‘Continued Improvement’ Expected in 2024, Trinity’s Savage Says

Written by Marybeth Luczak, Executive Editor![“We are introducing 2024 EPS annual guidance of $1.30 to $1.50, which reflects improving margins in both our segments [Rail Products Group and Railcar Leasing and Management Services Group],” Trinity Industries President and CEO Jean Savage said on Feb. 22.](https://www.railwayage.com/wp-content/uploads/2024/02/Caterpillar_E_Jean_Savage.jpg)

“We are introducing 2024 EPS annual guidance of $1.30 to $1.50, which reflects improving margins in both our segments [Rail Products Group and Railcar Leasing and Management Services Group],” Trinity Industries President and CEO Jean Savage said on Feb. 22.

Trinity Industries’ closed out 2023 with revenue up 51% over 2022 and a backlog of $3.2 billion, President and CEO Jean Savage said during an Feb. 22 financial report. Rising leasing rates drove Railcar Leasing and Management Services Group revenue up 13% year-over-year, and despite challenges in the fourth quarter with the border closure and related congestion impacting deliveries in the Rail Products Group, as well as “unexpected headwinds through the year,” that segment reported operating profit up 119% over 2022, she added.

“In 2024, we expect to see continued improvement in our business,” Savage reported.

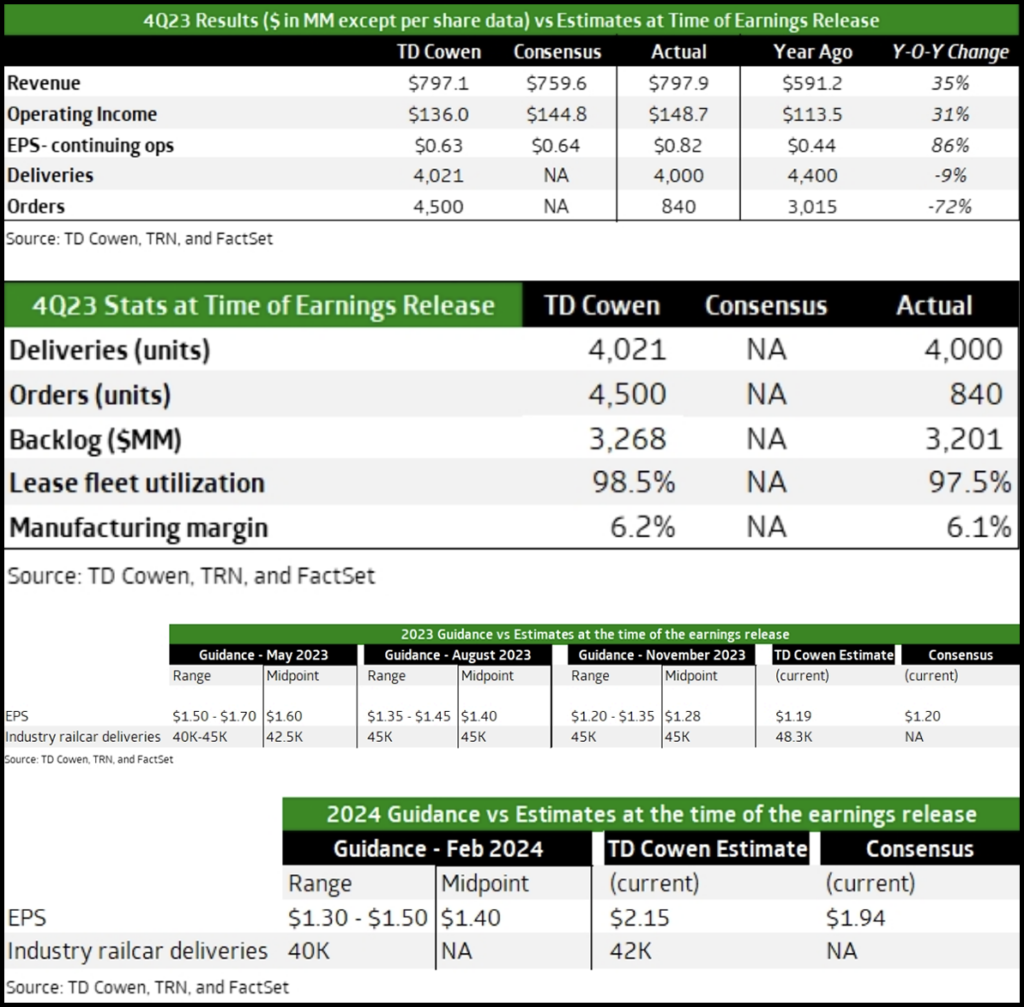

Trinity reported total company revenue of $797.9 million for the three months ending Dec. 31, 2023, up 35% from the prior-year period’s $591.2 million. It attributed this to “higher external deliveries and favorable pricing in the Rail Products Group.” Additionally, quarterly income from continuing operations per common diluted share (EPS) came in at $0.81; adjusted it was $0.82. The company noted that its results include “tax benefits related to state apportionment and tax law changes.”

Operating profit for fourth-quarter 2023 was $148.7 million, up 31% from fourth-quarter 2022’s $113.5 million, reflecting “higher external deliveries in the Rail Products Group, partially offset by lower lease portfolio sales volume,” Trinity reported.

Rail Products Group revenue came in at $674.0 million in fourth-quarter 2023, rising 3% from $655.7 million in 2022. The company said this reflects “favorable pricing, partially offset by lower deliveries.” In the three months ending Dec. 23, 2023, the Group delivered 4,000 railcars; received orders for 840 railcars, valued at $156.1 million; and had a backlog value of $3.2 billion. This compares with fourth-quarter 2022’s 4,500 railcars delivered; 3,015 railcars ordered, valued at $350.8 million; and a backlog value of $3.9 billion.

