UP3Q23: ‘Operationally, We Gained Momentum’

Written by William C. Vantuono, Editor-in-Chief

Union Pacific CEO Jim Vena. UP photo

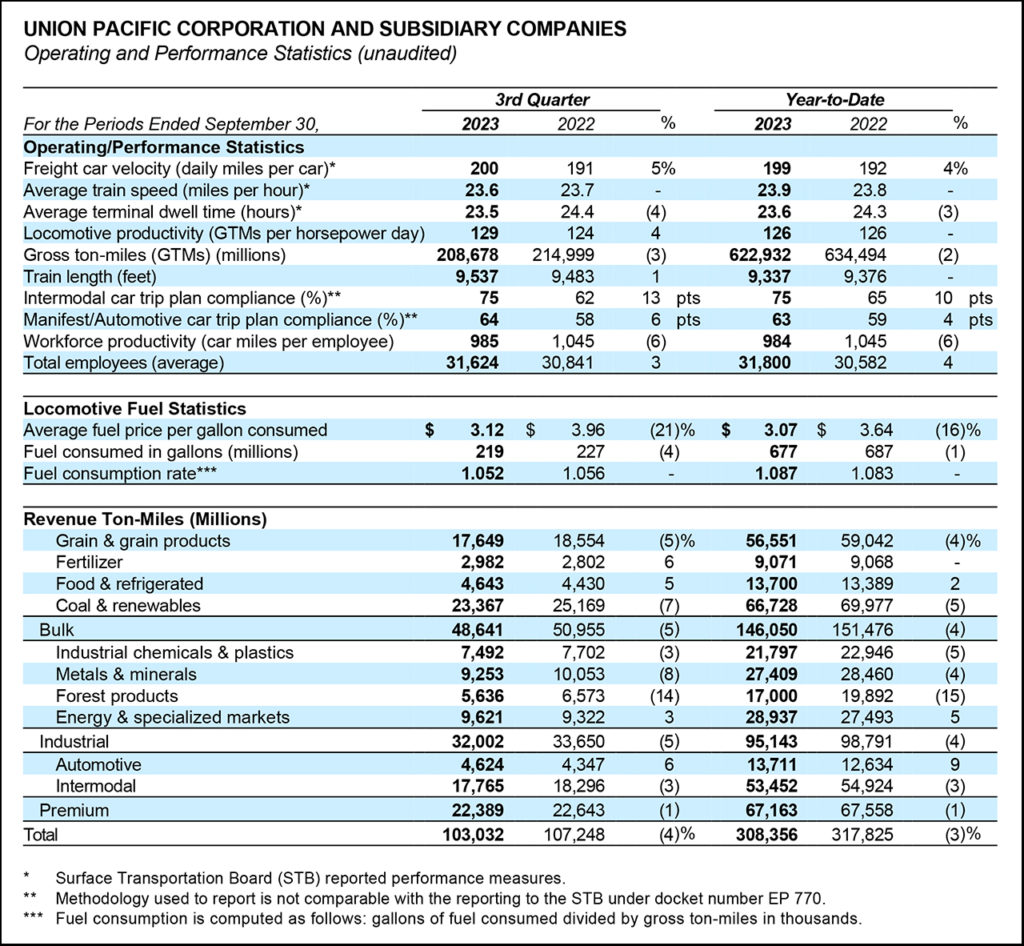

Union Pacific results for 2023’s third quarter reflected a drop in carloadings and a slight operating ratio uptick, and improvements in service quality, safety and equipment utilization.

“We faced many challenges in the quarter, including continued inflationary pressures and a drop in carloads,” said CEO Jim Vena. “Operationally, we gained momentum through the quarter, which positions us to provide our customers with great service. Operating and safety metrics are showing solid improvement, as we increase asset utilization. We are aligning the team around our strategy focused on being the best in safety, service and operational excellence as we drive growth to the railroad. Through our day-to-day actions, we will continue to make improvements as we exit the year.”

