UP 1Q24: ‘Strong’ Financial Results Despite ‘Challenging’ Freight Market (Updated, Interview with Jim Vena and TD Cowen Insight)

Written by Carolina Worrell, Senior Editor

Union Pacific Photograph

“Our team delivered strong financial results in the first quarter as we navigated a challenging freight market and normal winter conditions,” Union Pacific (UP) CEO Jim Vena said during the Class I’s financial report on April 25. “These results build on the momentum we established as we exited 2023 and provide further proof of what’s possible as we strive to be the best in safety, service and operational excellence. This is a great start to the year, but we understand there’s work to be done to achieve our goals and meet our stakeholders’ expectations.”

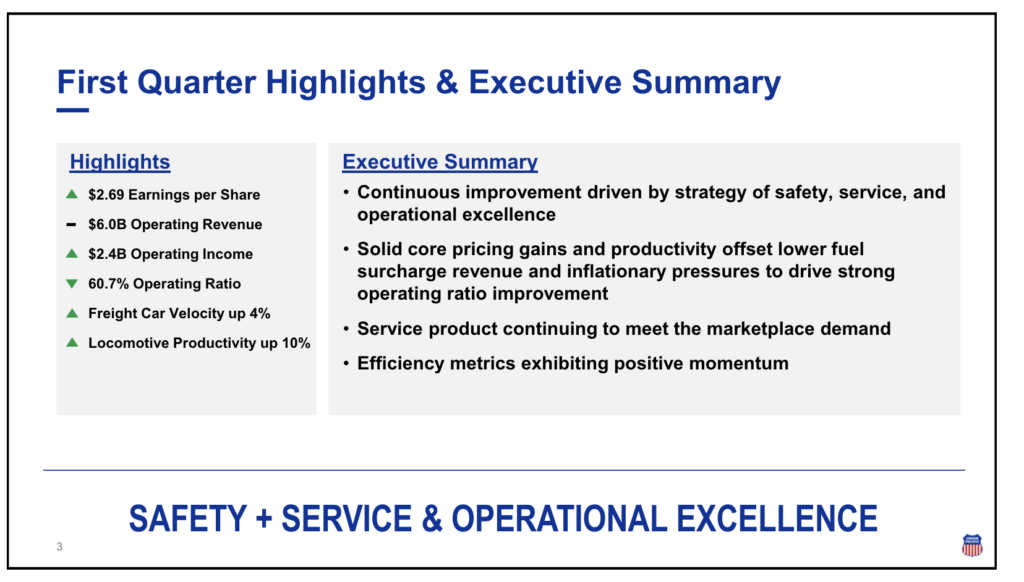

For first-quarter 2024, UP posted:

