Wabtec 3Q23: ‘Strong’ Results, Full-Year Guidance Raised

Written by Marybeth Luczak, Executive Editor

“Looking forward, we are confident that the breadth of our products and technologies combined with our ability to maintain resiliency during economic uncertainty will provide us with a solid foundation for growth and continued momentum as we close out this year and move into 2024,” Wabtec President and CEO Rafael Santana said during an Oct. 25 financial presentation.

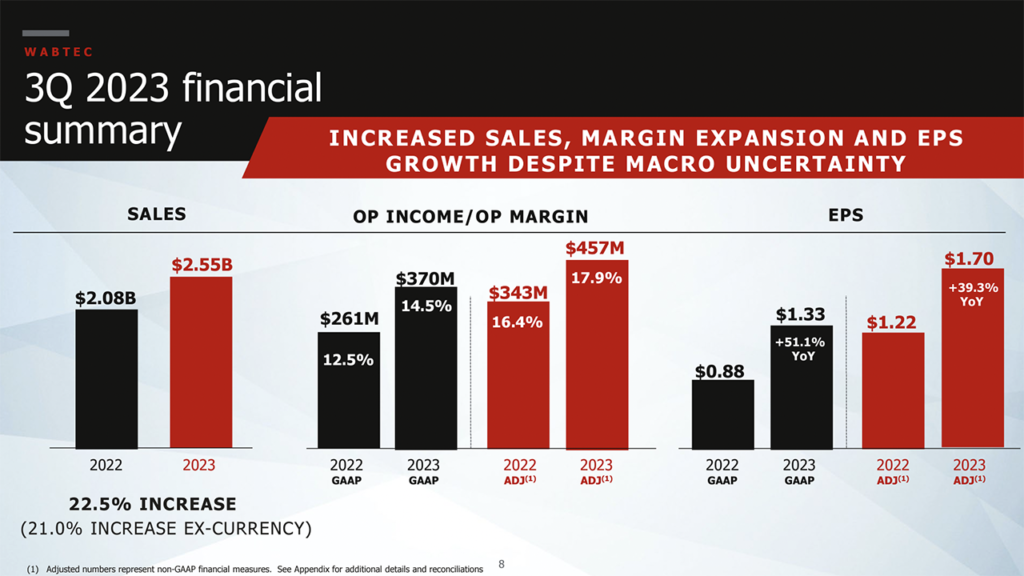

Despite “an increasingly volatile macro-economic environment,” Wabtec delivered a “strong” third quarter, as evidenced by increased growth in sales, margin, earnings and operating cash flow, Wabtec President and CEO Rafael Santana said during an Oct. 25 financial presentation. Sales were up 22.5% from the prior-year quarter, driven by the Freight and Transit segments, which experienced double-digit growth.

Santana said that in the three-months ended Sept. 30, 2023, “[d]emand remained strong, including international markets, where our pipeline of future opportunities continues to strengthen.”

For third-quarter 2023, Wabtec GAAP earnings per diluted share of $1.33 were up 51.1% from third-quarter 2022; adjusted, they were $1.70, up 39.3% from 2022. “GAAP EPS and adjusted EPS increased from the year-ago quarter primarily due to higher sales and margin expansion, partially offset by increased interest expense,” Wabtec reported.

Sales came in at $2.55 billion for this year’s third quarter, rising 22.5% from the same quarter in 2022 ($2.08 billion). Among the key drivers, according to Wabtec:

- Equipment: ”Higher North American and international locomotives sales” and “increased mining sales.”

- Components: “Higher OE railcar build and increased demand for industrial products (14.2% year-over-year growth excluding acquisitions).”

- Digital Intelligence: “Softness in North American signaling business, partially offset by higher demand for international PTC, on-board locomotive hardware, and digital mining products.”

- Services: “Increased sales from higher mods deliveries and increased parts sales.”

- Transit: “Strong OE and aftermarket sales; sales up 14.5% on constant currency basis.”

GAAP operating margin for third-quarter 2023 was higher than the prior year at 14.5%; adjusted, it was higher than the prior year at 17.9%, according to Wabtec. The company said that both “benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption driven by higher sales, partially offset by manufacturing inefficiencies related to a strike at our Erie site during the quarter.”