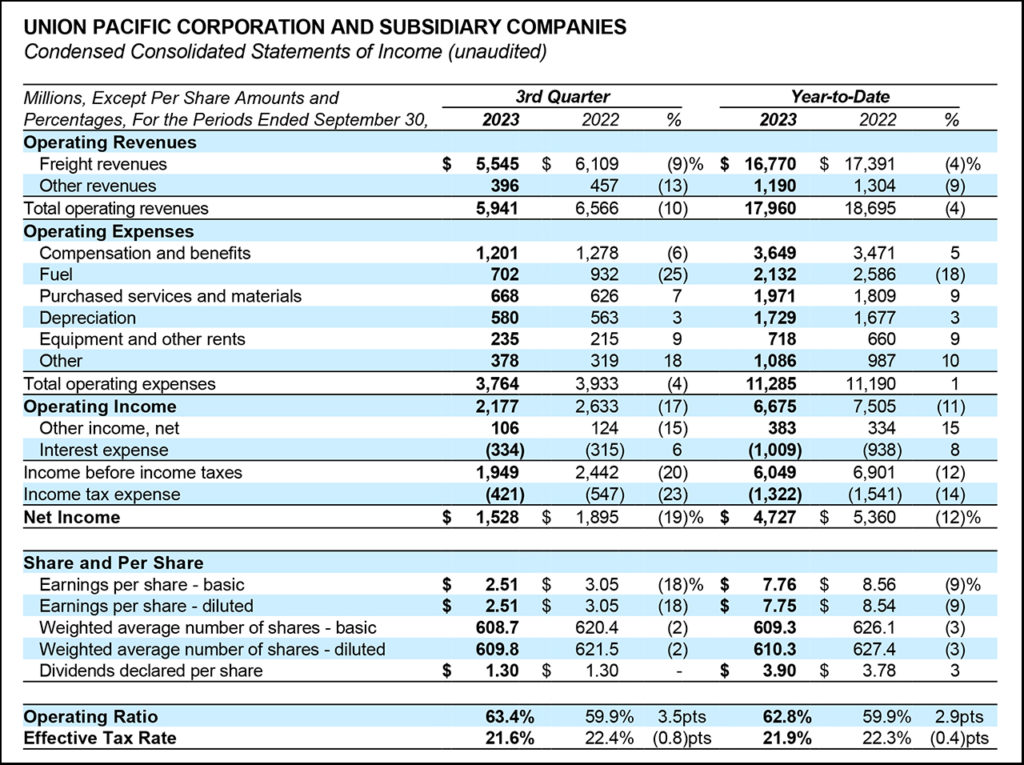

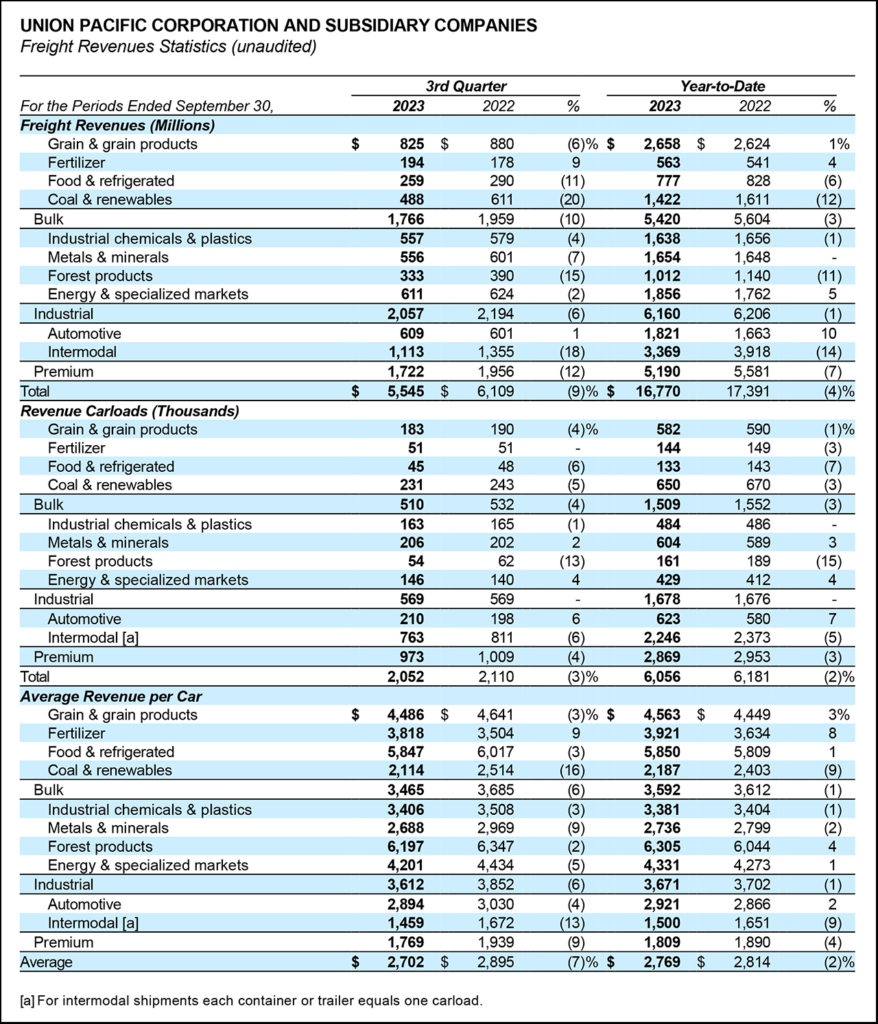

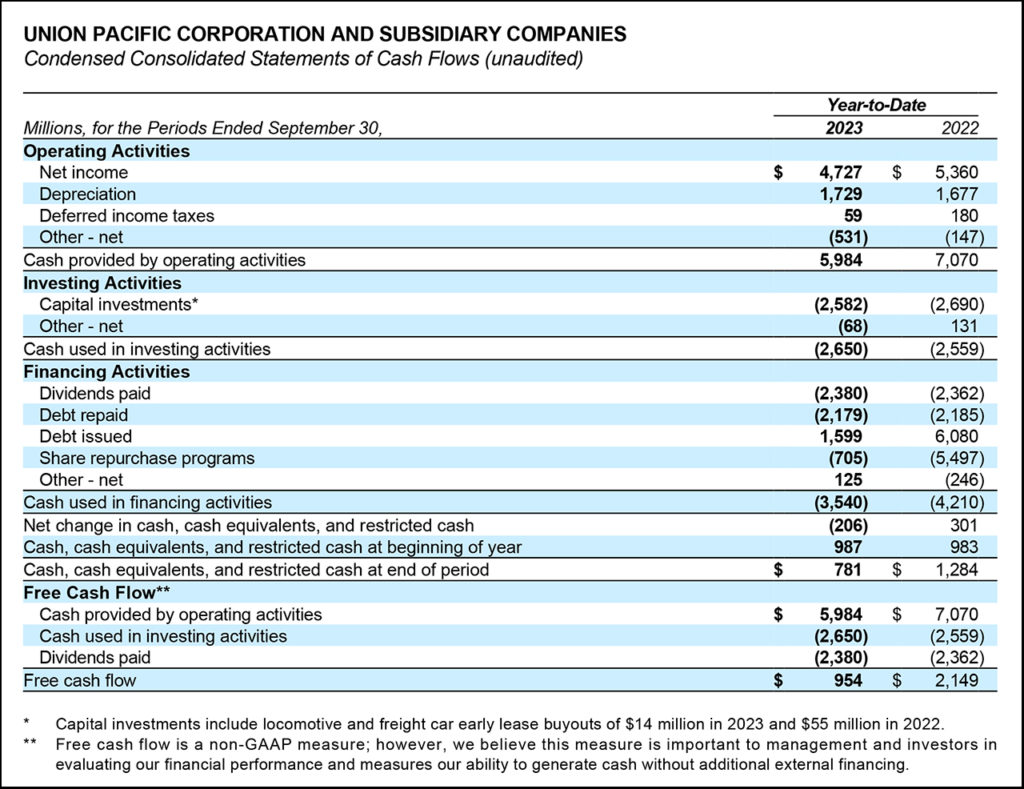

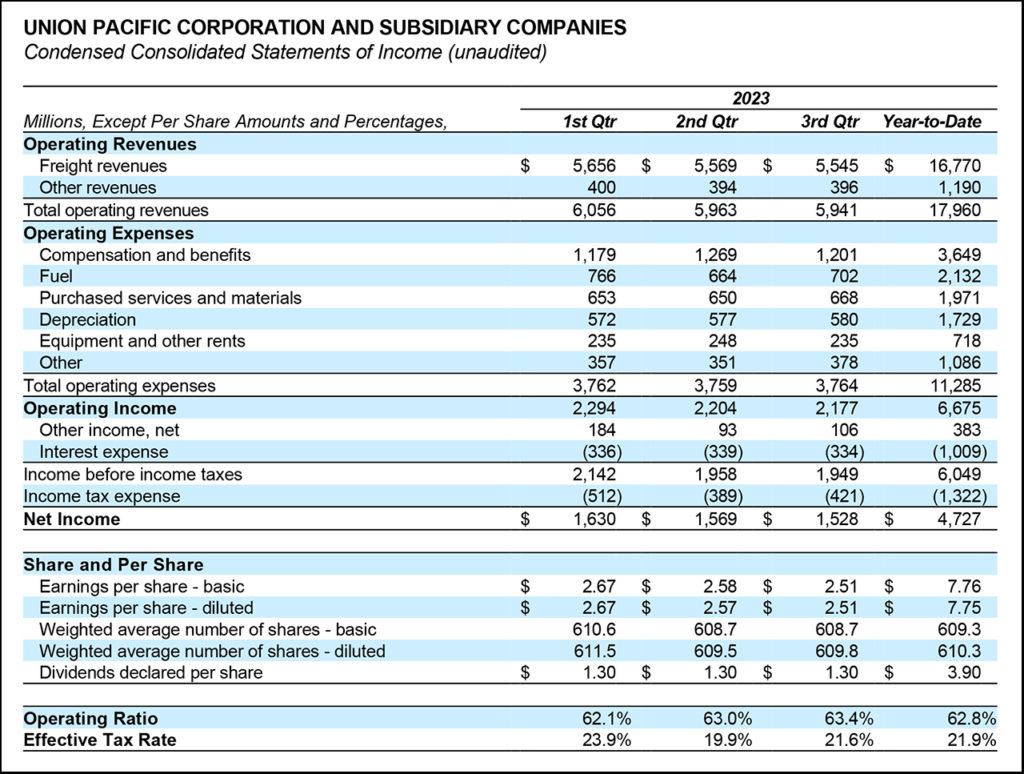

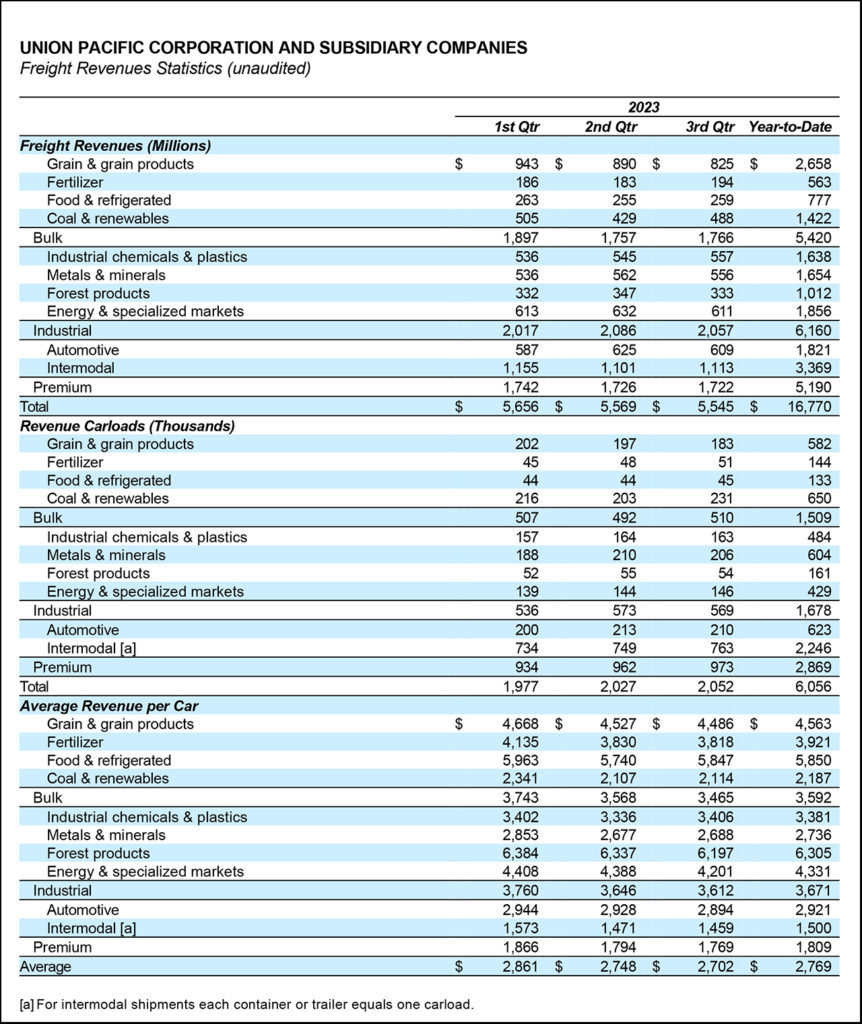

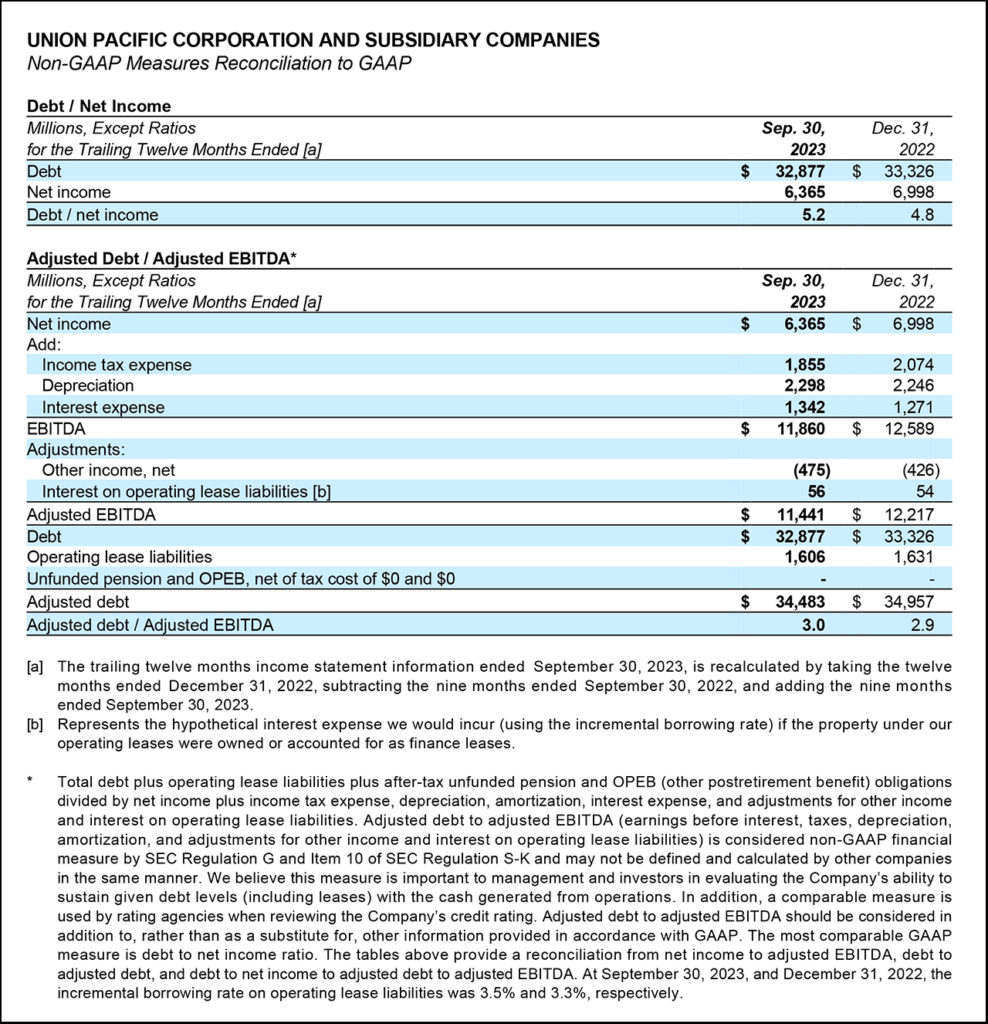

UP reported 2023 third-quarter net income of $1.5 billion, or $2.51 per diluted share, compared to third quarter 2022 