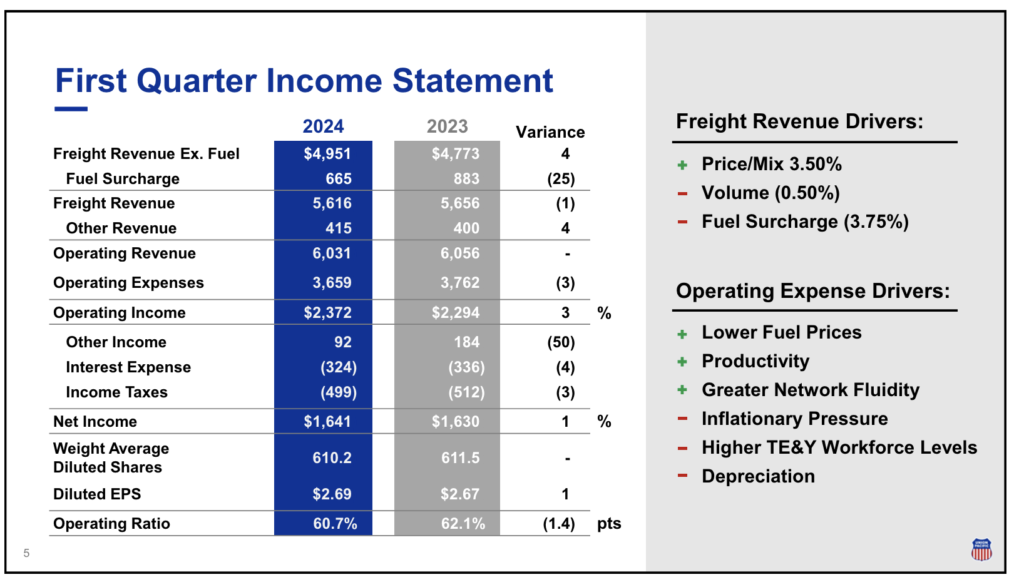

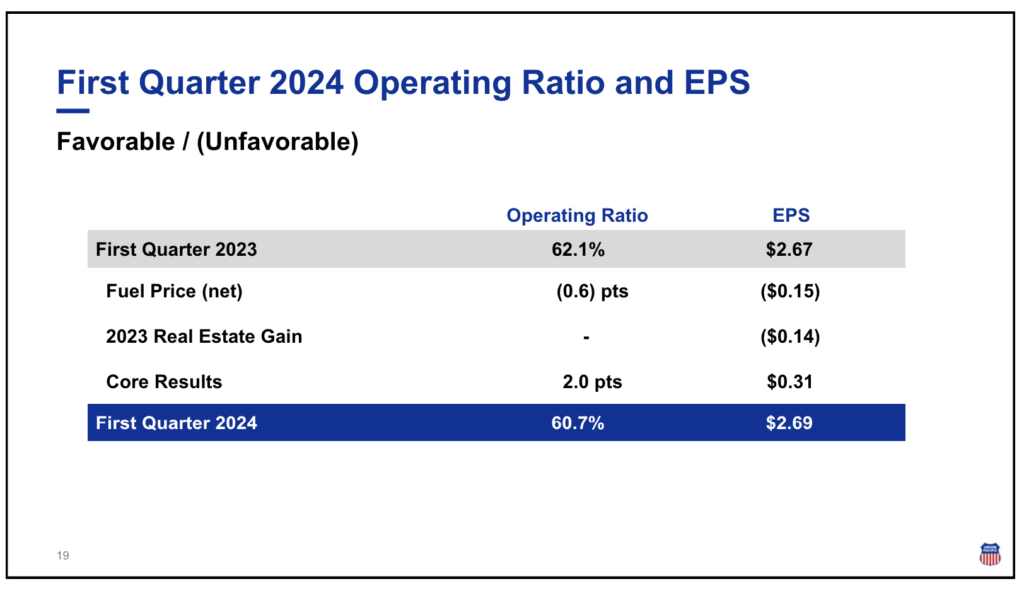

- Net income of $1.6 billion, or $2.69 per diluted share, compared to first-quarter 2023’s net income of $1.6 billion, or $2.67 per diluted share.

- Operating revenue of $6.0 billion was flat “driven by core pricing gains and business mix offset by reduced fuel surcharge revenue and lower volume.”

- Freight revenue excluding fuel surcharge revenue grew 4% as revenue carloads declined 1%.

