FTR: Freight Rail Transitioning to Growth in 2024

Written by Jim Blaze, Contributing Editor

BNSF photo

I have not been this optimistic about seeing real chances for future rail market share growth since about 2018. I became pessimistic during 2019, and then progressively more pessimistic with the oncoming pandemic—not about the financial dip for U.S. freight railroads, but about market share growth. Those are, of course, two different measurements of success or failure.

Finally, I’m in the beginning of the plus side view. There are challenges ahead, but with possible solutions at least selectively by market segment and by certain strategic corridors.

FTR Transportation Intelligence freight rail experts recently hosted a seminar as to how they see the year 2024 developing. They are one of about six independent professional groups that I study closely to pick up selective and interesting intelligence about market demand and market supply as a railway guy. I share my views with others such as Railway Age readers.

In particular, I like how FTR looks at key national/international trade indicators and the trucking, industrial and consumer market segments, and then share their measured intel with us by using easy-to-understand graphics. The charts are not overloaded with too much detail—relatively easy to read and comprehend.

Here are a few of my picks as the most outstanding slides to think about after my quick read of FTR’S lengthy slide deck. These are the important subjects that during my railroad career seemed to suggest best what the rail freight commerce trend seemed to be.

My overall takeaway here is a sign of optimism as to how rail freight might now actually be starting its search for a growth shift during 2024 that could indeed capture market share from trucking, certainly within a few commodity sectors as well as in several national rail corridors. It is a good message to consider until Railway Age readers gather next at Rail Equipment Finance 2024 in less than two months.

If true, the shifting supports economic policy and commercial/geopolitical refocusing of bringing home more manufacturing and production out toward 2030—nearshoring.

Following are the slides I picked with a short commentary as to why I’m upbeat as a pragmatically trained rail engineer and economist. I’m upbeat—which is different than my typical contrarian interpretations.

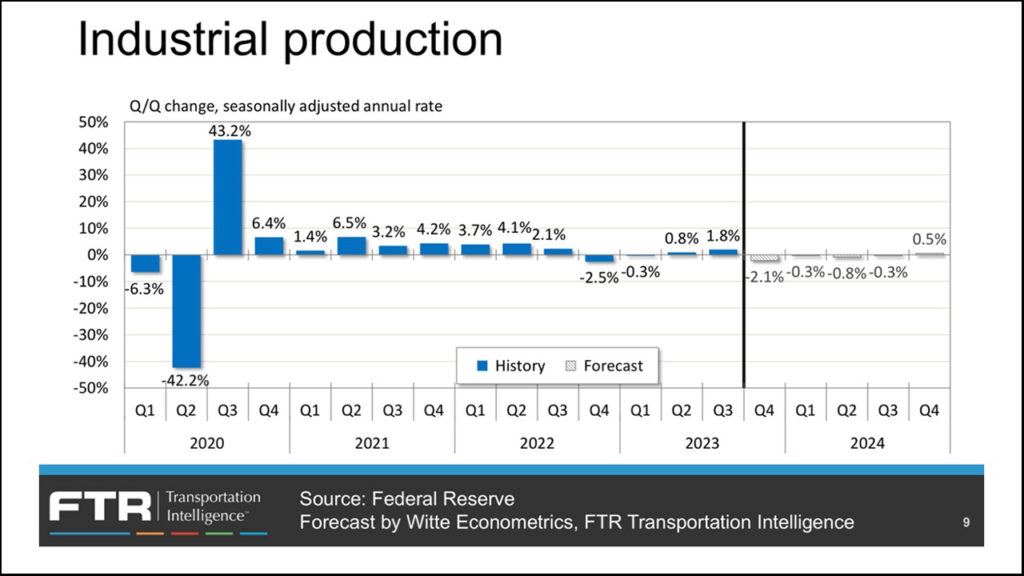

The first key I look for is the Industrial Production trend, because railroads are in the heavy-haul transport movement segment:

FTR’S projection into the four quarters of 2024 seems a bit underwhelming, at maybe a –0.5% rate of growth. That does seem conservative given various infrastructure and mineral and high-tech construction investments under way across the country. Nevertheless, I believe it’s in reasonable range of other forecasters who see a more favorable late into 2024 improvement change ahead. I’ll take that outlook as a positive upward trend out toward 2025 and 2030.

