CN’s Robinson: ‘Our Pivot to Profitable Growth Is Under Way’

Written by Marybeth Luczak, Executive Editor

The CN network “is in great shape”; “we have the right people”; “CN-specific growth initiatives are producing”; and “our pivot to profitable growth is under way,” said Tracy Robinson, CN President and CEO and Railway Age’s 2024 Railroader of the Year.

“Through 2023, our team of dedicated railroaders leveraged our scheduled operating model to deliver exceptional service for our customers and remained resilient in the face of numerous external challenges,” said Tracy Robinson, President and CEO of CN, the first of the six Class I railroads to issue fourth-quarter and full-year 2023 financial results. “While economic uncertainty persists, we have the momentum to deliver sustainable profitable growth in 2024.”

4Q23 Financial Performance

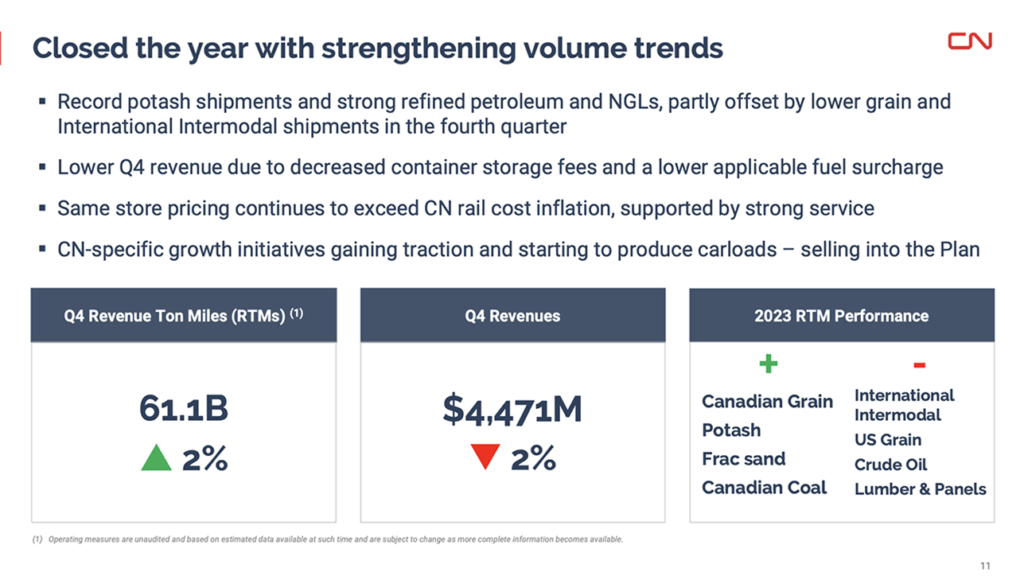

Fourth-quarter 2023 revenues came in at C$4.471 billion, down 2% or C$71 million from the same quarter in 2022 (C$4.542 billion), according to CN’s financial report released Jan. 23. The railroad said the decrease was “mainly due to lower shipments of intermodal and grain, as well as lower container storage fees and lower fuel surcharge revenues as a result of lower fuel prices; partly offset by freight rate increases and higher shipments of potash, natural gas liquids, and refined petroleum products.”

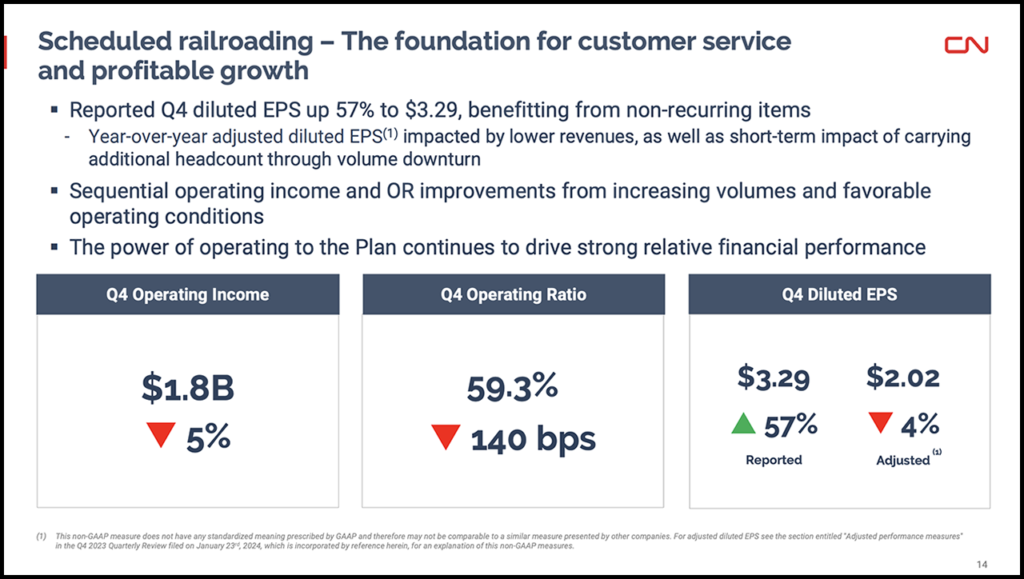

Operating income for the quarter was C$1.818 billion, down 5% or C$94 million from the prior-year period’s C$1.912 billion.

