Supply Inelasticity

Written by David Nahass, Financial Editor

All photos by Bruce Kelly

RAILROAD FINANCIAL DESK BOOK, RAILWAY AGE OCTOBER 2023 ISSUE: Welcome to Railway Age’s 2024 Railroad Financial Desk Book. Fall is upon North American rail. It is a time for the grain harvest and a time to begin reflection on what the year has delivered and an opportunity to look forward to the future. It is a time for closing the Southern border as South and Central American migrants decide that the roof of a covered hopper car is the new passenger ship to freedom and the American Dream and that Eagle Pass, Tex., is the new Ellis Island. After a four-day border closing by U.S. Customs and Border Protection, Union Pacific reported a 24-train backup in both directions equivalent to 32 miles.

Sociologists suggest that nostalgia tends to mute the more challenging aspects of our collective past in favor of a rosier, recollective narrative. (The memory of Hunter Harrison may disagree with the rosier look at one’s past.) In a recent article in the Los Angeles Times, a study from the American Enterprise Group was cited indicating that the 1980s and 1990s are replacing the 1950s as the era on which people reflect as “the good old days.”

Imagine that! The Eighties! Respectability! For industry veterans, let’s all go back to the pre-Staggers era. The article goes on to say that in the 1930s, people thought the good old days were the horse and buggy era. Human nature is a fallible thing.

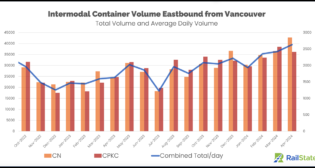

When were the good old days of intermodal loadings? Was it the robust loadings of 2018? In 2023, intermodal loadings continue to languish down 8.7% for the year (through Sept. 16, 2023, and after a better-than-expected August). At the most recent Intermodal Association of North America (IANA) Expo Conference in Long Beach, Calif., Journal of Commerce correspondent Ari Ashe noted in reporting about the state of the intermodal market, “While intermodal train speeds were up 3.8% and on-time performance was 12% higher year-over-year in the first week of September, shippers remember the subpar service that existed between 2020 and 2022.”

Intermodal loadings are the hangover that won’t go away. Remember when intermodal was going to be the great growth engine of rail for the 21st century? That’s so 2000s and 2010s and 2020s and … Except for the fracking boom, which gave intermodal a rail pass level moment of silence, intermodal (or as Tony Hatch would call it, “The Great Experiment”) has been the unfulfilled promise that couldn’t or hasn’t.

Ashe continues in his article: “North American railroads are moving to reverse a multi-year loss in market share … by fixing … root causes … including unreliable service [and] uncompetitive pricing.” Focus on the latter point for the moment and realize that one reason that the railroads have been so blasé about intermodal service is that the operating ratio is generally higher on intermodal business than on other types of freight.

Heading into 2023’s fourth quarter, early year projections on a rebound are falling flat. The grip of a potential recession (and contrarily, the chances for sticking a soft landing) seems a little stronger. That does not bode well for recovery.

Some factors such as a change in how railroads handle the first and last mile for intermodal shipments that may improve the throughput of intermodal trains are fundamental supply chain changes that may be a generation in the making. As an industry, change is not something we do well, and there is no nostalgia for a time when rail pivoted with great rapidity.

Issues related to length of haul play a factor in intermodal’s future. After the West Coast pandemic-related container ship pileup, loads moved to the Southeast and the Northeast. The Panama Canal is having to place restrictions and penalty payments on certain types of shipments due to operating issues resulting from water supply. This could direct more traffic back to the West Coast (especially after the settling of labor-related issues at the Port of Long Beach). The Wall Street Journal has a video explaining the reason for Panama’s operational issues that is worth a viewing.

In previous musings, “Financial Edge” has highlighted how intermodal loadings have always bounced back from downturns with relative ease. Perhaps that is what the industry has to look forward to in 2024. Maybe it won’t be eye-popping, but as the cheap romance novelists like to say, “life isn’t always pretty but it is always beautiful.”