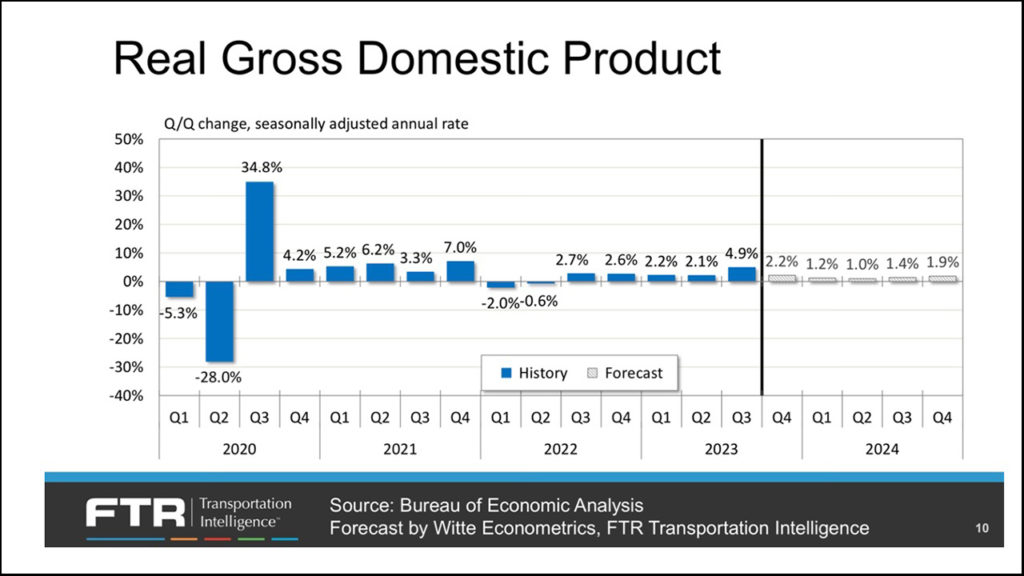

The second important national indicator is FTR’s outlook on GDP. They don’t project a wild or inflationary increase across the estimated 4th quarter 2023 toward 4th quarter 2024:

I interpreted a more-stabilizing pattern in the 1.2% to 1.5% growth range, then shifting toward the 2% range by year-end 2024. That’s reasonable during the Fed’s inflationary control period (using its interest rate power). That sets up 2025 perhaps for a more robust 2.5% or slightly higher run rate as the U.S. tries to onshore industrial and manufacturing production investment to lighten the risks associated with too many distant global logistics. If successful, this should help with generating more rail carload domestic growth out toward 2030.

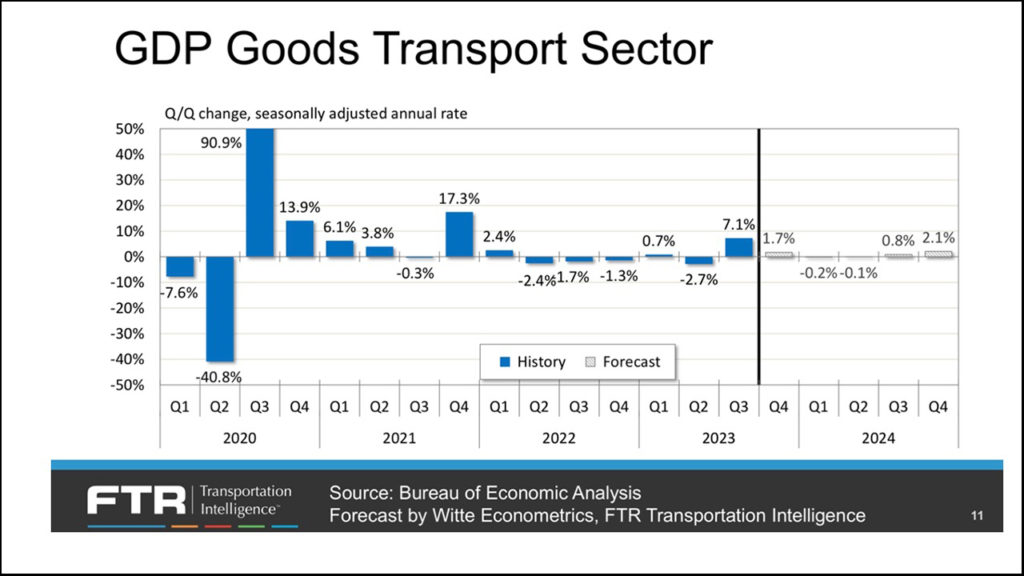

There are some slowdowns ahead into perhaps the third quarter of 2024, even for the goods movement segment of GDP as shown on FTR’s next slide I consider important:

