Arctic Blast Recovery; NS Activism (Again)

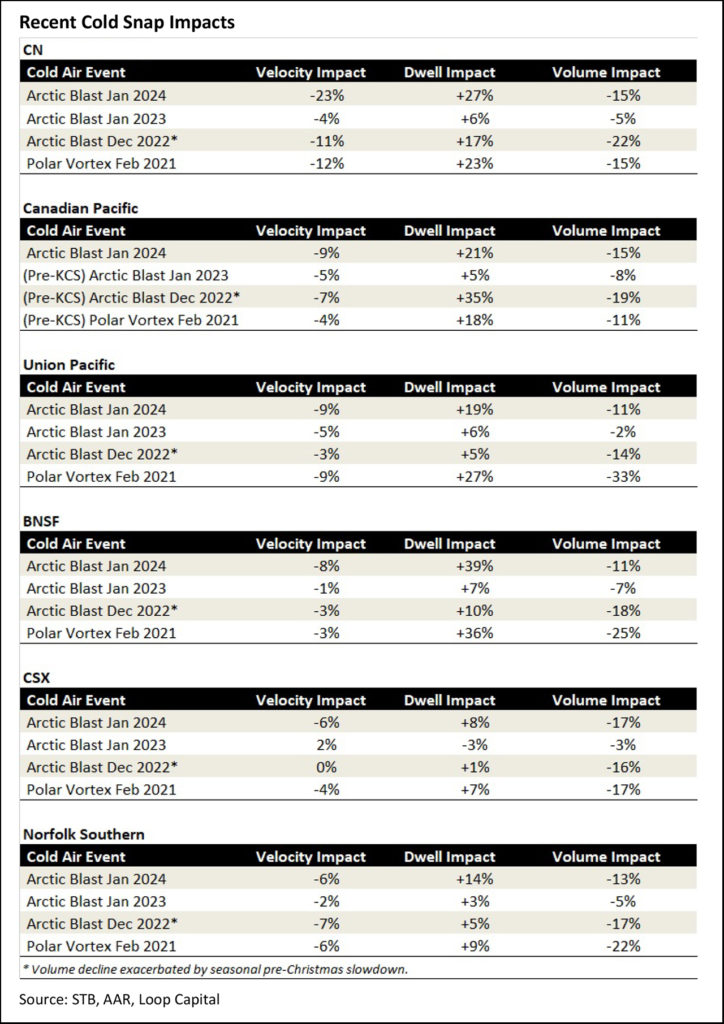

Written by Rick Paterson, Managing Director, Loop Capital MarketsBefore we talk about the recovery, let’s compare the recent Arctic Blast with comparable cold snaps over the past four winters. There were two Arctic Blasts last winter, falling in reporting weeks that ended Dec. 23, 2022, and Feb. 3, 2023, and if we go back a couple of years before that we have the most recent Polar Vortex, which primarily impacted the week ending Feb. 19, 2021. The comparisons are in the table below, and you can see just how damaging the recent cold snap was:

CN took a bigger operational hit from the recent Arctic Blast than it did from the 2021 Polar Vortex, while both events had the same suppressive effect on volumes. CPKC was also hit harder, operationally, by the recent cold snap compared to the Polar Vortex, despite being more geographically exposed in 2021 because it of course pre-dated the KCS acquisition. CP struggled the most with the December 2022 Arctic Blast. BNSF similarly took a bigger operational punch this year compared to the last Polar Vortex, but the volume impact wasn’t as severe. Union Pacific wasn’t impacted as much as the 2021 Polar Vortex, but the recent cold snap still eclipsed the two Arctic Blasts from last winter. CSX saw a similar impact between the recent Arctic Blast and the 2021 Polar Vortex, while Norfolk Southern took a bigger operational hit from the 2024 Arctic Blast but less of a volume hit.

Fast Start to the Recovery

In terms of the recovery, a couple of weeks ago we expected good recoverability from the cold snap, and that’s what we’re seeing. Railroads only really get into trouble when an event like this compounds a problem that already exists (it’s the ‘2’ in a 1-2 punch). For example, had this cold snap occurred on the back of a few months of unanticipated volume growth that depleted crew capacity at some critical locations, some of the networks might have been vulnerable (à la 2014). We’ve of course had flat growth and an absence of volume pressure in recent times.