It was a really great time to be writing a lengthy article about railcars and finance. The Federal Reserve’s Sept. 20 decision to hold interest rates level while projecting another increase between now and the end of 2023 was not unexpected. Pretty? Probably not. The Fed’s unanswerable question seems to be what the magic interest rate will be that will slow down unemployment and hold inflation at the targeted 2%. For years, that number (for the ten-year Treasury bond) seemed to be somewhere between 2% and 3%.

Interest rates are an impact factor in rail finance. Using some loose estimates, a 1% increase in interest rates can equate to an increase in lease rates on a railcar of $100 per car per month. (Sit down if you need to.) If you happened to be considering leasing a railcar in October 2021 (when the ten-year Treasury was about 1.5%), the cost adjustment (based on interest rates alone) could be equal to $300 per car per month for each month of your lease term. (The ten-year Treasury is just about at 4.5% after the Fed’s recent pronouncements.)

It’s just enough to have one wishing for the good old days of the 1980s and 1990s! Before going all in on purchasing a pair of vintage “Risky Business” Wayfarers (“Risky Business” was a popular movie in 1984 that launched Tom Cruise’s lengthy movie career—yes, Tom Cruise is that old), check the facts. For those of you who were able to keep score at home in the early ’80s, the ten-year Treasury was 15% in 1981 and didn’t stabilize at today’s levels until the turn of the century. The only good things to buy in the early 1980s were municipal and Treasury bonds.

In addition, The Greenbrier Companies (whose fiscal year end is Aug. 31), announced earnings on Sept. 21 and announced what felt like the railcar industry equivalent of a quarterback dropping a dime in the fourth quarter of a close game. The revelation that Greenbrier had secured orders for 15,000 railcars in its fiscal fourth-quarter 2023 was material indeed. This is more surprising, considering that orders in the second quarter of calendar-year 2023 were 16,194 for all builders. The total value of Greenbrier orders: a cool $1.9 billion. But keep the facts straight: With Greenbrier’s fiscal year reporting including the calendar month of June 2023, there is some overlap between the eye-popping RSI American Railway Car Institute Committee second-quarter 2023 order number and the equally eye-popping Greenbrier fiscal fourth-quarter order number.

Greenbrier did not provide much granular detail for the orders received. Clearly, some cars are for European orders (Greenbrier has European manufacturing facilities in Poland, Romania and Turkey) and they indicated that there were no multi-year orders. (This refers to a GATX-style multi-year.)

Certainly, no one expects Greenbrier to build only these 15,000 cars and not add to its prodigious backlog. In addition, at the recent 16th annual TD Cowen Global Transportation Conference, Greenbrier in its presentation (available on its website) noted that it expected new car production for the next three years to be around 40,000 cars annually. As of June 30, 2023, Greenbrier had 41% of the North American railcar manufacturing backlog of roughly 60,000 railcars. If these orders were all U.S. based, that would raise Greenbrier’s North American backlog to almost 40,000 railcars. Put all that together, and the 15,000 additional cars would suggest that Greenbrier’s deliveries are out until 2025. Knowing that at least a portion of the orders received by Greenbrier were European clearly matters, but concerns about scale are still warranted.

An industry contact marveled at this most precise example of the inelasticity of supply in the railcar market right now. It will be interesting to see where Trinity, FreightCar America and National Steel Car orders come in from the third quarter. Furthermore, it will be even more interesting to see how high the backlog and how long the delivery window will need to get until the OEMs decide to start building more than 40,000 cars annually.

Any continued strengthening of loadings will continue to require more equipment. Roughly 20% of the national fleet of railcars is in storage. Most of those have been there for some time and many will never move again. With general freight loadings neutral for 2023 (thanks to all you automobile purchasers), any additional demand will continue to stress car supply.

It’s difficult to find balance between adequate supply and over supply. As an industry, railcar manufacturing has historically struggled to do this. The inelastic supply mentioned above is a new twist for railcars and railcar manufacturing. It will be interesting to see if it sticks, or maybe even more so to find out what throws it off kilter. A return to the good old days of railcar manufacturing and its boom/bust cycles shouldn’t really be on anyone’s agenda. Good luck closing out the year successfully.