For the three-months ended Dec. 31, 2023, CN’s operating ratio was 59.3%, up 1.4 points from the same period in 2022.

Among other four-quarter 2023 highlights:

- CN reported net income of C$2.130 billion, a 50% increase or C$710 million over fourth-quarter 2022’s C$1.420 billion. Adjusted net income was C$1.305 million, down 8% or C$115 million.

- Diluted EPS came in at C$3.29, an increase of 57%; adjusted, it was C$2.02, a decrease of 4%. The railroad said year-over-year adjusted diluted EPS was “impacted by lower revenues, as well as short-term impact of carrying additional headcount through volume downturn.”

- Operating expenses for the quarter rose 1% to C$2.653 billion, when compared with the same period in 2022. CN said the increase was “mainly due to higher labor and fringe benefits expense mainly driven by general wage increases and higher average headcount and higher personal injury and legal claim provisions; partly offset by lower fuel prices.”

2023 Financial Performance

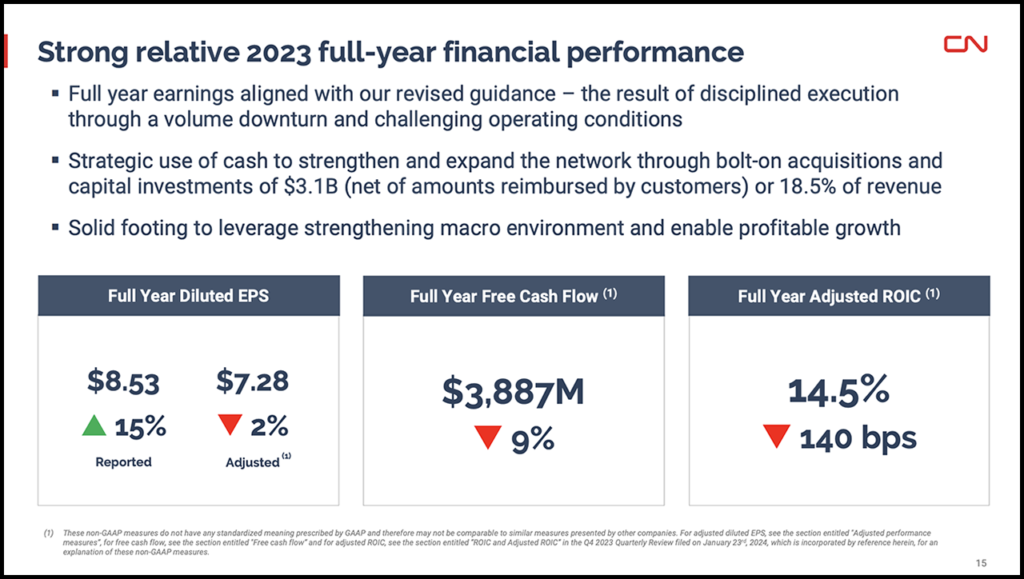

CN revenues for the year came in at C$16.828 billion, down 2% or C$279 million from 2022’s C$17.107 billion. This decrease, the Class I said, “was mainly attributable to lower shipments of intermodal, crude oil, U.S. grain and forest products, as well as lower container storage fees and lower fuel surcharge revenues as a result of lower fuel prices; partly offset by freight rate increases, higher Canadian grain export shipments, and higher shipments of potash and the positive translation impact of a weaker Canadian dollar.”

Operating income of C$6.597 billion was a decrease of 4% or C$243 million compared with 2022’s C$6.840 billion.

The 2023 operating ratio of 60.8% was up 0.8 points, or an increase of 0.9 points on an adjusted basis compared with 2022.

Among other full-year 2023 highlights:

- Net income of C$5.625 billion was up 10% or C$507 million from 2022’s C$5.118 billion. Adjusted net income of C$4.800 billion was down 7% or C$334 million.

- Diluted EPS came in at C$8.53, an increase of 15% from 2022; adjusted diluted EPS was C$7.28, a decrease of 2%.

- CN reported that operating expenses of C$10.231 billion were flat with 2022, “mainly due to lower fuel prices; offset by the negative translation impact of a weaker Canadian dollar and higher labor and fringe benefits expense mainly driven by general wage increases and higher average headcount.”

- CN said that return on invested capital (ROIC) was 16.8%, an increase of 1.0 point; adjusted ROIC was 14.5%, a decrease of 1.4 points.