That’s a prudent warning, given the various global conflicts we are witnessing, and the global recession impacts across many nations, including those in Europe and China.

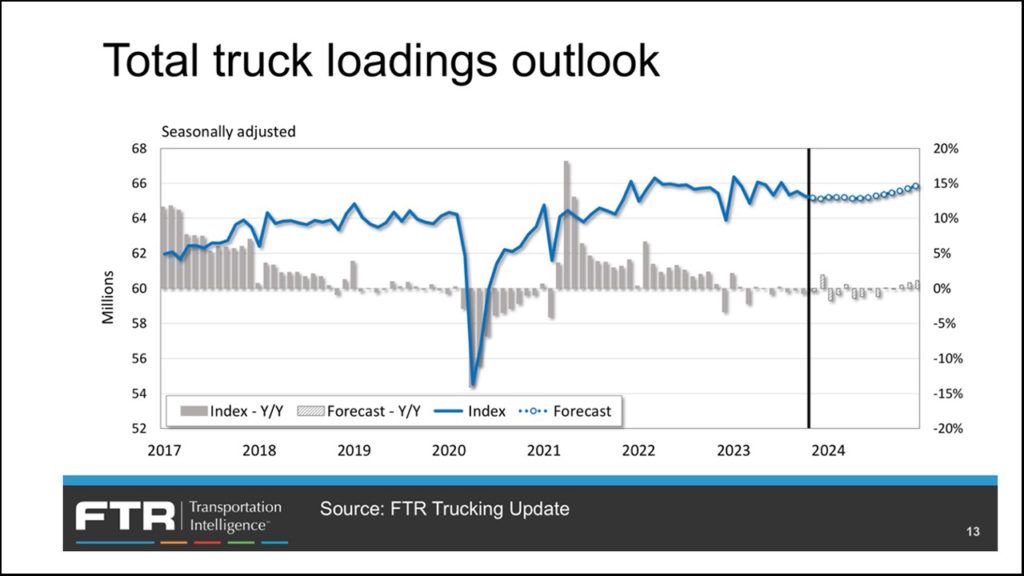

This next slide is a reminder that rail is still chasing the trucking sector:

Trucking is certainly seeing its own market and growth challenges, but it’s not giving up its market share lead. As railroaders, “never take our eyes off the leader.” There’s still lots of trucking capacity out there, and still a lot of truck drivers. Rail freight can’t gain share by hoping to see trucking stumble in those resource areas. Service robustness and reliability improvement by the railroads themselves are the ways to beat trucking. Let’s keep that in mind.

