NEARS Report: How FTR Sees the Market

Written by Jim Blaze, Contributing Editor

BNSF Logistics Park Kansas City. BNSF photo

Jim Blaze reporting on the NEARS (Northeast Association of Rail Shippers) Fall 2023 Conference: FTR Transportation Intelligence Vice President Rail and Intermodal Todd Tranausky and his colleagues conduct high-quality research. They are one of my recommended (and depended upon) independent freight intelligence observers and reporters I recommend and use for monitoring and trying to predict railroad competitive market forces.

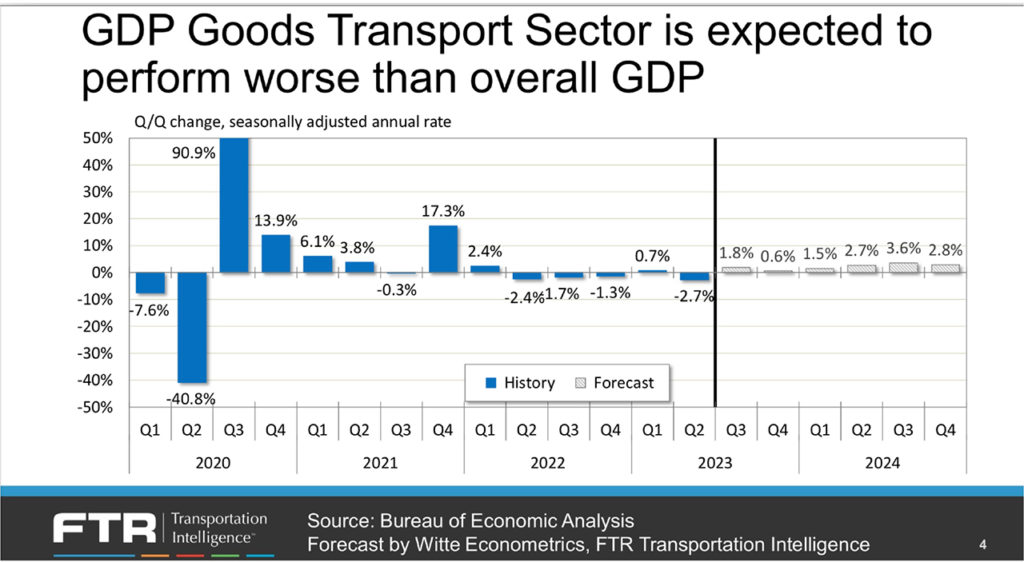

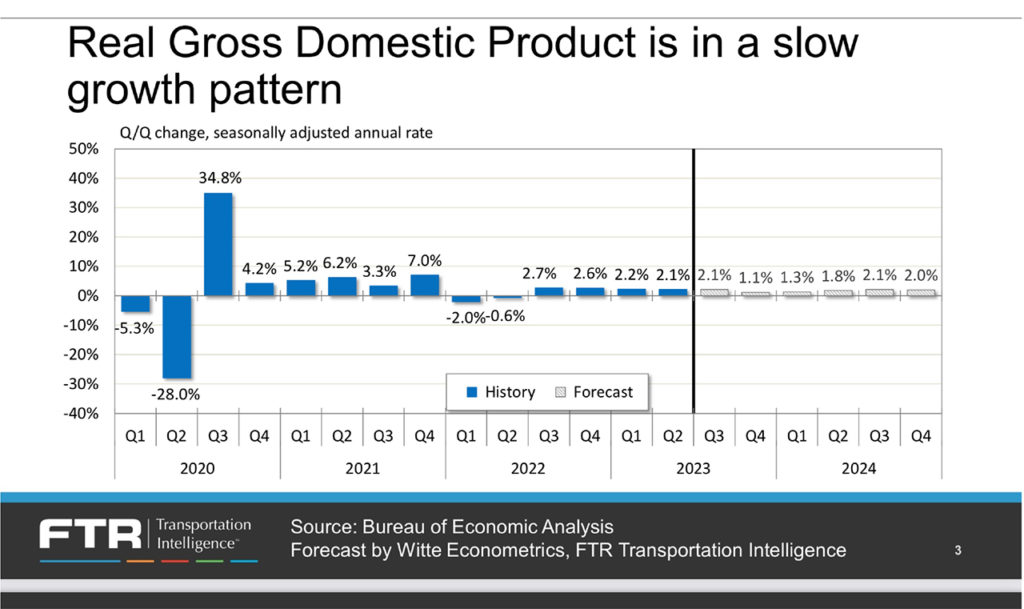

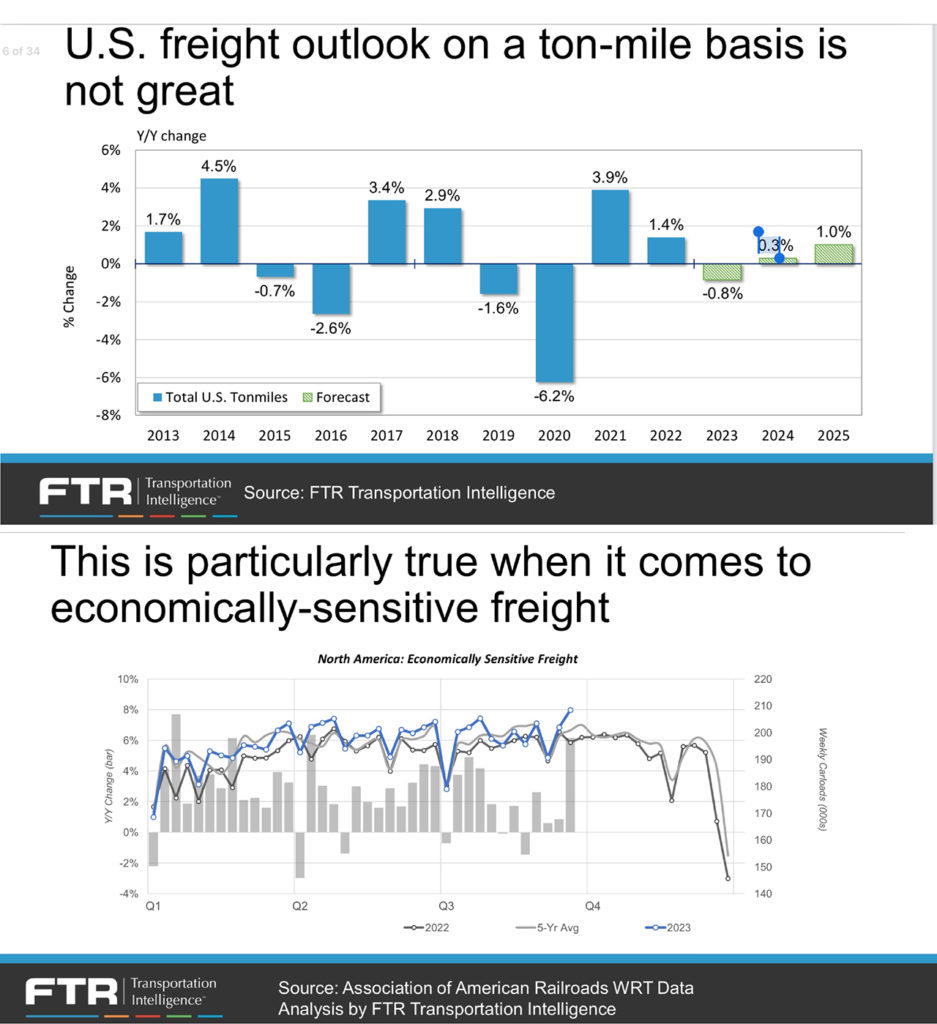

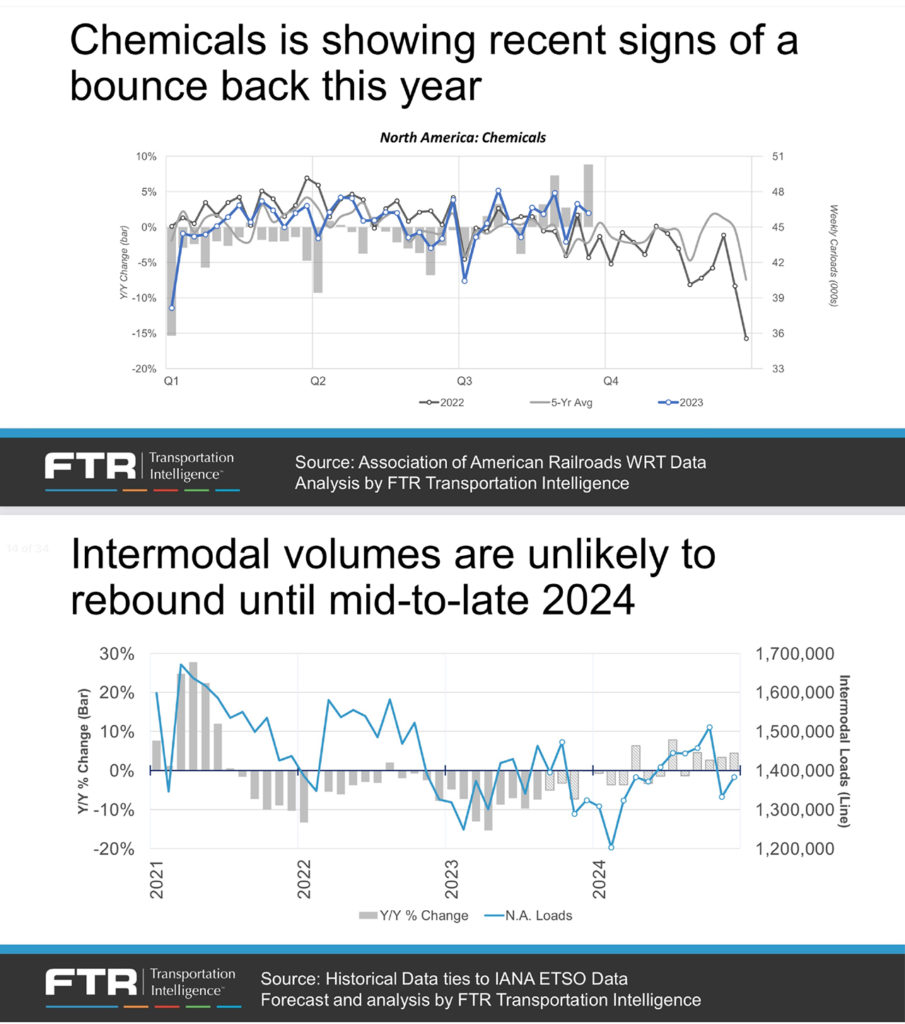

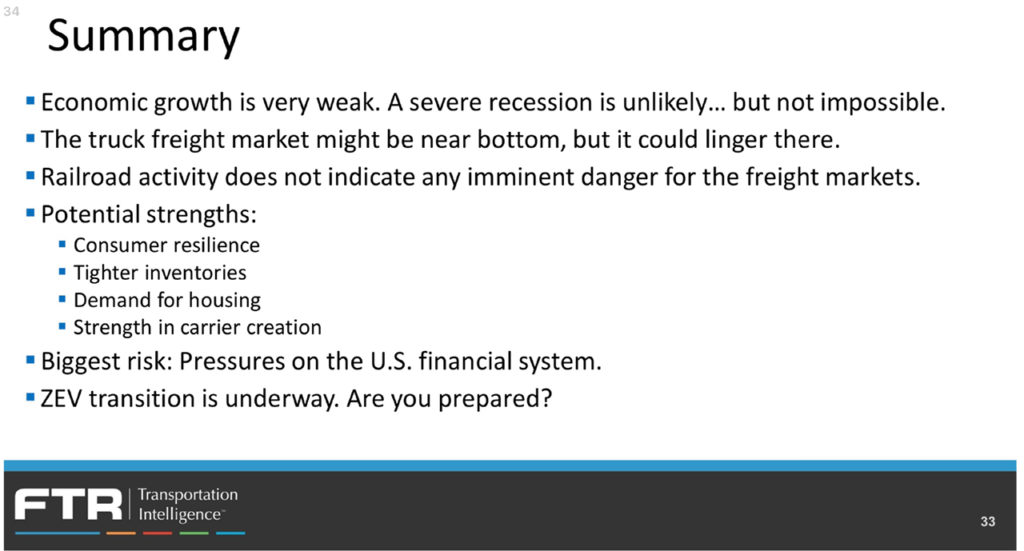

Tranausky outlined several important market views as to rail freight’s competitive positioning:

