BNSF Closes 2022 With Earnings Flat, Volume Down From 2021

Written by Marybeth Luczak, Executive Editor

(BNSF Photograph)

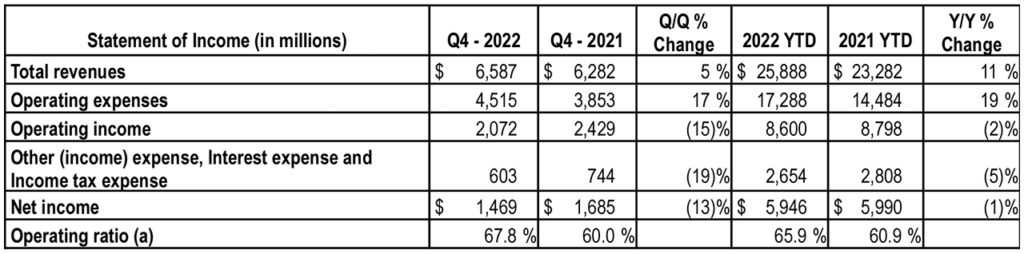

BNSF posted net earnings of $5.946 billion in 2022, virtually flat with 2021’s $5.990 billion, reflecting “higher revenue per car/unit, substantially offset by lower overall freight volumes and higher fuel and other operating costs,” reported parent company Berkshire Hathaway Inc. on Feb. 25. This follows 2021’s net earnings’ increase of 16.1% over 2020.

Net earnings for fourth-quarter 2022 were $1.469 billion, down 13% from fourth-quarter 2021’s $1.685 billion.

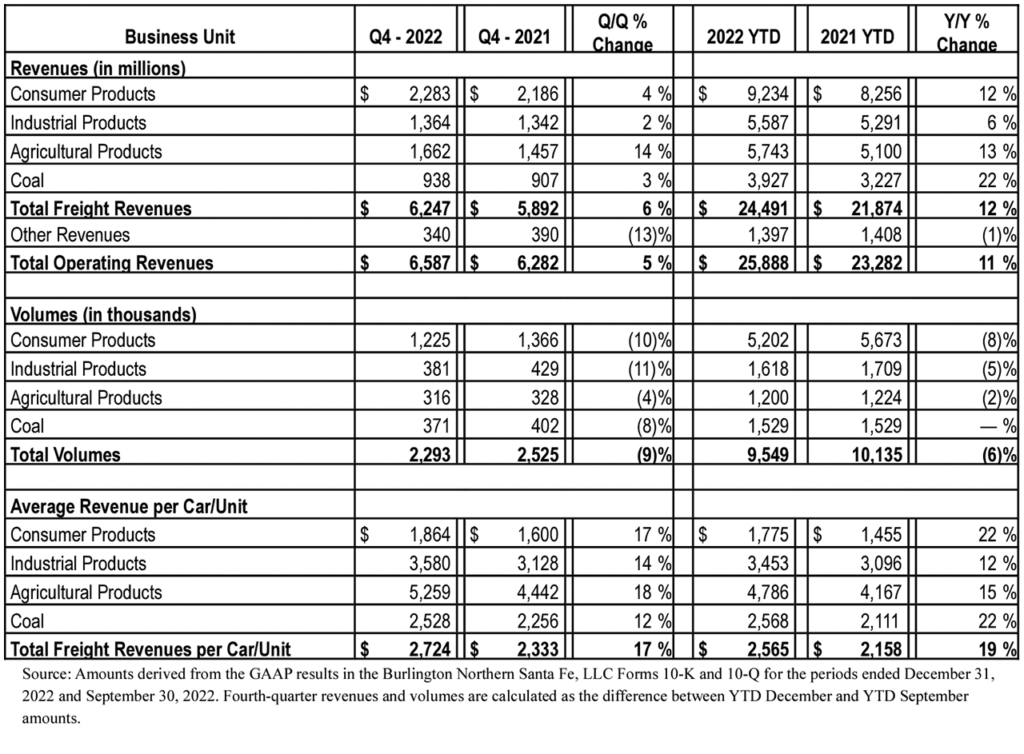

Total volume was 2.293 million cars/units for the fourth quarter, down 9% from the year-ago period, and 9.549 million cars/units for 2022, down 6% from 2021.