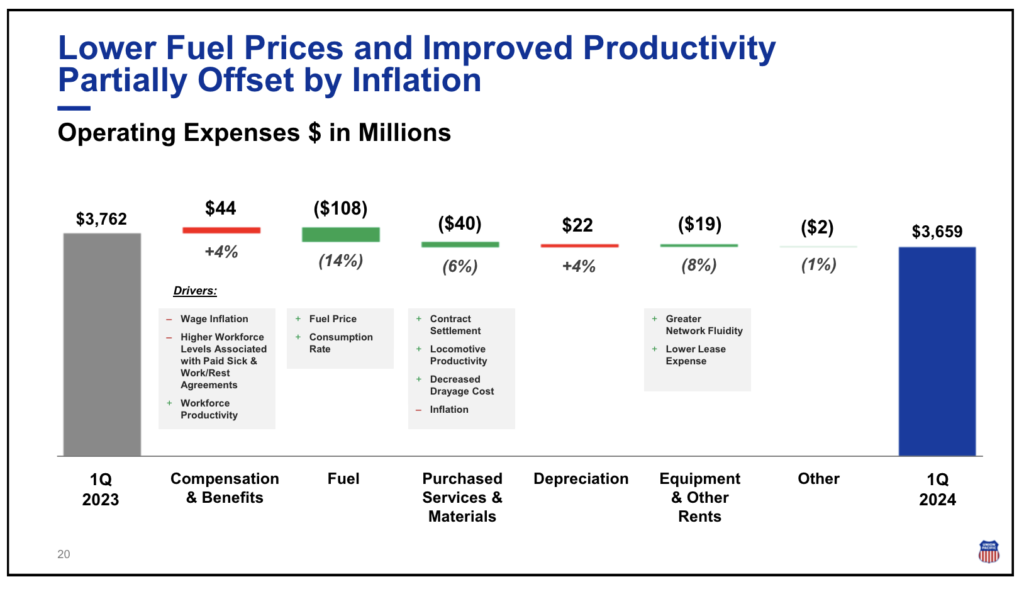

- Operating ratio was 60.7%, an improvement of 140 basis points. “Lower fuel prices during the quarter negatively impacted the operating ration 60 basis points,” UP said.

- Operating income of $2.4 billion was up 3%.

Among UP’s operating performance results for first-quarter 2024:

- Union Pacific’s reportable personal injury and reportable derailment rates both improved.

- Quarterly freight car velocity was 203 daily miles per car, a 4% improvement.

- Quarterly locomotive productivity was 135 gross ton-miles (GTMs) per horsepower day, a 10% improvement.

- Average maximum train length was 9,287 feet, a 1% increase.

- Quarterly workforce productivity improved 1% to 1,000 car miles per employee.

- Fuel consumption rate of 1.115, measured in gallons of fuel per thousand GTMs, improved 1%.

2024 Outlook

Updated:

- Profitability outlook “gaining momentum with strong service product, improving network efficiency, and solid pricing.”

- Restarting share repurchases in second quarter.

Affirmed:

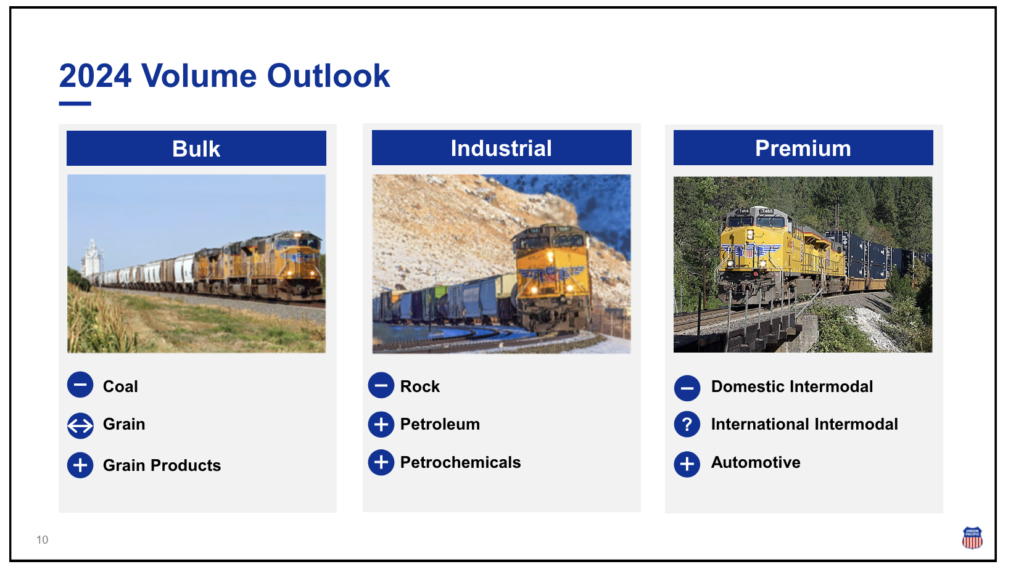

- Volume outlook “muted by international intermodal business loss, lower coal demand, and soft economic conditions.”

- Pricing dollars in excess of inflation dollars.

- No change to long-term capital allocation strategy (Capital plan of $3.4 billion).

Q&A With Jim Vena

RAILWAY AGE: Out of your capital budget, where is your biggest focus going to be? Priority projects?