net income of $1.9 billion, or $3.05 per diluted share. Operating revenue of $5.9 billion was down 10%, driven by reduced fuel surcharge revenue, lower volumes and business mix, partially offset by core pricing gains.

Business volumes, as measured by total revenue carloads, were down 3%. The operating ratio was 63.4%, up 350 basis points. Rising fuel prices during the quarter negatively impacted the operating ratio 170 basis points. Operating income of $2.2 billion declined 17%.

Compared to third-quarter 2022, freight car velocity was 200 daily miles per car, a 5% improvement. Quarterly locomotive productivity was 129 gross ton-miles (GTMs) per horsepower day, a 4% improvement. Average maximum train length was 9,537 feet, a 1% increase. Quarterly workforce productivity decreased 6% to 985 car-miles per employee. The fuel consumption rate of 1.052, measured in gallons of fuel per thousand GTMs, was flat. UP year-to-date reportable personal injury and derailment rates improved.

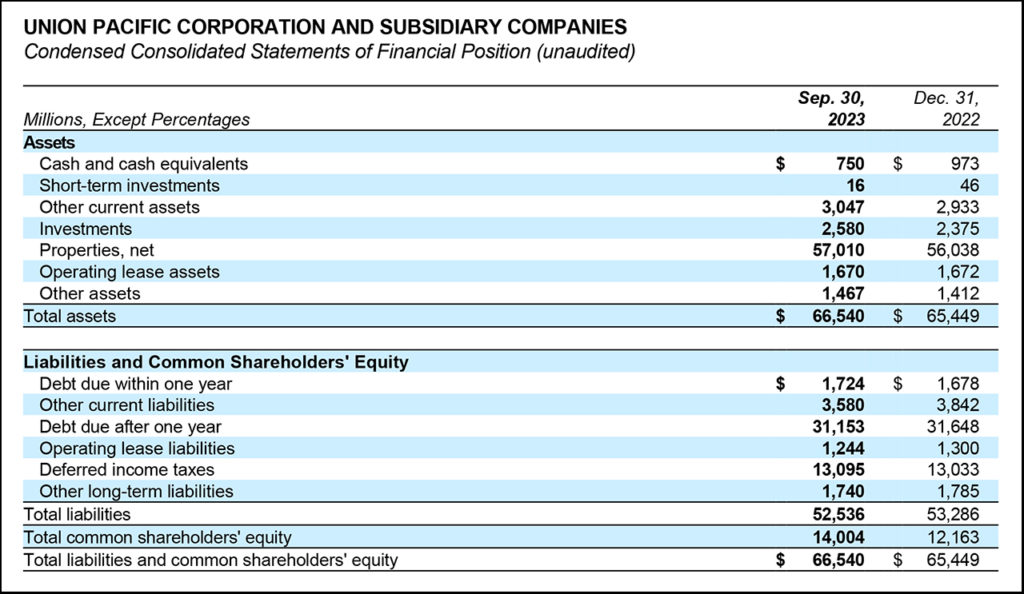

UP’s full-year outlook “remains relatively unchanged,” the railroad said. “Year-to date softness in consumer-related volumes likely will drive full-year volume expectations below Industrial Production (current forecast: 0.0%). Pricing dollars will be in excess of inflation dollars. Our 2023 Capital Allocation is updated to $3.7 billion, and we expect to maintain a dividend of $1.30/quarter. No further 2023 share repurchases are planned.”

