NS Confirms 1Q24 Prelim Results, Outlines Strategy (UPDATED, 4/25)

Written by Marybeth Luczak, Executive Editor

(NS Photograph)

Norfolk Southern (NS) has confirmed that its first-quarter 2024 financial results are in line with the preliminary results it announced April 9, one month before the May 9 shareholder’s meeting in which a proxy vote prompted by activist investor Ancora Holdings is scheduled. During an April 24 earnings call, President and CEO Alan Shaw and other NS executives discussed the Class I’s quarterly results, as well as the 2024 outlook. Railway Age provides highlights. TD Cowen also weighs in.

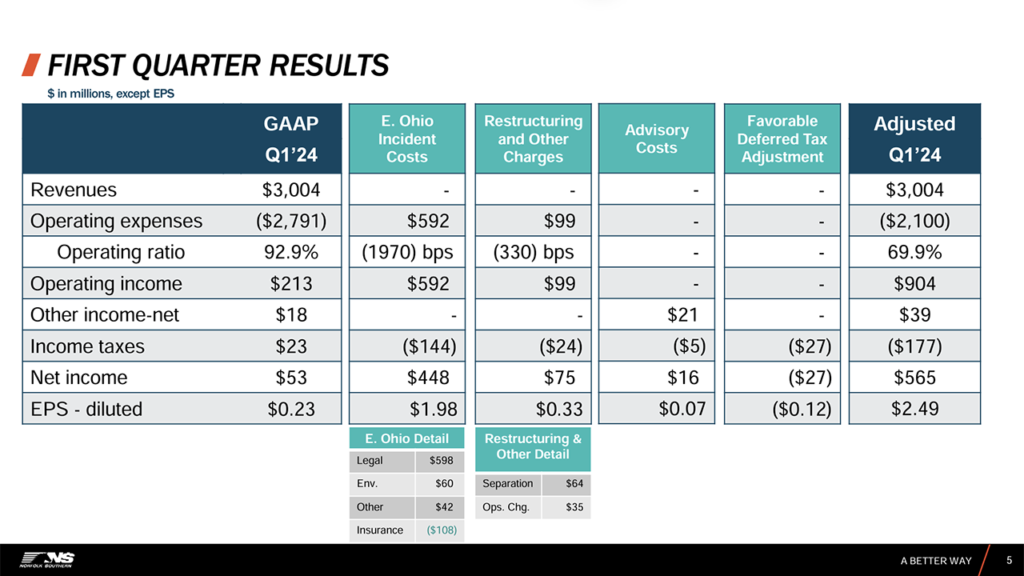

Among NS’s first-quarter 2024 financial data released April 24:

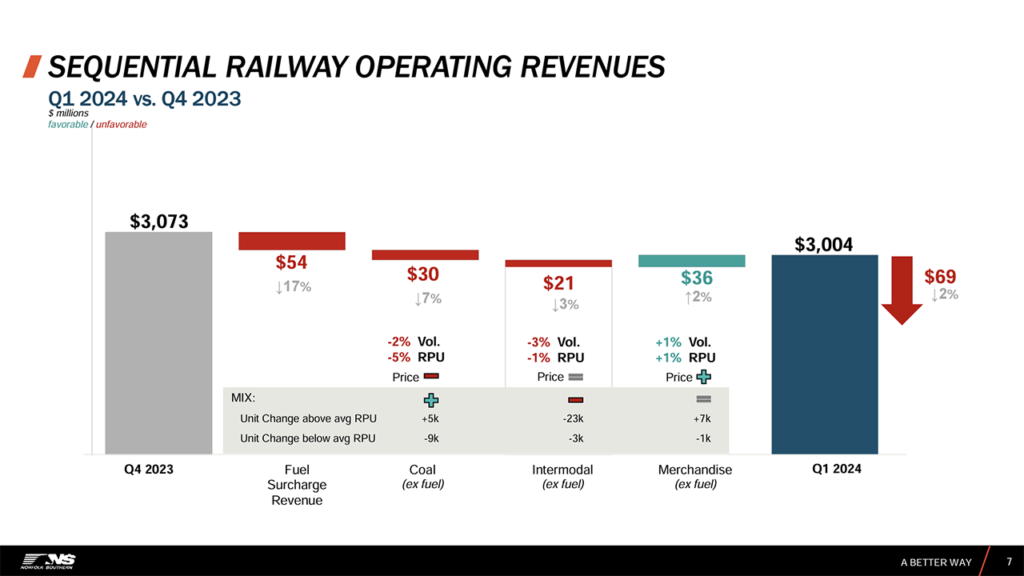

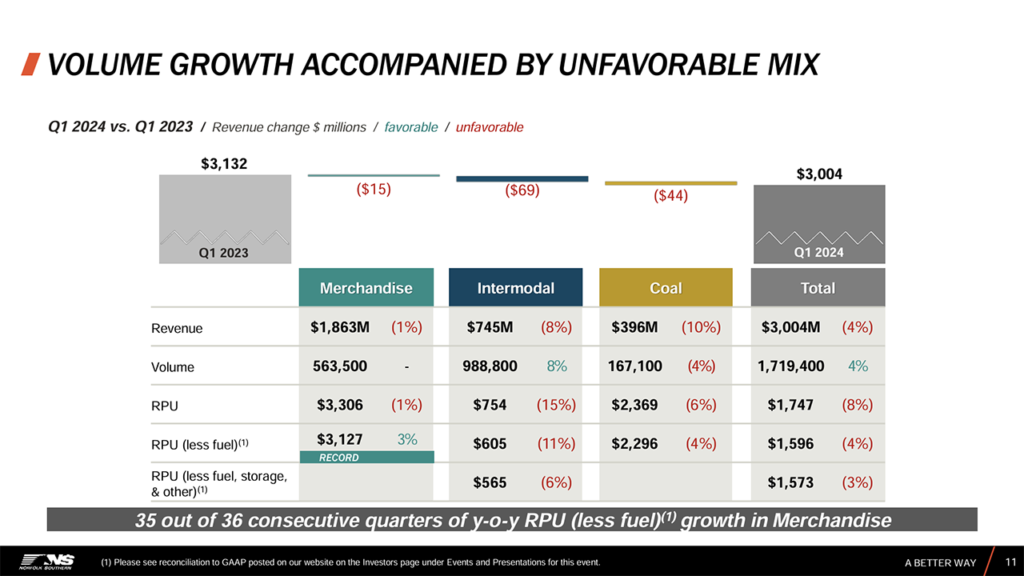

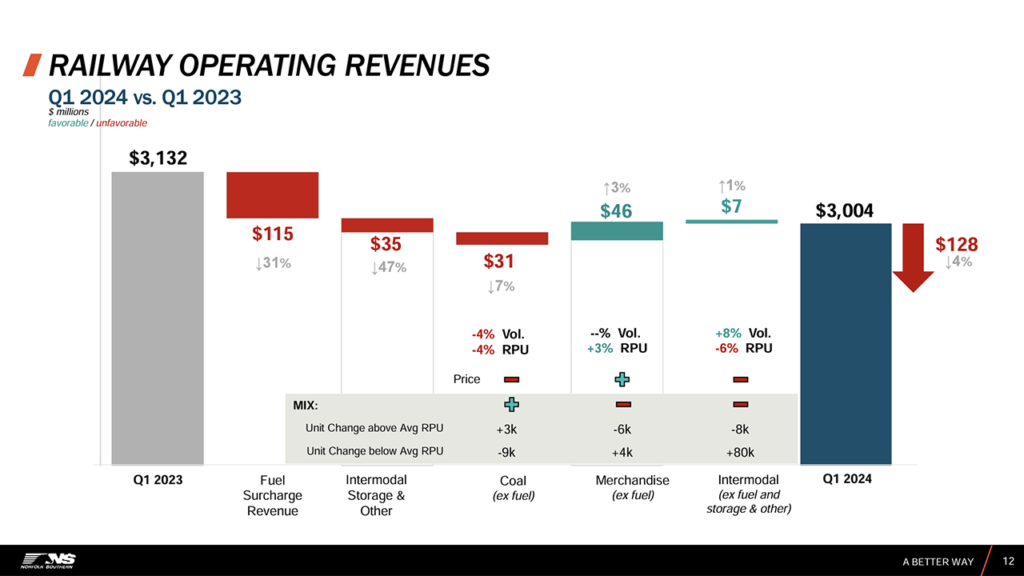

- Railway operating revenue came in at $3.004 billion, down 4% from first-quarter 2023’s $3.132 billion.

- Net income was $53 million, down 89% from first-quarter 2023’s $466 million.

- The Class I railroad’s operating ratio for the first three months of 2024 was 92.9% vs. 77.3% for the prior-year period.

- NS reported that total volumes in first-quarter 2024 were up 4% from first-quarter 2023; merchandise was flat, intermodal was up 8% and coal was down 4%.

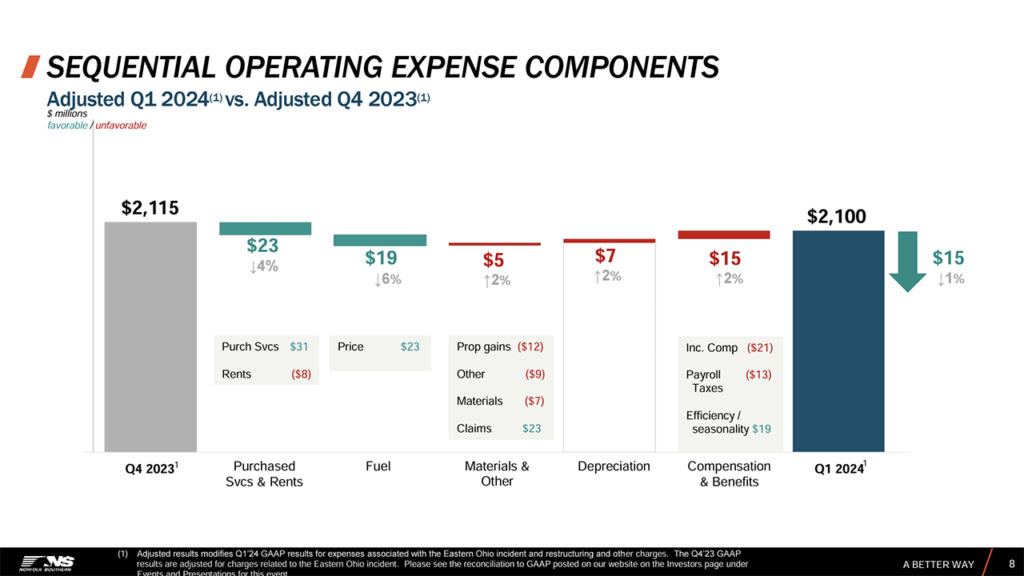

- Total railway operating expenses for first-quarter 2024 were $2.791 billion, up 15% from first-quarter 2023’s $2.421 billion.

NS’s first-quarter 2024 results included the impact of its Feb. 3, 2023, derailment in East Palestine, Ohio. The Class I recognized $592 million and $387 million of expense during the first quarters of 2024 and 2023, respectively, for costs related to derailment. The total expense recognized in first-quarter 2024 includes the impact of $108 million in insurance recoveries. No insurance recoveries were recorded in first-quarter 2023. The railroad noted that “[a]ny additional amounts recoverable under our insurance policies or from third parties will be reflected in future periods in which recovery is considered probable. No amounts have been recorded related to potential third-party recoveries, which may reduce amounts payable by our insurers under applicable insurance coverage.”

NS also reported “Restructuring and Other Charges” for first-quarter 2024. They include:

- $64 million of costs due to “a voluntary and an involuntary separation program.” During the first quarter, NS executed the program that will result in a reduction of approximately 350 nonagreement employees by May 2024. The resulting costs are primarily separation payments to the impacted employees.