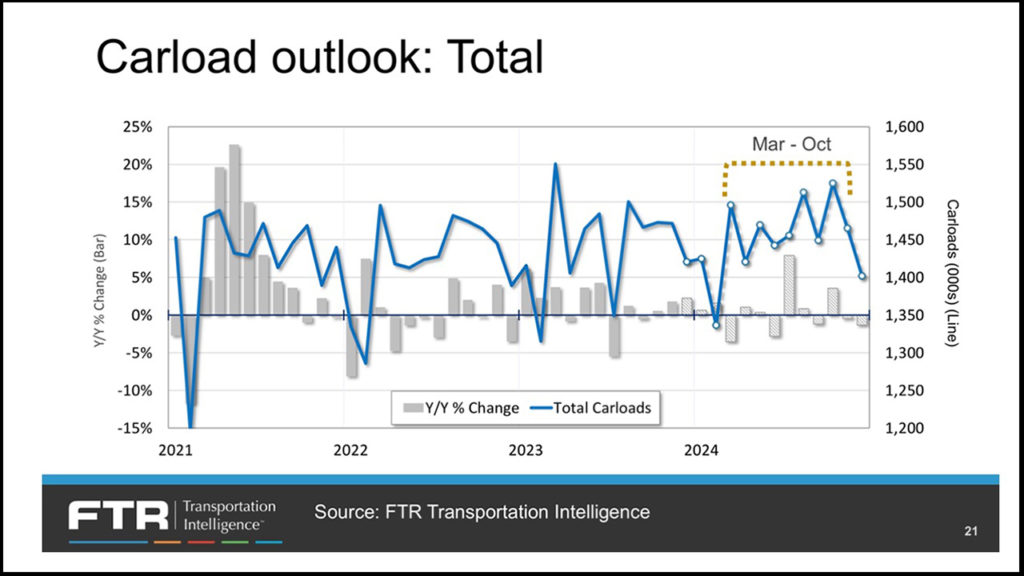

Railway carload traffic volumes ought to significantly increase for specific commodities through 2024. Here’s the carload sector view as seen by FTR’s experts:

Carload traffic is environmentally valuable since it typically involves both first-mile and last-mile steel wheel efficiency instead of truck drayage. FTR seems to be expecting a late spring to mid-autumn 2024 surge in carload traffic by selective commodities as shown in this graph. The performance of all kinds of rail freight is and continues to look to be improving. If that continues, along with improved final delivery on-time percentage, customers should regain their trust in the rail freight supply chain—something the railroads gave away during the pandemic. This FTR slide suggests a recovery, but with some 2024 uncertainty.

It is time for the new rail executives to prove it. From my reviews, at least three of the Class I carriers seem to be aggressively focused upon that execution improvement. Let’s see how this graph changes by, say, September 2024.

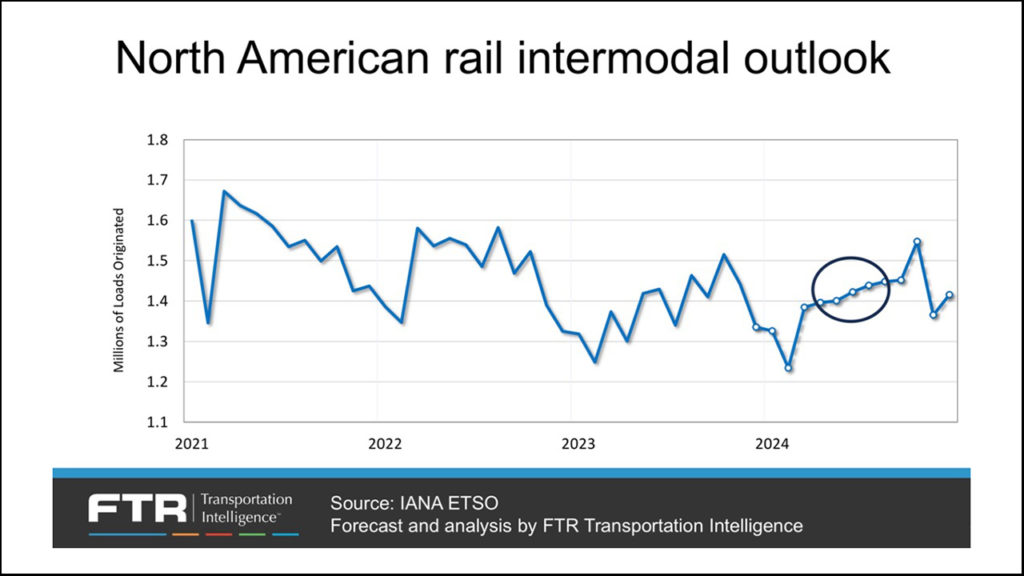

Finally, still critical for taking modal freight share, the Class I railroads need to significantly up their market service “supplied” share of intermodal:

To gain volume share, I’d estimate that the Class I’s need to hit a near-1.8 million target or better on this FTR graph by the late third quarter. Otherwise, they won’t yet prove that intermodal is their real growth segment—an argument they have been making now for about two decades.

