ITS Logistics Issues January Port/Rail Ramp Index

Written by Marybeth Luczak, Executive Editor

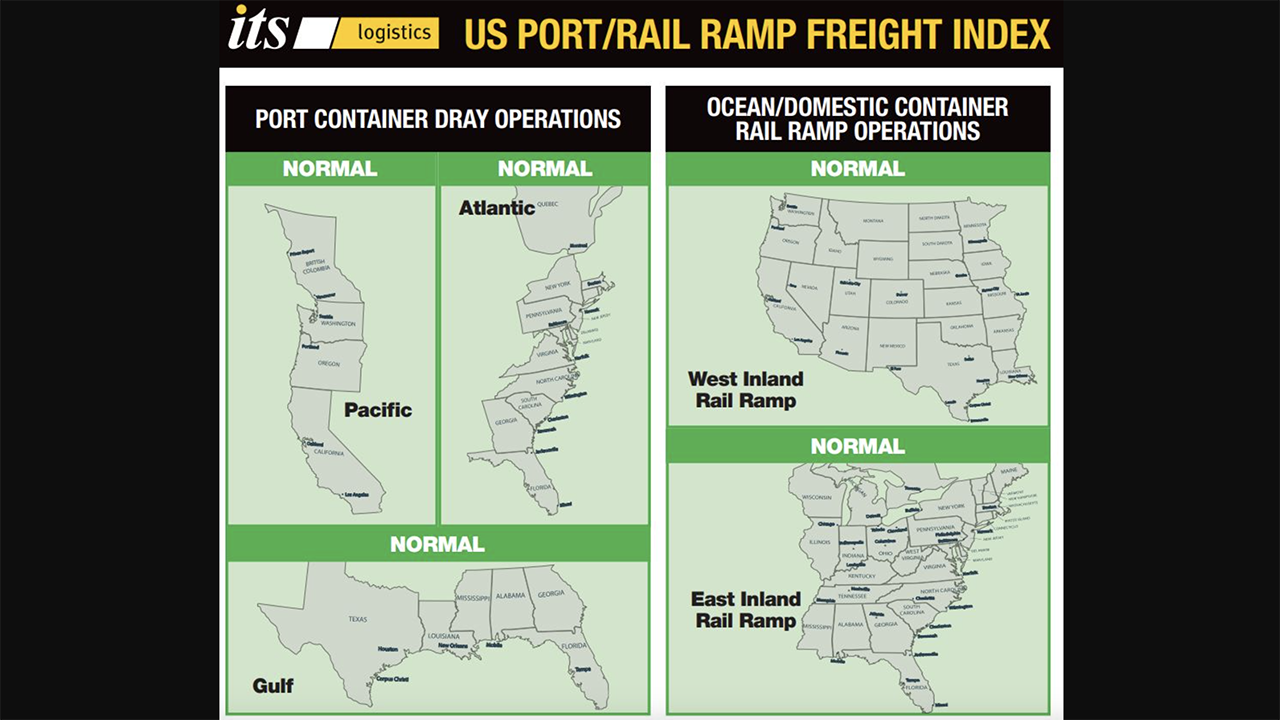

ITS Logistics U.S. Port/Rail Ramp Freight Index for January 2024. (Image Courtesy of ITS Logistics)

The January forecast for ITS Logistics’ U.S. Port/Rail Ramp Freight Index shows increased transpacific volumes on the U.S. West Coast due to seasonal Lunar New Year restock and geopolitical unrest, as well as the strong possibility of congestion at East Coast ports and at rail ramps throughout the U.S., the Nevada-based third-party logistics (3PL) firm reported Jan. 22.

“The current Lunar New Year restock has been paired with diverted volumes that are a direct result of shippers’ efforts to avoid the crisis in and around the Suez Canal,” according to ITS Logistics, which provides drayage and intermodal services in 22 coastal ports and 30 rail ramps throughout North America. “As a result, underutilized West Coast ports are expected to become stressed, especially in the Los Angeles and Long Beach terminals.”

The 3PL firm each month releases the ITS Logistics U.S. Port/Rail Ramp Freight Index, which forecasts port container and dray operations for the Pacific, Atlantic and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions.

“Despite our data showing all operations at normal levels, we are projecting that status to drastically change at both rail ramps and ports throughout the U.S. towards the end of January and beginning of February,” ITS Logistics Vice President of Drayage and Intermodal Paul Brashier reported. “On the U.S. East Coast, there is the strong potential that containers could be diverted to unscheduled ports throughout the U.S. Gulf/East Coast to get vessels back into position due to increased transit times.”

As more freight is routed to the U.S. West Coast to avoid the Suez Canal, “a significant amount of that volume will be transported via rail to reach East Coast ports,” according to the 3PL firm. “This will cause congestion at rail ramps throughout the U.S. as the infrastructure absorbs the change to the nation’s supply chain. In addition, data shows that both rates and bookings on transpacific lanes have increased drastically over the last two weeks.”

Long-term contracted rates and capacity will be affected, ITS Logistics said, especially since these challenges are occurring during the ocean carrier contract season.

Reuters reported that as of last week U.S. and U.K. militaries have advised all ships to steer clear of the current conflict zone near the Red Sea, according to ITS Logistics. “This will raise the risk of a new round of global inflation, with the benchmark Shanghai Containerized Freight Index already showing an increase of 16% week-on-week to 2,206 points last Friday [Jan. 19],” reported the 3PL firm, which added that rates on the Shanghai-Europe route rose 8.1% to $3,103 per 20-foot container on Jan. 19, and rates for containers to the U.S. West Coast increased by 43.2% to $3,974 per 40-foot containers week-on-week.

“Re-routed lanes from Asia to the U.S. East Coast have additional cost and transit time pressure that will continue to push volumes to transpacific trade lanes,” Brashier concluded. “Ultimately, the full spectrum of the supply chain is being impacted globally. As with all disruptions, shippers, as well as carriers, need to be proactive about finding solutions to the current challenges and taking into consideration the financial impact of these decisions that the industry is feeling as a collective.”

Further Reading:

Maersk Shifts OC1 Panama Canal Traffic to Panama Canal Railway