- $35 million of costs associated with the March 2024 appointment of Jon Orr as Chief Operating Officer.

- $21 million in costs associated with shareholder advisory matters.

“Our strategy is about balancing service, productivity, and growth, with safety at its core,” NS President and CEO Alan Shaw said during the April 24 earnings presentation. “It’s anchored on a PSR-driven operating plan and designed to deliver top-tier earnings and revenue growth, with industry-competitive margins. To better serve our customers, we are enhancing productivity through disciplined operational excellence.”

Operations Performance, Strategy

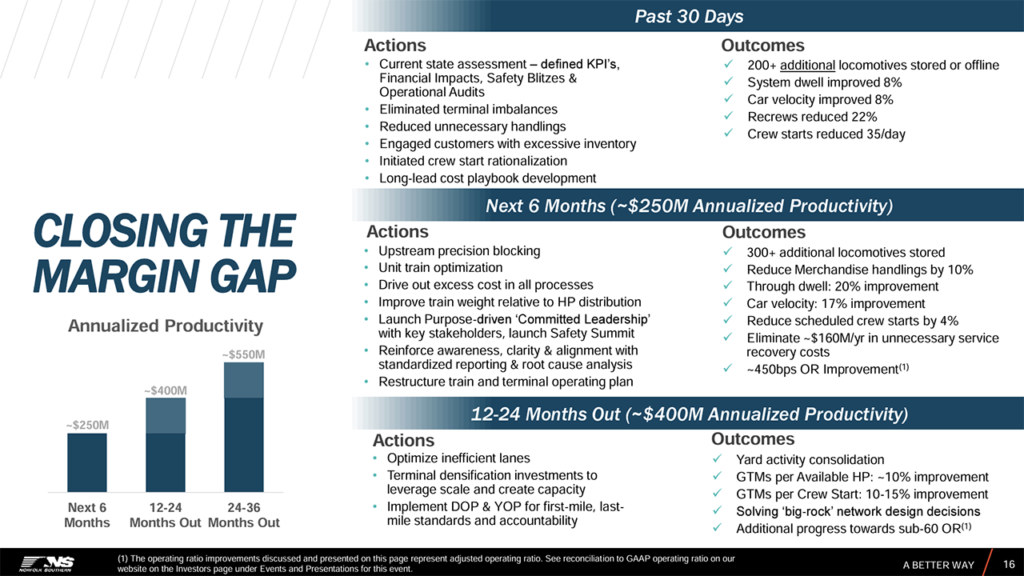

At the start of NS’s earnings presentation, COO John Orr outlined his first month on the job and the operations performance and strategy going forward. “[I]t is imperative that we close the profitability gap with our peers,” Orr told investors. “We are now delivering encouraging trends in productivity. Our strategy is balanced, where operating efficiency and service excellence are achieved in tandem. Our approach is a flywheel of value creation, where people, processes and accountability intersect to drive performance, anchoring our service and profitability proposition. Accountability is key. We’re providing our team with the metrics they need to track their performance.

