TD Cowen: 1Q23 Surveys Say …

Written by Matt Elkott, Jason Seidl, Bhairav Manawat and Elliot Alper, TD Cowen

The results of our 1Q23 Rail and Equipment Surveys indicate a slight decrease in business growth expectations, and some resilience in railcar demand.

Expected rate increases were +3.5%, down 110bps sequentially in 1Q, now sitting below the survey’s long-term average. Business growth expectations ticked down marginally this quarter, and economic confidence slightly improved. Fewer shippers are holding more inventory as a strategy, suggesting a steady normalization in inventory mgmt. Survey results are a negative for the rail group, in our view. Railcar demand showed some resilience against a tough macro backdrop, although we view the results as a slight incremental negative. While order outlook remains largely unchanged on the balance, a notably higher percentage of those not planning orders cited “No Need,” compared to our 4Q22 survey. That said, we see a favorable setup into the print for TRN and GATX.

1Q23 RAIL SURVEY

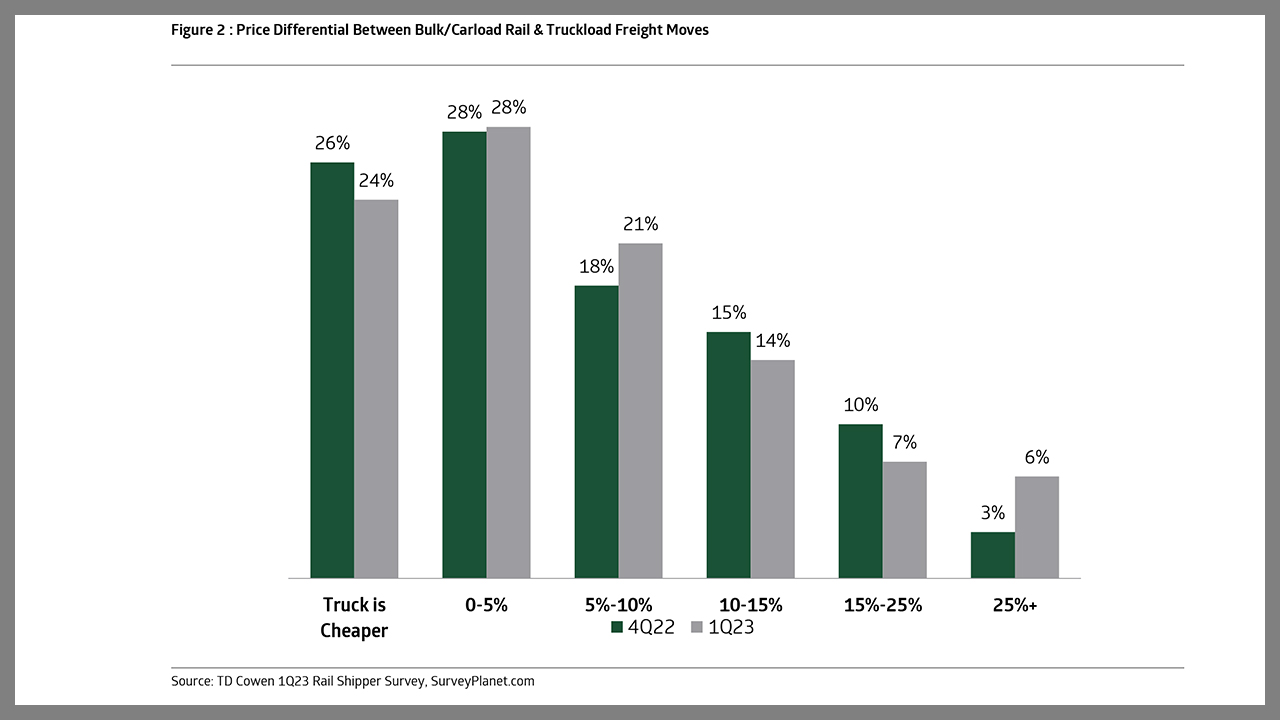

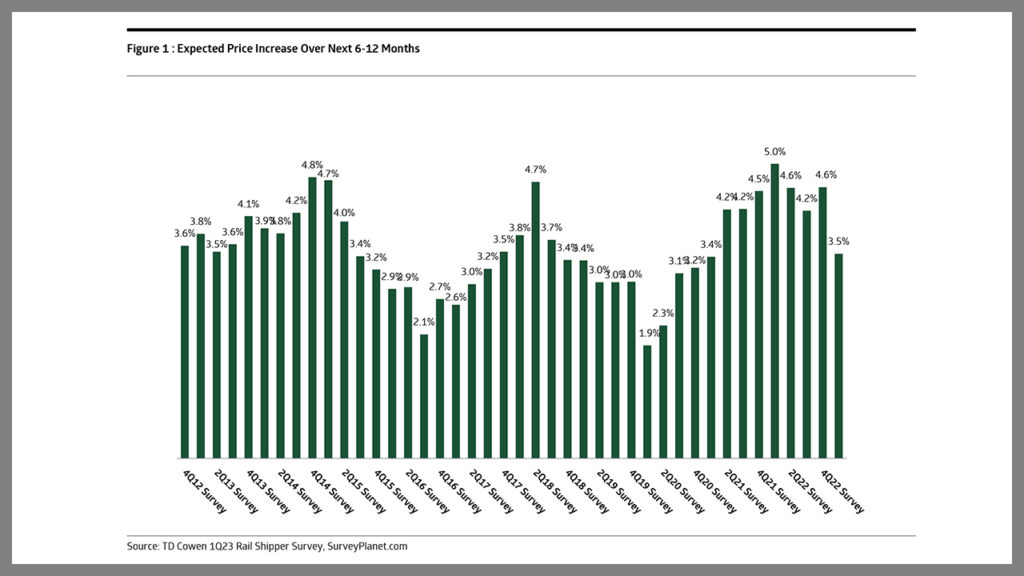

Pricing Expectations Stepped Down Sequentially: Shippers anticipate rail prices to increase by 3.5% over the next 6-12 months, down 110bps compared to last quarter’s survey, decelerating to levels not seen since our 1Q21 survey. The 3.5% result slipped just below the survey’s five-year average and long-term average of 3.6%. We view the sequential decrease of more than 1 point sequentially as a negative for the rail group, given we haven’t seen a deceleration of this magnitude since 1Q20, at the beginning of the pandemic. Decelerating pricing comes amid inflationary pressures; a suppressed trucking market is a contributing factor, with 27% of respondents (up 2% sequentially) citing that truck is cheaper than intermodal rail moves.

Business Growth Outlook Ticked Down Marginally: Business growth expectations decreased 10bps sequentially to 1.7%, back down to 3Q22 levels, below the survey’s eight-year average of 2.5%. The percentage of shippers expecting their employee counts to increase over the next 12 months increased 2% sequentially, though down 25% from our 1Q22 survey. 23% of shippers answered that they are more confident in the direction of the economy today than they were three months ago, a small step up from last quarter, while still materially below the survey’s 43% average.