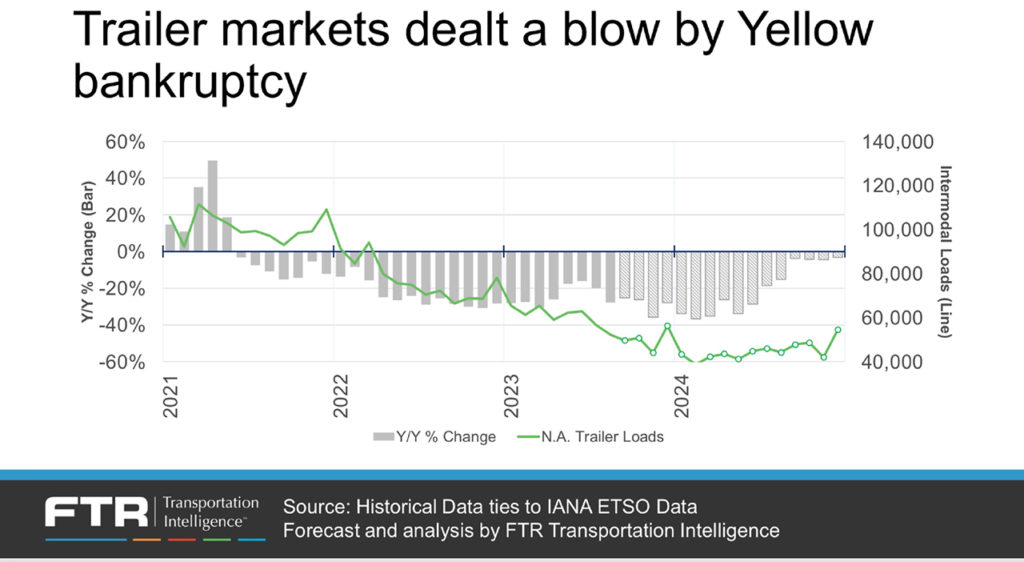

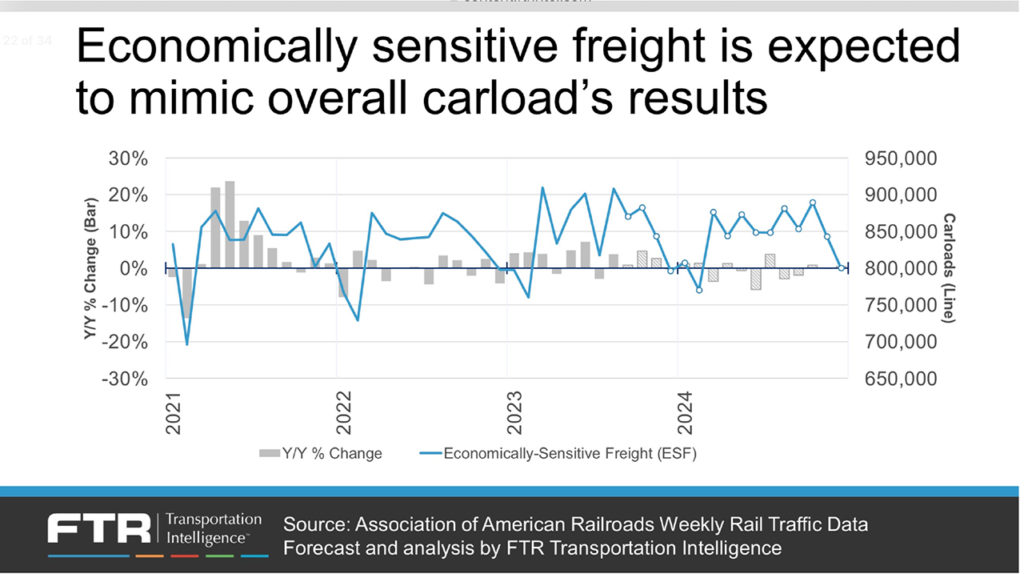

- Rail mixed general cargo traffic volumes are surprisingly good—not fully recovered, but certainly higher than expected. As of third-quarter 2023, they’re performing better than the long-favored intermodal rail sector.

- Economically sensitive industrial production freight is not only doing well as recovery volume, but will also be where the rail industry will likely continue to grow volume plus grow some market share vs. trucking (and barge) during this decade. FTR continues to highlight this statistical evidence.

- Where U.S. geographic industrial production increases, those will be the market regions and railway corridors that will see important railway volume gains. That will in turn impact mixed passenger and freight train competition for daily train paths.

My observations on these FTR graphics about what’s driving rail freight markets will be highlighted in the captions. Thank you to Todd and Scott McCalla for this opportunity to share with our Railway Age audience.

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for close to 50 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)