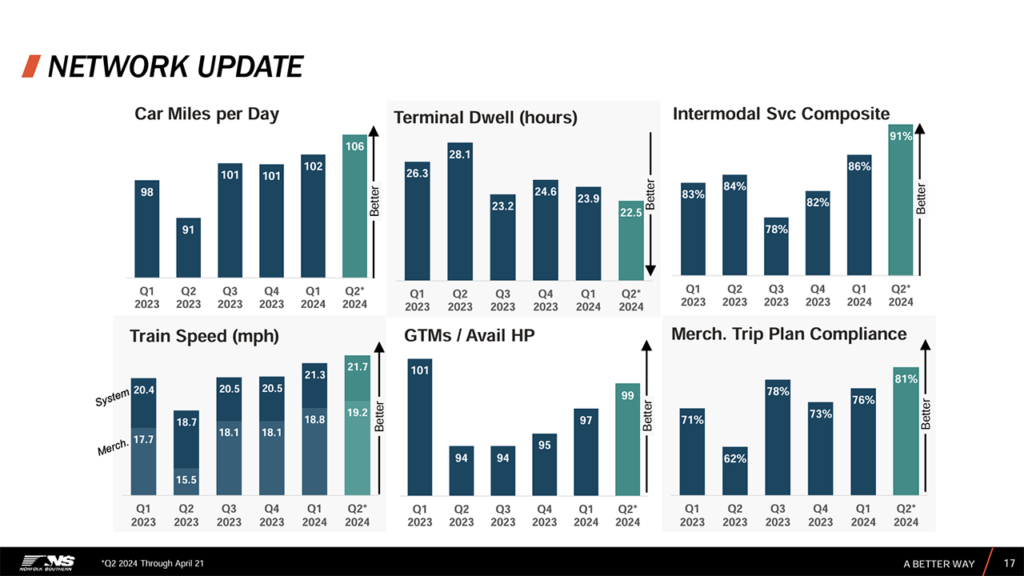

“In my first 30 days, we have removed approximately 200 locomotives from the available fleet. Most of these have gone into storage status or driven offline for HPH ballast. Our availability count is now below 2,500 units … [W]e will be able to increase locomotive drawdown over the next six months.

“Terminal Dwell has improved by 8%. We are driving out more waste by fine tuning workload in our terminals through disciplined planned execution. Near-term, we are targeting 20% improvement. Car miles have improved by 8%, and this is another productivity measure we target for double-digit

improvement. Recrews are trending down 22% as network and terminal improvements are combining to improve fluidity across the mainline. And lastly, we are reviewing the entire train service plan. This will drive co-rationalization in the range of 4%. Resulting from these initiatives, we are driving out excess cost as we close the gap to our peers …

“To accelerate improvements and address network underperformance, I have established a network optimization team that identifies areas for immediate improvement. I have deployed two task forces to drive field productivity and throughput at two major terminals. The outcomes from these efforts will rapidly go to scale throughout the network. We are training our operations leaders to think differently, to make faster decisions, and to eliminate waste more vigorously.

“My commitment is to develop PSR railroaders, to instill the discipline for continuous improvement, and to streamline execution by relentlessly managing assets in context to our commercial obligations. The initial results across the entire network have been promising. Our people are driving PSR results. To create accountability and to track progress, we’re introducing a comprehensive set of metrics.

“I’ve laid out challenging and urgent near-term targets, and I’m taking an aggressive disciplined approach to achieve our long-term financial glide path. And, I can tell you now we have a significant runway on cost reduction. As our fleet becomes more efficient, we benefit in rents and materials by shedding assets and from improving the fleet composition and getting out more costly cars. Our locomotive fleet now has significant capacity.

“My commitment is to develop PSR railroaders, to instill the discipline for continuous improvement, and to streamline execution by relentlessly managing assets in context to our commercial obligations. The initial results across the entire network have been promising.”

– NS COO John Orr

“I believe we will be able to scale down discretionary capital spending on the fleet, and we have a robust terminal footprint covering a rich array of industrial activity. And, as we optimize our terminals, we are challenging their historic use to create value through consolidation and efficiencies. I am proud and excited to have the opportunity to lead the operations team at NS.”

Discussion of NS operations continued during the Q&A portion of the earnings presentation. Following are highlights of what Orr and other top NS executives had to say to the 11 investment and research firm representatives in attendance.

Railway Age Wall Street Contributing Editor and TD Cowen analyst Jason Seidl questioned Orr about the new PTO and sick leave regulations, asking, “how much of an impact have you’ve seen there and what do you expect going forward?” He also asked Orr to discuss yards and about the potential for future yard closure. (Scroll down for Seidl commentary on NS.)