Shippers Attest To Better Service, CSX Records Large Improvement: The average “positive” (excellent or good rating) rating of Class I rail service ticked up again in 1Q increasing 6 percentage points sequentially to 55% lending credence to the Class Is’ claims of gradually improving network fluidity. CSX recorded the largest improvement with a 14% sequential improvement in positive ratings. This jives with commentary from our 4Q happy hour, where participants called out CSX as having materially improved service quality.

Fewer Shippers Are Holding More Inventory As A Strategy: Rail shippers that answered they are holding more inventory in response to pandemic disruptions stepped down 9% sequentially to 36%, and down 22% compared to our 1Q22 survey. This is the fourth consecutive quarter where shippers that answered that they are holding more inventory has stepped down, which may be a sign of a normalization to pre-pandemic inventory management. According to Federal Reserve data, inventory/sales ratio remains below pre-pandemic levels at 1.2x, suggesting that while the inventory glut is improving, it may take more time to normalize.

Thoughts on Rail Stocks Ahead of Earnings: We published updated rail estimates last week to adjust our Q1 estimates downwards to account for QTD volume trends using our railshare data, diesel pricing, and yields. Rail volumes continue to track below pre-COVID levels despite easy comps in 1H and look for a 2H rebound in volumes, as suggested by the rails through 4Q earnings. A softer than expected 1Q may push out a rail volume recovery, which ultimately hinges on the consumer (inventory restocking) and a normalization of trucking rates. An absence of a dry van spot rate bottom suggests that pressure on intermodal markets should persist (though we do not think the current rate environment can continue for too much longer). Weak import data from the ports has also pressured international intermodal operations. We believe that diesel should be a sizable tailwind in 1Q for the rails given the fuel surcharge lags. We expect the rails to address safety precautions following the East Palestine derailment though do not expect any material changes to capex in 2023.

