TD Cowen 1Q24 Rail Equipment Survey Says …

Written by Matt Elkott, Jason Seidl, Bhairav Manawat and Elliot Alper, TD Cowen

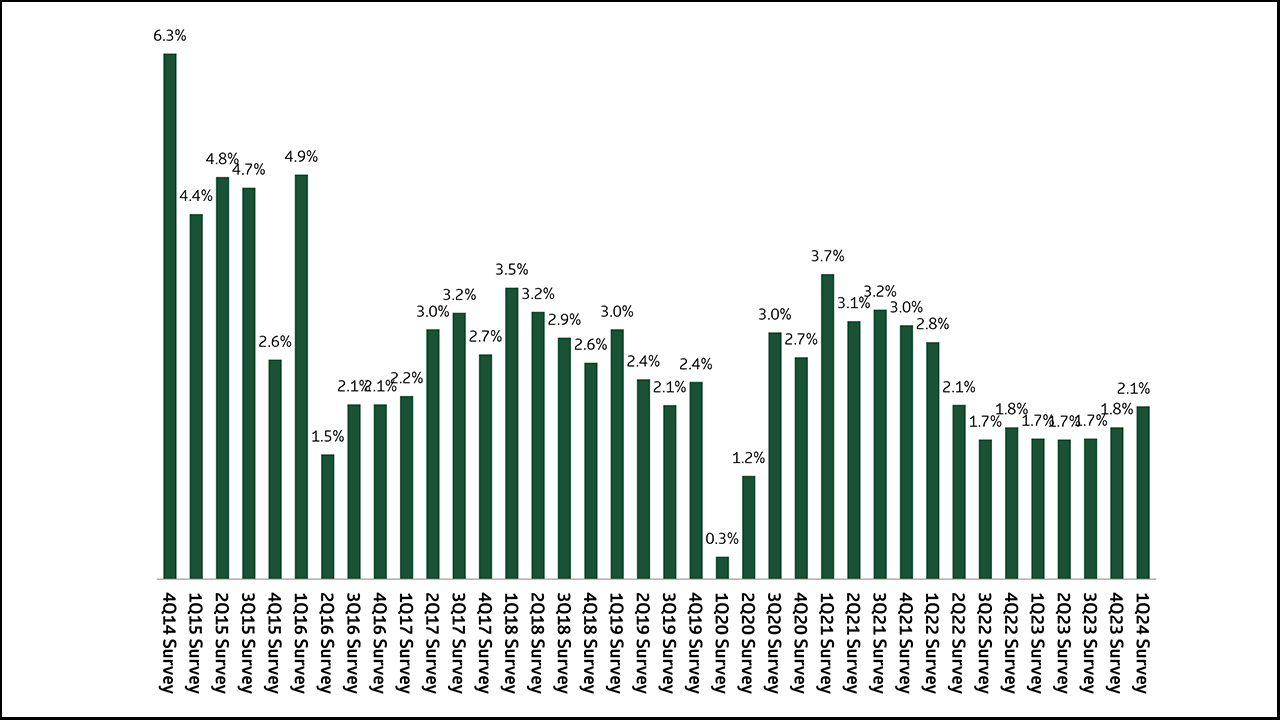

Shippers’ expectations of business growth over the next 12 months. Source: TD Cowen 1Q24 Rail Shipper Survey, SurveyPlanet.com.

Our 1Q24 survey results are neutral to mildly positive for railcar demand. The order outlook was mixed, but a lower percent of shippers not ordering cited “no need” in 1Q24 than did in 4Q23. Business growth expectations and economic confidence improved modestly in 1Q. We see TRN as having a fairly favorable setup into the print.

Order Activity Metrics

When it comes to order activity, we consider four key metrics: (1) The percentage of “all participating shippers” who will or may order railcars; (2) the conviction level about ordering (the split between “yes” and “maybe”) within this “all participating shippers” group; (3) the percentage of “same shippers” who will or may order railcars; and (4) the conviction level about ordering (the split between “yes” and “maybe”) within this “same shippers” group.

In our 1Q24 survey, the first and third metrics improved, while the second and fourth deteriorated. The deterioration in order conviction could be partly a function of still-extended manufacturing lead times (although less extended than three months ago), not just the underlying need for equipment. One potential risk to manufacturers is if lead times do not shorten further and quickly enough to take advantage of a still tight (albeit easing) railcar supply, because if traffic remains modest and service continues to improve, the railcar supply tightness could be alleviated by further weakening in demand, not higher railcar production.

Improved Order Outlook Generally, But Decreased Certainty

Roughly 44% of all shippers surveyed said they will or may order railcars in the next 12 months, up from 39% in our 4Q23 survey. About 56% now say they do not plan to order railcars, compared to 61% in 4Q23. Within the 44% of total shippers who are contemplating orders in the next 12 months, 48% said “yes,” they plan to place orders vs. 55% in 4Q23, and 52% said “maybe,” compared with 45% in 4Q23. This could mean a lower level of certainty about ordering within the total shipper group.

Despite still anemic rail traffic in 1Q24 (up 1.1% y/y through March 30), a bit of tightness continues in some railcar types, although moderating relative to recent quarters.

Supply forces have been favorable over the past 3+ years, but due to the premium placed on newly manufactured equipment at times by higher steel prices as well as stubborn supply chain disruptions and higher interest rates hampering production, the favorable supply fundamentals have largely benefited the leasing market, driving ~13 consecutive sequential quarterly increases in lease rates through 3Q23 ranging from the low-single digits to high teens (largely flat in 4Q23, and we believe flat to down slightly in 1Q24).

During the past 3+ years, high steel prices have led to increased scrapping of idle railcars and limited manufacturing activity of new units. As a result, the industry fleet utilization has risen from ~68% in mid-2020 to the low 80% in the last couple of years.

On a same-shipper basis, about 44% of same respondents in 1Q24 said they will or may order railcars, compared to 33% in our 4Q23 survey. Roughly 56% do not plan to order railcars, vs. 67% in our 4Q23 survey. Within the 44% of same shippers who are contemplating orders in the next 12 months, 45% said “yes,” they plan to place orders (56% in 4Q23), while 55% said “maybe” (44% in 4Q23). This could mean a decreased level of certainty about ordering within the same-shipper group.

The percentage of shippers who only plan to place small orders (fewer than 500 units) remained at 93% in 1Q24, similar to 4Q23. The percentage of shippers who plan to order 500-2,000 units decreased to 5%, down 2% sequentially. It appears that hopper cars and tank cars saw demand improvement relative to 4Q23. Boxcars, autoracks, centerbeams and gondolas declined relative to 4Q23. Among the shippers who said they don’t plan to order railcars in the next 12 months, the percentage who said it is because they don’t have incremental equipment needs decreased to 67%, from 74% in 4Q23. The Percentage of shippers not ordering due to “capex restraints” increased to 16% in 1Q24 from 8% previously.

32% of shippers answered that they are concerned about rail capacity, a 6% decrease compared to the prior quarter. The results are still significantly lower than post-COVID levels amid modest volume growth on the U.S. Class I network. Compared to a quarter ago, 9% more shippers cited “equipment,” 8% fewer cited “track,” and 14% fewer answered “manpower.”

Business growth expectations over the next 12 months ticked up 30bps to 2.1% though they are still significantly below the survey’s 3.6% long-term average and below the 2016-present average of 2.4%. These survey results are in line with commentary on tepid volume outlook uncovered in our quarterly carrier survey.

Economic confidence ticked up again, with 40% of participants stating that they are more confident up 6 percentage points compared to the prior quarter.