Railway Age Editor-in-Chief William C. Vantuono spoke with Vena following the earnings call:

RAILWAY AGE: I want to talk with you based on your history as an operating person. What adjustments and improvements have you been making to improve your service metrics and your key performance indicators specifically?

JIM VENA: Let me start by saying that people make one mistake about me all the time. I worked for 40 years at CN, and I wasn’t just an operating guy. I was at the table negotiating at midnight with the big unions on whether we were going to have a deal or not. And I was at the table to close the deal when we went to the first remote-control locomotives in North America, back 20 years, so I’ve had a lot of different jobs. I’ve been in marketing and sales.

When I first came to UP, I came as an operating person. I was here because the place had the opportunity to be way more efficient, which a railroad needs to be. You cannot have the kind of capital spend on assets that you don’t need because you’re not using them right or have the right service. My KPIs are really simple. I look at the railroad on what our service level is, on what our safety and operational metrics are. In all those you need to make sure that as an industry we’re headed in the right direction. We’ve all gotten better over the years, but I think we must change the trend line and make ourselves even better and safer and invest and do everything we can on the service side. We must deliver on the business we sold our customers.

That’s what we measure, and a TPC (train performance calculator) really doesn’t do that. It’s hard to put out 2,000 O-D pairs every day to decide whether we had good service. It’s all about operational excellence and making sure that you have buffers so that people don’t get surprised. I’ve been doing this for way too long to ever think we would cut down to the last person, the last locomotive, the last piece of rail we can install. You always have buffers because the business is not flat. It goes up and down during the year, and we’re going to have weather events. Who thought that we were going to get a hurricane in the western part of the United States? And at the end of the day, the more business we can move on to the railroad that is using other modes that are not as greenhouse gas efficient as we are, the better. I find that to be a positive story for the railroads.

RAILWAY AGE: What are you seeing in in the field at the T&E levels, in terms of employee relations, employee engagement?

JIM VENA: Let me back up here a little bit. I’ve been at the table with the BLET, BMWED and SMART-TD. There is never a round of negotiation that is not tough. We both have a list of things, and we both have the same goals at the end of the day. The unions don’t want to make us so inefficient that we lose jobs and they lose members. We want our employees to stay and feel that they’ve got a great workplace, and that we give them a good quality of life. Sometimes we look at them a little bit differently, but fundamentally we have the same goals. The latest round was contentious and got more press coverage. It was out there, and the unions were asking for things.

I remember when we went from five- to four-person crews there were a lot of people who said, you know, it’s going to be unsafe to go to four. And then when we went to three, my God, it was the end of the world. And then we went to two. I negotiated the first remote-control agreement in North America. I was the operations rep to do that. I remember putting on the 15 miles an hour limit in Canada, and it was going to be the end of the world. And you know what we found? We could become safer with technology. But those were very contentious negotiations. This last one was just more out in the public, but they’re always contentious.

RAILWAY AGE: This year there have been a few high-profile accidents. They’re few and far between, but everything generally—not just railroads—seems to be highly politicized.

JIM VENA: You know, we have a responsibility to be better, and that’s the way I look at it. The industry needs to get better and that’s why it’s one of the key goals I have is safety. I think we’re very safe, but that’s not good enough in today’s environment. We really need to double down and figure out ways to become safer, using technology. We have to invest money in safety, and we must train people better, have a better relationship with them. That’s why I’m trying to drive decisions to the right level in the company.

