ITS Logistics Issues November Port/Rail Ramp Index

Written by Marybeth Luczak, Executive Editor

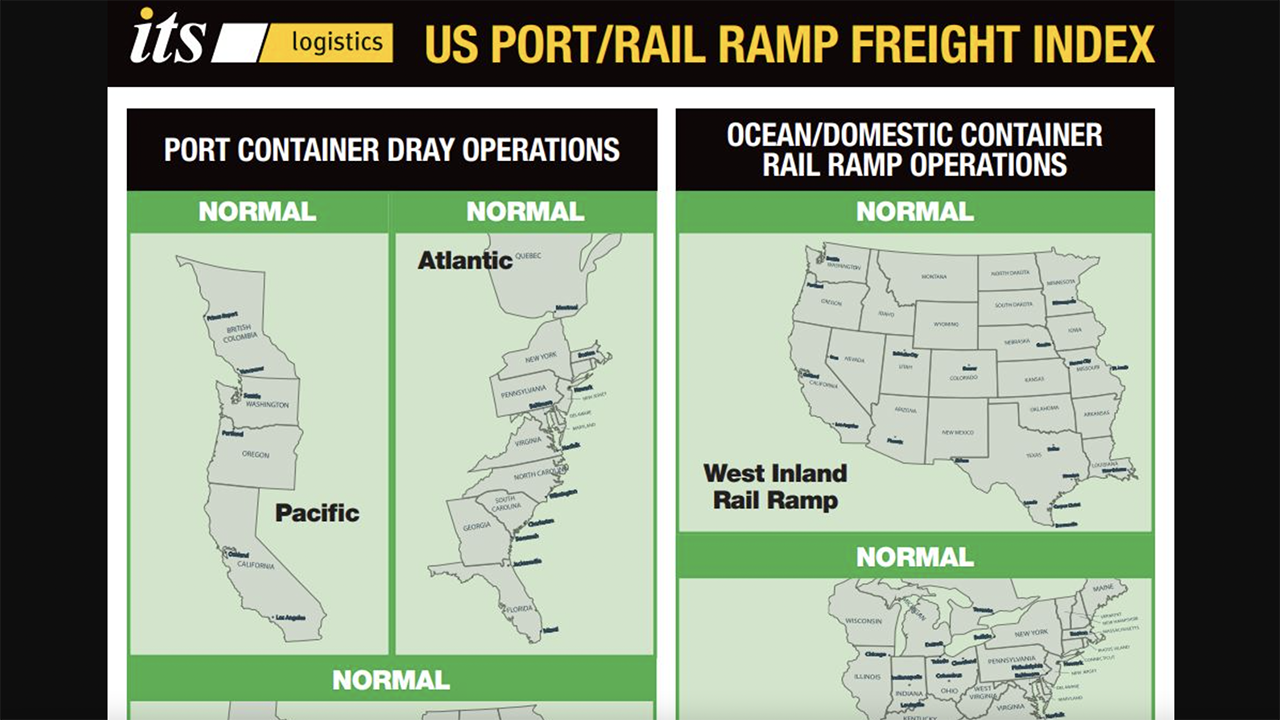

ITS Logistics U.S. Port/Rail Ramp Freight Index for November 2023. (Image Courtesy of ITS Logistics)

The November forecast for the ITS Logistics U.S. Port/Rail Ramp Freight Index shows that all modes across all regions are at normal operations, but shippers and carriers should continue to closely follow “the choke points at the Suez and Panama canals as water conditions worsen and the current conflict between Israel and Gaza,” the Nevada-based third-party logistics (3PL) firm reported Nov. 13.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic and Gulf regions, according to the 3PL firm, which provides drayage and intermodal services in 22 coastal ports and 30 rail ramps throughout North America. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions.

“While there are no adverse effects yet, water levels in the Panama Canal are limiting the amount of cargo that can be transported on ocean vessels,” ITS Logistics Vice President of Drayage and Intermodal Paul Brashier said. “Geopolitical unrest in the Middle East also has the potential to affect vessel flow through the Suez Canal. The Panama Canal is responsible for moving over 40% of all U.S. container traffic, which equates to approximately $270 billion in cargo.”

According to ITS Logistics, the Panama Canal Authority was expected this month to implement additional vessel reductions “with the sole goal of conserving water as levels are still being impacted by a severe El Niño weather system. As a result of the drought, the Panama Canal authorities need to reduce the number of daily transits from 29 to 25 ships in the coming weeks. A decrease in vessels will continue to occur until transit is reduced to 18 ships per day in February. Popular to East Coast trade due to being a faster route, the reduction to 18 ships will represent between 40%-50% of full capacity.”

Brashier reported that the “supply chain disruption is taking place while a significant freight recession is occurring, which has impacted companies such as Convoy and Yellow.” With many trucking companies now executing at rates “under their operations cost,” he said, “there will likely be an escalation of providers that exit the market. Trucking capacity is at risk due to high fuel costs, low rates from shippers, high capital access costs, and government mandates. Safety and service level declines will be the first indicators that a trucking provider is struggling. Industry professionals should prioritize vetting their selected partners’ fiscal health as we head into the new year.”

ITS Logistics is advising industry leaders “to take the opportunity to transition from reactive measures to proactive supply chain planning by collaborating with supply chain partners to reconfigure networks and implement lessons learned from the past five years.” It reported that the supply chain is expected to stabilize, “allowing for a strategic shift, while freight rates for trucking, rail, and ocean are at levels not seen since before the pandemic.”