Around the Market

Railcar users of all types are spending time in hindsight thinking about the rates they could have locked in for the long term when it felt like the siren song of low-cost lease rates and flexible terms would never come to an end. TD Cowen’s Matt Elkott has suggested that lease rates may have peaked in the most recent quarter. The question is, will today’s currents rates, even if they plateau, remain at lofty levels? Current car supply levels (Greenbrier orders notwithstanding), service levels and interest rates suggest that there is some grip to today’s economics. Lessors generally are pushing lease terms. Rates quoted here are five to seven years generally. Expect shorter-term leases to be more costly across all car types.

Here’s what’s going on in the market:

Coal Cars: Coal loadings have been flat for the year, but coal generation is down to 14% of overall energy generation in the U.S. Even with advances in carbon sequestration, the flame here continues to flicker. But with car supplies lower, demand continues, and rates remain elevated. For rapid discharge cars (if one can find them) expect lease rates in the high $300s full service (FS), with some uplift for terms of less than three years. For gondola railcars expect rates in high $200s to low $300s. Rates here continue to stay at elevated levels despite dropoffs in the cost of natural gas drifting well below the $3.50 to $4.00 MMBTU price generally viewed as the cost threshold for moving and burning coal vs. burning natural gas. While car owners may be wishing for the good days of the 1990s, this is a better alternative than what was available in the 2019 timeframe. Expect rates to continue to hold at these levels.

Mill Gondolas: The high price of new cars really has an impact here. While scrap is holding at reasonable levels, loadings are up year-over-year (YOY) with service stressing car supply. Age matters more here than with other car types. Looking for 52-foot (Eastern scrap) gons? Expect lease rates in the mid-$500s. Need a car that works out West? Sixty-six-foot mill gondolas are in the mid- to high-$600s. Do expect a slight autumnal drop in scrap prices (currently at $325 a ton for Chicago heavy melt #1) to be a high impact near-term factor.

Centerbeam Flat Cars: Oh wither the housing market! Wall Street seems bullish on builders even with mortgage rates up to a high 7%. (Miss the good old days? In 1982, the 30-year mortgage rate peaked at 18% and was nary below 7% until after 2000). The Association of American Railroads notes that a lack of sales of existing homes supports new builds. That suggest some strength in the loads here. Look for continued strength in this car class and rents in the low-$400s.

Tank Railcars: A bevy of cars moving in energy service continue to remain in demand: DOT 117Js are running north of $1,000 per car per month. DOT 117Rs are in the high $800’s/low $900s. Both of those are 29,000-gallon tank railcars; 25,500-gallon tank railcars cars are a little softer and more readily available. Want pressure cars? Expect the pressure here as rates are in the $1,000 range FS. The slide in natural gas has impacted this market, but a cold winter could shift these prices higher. Food grade tanks are not much better, with rates in the high-$900s or low-$1,000s.

Covered Grain Hoppers: Ah, remember the good old days when lessees could lease jumbo cars for less than $400? Oh wait, that was early 2020. Back to the now, nothing says service matters like a market segment where loadings are down 13% YOY and rates continue to remain firm and at the highest levels in the past 20 years. Jumbo hoppers continue to command lease rates in the low $600s. If you’re able to use a smaller car, expect to pay in the low-$400s for the 4,750cf car, with possible sightings of numbers in the high-$300s.

Covered Cement and Sand Hoppers: A prodigious number of covered hoppers remain in storage. One would assume that a number of these are smaller cube. Despite what continues to seem like an oversupply issue, rate grip is a real thing here, with rates in the mid- to high-$200s. Attribute it to the costs of moving cars into service (repair shop and empty freight). As a result, cars are also transacting at higher sale prices. Expect the older fleet to slowly continue transitioning to newer cars and for these lease rates to stay in place for some time to come.

Boxcars: A little softness here as the paper market has been seeing some price compression and weakness. There might be a little near-term softness as new cars being built (primarily for TTX) get absorbed into the fleet. The long-term perspective here is strong with the aging out of such a large percentage of the national fleet over the next eight years. It’s a commodity business, folks, so there will be ebbs and flows. Fifty-foot boxes have moved back into the mid-$500s, while 60-foot boxes are sitting in the mid-$600s. Those are low prices when compared to the cost of a new boxcar, so don’t expect those rates to remain. I have resisted the urge to talk about the good old days and grandfathered boxcars.