I don’t look at our front line employees as unionized. They’re the employees that operate and maintain the trains and fix the track and service the signals. They understand how important it is to work in a safe manner. If we do that, we change the culture, we end up with a better employee. We end up with a better safety record and we have a better relationship as we move ahead. I want everybody in the company to be shareholders in the company. If our shareholders succeed, our company succeeds, and they succeed. We offer a great employee share participation plan so that everybody can become owners in the company.

The operating ratio or margin is a result of everything else you do. You never should have a goal that says, I want to drive to this margin, whether it’s margin or operating ratio. It’s just a flip on the on the reciprocal. At the end of the day, that’s the way I look at it. UP has the capability to be the best in the industry. We have a physical plant like nobody else’s. We have the longest length of haul compared to any other of the publicly traded companies. We have the opportunity to be the most efficient, and we should take advantage of that.

RAILWAY AGE: What about capex for next year?

JIM VENA: I think we will start lower than where we’re going to end up this year. But if we need to spend an extra $100 million on something for business growth or safety, then we will spend it. That’s the nice part about Union Pacific and how we are set up financially. If we have to spend, we will. But we also have to be cognizant of where we want to start. Starting in January, we’ll tell people where we think our capital envelope is going to be next year.

TD COWEN PERSPECTIVE: UP RIDING VENA’S VISION

By Jason Seidl, Matt Elkott, Bhairav Manawat, Elliot Alper and Uday Khanapurkar

UP’s 3Q23 topped low expectations. Mild signs of life have emerge in recent weeks within intermodal traffic as investors begin to appreciate Vena’s approach. We still look for muted growth in 2024 while acknowledging the likelihood of noteworthy improvement in the network’s fluidity and service metrics. Our price target to $228 and we reiterate Outperform.

3Q23 EPS of $2.51 beat our estimate of $2.44 (recall we lowered our expectations from $2.68 on 9/21) and consensus of $2.41. Operating income was in line with our estimates as OR came in 30bps better than expected at 63.4% (~350bps worse y/y) and offset top line drag from soft pricing (which was highlighted in our 3Q23 rail survey). A lower tax rate owing to tax cuts in three states added $0.08 to the bottom line and supported operational results in producing the beat for the quarter.

Core pricing and mix added 1.5% y/y in 3Q as UP held on to as much pricing discipline as it could have given pressures from truckload competition. UP expressed confidence in continued core pricing resilience, noting that customers are still receptive to the case for price hikes. Investors should remember that roughly half of UP’s book of business is tied up in multi-year contracts. Declining fuel surcharges affected overall pricing in the quarter, with ARPU down 6.2%, though with fuel having shot back up in 3Q23, surcharges should recover somewhat in 4Q23 following the customary 6-8 week lag. Management called out a $0.10 fuel hit to the bottom line in 4Q23 (compared to the $0.34 hit in 3Q23).

In Vena’s first quarter in the CEO position, he discussed early initiatives to “reduce layers” (likely talking about management here and not T&E employees) and speed up the decision-making processes. Vena appears very focused on improving the network’s velocity and creating a strong service product for customers that will ultimately bring growth back to the network. As we highlighted last quarter, UP has long struggled to grow volumes on its network for a decade and carloadings in the third quarter were still below 2019 levels. We look for Vena to re-ignite a sense of urgency across the network and build volumes off current levels. We continue to model 2024 carloadings below 2019 levels as UP looks for areas of growth.

UNP reiterated expectations of labor-related cost pressures but highlighted mitigation efforts. The TE&Y training pipeline has shrunk to 500 employees from 1,200 last year. Gains from productivity measures allowed UP to hold comp/employee flat, and management expects FY comp/employee except one-time payments to be up ~3% y/y. Vena referred to preserving a buffer of labor to bolster service a couple of times on the call but also pointed out that UP will lean into attrition to manage costs through the current downcycle.

UNP sounded cautiously optimistic on 4Q23 OR, noting that there is an opportunity for sequential OR improvement despite a lackluster volume environment (intermodal is showing moderate sequential improvement) given robust pricing and productivity initiatives in labor and train velocity combined with recovering fuel surcharge. Management emphasized on the call that volume growth can outpace headcount growth as the cycle inflects.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)