4Q23 Operating Performance

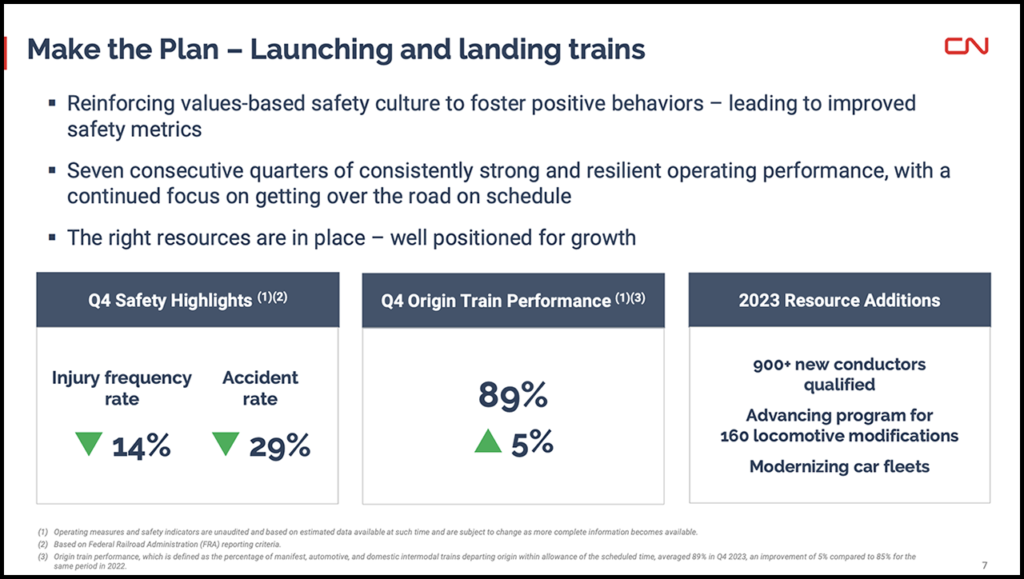

According to CN, operating performance improved across most measures in the fourth quarter of 2023 when compared to the same period in 2022:

- Injury frequency rate was at a “record low” of 0.79 (per 200,000 person hours), an improvement of 14%.

- Accident rate of 1.51 (per million train miles) was an improvement of 29%.

- Fuel efficiency of 0.874 (U.S. gallons of locomotive fuel consumed per 1,000 gross ton miles [GTMs]) was an improvement of 1%.

- Through dwell of 6.9 (entire railroad, hours) was an improvement of 4%.

- Car velocity of 215 (car miles per day) was an improvement of 4%.

- Through network train speed (mph) of 19.6 remained flat.

- Train length of 7,951 (in feet) was up 1%.

- Revenue ton miles (RTMs) of 61,136 (millions) was up 2%.

2023 Operating Performance

CN attributed improvements in car velocity, train speed and through dwell in 2023 over 2022 to its “continued focus on scheduled railroading in 2023, helped by more favorable winter operating conditions partly offset by operational disruptions related to Canadian wildfires and the Canadian West Coast dock workers strike.” It posted the following results:

- Injury frequency rate at a “record low” of 0.96 (per 200,000 person hours), an improvement of 13%.

- Accident rate of 1.74 (per million train miles), an improvement of 17%.

- Through dwell of 7.0 (entire railroad, hours), an improvement of 8%.

- Car velocity of 213 (car miles per day), an improvement of 9%.

- Through network train speed of 19.8 (mph), an improvement of 5%.

- Fuel efficiency of 0.874 (U.S. gallons of locomotive fuel consumed per 1,000 GTMs), less efficient by 1%.

- Train length of 7,891 (in feet), down 3%.

- Revenue ton miles (RTMs) of 232,614 (millions), down 1%.

2024 Financial Outlook

CN reported that in 2024 it expects to deliver diluted adjusted EPS growth of approximately 10% over 2023 “in the context of a slightly positive economic environment,” and to invest approximately C$3.5 billion in its capital program, net of amounts reimbursed by customers, which is “in line with [the] Investor Day outlook.” It also anticipates return on invested capital to be within the targeted range of 15%-17%.

“CN reiterates its longer-term financial perspective and continues to target compounded annual diluted EPS growth in the range of 10%-15% over the 2024-2026 period driven by growing volumes more than the economy, pricing above rail inflation and incrementally improving efficiency, all of which assumes a supportive economy,” the railroad said.

The CN network “is in great shape”; “we have the right people”; “CN-specific growth initiatives are producing”; and “our pivot to profitable growth is under way,” summed Robinson, Railway Age’s 2024 Railroader of the Year, who will be a featured speaker at the Railway Age Next-Gen Freight Rail 2024 conference, to be held March 12 in Chicago.