BNSF reported its fourth-quarter and full-year 2022 financial results on its website on Feb. 27. Operating income for the three months ending Dec. 31, 2022, came in at $2.1 billion, down 15% (or $357 million) over the prior-year period; for full-year 2022, it was $8.6 billion, down 2% (or $198 million) over 2021. Operating ratios were 67.8% for fourth-quarter and 65.9% for full-year 2022, increases of 7.8% and 5.0%, respectively, compared with the same periods in 2021.

Total revenues for fourth-quarter ($6.587 billion) and full-year ($25.888 billion) 2022 rose 5% and 11%, respectively, compared with the prior-year periods. The growth was “primarily due to an increase in average revenue per car/unit of 17% in the fourth quarter and 19% for full-year 2022 resulting from higher fuel surcharge revenue driven by higher fuel prices, partially offset by lower volumes of 9% in the fourth quarter and 6% for full year 2022,” BNSF reported. The Class I railroad said revenue changes also resulted from the following:

- Consumer Products volumes falling 10% for fourth-quarter and 8% for full-year 2022 from the corresponding 2021 periods. BNSF said this was “primarily due to lower intermodal shipments resulting from supply chain challenges and lower west coast imports during the second half of the year.”

- Industrial Products volumes dropping 11% and 5% for fourth-quarter and full-year 2022, respectively, vs. the 2021 periods. “The full year decrease was primarily due to a decrease in petroleum related to lower demand for shipments of crude by rail, lower building products shipments due to lower wind volumes, and lower steel and taconite shipments due to network rail challenges, partially offset by increased mineral shipments,” reported the Class I railroad, which attributed the fourth-quarter decline to primarily “lower chemical shipments and lower steel and taconite shipments due to network rail challenges.”

- Agricultural Products volumes decreasing 4% for fourth-quarter and 2% for full-year 2022, compared with 2021. These changes reflect, primarily, “lower grain exports and fertilizer shipments, partially offset by higher volumes of domestic grains, renewable diesel, and feedstocks,” according to BNSF.

- Coal volumes declining 8% for fourth-quarter 2022 and remaining relatively unchanged for full-year 2022, vs. the same periods in 2021. The railroad noted that the volume decrease in the fourth quarter “was primarily due to network service challenges.”

For the year ending Dec. 31, 2022, 38% of freight revenues were derived from consumer products ($9.307 billion), 23% from industrial products ($5.633 billion), 23% from agricultural products ($5.633 billion) and 16% from coal ($3.919 billion), according to Berkshire Hathaway.

Operating expenses for fourth-quarter and full-year 2022 were up 17% and 19%, respectively, from the 2021 periods. This “reflected significant increases in the cost of fuel, as well as higher compensation and benefits expenses,” BNSF reported.

Fuel expense increased 43% and 66% in fourth-quarter and full-year 2022, respectively, compared with the same periods in 2021. The changes were “primarily due to higher average fuel price, partially offset by lower volumes,” according to the railroad, which noted that locomotive fuel price per gallon rose 48% in fourth-quarter and 69% in full-year 2022, vs. 2021.

Compensation and benefits expense went up 9% and 12% in fourth-quarter and full-year 2022, respectively, vs. 2021. BNSF said this was primarily driven by “wage inflation, including the impact from the ratified union labor agreements, higher health and welfare costs, and lower productivity due to supply chain challenges.”

The materials and other expense grew 42% and 31% in fourth-quarter and full-year 2022, respectively, from 2021. The full year increase “was primarily due to general inflation, lower gains from land and easement sales, and higher casualty and litigation costs, while the fourth quarter increase was primarily due to general inflation and litigation costs,” according to BNSF.

