ITS Logistics Issues December Port/Rail Ramp Index

Written by Marybeth Luczak, Executive Editor

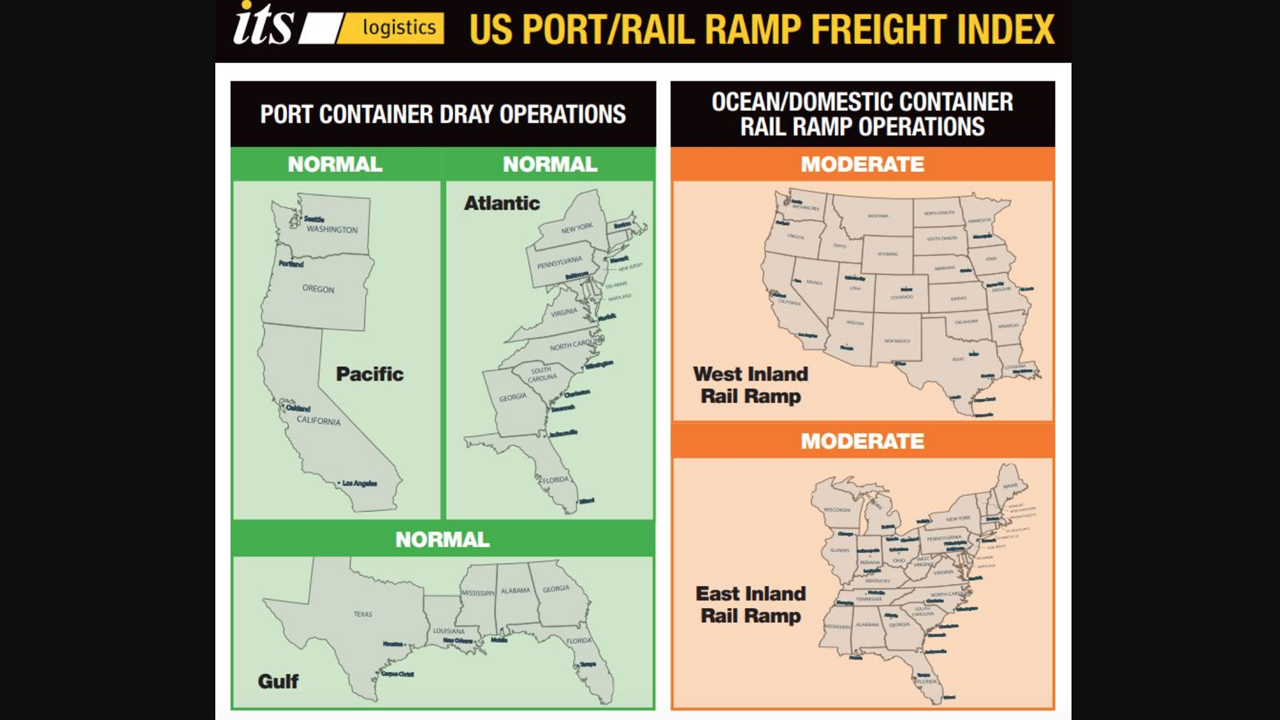

ITS Logistics U.S. Port/Rail Ramp Freight Index. (Image Courtesy of ITS Logistics)

The December forecast for the ITS Logistics U.S. Port/Rail Ramp Freight Index reflects “normal status at all U.S. port container dray operations, but a lack of ocean chassis availability at both the West and East Inland Rail Ramps raises alarm bells,” the Nevada-based third-party logistics (3PL) firm reported on Dec. 13.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic and Gulf regions, according to the 3PL firm, which provides port and rail drayage services in 22 coastal ports and 30 rail ramps throughout North America. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. (Scroll down for the downloadable December index.)

“Chassis at the rail ramp has been one of the biggest challenges that the supply chain industry is facing,” ITS Logistics Vice President, Drayage and Intermodal Paul Brashier said. “Ocean chassis in particular have become the issue. More and more freight is moving interior point intermodal (IPI) now, and we are concerned about those chassis that are available in the pool. This is especially the case if the drive chassis (DC) stay full.”

According to ITS Logistics, the Federal Maritime Commission (FMC) in October awarded a $500,000 contract to the National Academies of Sciences (NAS) “to conduct a study that examines the intermodal chassis pools and provides recommendations on best practices for their management. Mandated under the Ocean Shipping Reform Act of 2022 (OSRA’22), under the law, the study is expected to outline the obstacles faced when implementing chassis pools and offer possible solutions that optimize supply chain information sharing across pool models, efficiency and overall communication.”

Brashier reported that the “limited supply of chassis has contributed to port and rail congestion here in the U.S. for over a year now and even though the FMC is addressing the chassis concerns ahead of the Ocean Shipping Reform Act’s deadline of April 2023, the impact is still being felt across the industry.” As one remedy, he recommended that companies “work with a dray provider that has container grounding operations to keep ocean chassis moving effectively.”

To relieve container port congestion and speed cargo turnover at maritime logistics sites, ITS Logistics reported the FMC last month approved a plan for East Coast seaports to operate a shared pool of truck chassis. “This decision further supported the proposed South Atlantic Chassis Pool (SACP 3.0) deal,” the company said. “The deal is meant to fill the existing pool with new, high-quality chassis; and once live, it will be the largest fully interoperable pool in the country, with over 60,000 chassis available to ocean carriers, motor carriers, and shippers at various ports in inland locations. The SACP 3.00 deal has a target date of October 2023.”

Brashier expects to see improvement in the current chassis situation by 2023. Additionally, he said, “[i]n the big picture, December has seen a continued improvement in marine terminal operations in all regions throughout the U.S. There is very little congestion to report, and vessel dwell time is under two days in every port throughout the U.S., excluding in Savannah, Ga.”