For the Railcar Leasing and Management Services Group, revenue was $221.6 million in fourth-quarter 2023, up 12% from the prior-year period’s $197.4 million. The company attributed this to “improved lease rates and net additions to the lease fleet, as well as acquisition-related revenues included in the current year period.” Lease fleet utilization came in at 97.5% vs. fourth-quarter 2022’s 97.9%. The Future Lease Rate Differential (FLRD) was positive 23.7% at the end of fourth-quarter 2023 vs. positive 25.1% for the prior-year period.

Following are highlights of Trinity’s full-year 2023 financial and operational results:

- Total company revenue came in at $3.0 billion.

- EPS was $1.43. Adjusted EPS was $1.38, up 47% year-over-year.

- Cash flow from continuing operations and adjusted free cash flow after investments and dividends (Adjusted Free Cash Flow) were $309 million and $29 million, respectively.

- Railcar deliveries came in at 17,355 and new railcar orders were 11,500.

2024 Guidance

Looking ahead, Trinity reported that it expects industry deliveries of approximately 40,000 railcars in 2024. Additionally, this year, it would have a net investment in the lease fleet of $300 million to $400 million; manufacturing capital expenditures of $50 million to $60 million; and EPS of $1.30 to $1.50, “exclud[ing] items outside of our core business operations.”

“We are introducing 2024 EPS annual guidance of $1.30 to $1.50, which reflects improving margins in both our segments,” Jean Savage said. “This is offset by significantly lower planned railcar sales, higher elimination of profit from intercompany railcar sales, and a normalized tax provision as compared to 2023.

“We view ourselves as a leasing company that is enabled by our manufacturing and services businesses. As a result, we are re-aligning our segments starting in 2024 and moving our maintenance business into the Railcar Leasing and Services segment. This allows us to better leverage our maintenance capabilities to support lease fleet optimization and growth in our services business.”

The TD Cowen Insight

“Adjusted fourth-quarter EPS was a beat aided partly by a tax benefit,” TD Cowen Freight Transportation Equipment Analyst Matt Elkott reported Feb. 22. “Orders were light. Manufacturing margin was 6.1%, just 10 bps lower than our forecast. FLRD remained strong at 23.7% vs. 26.6% third-quarter 2023; utilization 97.5% vs. 98.1% in third-quarter 2023. Guidance $1.30-$1.50 vs. our estimate of $2.15 and consensus $1.94. Deliveries unfavorably impacted by 1.3K units by border closure/congestion. Shares should see pressure.”