CSX 3Q23: ‘Improving Sequential Trends’

Written by William C. Vantuono, Editor-in-Chief

CSX President and CEO Joe Hinrichs. CSX photo

The third quarter of 2023 for CSX saw a few significant and continuing performance and service improvements in a market best described as challenging.

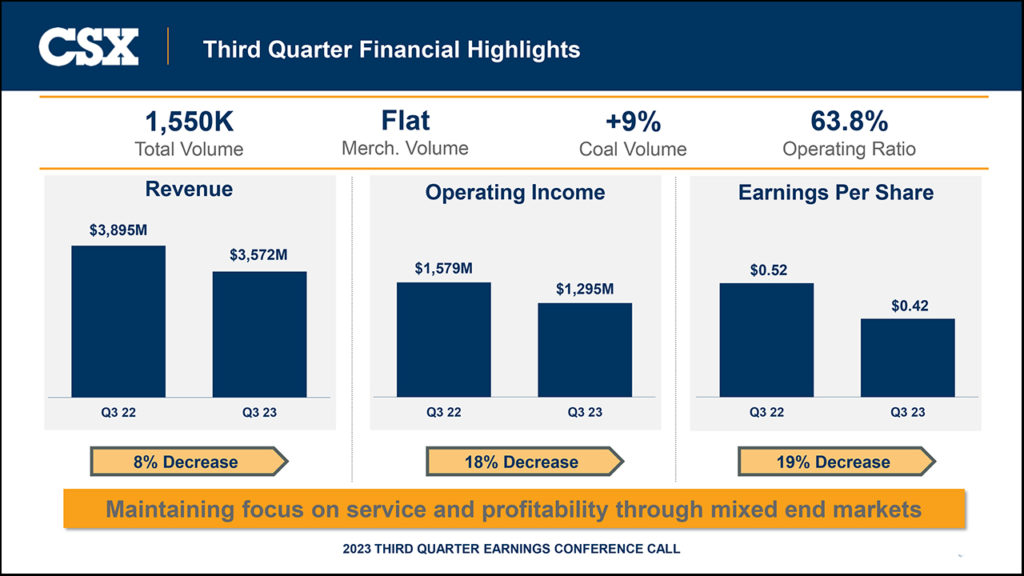

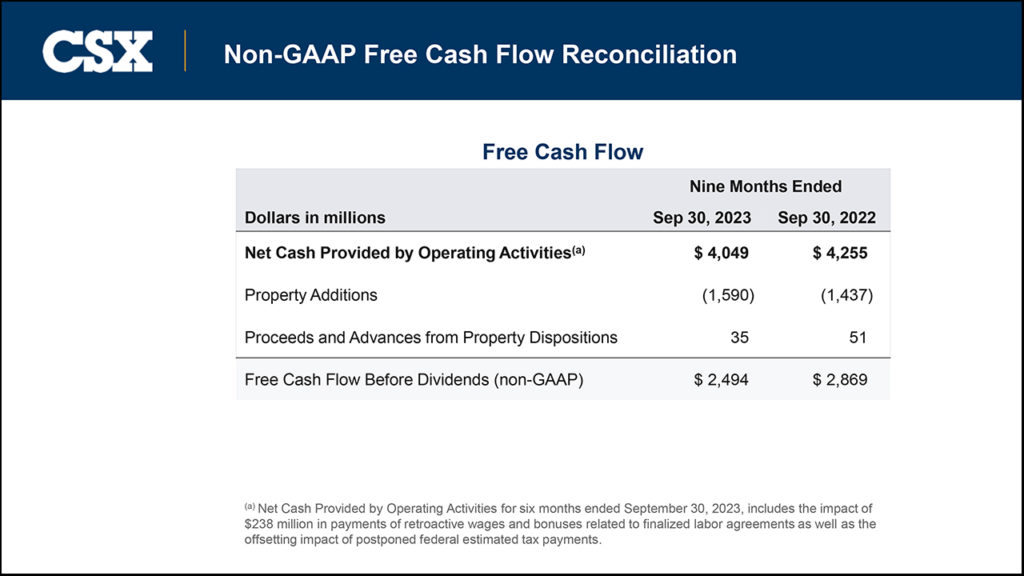

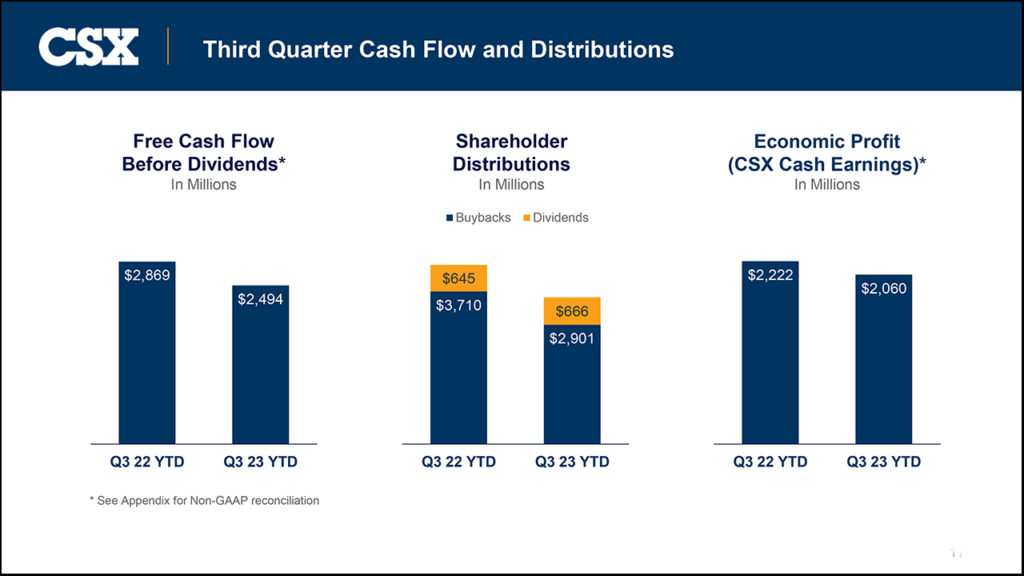

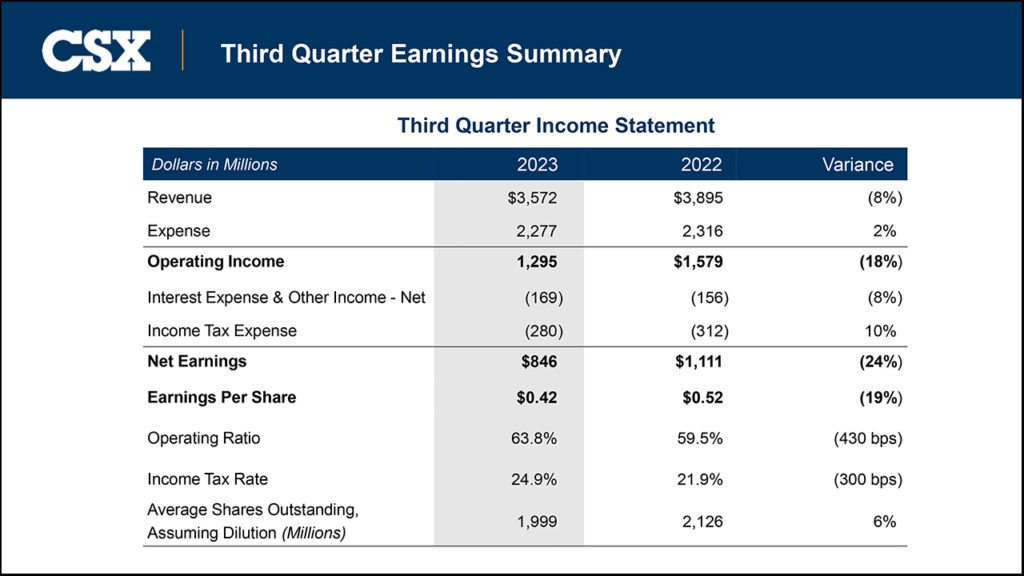

Third-quarter 2023 operating income of $1.30 billion decreased 18% from $1.58 compared to the same period in 2022, with an operating ratio of 63.8%. This includes negative impacts of approximately $350 million related to net fuel, storage revenue and coal prices, partially offset by the favorable impact of $42 million due to out-of-period labor and fringe expenses incurred in the prior year. Net earnings of $846 million, or $0.42 per diluted share, a 23% drop compared to $1.11 billion, or $0.52 per diluted share, in the same period last year.

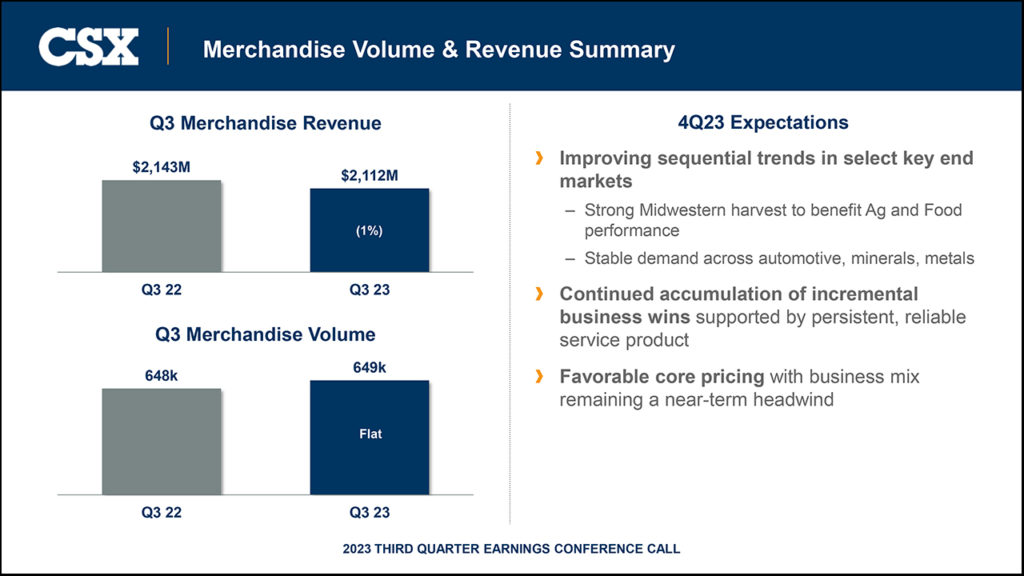

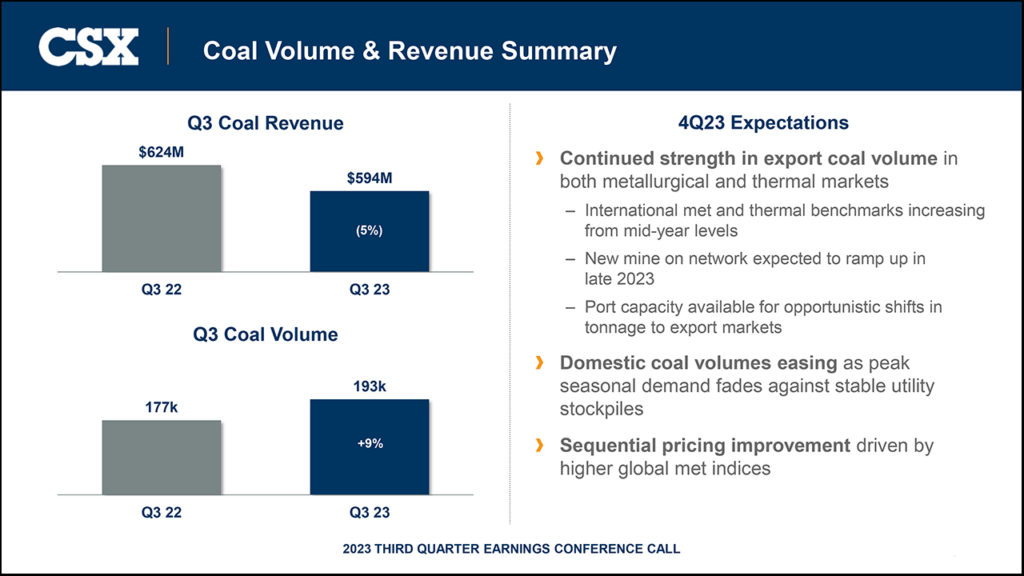

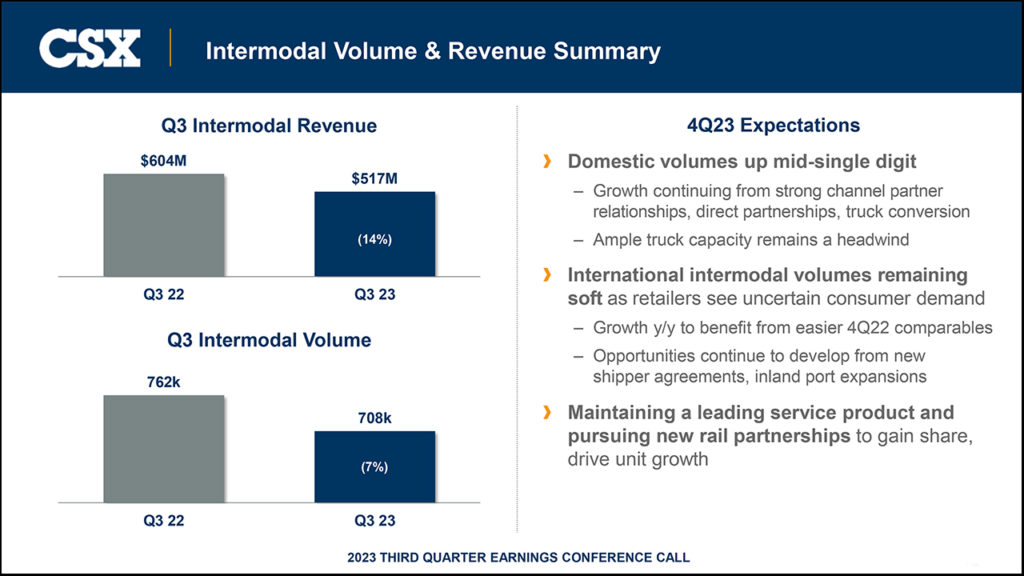

Revenue totaled $3.57 billion for the quarter, declining 8% year-over-year as the effects of lower fuel prices, reduced intermodal storage revenue, a decline in export coal benchmark prices and a decrease in intermodal volumes more than offset the effects of higher merchandise yields and coal volume growth.

“Over the third quarter, our efforts centered on delivering the reliable customer service that has allowed us to remain resilient and successfully maneuver through mixed markets,” said President and CEO Joe Hinrichs. “Our merchandise business remained solid, and our coal operations delivered strong volume growth. As we approach year-end, we are proud of the cohesive culture taking shape across our ONE CSX team that is helping to drive positive business results, and we are encouraged to see improving sequential trends in some of our key end markets.”

Railway Age Editor-in-Chief William C. Vantuono spoke with Joe Hinrichs following the earnings call:

RAILWAY AGE: This past quarter across the board for all the railroads has been a bit tough in terms of volume. That’s not unexpected. But CSX has some significant improvements in train velocity, dwell time, and intermodal and carload trip plan performance. That said, would you characterize this past quarter as tough or challenging in terms of traffic volume?

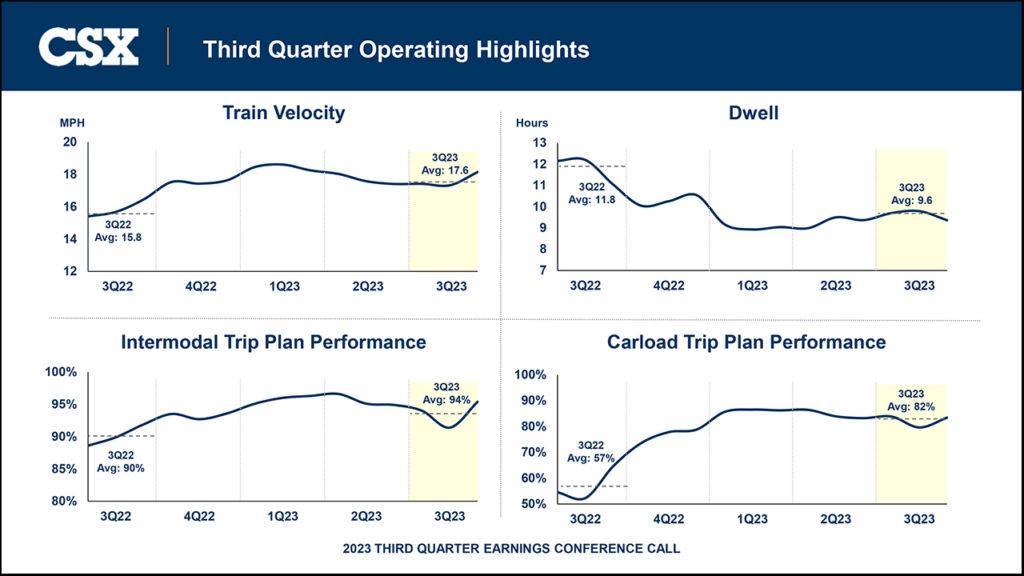

JOE HINRICHS: On the things we can control, we had a very strong quarter—the operating performance of the network, velocity, dwell, trip plan, compliance numbers. Our carload trip plan performance was up more than 30% year over year, a big improvement. I really want to thank our teams for the work they’ve done. We had several things in the third quarter of last year that went our way that added a lot of revenue but didn’t add a lot of cost. They didn’t repeat this year. Met coal prices were at record highs last year, and our business is tied to those prices. We had a fuel surcharge that was up significantly in last year’s quarter. We benefit from that based on timing when fuel price rises, and we can put a surcharge on.

Finally, there was the peak. It seems like it was forever ago, but the third quarter of last year saw a peak in storage revenue because of all the congestion in the ports and with intermodal. Nowadays there is almost none. We had $350 million of revenue that came in the third quarter of last year that didn’t repeat this year, even though we’re running a lot better. We’ve been talking about it all year that it’s happening, it’s coming. If you look at the first three quarters of this year, our merchandise volume, our carload volume is up year-over-year in a down market. Our intermodal business is down, which is true for everybody. That’s a long way of saying our operating performance was very strong in the third quarter, and our sequential cost improvements were meaningful in the third quarter vs. the second quarter, but we just didn’t have all that supplemental extra revenue we had last year. This will most likely be the last quarter of that, but it was the most prominent on a year-over-year basis. That will start to normalize going forward. Again, we’re focused on the things we can control, how our network runs, what kind of trip plan compliance we have for our customers—our safety and our efficiency. I feel good about our ability to keep moving forward on that.

RAILWAY AGE: We’re now in the middle of the peak season. How does that look?

JOE HINRICHS: We’re encouraged by what we’re seeing in the start of the fourth quarter across most of the sectors of our customer base. We expect a strong ag quarter with the Midwestern grain harvest looking strong. Obviously, we’re watching what’s happening in the motor vehicle space with the strikes, but our auto business has been strong. We’re moving a lot of Teslas, and Tesla not long ago was only doing truck. We’re even seeing some recovery in some other areas that have been down for most of the year. And the domestic intermodal business continues to improve year-over-year. We’re encouraged by what we’re seeing now. I’ve read a lot of the commentary by the trucking firms about the holiday peak season on the consumer side, that maybe it won’t peak so much, but we’re not as exposed to that. We have a strong business with UPS. We have a strong intermodal business, but our business overall is not quite as exposed to the consumer retail side.

RAILWAY AGE: You recently, of course, added New England to the railroad. You’re putting some money into the infrastructure, getting it up to snuff. What do you see as the future of New England railroading?

JOE HINRICHS: We’re putting more than $100 million into the former Pan Am network to get it to our speed requirements. We’re hearing from a lot of customers both in New England but also in the eastern part of Canada about being excited about the opportunity to take advantage of our network to get into the Northeast United States faster, because a lot of that Pan Am network is running 10 miles per hour, and we’re going to be able to run much faster speeds once we get everything finished. That will be next year sometime, not that far away. I can tell you there’s a lot. I was up in Worcester and Boston, and I went up to Portland for NEARS, and had a chance to talk to several groups. We’re hearing from customers that they’re excited about being able to access our network, and our marketing and sales team is ready to go. They’re waiting for us to turn the switch on to say, okay, we’re ready to go fast. I think we’re going to be pleasantly surprised by the opportunity up in New England.

RAILWAY AGE: There has also been a lot of activity in your network in the Southeast. You’re doing some work with CPKC, building some new connections to gain some directional running and more routing options. What are your expectations? CPKC, of course, is very optimistic about that.

JOE HINRICHS: We are, too. I think it’s one of the most exciting developments going on in the rail industry. When’s the last time we had a new interchange point established? It has been decades, I’m told. It’s a big deal. I know Keith [Creel] and CPKC are excited about it. We just submitted our application and information to the STB. Chairman Oberman talked about competition as good for the industry. So we’re anticipating support from the STB for that. It’s a big opportunity because we’re already seeing a competitive dynamic playing out in the West with CPKC being more aggressive with Kansas City Southern in its network. Now with Jim [Vena] coming on at UP, we’re seeing a lot of competition in the West. That’s a big opportunity for CSX because the population is in the East, and the growth is in the Southeast—perfect for our network. Traffic coming into Alabama and then accessing our network in Montgomery or Birmingham or over to Jacksonville or up to Atlanta or Waycross, we’re very excited about it. We and CPKC need to go through the process to invest in the Meridian & Bigbee to get it to our speeds and comfort level, the bridges and all the infrastructure. Get STB approval and we should be running next year. We’re excited about it.

RAILWAY AGE: Would you agree that that the STB will look favorably upon anything done to enhance competition, whether it’s railroad-to-railroad or, more important, railroads competing with trucks and other modes?

JOE HINRICHS: Yes, we believe that. I’m not going to speak for the STB, but we believe that can be the case. One of the exciting things when we announced this with CPKC was that we see a lot of conversion opportunity. With their service product and our service product, we can compete with trucks and provide more. There’s a lot: trucks from Mexico into the United States, both Midwest and Southeast. We can compete for that across that network and into our network. So yes, I believe the STB will be very supportive of what’s going on.

TD COWEN PERSPECTIVE: RUNNING A SMOOTH SHIP WHILE LOOKING THROUGH THE CYCLE

By Jason Seidl, Matt Elkott, Bhairav Manawat, Elliot Alper and Uday Khanapurkar

CSX’s 3Q23 largely met expectations as 4Q23 trends show initial momentum through the first few weeks of October. Rail pricing and inflationary pressure are likely going to continue to impact margins into 2024 as management works to counter headwinds with further efficiency gains. Our price target is $33 and we reiterate Market Perform.

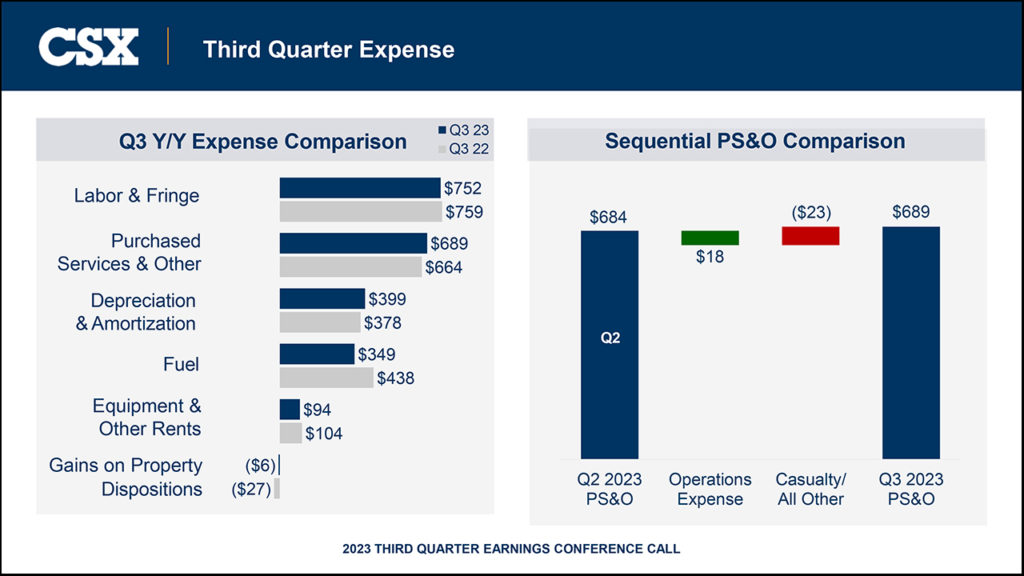

CSX reported 3Q EPS of $0.42, above our estimate of $0.40 but slightly below the consensus of $0.43. Adjusted OR of 63.8% deteriorated y/y but beat our forecast by 170bps on nicely improved network fluidity and cost initiatives that drove a $20MM decline in PS&O. Consolidated revenues down 8% y/y came in slightly better than our forecast mainly due to better-than-anticipated revenue/carload.

Intermodal carloadings declined 7% in 3Q, though grew sequentially, with RPU declining 7.9%, leaving revenues down 14%. Intermodal trip plan compliance rose to an impressive 94% (up from 90% in the prior year). The trucking market continues to weigh on domestic intermodal markets, and while we have seen a slight uptick in carloadings in recent weeks, we don’t expect material improvement until OTR rates inflect upwards. International intermodal is showing signs of stabilization, but CSX highlighted that retailers continue to move cautiously, given uncertain health of the consumer; this has resulted in a lack of confidence and thus lower order rates/imports. We note that CSX benefits from much easier comps in 4Q.

On headcount, management noted that hiring is by and large still under way to support volume growth in merchandise as well as to resource understaffed regions. CSX reiterated the ability to manage headcount with attrition should the need arise, though we see the company’s new focus as a growth railroad likely meaning stable headcount going forward. CSX guided a few percentage points of sequential increase in comp/employee in 4Q, similar to what UP suggested.

While CSX indicated that 4Q OR can improve sequentially, bucking the post-COVID seasonal trend of deterioration, we remain cautious given softness in intermodal markets and expectations of a delayed TL market recovery. We model slight sequential deterioration, while acknowledging that 4Q bottom line results should be supported by subsiding fuel headwind as surcharges start to kick in following the typical 6-8 week lag.

Coal held strong in Q3 with volumes +9% driven primarily by strength in export coal as global demand remains strong for both met and thermal. Domestic coal is expected to slow down in the third quarter, which outperformed in Q3 due to hot weather. We model normalization of coal demand going forward in 2024.

CSX once again verified that industrial development and nearshoring trends are intensifying. Benefits should begin to materialize in late ’24 and pick up in ’25 and ’26 according to management, and are showing no signs of slowing down with the general economy or volumes. CSX indicated that it will disclose some numbers on the industrial development front sometime in the near future.

CSX is a high-quality company with solid fundamentals that appears well-positioned to benefit from long-term economic growth. Forthcoming catalysts are long-term intermodal growth driven by the ongoing shift from the highway, as well as expansion of some of the company’s hubs and potential longer-term benefits from the ongoing operational turnaround plan.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)