UP: 2Q23 Revenues Down as Consumer Market Softens (UPDATED, TD Cowen Insight)

Written by Marybeth Luczak, Executive EditorOn July 26, concurrent with executive leadership changes tagged by some as the “Fritz Split,” Union Pacific posted second-quarter 2023 financials reflecting lower net income and operating revenues, and a higher operating ratio, compared to the prior-year quarter.

“The results this quarter were impacted by softening consumer markets, inflation, a one-time labor expense, and increased workforce levels,” Lance Fritz, Union Pacific (UP) Chairman, President and CEO said during his final quarterly financial report for the Class I, which named railroad industry veteran Jim Vena as CEO and member of the Board; elevated Executive Vice President, Sustainability and Strategy and Chief Human Resources Officer Beth Whited to President, reporting to Vena; and elected UP lead independent director Mike McCarthy, as Chairman of the Board.

“The entire team remains focused on maintaining a solid service product while taking steps to recapture lost productivity and lay a strong foundation for sustainable future success,” said Fritz, who is stepping down from the leadership role he’s held since 2015. “We took actions throughout the second quarter to drive greater network fluidity and provide our customers with better service. We finished the quarter with resource levels more aligned with demand, as we stored excess locomotives, improved recrew rates, and reduced borrowed-out employees.”

UP’s financial highlights for the three months ending June 30, 2023, include:

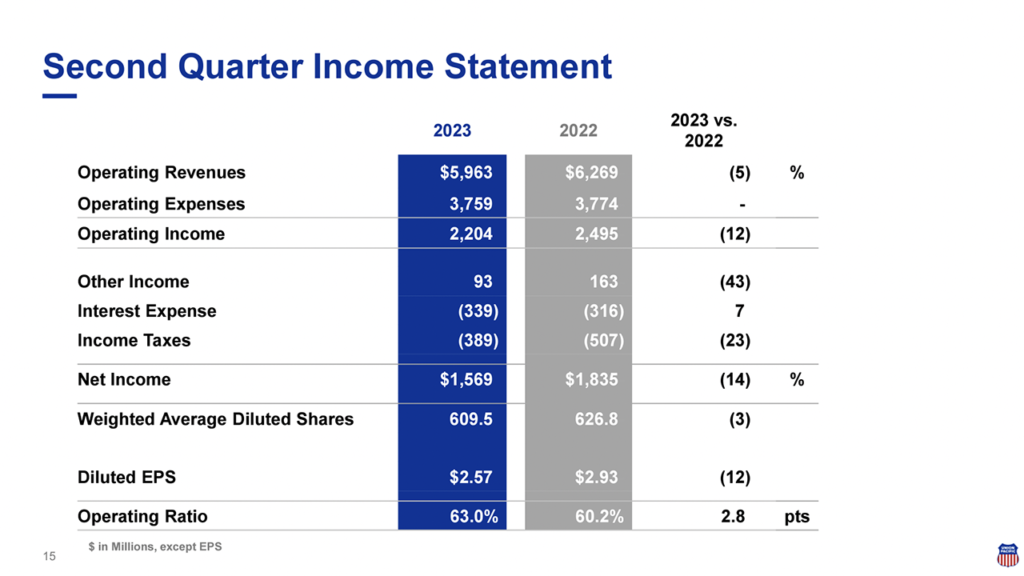

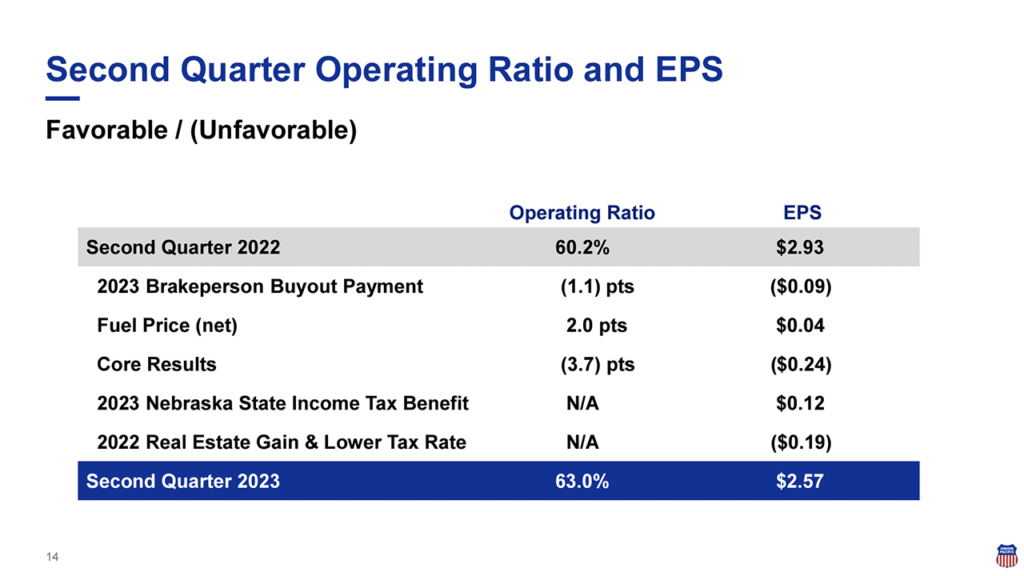

- Net income of $1.6 billion (or $2.57 per diluted share), down 11% from the prior-year period’s $1.8 billion (or $2.93 per diluted share). “These results include the previously disclosed $67 million labor expense and $73 million income tax benefit,” UP reported.

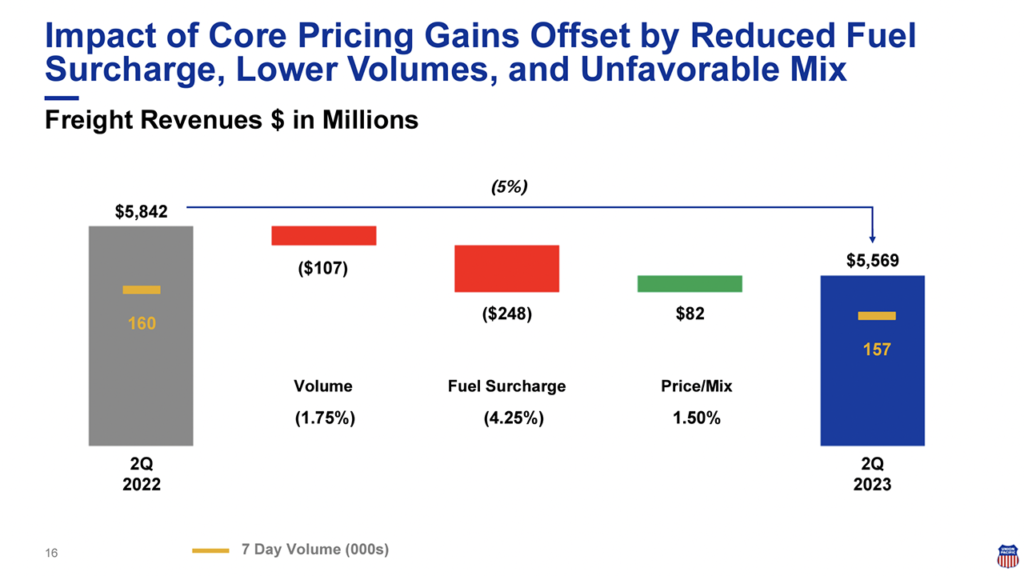

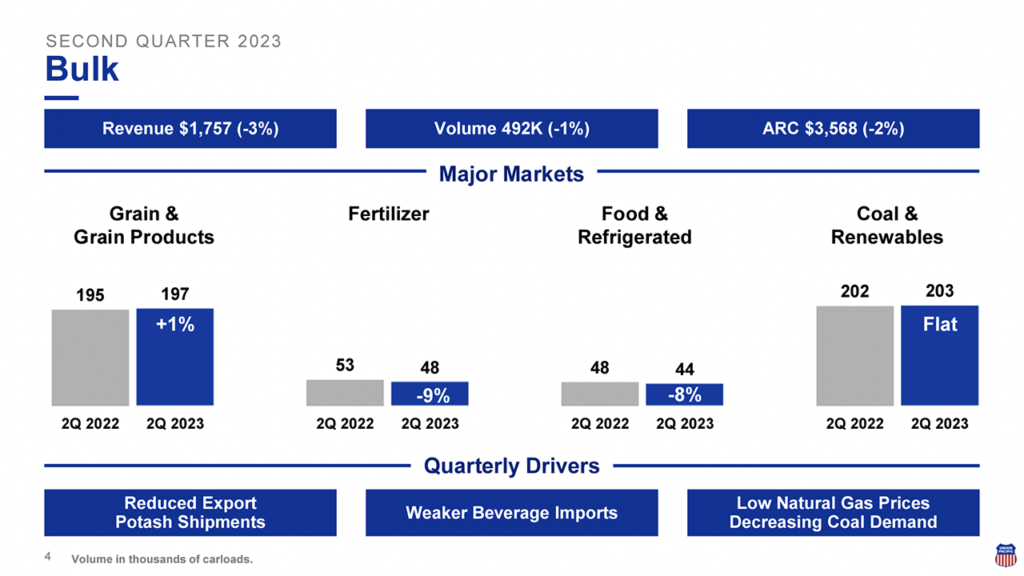

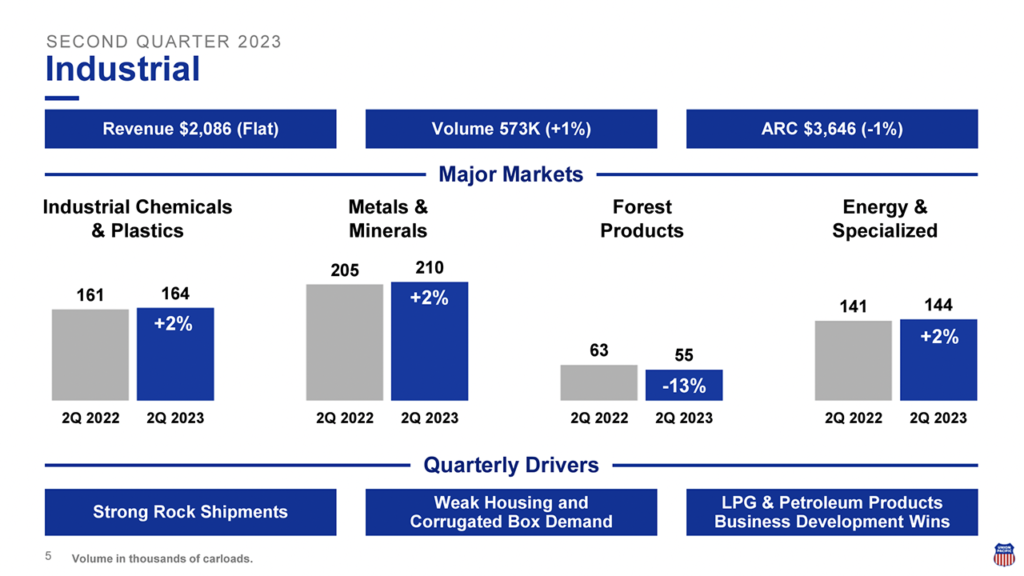

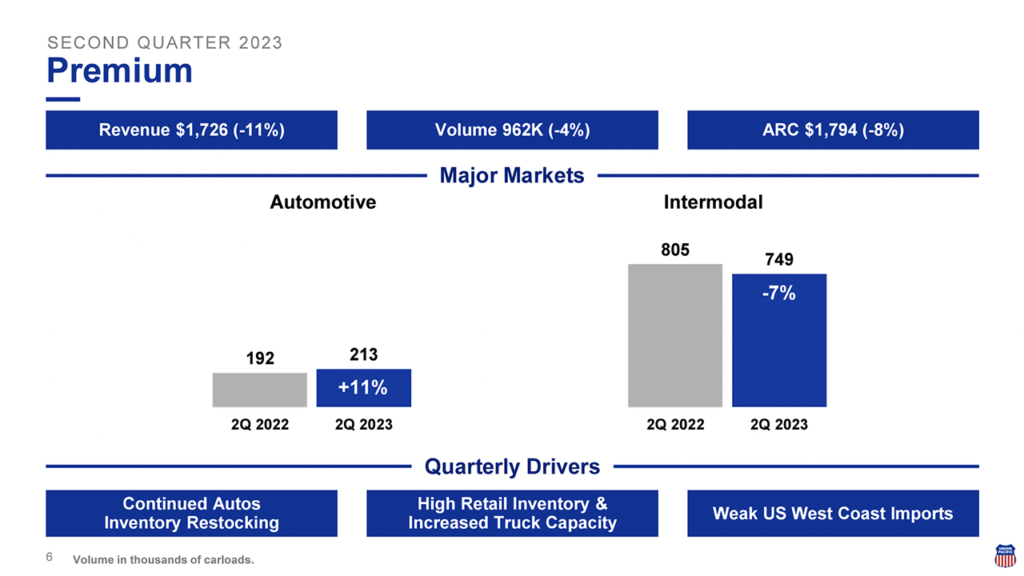

- Operating revenue was $5.96 billion, a 5% decrease from second-quarter 2022’s $6.27 billion, “driven by reduced fuel surcharge revenue, lower volumes, and an unfavorable business mix, partially offset by core pricing gains.”

- Business volumes, as measured by total revenue carloads, were down 2%.

- Operating ratio was 63.0%, up 280 basis points. According to UP, this includes “an unfavorable 110 basis point impact from a one-time labor agreement payment and a 200 basis point benefit from falling fuel prices.”

- Operating income of $2.2 billion declined 12% from second-quarter 2022’s $2.5 billion.

- UP said it repurchased 600,000 shares in second-quarter 2023 at an aggregate cost of $120 million.

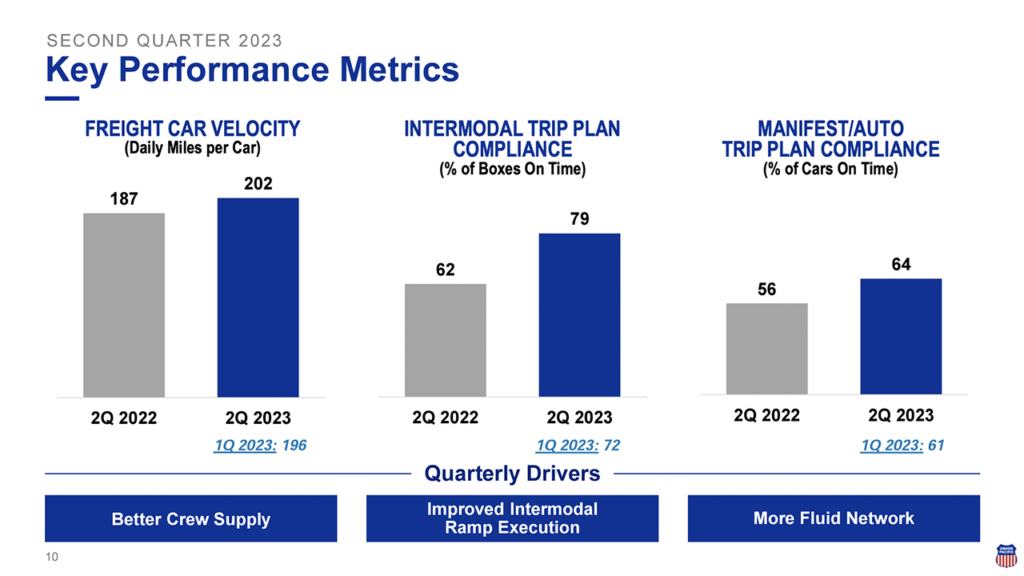

UP posted the following second-quarter 2023 operating performance results:

- Quarterly freight car velocity reached 202 daily miles per car, an 8% improvement over second-quarter 2023.

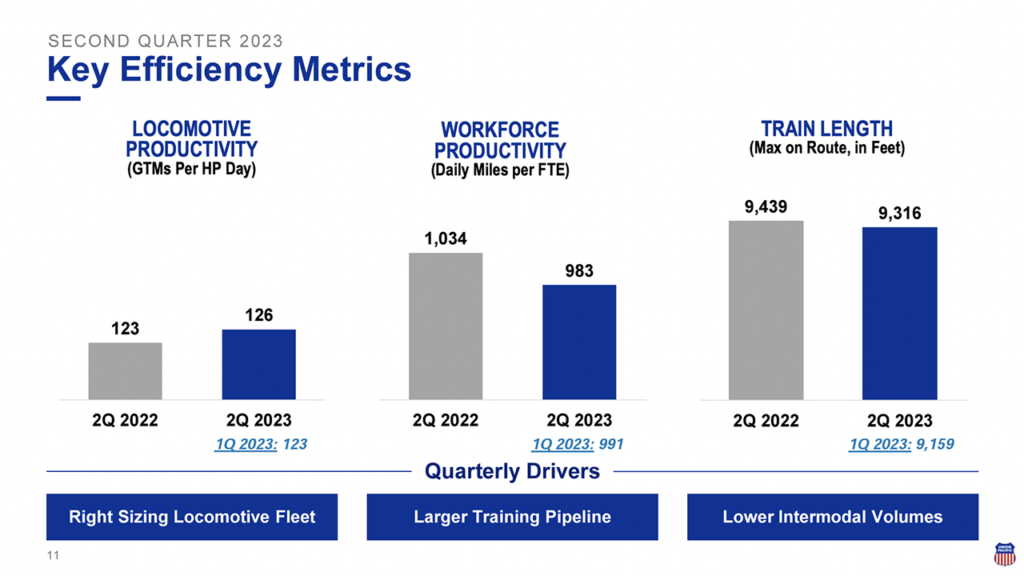

- Quarterly locomotive productivity was 126 gross ton-miles (GTMs) per horsepower day, a 2% improvement over the prior-year period.

- Average maximum train length was 9,316 feet, a 1% decline from the same period last year.

- Quarterly workforce productivity decreased 5% to 983 car miles per employee vs. second-quarter 2022.

- Fuel consumption rate of 1.086, measured in gallons of fuel per thousand GTMs, deteriorated 1% from second-quarter 2022.

- UP said that its first-half reportable derailment rate improved 9% to 2.45 per million train miles compared with 2.68 for 2022.

2023 Outlook

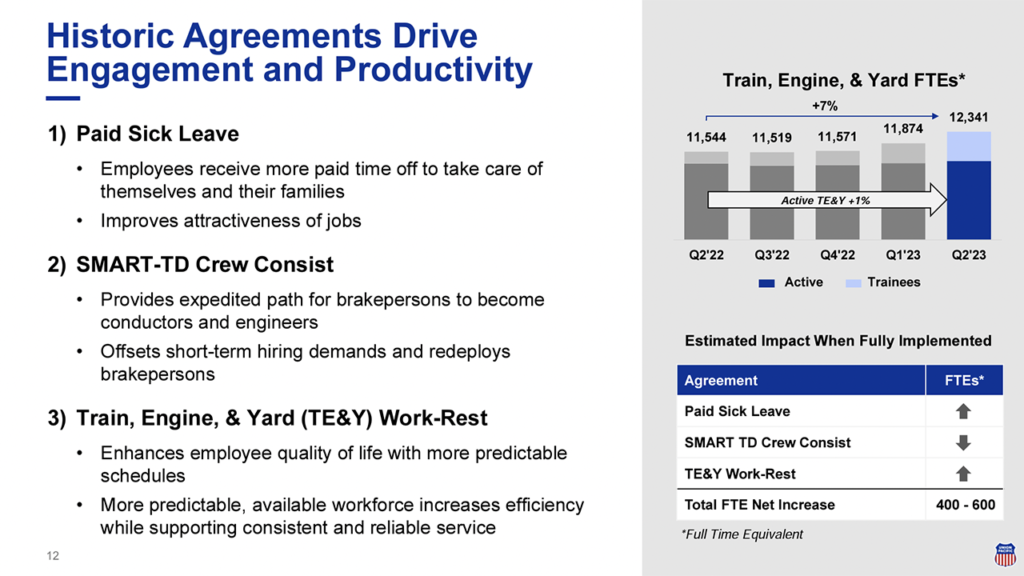

Looking ahead, UP reported that consumer-related volumes will likely drive full-year volume expectations below industrial production; the current forecast, it said, is +0.1%. Additionally, pricing dollars will be in excess of inflation dollars. The railroad is forecasting $50 million to $70 million in labor expense from new agreements in second-half 2023. Finally, it reported a capital plan of $3.6 billion.

TD Cowen: Vena Return Overshadows “Lackluster Performance“

“A lackluster 2Q performance was overshadowed by the return of a tenured and respected operator, Jim Vena,” according to TD Cowen Managing Director and Railway Age Wall Street Contributing Editor Jason Seidl. “UP faces structural cost headwinds and potential rail regulation that we believe could limit near-term upside after today’s strong move. UP looks for the next growth engine, given carloadings are at 2009 levels. We look for Vena’s vision for UP’s future.”

“Incoming CEO Jim Vena was UP’s COO during 2019-2020 and we are encouraged by his appointment, given his strong operational track record at the company as well as other Class I‘s. We believe Vena is a good choice of leader. While Vena was not on the earnings call, we are eager to hear his long-term plan for the Class I, given the industry-wide imperative to grow carloads, and will monitor UP’s strategic leadership under him closely. We are also encouraged to see Beth Whited appointed President of UP, carrying 35-plus years of experience across several departments at the railroad.

“UP (and the Class I’s as a whole) has struggled to grow volumes on its network for years, with carloadings down 3% compared to pre-COVID levels and relatively flat compared to 2009 GFC levels. We model 2% volume growth for UP in 2024 with an operating ratio of 60%, improving ~200bps y/y. Our current EPS estimate of $12.00 assumes volume, pricing and margin improvement next year, despite potential industry headwinds on the cost and productivity side.

“UP did not change its long-term capital allocation strategy during its 2Q call, but we were surprised to see management pause their share repurchase program for the remainder of the year. The last time UP paused its repurchase program was in 2Q20 as COVID consumed the market. While we have strong respect for UP’s management team, we believe capital allocation strategies may be revisited next year as UP begins to generate more cash.

“We note that UP faces incoming headwinds that could limit near-term upside. UP recently reached new agreements with rail unions relating to a host of work/life issues and anticipates the cost impacts of new labor agreements to materialize in 2H23 (increase of $50MM-$70MM called out) and bleed into 1H24. Additionally, rail regulation risk is salient in the form of a reciprocal switching rule likely to be formalized in 2H23, and FRA restrictions on train length and weight (probe presently under way).

“We adjust our 2023 and 2024 EPS estimates to $10.60 from $11.40 and $12.00 from $12.70. We increase our multiple to 20x (up from 16.5x), which is ~2 turns above the company’s historical average but ~2 turns below its peak multiple of ~22x. We believe the increased multiple is justified by Vena’s return to the company and our belief that brighter days are ahead for the railroad. Using our 20x multiple and $12.00 2024 estimate, our price target goes to $240. We maintain our Outperform but look for guidance on UP’s growth vision from its incoming CEO.”