Arctic Blast Rebound Shows Good Industry Recoverability

Written by Rick Paterson, Managing Director, Loop Capital Markets

CPKC image.

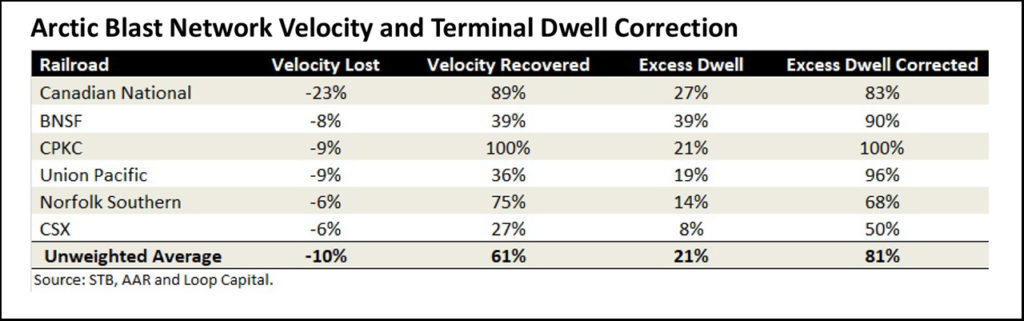

Arctic Blast recovery, week 2: We’ll be able to shift focus shortly, because most of the damage from the Arctic Blast in the third week of January has now been corrected, and in just the two subsequent weeks. In terms of operating efficiency, the table below shows the updated numbers.

Using the averages along the bottom, the cold snap slowed the networks by an average of 10%, but through Feb. 2, 61% of that speed loss has been recovered. Similarly, the Arctic Blast pushed terminal dwell 21% above where it was in the week prior, but 81% of that excess dwell has now been corrected—good recoverability across the board.

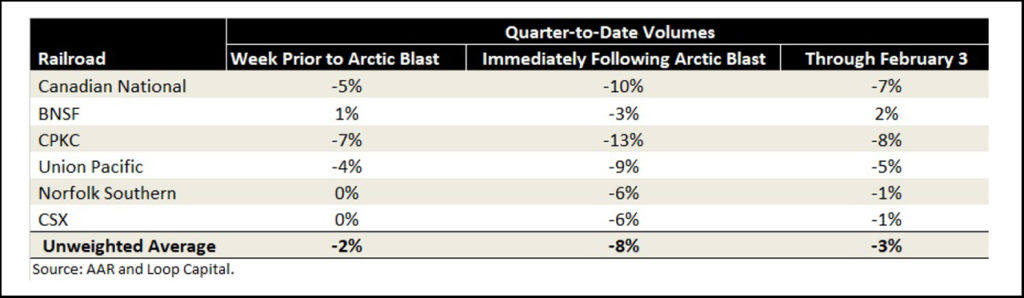

The fast operational response has helped propel catch-up volumes on the back of the cold snap. In the first half of January the six Class I railroads were averaging a 2% volume deficit to the same period in 2023, but that YoY deficit plummeted to 8% immediately following the Arctic Blast. Two weeks later, through Feb. 3, the railroads have pulled that deficit back to just 3%. Lapping a smaller Arctic Blast in the last week of January 2023 helped. Notably, BNSF is now running volume-positive YTD. largely on intermodal strength (+12% YTD vs. -8% carload traffic).

Given the rapid restoration in operating efficiency and catch-up in volumes, hope has now been restored that some of these companies will be able to post respectable 1Q24 financial results.

The Bigger Picture

More important, the bigger long-term goal here is an industry that has enhanced resiliency and recoverability to the extent that it can better take on the trucks and win back some customer business. Growth: The reason we’re over-analyzing the Arctic Blast is because it’s the first little piece of evidence, post-Service Crisis, in this endeavor.