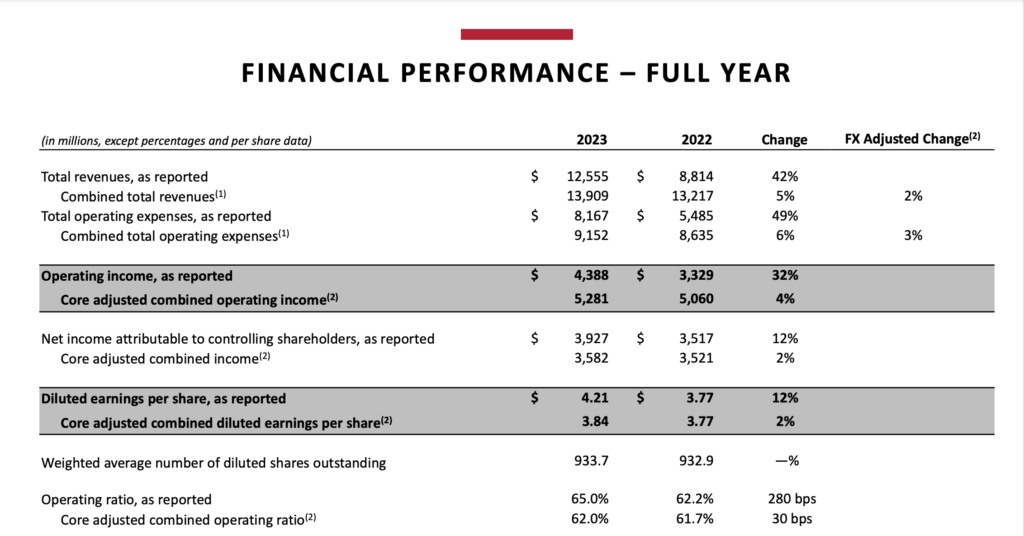

Full-year 2023 results:

- Reported OR increased by 280 basis points to 65.0% from 62.2% in 2022.

- Core adjusted combined OR2 increased 30 basis points to 62.0% from 61.7% in 2022.

- Reported diluted EPS increased to $4.21 from $3.77 in 2022.

- Core adjusted combined diluted EPS2 increased 2% to $3.84 from $3.77 in 2022.

- FRA-reportable train accident frequency declined 32% to 0.99 from 1.45 in 2022 on a combined basis.

- FRA-reportable personal injury frequency declined 12% to 1.14 from 1.30 in 2022 on a combined basis.

In 2023, CPKC says it led the industry with the lowest FRA-reportable train accident frequency among Class I railroads, “building on Canadian Pacific’s (CP) legacy of 17 consecutive years of industry leadership.”

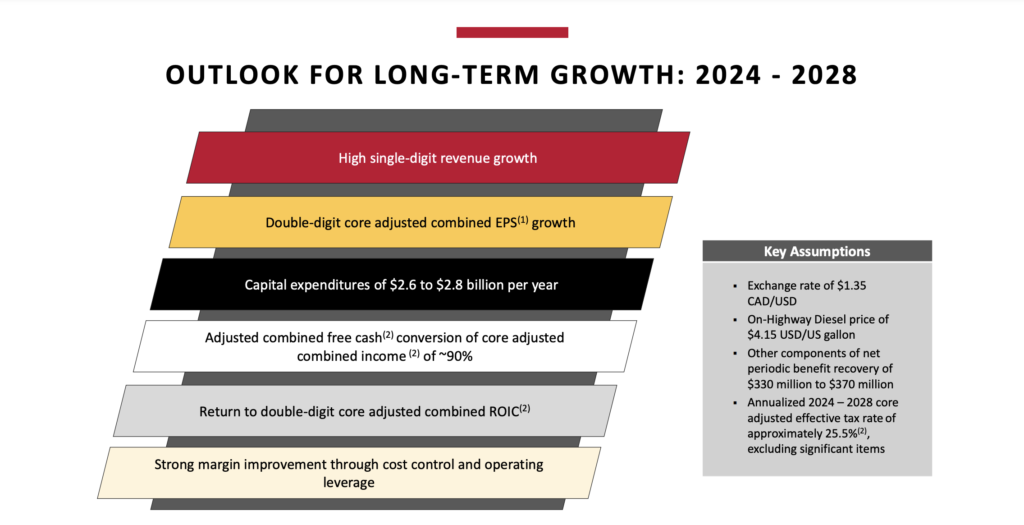

Full-year 2024 guidance:

- CPKC expects core adjusted combined diluted EPS2 to grow double digits versus 2023 core adjusted combined diluted EPS2 of $3.84.

- Capital expenditures of $2.75 billion.

- Other components of net periodic benefit recovery will increase by approximately $23 million from $327 million in 2023.

“Looking forward to 2024, we are confident that our unique synergy opportunities, along with improving macro-economic conditions, can overcome a weak Canadian grain crop and position us for another strong performance this year, our first full year as a combined company,” said Creel. “We stand ready to deliver on our commitments to our customers and our shareholders with long term sustainable growth.”

Passenger Rail Hosting in Mexico?

At the earnings call, Creel said he’s not concerned with the Nov. 20 decree from Mexican President Andrés Manuel López Obrador (AMLO) the nation’s freight railroads are obligated to host long-distance passenger trains, which largely disappeared following privatization in the late 1990s. CPKC’s prime Nuevo Laredo-Monterrey-San Luis Potisi-Mexico City main line (formerly Kansas City Southern de México) is among those routes. In the decree, AMLO said that “preference will be given to public passenger rail service, and freight rail transport will be respected, according to the terms of the corresponding concession.”

“I have zero expectation and belief that Mexico’s ambition and intent to integrate and initiate passenger rail service in concert with freight rail service will impact our ability to hit our synergies or any of the targets of our multi-year guidance,” said Creel, who noted that he has met twice with AMLO (who leaves office this year) and reached an agreement with the Mexican government to carry out a study whose completion is expected in May. “He committed to me that he’s aligned exactly with what my expectations are. He does not want to jeopardize any of that.” Creel added that CPKC is willing to host passenger trains “with the right infrastructure and right investment.”

DOWNLOAD CPKC’s 4Q23 EARNINGS REVIEW PRESENTATION BELOW: