NEARS Report: ‘The Seidl & Hatch Show’

Written by Jim Blaze, Contributing Editor

Tony Hatch (left) and Jason Seidl.

Jim Blaze reporting on the NEARS (Northeast Association of Rail Shippers) Fall Conference: ABH Consulting independent analyst Tony Hatch and TD Cowen Managing Director/Railway Age Wall Street Contributing Editor Jason Seidl have developed a sort-of rail business entertainment style. It’s highly technical, rapid-fire, requiring focused listening, or the audience can miss the main points. Hatch, a passionate baseball fan, hurls fastballs. Seidl’s speaking style is more like an NBA player with a deadly accurate three-point shot—and an occasional flying slam-dunk.

This is intended to be high praise. Why? They resemble a troubadour tradition dating back to at least the 11th century. Troubadours were both entertainers and teachers (journalists are another description). Back then, ‘the texts of troubadour songs often dealt with themes of chivalry and courtly love. Bravo to these gentlemen for keeping that style alive!

Here’s my interpretation of this specific NEARS session.

There still is economic uncertainty affecting the U.S. economy. Both acknowledged that, but sort of oozed commercial optimism. Each has their respective logic. But, NEARS attendees had to listen carefully, Because their back and forth covered quite rapidly a whole lot of nuances about their “assumptions.”

That’s the listener’s challenge. In less than an hour’s time, you had to listen, weigh, interpret and then conclude that you heard them correctly and that there wasn’t some other third opinion to be considered. As an analyst myself, I’m okay with this challenging approach.

Two reasons to trust Seidl and Hatch: They have a good track record accumulated over the past decade. Not perfect forecasting, but pretty well balanced. Each of them has made quite a few good calls.

The only thing missing? I wish they’d used maybe three or four graphics to help me, and the audience, visualize their key points. I was surprised that they didn’t have handout notes as they often had used in previous conferences. Interestingly, Seidl highlighted the difference between his analytic research method and mine. He tends to avoid over-dependence upon theory and evidence offered by others, while my training is the opposite. But he clearly justified his approach by asserting that his predictions are entirely his. I can appreciate and respect that open distinction. By the way, Hatch has recently disciplined his speaking pace by slowing his fastball a tad. My mind now has a fighting chance of keeping up with him! It’s also important to note that, as a fan, he often uses baseball analogies to make his point.

Style-wise, the two are clearly pro-freight railroad, maybe giving a bit more slack to the carriers than others like me might. But that’s okay, because we can all use balance in interpreting complex market mechanisms. Otherwise, we tend to focus on our own prejudices that blind us to a more restrictive market interpretation. Their record of predicting future outcomes has been remarkedly good over my decade or two of listening and absorbing their business intelligence.

In case you catch them down the road, be aware. They don’t wear ties. They don’t need to create a positive “white shirt credibility” image. I’m not talking IBM culture here. And that, colleagues, is an intended compliment.

These two gentlemen work the connections that personal relationships can bring to a business analysis. They seem to know everyone. They read the footnotes of rail company reports and then ask rather precise “so what are you going to do about this or that?” questions. Then they deliver the answers with their background perspective.

Siedl and Hatch started by acknowledging the brutally honest executive opinions they heard during the NEARS conference as the railroads wrestle with a long no-growth period. Seidl accepted the high fuel costs and the somewhat tough road to grow. Ironically, if truck fuel prices stay high, then that might actually favor a rebalancing toward more rail freight.

Hatch confirmed that even JB Hunt Intermodal is recognizing tough times ahead into 2024. He remarked how aggressive CN might grow, but only because it is stepping up its capital investment rate. CN needs to eliminate capacity bottlenecks, and must spend money to do that. There was some Wall Street pushback when CN recently reaffirmed its aggressive investment rate.

Hatch noted the recent railroad labor agreements and West Coast strike settlement are important because these developments guarantee a future income stream for railroads. Truck diversion is out there, but some of the future rail growth is to come from carload vs. carload diversion competition. He is hopeful that the railroads will return to trying out more interchange partnerships to push for growth, something “they used to do more often.” As well, the railroads seem to be backing away from T&E labor reductions to have the people needed to operate trains as traffic levels hopefully rise.

Meanwhile, the Class I C-Suite profile is changing. Two women—Katie Farmer (BNSF) and Tracy Robinson (CN)—are now CEOs. A former railroad customer, Joe Hinrichs, heads up CSX. There seems to be less of a “tough guy” corporate image in the corner office. There is one former leader known to have viewed customers (shippers) as an “inconvenience.” He’s gone. Is this a sign of more new behavior ahead?

As the STB continues to consider service problems as its number one concern, rather than rates and a broad open-access regime, both Seidl and Hatch sense that the agency might not be “the enemy at the reregulation gate” the railroads have been fearing. Both sense that over-regulation of safety by the Federal Railroad Administration—or Congress—might now be the bigger re-regulation threat. Who saw that coming?

Meanwhile, railroads as “green” transportation service might not yet be a value-added brand image. The environmentally friendly badge might not stick with the railroads for a couple of more years.

NEARS New England Specifics

Regarding the shift from Pan Am to CSX stewardship of New England railroads, Seidl and Hatch both implied that the deal (and subsequent track rehab programs) has to play out in order to understand the granularity of the results. They reminded us that the CSX acquisition was built around a rather low approximately 1.5% traffic growth rate in freight Give CSX some time to execute its rehab program for the acquired assets, and then let’s revisit the expanded CSX coverage. There may be a good scorecard report in early 2025.

Neither spoke about the challenge of building rail volume in a region with low industrial development. State and regional planners are not providing a great deal of input on possible industrial development in New England. Does a robust railroad growth market exist? This is something that CSX didn’t expand upon in its STB application.

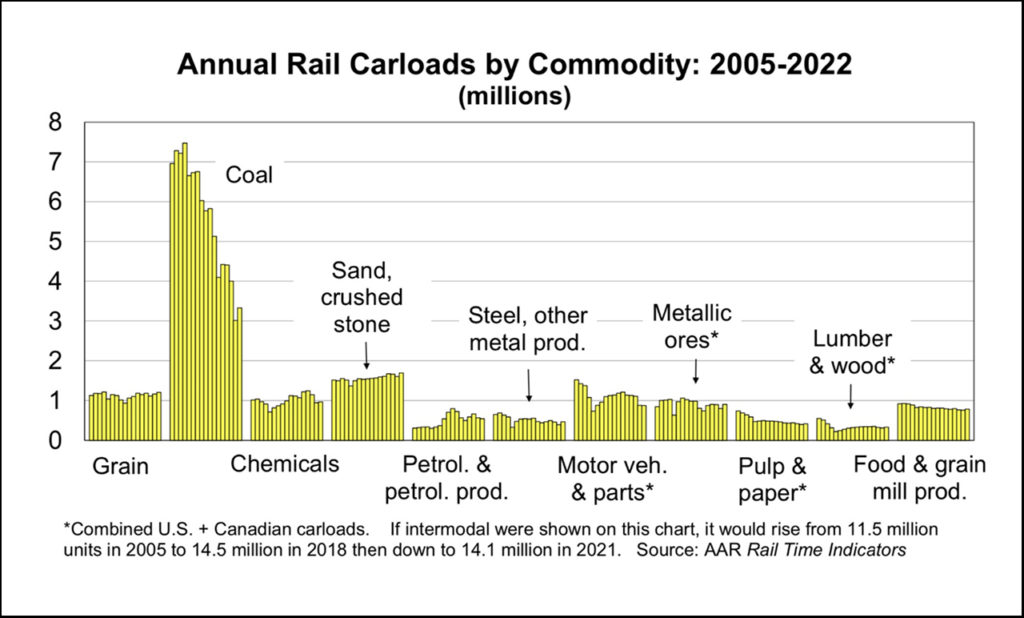

Following are a few graphics I’ve added to consider when thinking about rail freight in New England:

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for close to 50 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)