John Orr: “Yes, obviously the sick leave is a national issue. I think [that’s] no different than any other regulated or introduced crew limitation. We all have to deal with it. What I’m really focused on is crew productivity and yard productivity and increasing the capabilities of each assignment to do more within the timeframe they’ve got to work. And so, delivering more getting accountability to connections, getting yield on our trains, that’s the most important piece. And, we’re balancing that. I’m on the team every day on crew availability to make sure that whatever we’ve committed to with our labor organizations or through the CBA process that we’re living up to that. And, on the flip side, making sure that the unions understand that they have an obligation to come to work within the timeframes dressed and ready to deliver for our customers each and every day. So, it’s both sides of that coin.

“As far as the terminals are concerned, the reason when I started with hump yards is because they can add a lot of value. They can drive a lot of mechanized performance. But, as we all know, they’re costly. I want to get the most yield I can get out of them. I’ve already challenged our yard plan from yard-to-yard, node-to-node and we’ve started to eliminate power imbalances at a place like Chattanooga.

“We’ve reduced the bunching in the terminals by re-establishing a terminal clock at all of the major terminals. And, we’ve even decreased a number of assignments that were moving cars and causing multiple handlings between the yards. So, I would say everything’s open. I’m challenging the historic reason for a yard, so that whatever we do is going to meet the operational need of today and tomorrow. So, everything’s on the table, everything’s being scrutinized and we will be rolling out a redefined yard operating plan and yard operating strategies in the next 30 days. And, that will then drive our re-design of most of the operating plan over the next 60 days to 90 days.”

Jeff Kauffman of Vertical Research asked Orr about his impressions of NS coming on board, and what people “on the outside might not appreciate about the Norfolk [Southern] network and what can and can’t be done.”

John Orr: “I’ll tell you in my first official act with boots on the ground was to go to East Palestine and really understand the scope of that issue. Because I’ll tell you, I’ve been a railroader for over 40 years. I’ve been the incident commander at a number of derailments, some very consequential and some that I’ve had to make those same decisions that were made here to resolve imminent safety concerns and understanding the scope and scale of the commitment that NS has made to that community, I’ve never experienced anything like that. And, so I came in with a bias and really had to understand the magnitude of that event and how that could have had a more lasting impact across not only NS, but the sector. As I looked at our operations, I always have a bias for yards, because I think yards, especially in a merchandise environment are where cars and customers kind of coincide. So, how we handle them, how we accelerate or drag is really important to evaluate. And, so I was pleasantly surprised at the richness of the terminals, but also quickly realized as I got under the hood that, that was where a lot of the underperformance was happening.

“And, that’s why I set up a task force to kind of look at the data and drive performance through data, but also had a field component to check-in a balance to make sure that we were driving was actually going to add performance and not undermined or burn something down that didn’t need to be either intentionally or unintentionally. So, I think having a good perspective of what the network looks like, as an outsider, you have biases. As an insider, you start to get under the hood and realize, okay, here may be a big rock issue, but then you get to know the smaller rocks that need to be moved out of the way to create that momentum.

“[I]t’s a robust franchise with a talented team and the resources to deliver impressive results. We just have to properly execute.”

– NS COO John Orr

“I’ve made a career out of going across Canada, the United States and Mexico, unclogging drains and creating a lot of momentum and then leveraging that momentum to build very competent, capable service plans, very competent, capable operators of those service plans and creating sustained

improvements. And, that’s what I’m seeing right now. I think the architecture of NS is solid and it does come down to execution. And, it’s a very complex non-linear network. That’s what the East is all about. I’ve spent 35 of my 40 years in the East, either as a craft employee or as a leader, as a senior leader in the United States, a senior leader in Eastern Canada. And, I know networks, I know the industrial complex that we’re working in. It’s very similar to the density that I just converted in Mexico [with Canadian Pacific Kansas City].

“So, I think we’ve got lots of work to do, but as I said in my prepared remarks, it’s a robust franchise with a talented team and the resources to deliver impressive results. We just have to properly execute.”

Stephanie Moore of Jefferies asked Orr about the customer response to the changes under way at NS.