VENA: We need to look at capital over multi-year. It’s very important that we have the money to spend to keep the railroad safe. Our capital budget is $3.4 billion. That comes out to $10 million a day. We’ll be investing in the same big buckets – growth for customers, maintaining a reliable railroad and investing in assets, such as the $1.2 billion going toward modernizing 200 locomotives.

RAILWAY AGE: Before you became CEO, embargoes were controversial – what specifically led to the lifting of these embargoes?

VENA: It’s interesting that it got to that point. As a common carrier, we know we need to be flexible, specifically with customers. The fluidity of the railroad needs to be maintained; you want to make sure you don’t impact the entire industry (customers). What are the tools we have to fix that? Talk to them, work out a buffer, take a different route, lease some space. The only tool we have as a railroad—as a last resort that says you’re not taking the traffic or we have an issue (bridge is out, etc.)—is to embargo.

RAILWAY AGE: Given that the STB said it’s going to continue oversight, what specific steps have you taken to mitigate the possibility of having to impose embargoes in the future?

VENA: We have invested in the railroad and we carry a buffer so unless there is a huge change in the dynamics of what is happening, there may be a few embargoes here and there, but nothing substantial. For me, it’s less to do with the STB and more to do with the customers.

RAILWAY AGE: Have the conditions changed in your general traffic flows?

VENA: Yes, international intermodal has come up; domestic is still difficult. We see soda ash being strong; industrial projects (due to the economy and service level we’re providing); manufacturing/commercial and retail business; handling the railcars of autos. You name, we handle it, and we get to see first what’s happening with the economy. It’s not a big change but there is some optimism as long as the economy doesn’t change things. That’s the biggest concern—as long as the macro economy doesn’t change too much.

TD COWEN: ‘Vena’s Plan Bearing Fruit for UNP in 1Q’

“UNP posted a 1Q beat driven by OR improvements as cost initiatives flow through the network,” reported Jason Seidl, Managing Director, Industrials – Airfreight and Surface Transportation, TD Cowen, and Railway Age Wall Street Contributing Editor. “The railroad has parked ~500 locomotives and has maintained fluidity and improved productivity. Coal continues to be a notable headwind to volumes in ‘24 but overall pricing commentary sounded better than expected. Price target to $258 and reiterate Buy.”

TD Cowen Takeaways:

- “1Q adj. EPS of $2.69 beat our $2.47 estimate and the consensus figure of $2.51. Despite carloadings declining 0.5%, UNP delivered nearly 150bps of OR improvement of 60.7%, as cost initiatives are becoming visible. This sets a baseline OR to begin ’24 that we believe UNP will be able to continue to improve as PSR continues to be implemented through the network.

- “Carloading declines were primarily due to an 18% decline in coal given the mild winter and low natural gas prices. Excluding coal, volumes would have been +2% in the quarter. Coal should continue to be volume headwind for the remainder of the year, as high inventories and weather should negatively affect this business; management emphasized focus on other areas for growth including autos, petroleum, petrochemicals, and grain products.

- “Intermodal volumes grew marginally y/y, though UNP faces continued pressure from both the domestic market, and the customer loss it laid out last quarter that affected its international business. Despite strong import data from the West Coast ports, UNP continues to see its international intermodal business soft; we note that QTD UNP’s total intermodal carloadings are up nearly 5%. We don’t expect the domestic market to rebound until there is a clear and stable inflection in the OTR market (indeed, a recent IMC call noted that there was nearly a 30% pricing discrepancy in some intermodal lanes vs truck). We model intermodal pricing to step down sequentially in both 2Q and 3Q, similar to the other Class Is.

- “Locomotive productivity improved 10% y/y as UNP has reduced its fleet by ~500 locomotives y/y that have stayed parked and in storage, driven by increased fluidity in the system. UNP made it clear that if volumes do return onto the network, they will quickly be able to get the locos back into the network. Total employees declined 2% in 1Q primarily driven by a decline in non-transport employees offset partially by a slight uptick in its active T&E workforce. We expect headcount to stay ~neutral from here though cost per employee should continue to track at +5% reflecting wage inflation and the new labor agreements.”

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)