1Q23 RAIL EQUIPMENT SURVEY:A SLIGHT INCREMENTAL NEGATIVE

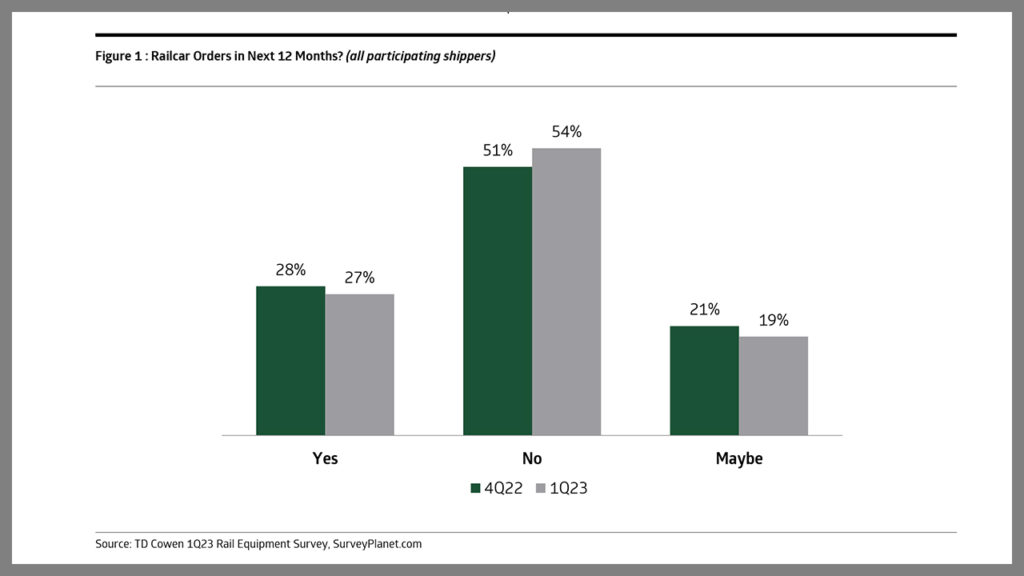

Results Summary: When it comes to order activity, we consider four key metrics: (1) The percentage of “all participating shippers” who will or may order railcars. (2) The conviction level about ordering (the split between “yes” and “maybe”) within this “all participating shippers” group. (3) The percentage of “same shippers” who will or may order railcars. (4) The conviction level about ordering (the split between “yes” and “maybe”) within this “same shippers” group. In our 1Q23 survey, the first metric deteriorated slightly, the second and third improved, and the fourth deteriorated a bit. The new cautionary signal is that among the shippers who said they do not plan to order railcars in the next 12 months, the percentage who said it is because they do not have incremental equipment needs increased to 67% from 58% in 4Q22.

More on the Results: Roughly 46% of all shippers surveyed said they will or may order railcars in the next 12 months, down from 49% in our 4Q22 survey. Within the 46% of total shippers who are contemplating orders in the next 12 months, 59% said “yes,” they plan to place orders versus 58% in 4Q22; and 41% said “maybe” compared with 42% in 4Q22. This could mean a slightly increased level of certainty about ordering within the total shipper group.

On a same-shipper basis, about 49% of same respondents in 1Q23 said they will or may order railcars, compared to 45% in our 4Q22 survey. Within the 49% of same shippers who are contemplating orders in the next 12 months, 62% said “yes” they plan to place orders (63% in 4Q22), while 38% said “maybe” (37% in 4Q22). This could mean a slightly decreased level of certainty about ordering within the same-shipper group.

Any hiccups in the manufacturing cycle could mean even more lease rate momentum barring dramatic rail service improvement and/or additional weakness in rail volumes. In our April 9 note about our April 6 rail equipment expert call we wrote: Tightness continues across a wide array of railcars, with a few exceptions such as centerbeams, which are tied to housing, and intermodal, tied to consumer. We expect an 11th consecutive quarterly improvement in spot rates in 1Q and positive guidance in leasing. Manufacturing inquiries are largely unchanged, with a few pockets in which tightening credit is hindering the translation into orders. Our survey results are not inconsistent with our call takeaways.