CAPEX

BNSF’s 2022 capital expenses came in at $3.67 billion. In 2023, they are expected to reach $3.96 billion, according to the railroad, which noted that its plan is focused on projects devoted to maintaining the core network and related assets. The maintenance and replacement component is anticipated to be $2.85 billion, primarily covering nearly 14,000 miles of track surfacing and/or undercutting work, replacement of 346 miles of rail and approximately 2.8 million rail ties, and rolling stock maintenance.

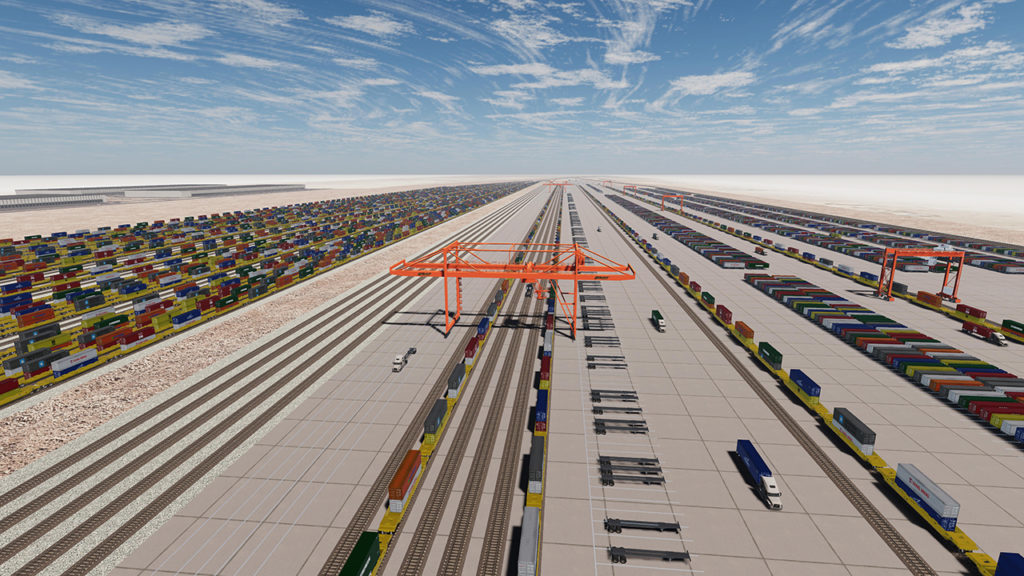

Some $709 million of the capital plan will be for expansion and efficiency projects, which BNSF said will support growth of its Intermodal and Automotive, Agricultural, and Industrial Products customers. On its Southern Transcon route between the West Coast and Midwest, the railroad “will support traffic growth by beginning the construction of a second bridge over the Missouri River at Sibley, Mo., completing double track for one of the last segments of single track along the Southern Transcon.” The plan continues projects that add several segments of new track in Eastern Kansas and Southern California, BNSF reported. The Class I will also begin a multi-year terminal and fueling project near Belen, N.M. All four of these projects, it said, will increase capacity throughout the corridor.

Additionally, in the South, BNSF will complete a second main track expansion in Fort Worth; in the Pacific Northwest, it will start a multi-year project to add double track near Spokane, Wash., including over the Spokane River and by constructing a siding near Pasco, Wash.; and will continue multi-year intermodal facility expansion projects in Chicago (Cicero) and Stockton, Calif. Finally, in California, BNSF will continue its track efficiency improvement projects in San Bernardino, along with property acquisitions in the Barstow area, which it said will enable “future rail facility and infrastructure development for the Barstow International Gateway Project.”

The capital plan also includes approximately $402 million for equipment acquisitions, according to BNSF.

In related developments, BNSF on Feb. 23 reported reaching agreements with the Transportation Communications Union (TCU) and the National Conference of Firemen and Oilers (NCFO) for paid sick leave.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)