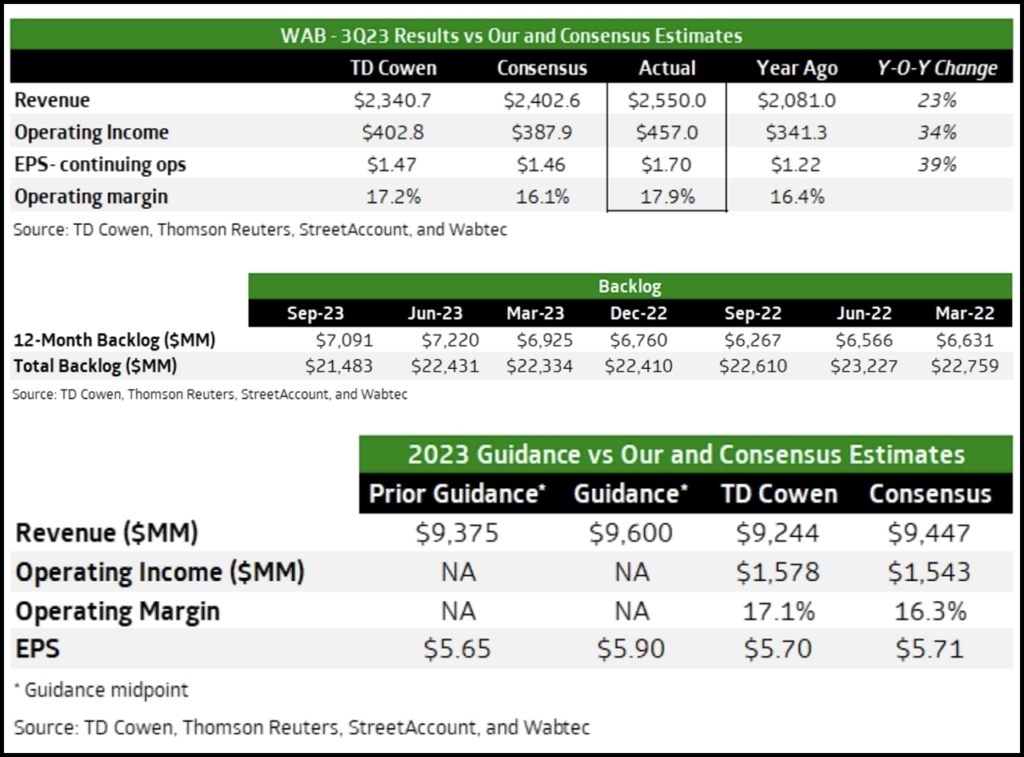

At Sept. 30, 2023, the 12-month backlog was $824 million higher than at Sept. 30, 2022, according to Wabtec, and the multi-year backlog was $1.127 billion lower than Sept. 30, 2022. The company said that “excluding foreign currency exchange,” the multi-year backlog decreased $1.383 billion, down 6.1%.

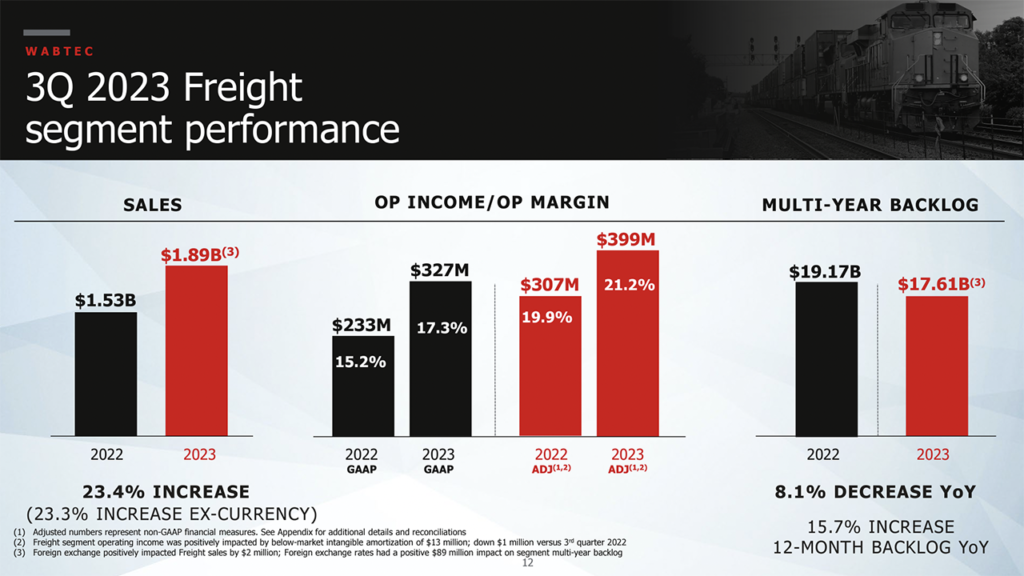

Freight segment sales for third-quarter 2023 were $1.89 billion, up 23.4% from $1.53 billion posted in third-quarter 2022. Sales were “up across most major product lines, with double-digit growth in Equipment, Components and Services,” Wabtec reported.

GAAP operating margin and adjusted operating margin, it noted, “benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption, partially offset by manufacturing inefficiencies related to a strike at our Erie site during the quarter.”

