GATX Modifies Lease Price Index Calculation

Written by Marybeth Luczak, Executive Editor

GATX will report its Lease Price Index (LPI) based on a modified methodology beginning with second-quarter 2023. Weighing in on the move: David Nahass, Railway Age Financial Editor, and Matt Elkott, TD Cowen Transportation OEM Analyst and Vice President Equity Research.

The modified methodology for GATX’s LPI calculation, accompanied by historical data dating back to the LPI’s 2008 debut, “is intended to provide investors and other constituents with a more complete representation of lease-rate and lease-term performance on renewals across GATX’s North American railcar fleet,” the Chicago-based railcar lessor said July 6.

GATX described the LPI as “an internally generated business indicator that measures renewal activity for GATX’s North American railcar fleet, excluding boxcars. The average renewal lease rate change is reported as the percentage change between the average renewal lease rate and the average expiring lease rate. The average renewal lease term is reported in months and reflects the average renewal lease term in the LPI.”

GATX explained that under the previous methodology, the LPI calculation included a subset of the renewal activity during the reported quarter that was judged to be representative of its North American non-boxcar fleet, and those renewals were weighted by fleet composition. “This methodology resulted in the exclusion of certain renewal transactions from the calculation,” the company pointed out. “Since the introduction of the LPI in 2008, GATX’s North American railcar fleet has continually become more diversified, which warrants reporting the LPI in terms of the entire non-boxcar fleet, rather than a subset.”

The modified methodology, it said, “aims to more consistently reflect actual trends in renewal lease rates and renewal lease terms across GATX’s North American non-boxcar fleet. Under the modified methodology, the LPI calculation will include all renewal activity based on a 12-month trailing average, and the renewals will be weighted by the count of all renewals during the reported period.”

GATX said it would retire the previous methodology starting with second-quarter 2023. The lessor is scheduled to report its second-quarter 2023 financial results on July 25.

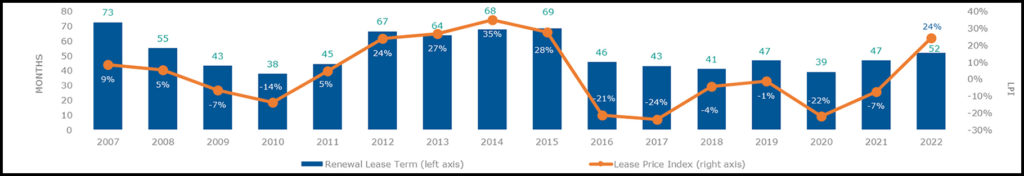

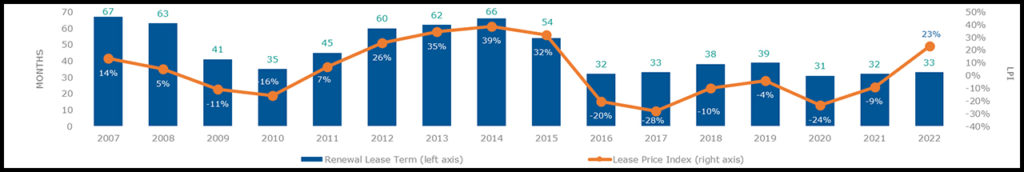

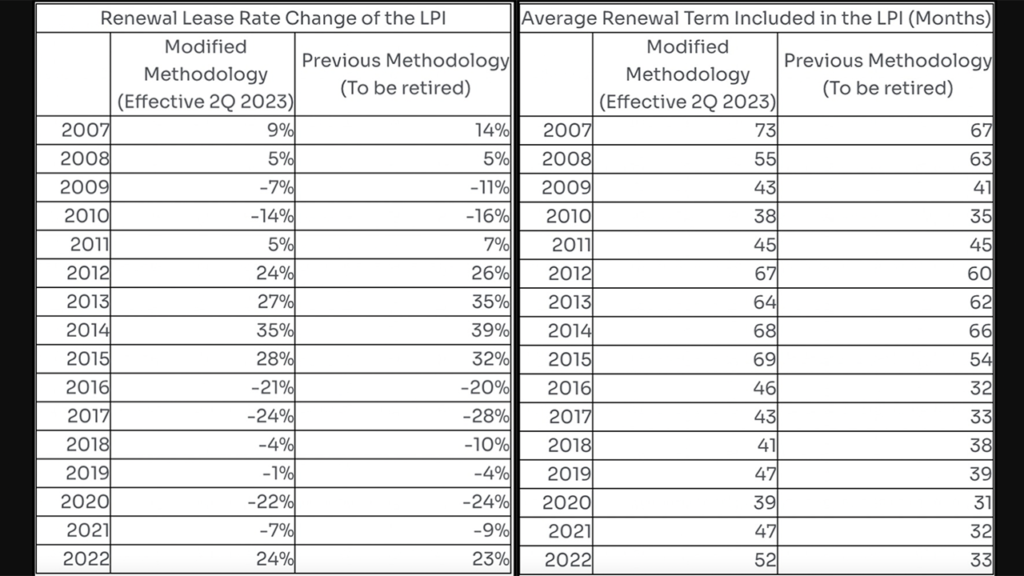

Annual historical LPI data on a comparable basis is provided in the GATX charts and tables below:

Nahass, Elkott Offer Insight

“The expansion of GATX’s LPI to include the entire non-boxcar fleet provides greater transparency into lease rate and lease term adjustments to the overall North American fleet rather than predominantly to tank cars,” Railway Age Financial Editor David Nahass commented. “Interestingly, when comparing the annual totals and the averages since the LPI has been put in place, the only meaningful difference is in the averages of the lease term length calculations (approximately 15% between the two calculations). While the 15% delta in lease term may seem statistically meaningful, it is relatively immaterial over the 50-year interchange life of a rail/tank car.

“The similarity between the two data sets seems reflective of the GATX sentiment and decision to adjust the LPI to be a more accurate reflection of the total GATX non-boxcar fleet. The greater inclusivity is a positive for parties that having been using the LPI as a barometer of the health of the railcar leasing marketplace.”

Matt Elkott, TD Cowen Transportation OEM Analyst and Vice President Equity Research, told Railway Age: “The previous methodology for calculating the LPI and average renewal term may have been helpful for gauging business conditions over a long period of time, but the weighting by fleet composition often created quirkiness that obfuscated what’s happening on the ground in any given period. The new methodology appears to convey a clearer, fuller and more consistent representation of leasing conditions. For example, the 2022 average renewal term of 52 months is a much better reflection of the ongoing lease rate strength than the 33 months reported under the previous methodology.

“Some may be concerned that, with the industry’s ongoing lease rate recovery having started 2.5 years ago, further upside is limited. But given tempered industry builds—both in the current cycle and structural right-sizing—conventional cycle math may not necessarily apply, and lessors like GATX could get more from the current recovery.”