We also have to give some credit to the STB here, because during the volume malaise of 2023 the railroads furloughed far fewer people than they normally would have due to the 2022 Service Crisis and the STB’s strong criticism, particularly with regard to headcount. The railroads therefore went into the Arctic Blast with adequate manpower and excess capacity, which is paying quick dividends in terms of a rebound.

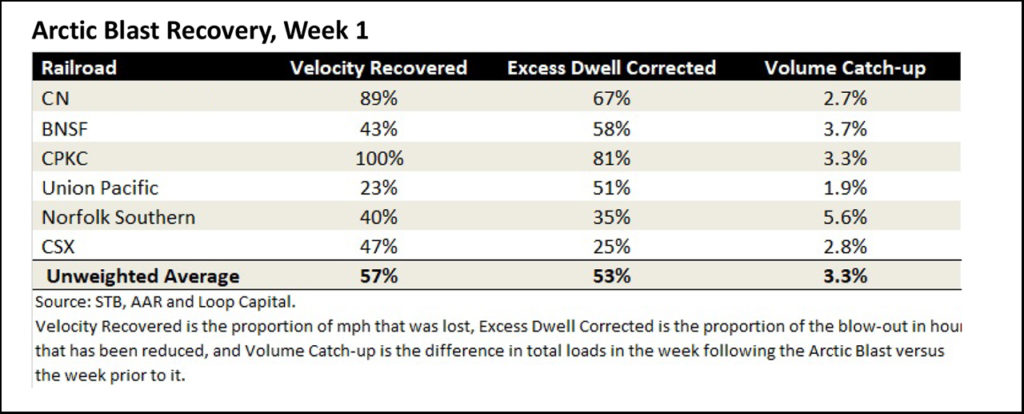

In just the first week of the rebound, the Class I’s have recovered 57% of the network velocity that was lost during the cold snap and corrected 53% of the blowout in terminal dwell. The table below has all the details, and like last week, is ordered by those networks most impacted. Of note, CN is rebounding quickly and strongly, and BNSF has also corrected more than half of the excess terminal dwell, which blew out to a quarter-century high during the cold snap.

Quick Operational Recovery Allows Volume Catch-up

The other issue is of course volumes, which were suppressed by about 14% during the Arctic Blast. Ideally, the vast majority of this 14% will be recovered, but it will be over time and necessitate a weekly volume run-rate higher than it would otherwise have been. Again, we’re off to a good start, with the last column in our table showing that, on average, volumes in the week following the Arctic Blast were 3.3% higher than the week prior to it. The important point is that the initial operational recovery from the Arctic Blast was sufficiently strong that it’s allowing these catch-up volumes to immediately begin.

The Velocity Flywheel Effect

Among other things, this report is highly focused on Class I network velocity. Generating it, maintaining it, and recovering it when things go wrong. Velocity is the magic elixir that makes everything better, and Norfolk Southern had a good graphic on it in its Q4 earnings slide presentation:

The railroads are also unintuitively unique because, unlike most industries, if you can get the delicate ballet of critical resources right and run to plan it costs less to provide better service, not more. It’s extraordinarily difficult of course and still a work in progress at NS.

Activism Again

We’ll say a few words about the elephant in the room, which of course is potential investor activism at NS. Like most of you, all we know is what was reported last week, and it’s still very early in the game. Whatever happens, it’s important to remember the context here:

NS melted down due to crew shortages in 2014, again in 2018, and again in late 2021. You’re therefore dealing with a somewhat frazzled customer and employee base that has been in and out of the ditch three times in nine years. Since late 2022 you’ve had a reconstituted management team and new COO that declared enough-is-enough and implemented a new long-term strategy that directly addresses the railroad’s historic Achilles Heel, which is crew capacity management. We’ve liked and supported all of it, but progress was of course stymied by East Palestine and the associated track bottleneck on a key route between Feb. 3 and July 5 last year. Five months were lost, contributing to NS coming last in the recovery race. High operating ratios in Q3 and Q4 appear to have been the last straws, drawing the activist. In the event we end up with a bruising activist battle, the uncertainty and dueling PR will layer on to the pre-existing scarring from the three meltdowns. It’s one step backwards, but is there two steps forward? Specifically, if you’re an activist making a run at NS, this is an apple cart that has already been upset too many times, so you’d better be bringing a better strategy than the current management team is already employing and better talent to execute it. Until we see detail on both those fronts. we’ll reserve judgement.