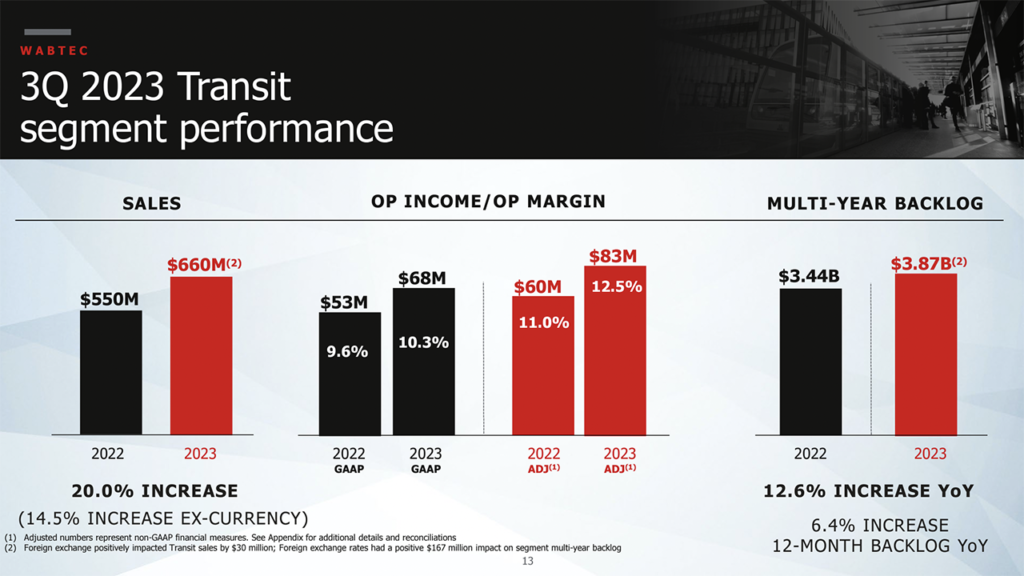

Transit segment sales for third-quarter 2023 came in at $660 million, a 20.0% increase from the $550 million posted in the same quarter in 2022. Wabtec attributed this to “to strong OE and aftermarket sales.” Additionally, GAAP and adjusted operating margins were up “as a result of favorable fixed cost absorption, improved product mix, and savings related to Integration 2.0, our three-year strategic initiative,” according to the company.

2023 Outlook

Wabtec updated its 2023 financial guidance, with sales expected to be in a range of $9.50 billion to $9.70 billion, and adjusted earnings per diluted share to be in a range of $5.80 to $6.00. For full year 2023, Wabtec said it expects cash flow generation, with operating cash flow conversion of greater than 90%.

“Looking forward, we are confident that the breadth of our products and technologies combined with our ability to maintain resiliency during economic uncertainty will provide us with a solid foundation for growth and continued momentum as we close out this year and move into 2024,” Rafael Santana said. “These factors, among others, give us confidence to raise our full-year 2023 guidance. Wabtec is well-positioned to continue driving profitable growth and maximizing shareholder value.”

The Wabtec website provides more earnings details.

The TD Cowen Insight

“Wabtec delivered another strong quarter and raised full year guidance, demonstrating yet again the high quality of the business and sound executions,” TD Cowen Transportation OEM Analyst Matt Elkott said. “The backlog remained strong but the sequential declines on both a 12-month and total basis give us some caution about the cycle.”

Key TD Cowen takeaways:

- “The total backlog remains strong but declined 4.2% sequentially. 12-month backlog declined 1.8% sequentially, its first sequential decline since 3Q22. 12-month backlog in 3Q23 was up 13.1% y/y while the total backlog in 3Q23 was down 5% y/y and down 6.1% y/y excluding unfavorable foreign currency exchange.

- “3Q23 adjusted EPS of $1.70 compared to our estimate of $1.47 and consensus of $1.46. Adjusted operating income of $457 MM compared to our and consensus estimates of $402.8 MM and $387.9 MM, respectively.

- “The company raised FY23 EPS guidance to $5.80 to $6.00, with a $5.90 midpoint, from previous guidance range of $5.50 to 5.80, with a $5.65 midpoint (current consensus $5.70; TD Cowen $5.71). It also raised guidance for revenue to $9,500 MM to $9,700 MM, with a $9,600 MM midpoint, from prior guidance of 9,250 MM to $9,500 MM, with a $9,375 MM midpoint (current consensus $9,447MM; TD Cowen $9,244 MM).

- “Wabtec noted freight segment sales for the third quarter were up across most major product lines, with double-digit growth in Equipment, Components and Services. Adjusted operating margin benefited from lower SG&A expense as a percentage of sales and improved fixed cost absorption, partially offset by manufacturing inefficiencies related to the strike at their Erie site during the quarter. • “Wabtec noted transit segment sales for the third quarter were up 20.0% due to strong OE and aftermarket sales. Adjusted operating margins were up as a result of favorable fixed cost absorption, improved product mix and savings related to Integration 2.0, their three-year strategic initiative.”