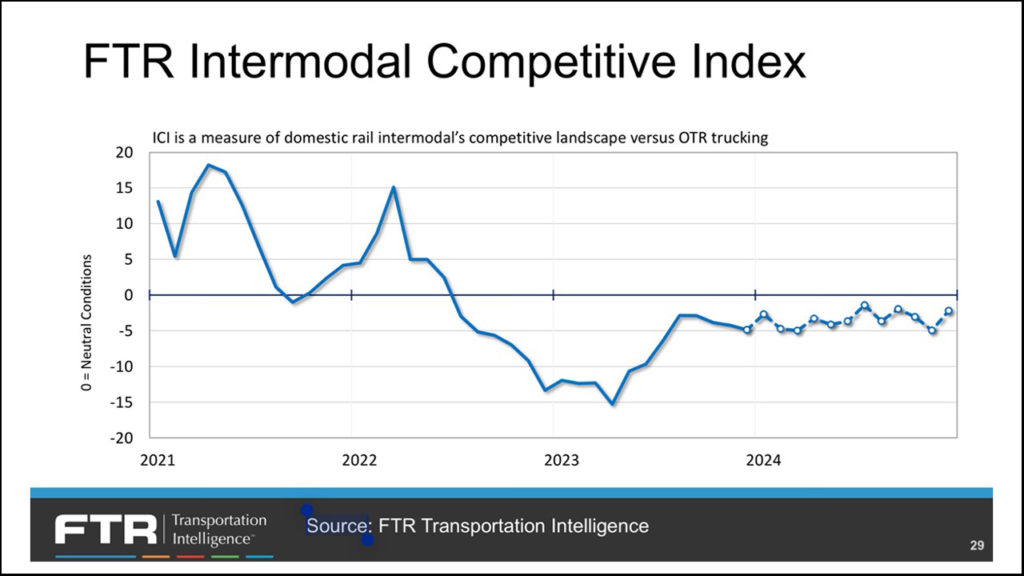

FTR puts that message forward in the next slide. It’s their calculated view as consultants as to the relative competitive index that intermodal service and pricing offers, from a customers viewpoint. Rail intermodal freight needs to get its core up above the FTR suggested “neutral” zone identified on the graph:

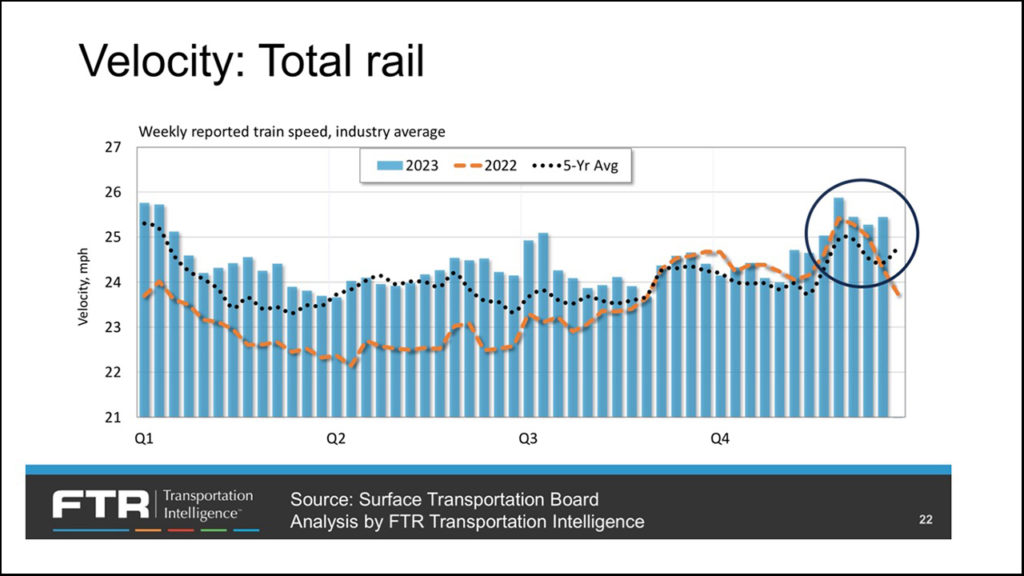

Velocity of the overall rail network is important, but actual service delivered on time above an 85% to 95% range is probably an equally watched measure when compared against competitive trucking. Delivery on-time scores of 85% or less won’t get the mode shift share accomplished:

These are my personal interpretations and not necessarily those of either FTR or Railway Age.

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for close to 50 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)