CBR: What’s happening in the Rockies?

Written by William C. Vantuono, Editor-in-ChiefAccording to the latest Energy Information Administration (EIA) monthly Drilling Productivity Report, crude production from the Niobrara shale region in Colorado and Wyoming, which peaked at 491 Mb/d (million barrels per day) in April 2015, is forecast to decline by roughly100 Mb/d to 388 Mb/d through March 2016, in response to falling crude prices and lower drilling activity.

As RBN Energy analyst Sandy Fielden reports, “Midstream companies are still building new pipeline capacity out of the region with the Saddlehorn and Grand Mesa projects set to add 350 Mb/d of takeaway capacity this year. The pipeline build out has already caused a shift of crude shipments away from crude-by-rail (CBR) that peaked in December 2014. Yet, rail terminals and infrastructure are still under construction in the region.”

In his latest report, Slow Train Coming –Terminal Projects Still Being Built As Rockies Crude-By-Rail Fades, Fielden notes that CBR volumes “are falling across the U.S. and Canada. The decline is mostly in response to narrower spreads between U.S. domestic crude benchmark West Texas Intermediate (WTI) and international equivalent Brent. The lower the spread between these two, the lower the incentive to move crude from inland basins to coastal refineries by rail because the latter is a more expensive transport option compared to pipelines. . . . After crude oil prices collapsed into the mid-$30s and Congress repealed regulations limiting U.S. crude exports in December 2015, WTI began to trade at a slight premium to Brent that averaged $0.26/Bbl in January 2016. Primarily in response to the narrowing spread, CBR volumes fell during 2015 but not as fast as you might expect, dropping only 20% between January and November 2015 even though the economics often made no sense. Looking at the epicenter of the CBR boom in North Dakota, the slower than expected decline in rail shipments is mostly because committed shippers and refiners continued to use rail infrastructure that they invested in and because some routes still do not have pipeline access.

This latest analysis looks at CBR traffic out of the Niobrara shale region in the Rockies. Some key takeaways:

• Since January 2015 CBR overall volumes out of PADD IV (Petroleum Administration District for Defense, consisting of Montana, Wyoming, Colorado, Utah and Idaho) have declined by about 30% to 123 Mb/d in November 2015. The take off in Rockies CBR coincided closely with growing crude production in the region. Production doubled from 228 Mb/d in January 2013 to 452 Mb/d in December 2014, then continued to increase to peak at 491 Mb/d in April 2015. falling off by 10% since then to 452 Mb/d in November 2015.

• The destination of Rockies CBR shipments has mostly been to the Gulf Coast region, home to over 50% of the nation’s refining capacity, with nearly all of 2013, an average 65% of 2014, and 70% of 2015 (year to November) shipments headed to the Gulf. East Coast destination shipments accounted for 20% of movements in 2014 falling to 17% in 2015. An average of 8% of shipments in 2014 went to the West Coast rising to 11% in 201. For Rockies producers, shipping crude to the East Coast is a longer (more expensive) haul than to the Gulf Coast although the lack of pipelines to the East Coast means refiners have built out CBR infrastructure and made longer term commitments to rail. The West Coast is a closer and more obvious target market for Rockies producers, and the lack of pipeline access makes rail shipments to that market less competitive than to the Gulf Coast. However, the slow pace of rail unload terminal development (mostly due to permitting issues) has constrained access to the California market. The movements to Canada are a bit harder to explain but might represent movements of Bakken crude across the border from Montana into Saskatchewan or condensate moving to Canada for use as diluent.

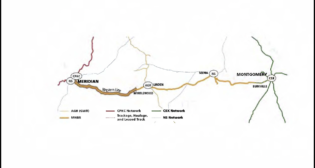

• Rockies CBR movements only really took off in 2014 because even though WTI/Brent differentials had narrowed from their 2012 extremes by then, Niobrara producers did not have enough pipeline capacity available to get their crude to market and had little alternative to using rail. The big increase in CBR movements during 2014 mirrored the buildout of rail load facilities in Wyoming and Colorado. If [two] pipelines are completed they should easily accommodate current CBR volumes out of the Rockies, reducing the rail terminals to occasional carriers.

• Yet (somewhat counter intuitively), rail load terminals and associated infrastructure in Wyoming and Colorado are still being built or expanded even as crude prices tumble to $30/Bbl or less. . . . Although these rail terminal developments were likely planned before crude prices started tanking, they do reflect a belief in the midstream sector that CBR will still have a role to play in the longer-term development of Rockies crude takeaway capacity.

Click HERE to access the full report.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)