Alan Shaw, President and CEO, answered first, saying that he has had “number of customers” approach him over the past month since Orr’s appointment was announced. They are “encouraged by our approach, encouraged by our direction and supporting our strategy,” according to Shaw. “Our customers, as John noted, in the East are familiar with John in large part. And, they’ve seen what he’s done wherever he’s been to enhance service and enhance safety and enhance productivity. And, that’s what customers are looking for … [j]ust this morning we got an e-mail from one of our largest customers thanking us for another excellent week of service.”

Following up, John Orr said: “[W]e’ve had to make hard decisions. Ed [Elkins, NS Chief Marketing Officer] and I have had to take very decisive decisions on car flows, on even on how customers are interacting with some of our service facilities. It is but having the work on the front-end, engaging with people, helping them understand what we’re doing, helping them understand where they fit into that, whether it’s union leaders, it’s regulatory leaders or our customers. That really, Stephanie, helps them understand what we’re doing, why we’re doing it and how we’re going to work together to create these standards.”

Walter Spracklin of RBC Capital also asked about customers. “When you take out 200 locomotives, soon to be 500 locomotives, that has a leave of mark,” he noted. “We know there’s been lane reductions. I guess feedback from those customers must have been quite negative. So, I’m wondering are you just refocusing on those other customers and you’re getting good service to them and they’re coming back to you with some good feedback and perhaps some of the less or lower margin customers are going to be shed a little bit. [I’m] just really surprised that we’re not hearing more customer blowback from some of these significant and important changes that you’re making.”

Alan Shaw took on the question first, saying: “Walter, that’s our strategy. That’s what we committed to doing. We’re going to implement and we have been implementing PSR in a responsible and sustainable manner. We saw what happened at our peer in 2017, and we’re not tearing this thing down to the studs. John knows how to do it without tearing it down to the studs, as the activist COO [Jamie Boychuk, formerly of CSX] has said he would have to do. Ed [Elkins] is close to our customers. Our customers appreciate and see the improved service. We’re focused on safety, and we’re focused on a sustainable plan for Norfolk Southern that drives long-term shareholder value. John, you want to talk about how you’re doing this in the right way?”

John Orr: “I would say, it’s what we said at the very onset that we’re taking a balanced approach. I’ve laid out really challenging and urgent near-term and mid-term targets, and I’m taking an aggressive disciplined approach to manage it. And, I’ve used the George Foreman Grill example, you don’t set and forget operations. You sweat it out and you can’t drive this alone. So, creating a team of capable railroaders focused on the big rocks and small rocks at the same time, delivering the fundamental of safety, creating stability across the network and then challenging every asset that we have, every standard that we have and building compliance and building momentum around those things is really important. So yes, it is sweat equity in a lot of respects, Walter. And, it is really the key focus areas of yard time and dwell. And, you know what that does. When we drive our current dwell down from mid-23s to 22 and we’ll be taking that down even further, not only are we handling the cars better in the terminals, but we’re getting more cars on trains, getting to the customers sooner and even the bad order count, taking it down by double-digits, by almost 50% means those the discipline of handling those cars in the terminal and getting them back into the flow of our core service offerings means the customers are seeing those cars faster than they would have otherwise seen them. So, I would think that they see that as a value and rather than a negative disruption, a positive indication that we’re building momentum and commitment to them, while at the same time reducing handling some costs.”

“We saw what happened at our peer in 2017, and we’re not tearing this thing down to the studs.”

– NS President and CEO Alan Shaw

Ed Elkins, Chief Marketing Officer, added: “Just to close the loop, Walter, on say the locomotives specifically. Remember last year, we actually had to add locomotives back into service. We spent a fair amount of money in materials trying to get locomotives that had been stored back up and running, so we could dig out of the tough hole we were in following the East Palestine derailment. It’s how we got service really back on the right trajectory. And, now we’re able to start attacking some of those resiliency costs we’ve added and remove locomotives and some of the other costs we had to throw at the system. So, there’s a lot of opportunity here to remove costs that will be non-disruptive to the customers.”

David Vernon of Bernstein asked Orr for his perspective on NS’s challenges as well as operating headcount.

Mark R. George, NS Executive Vice President and Chief Financial Officer, spoke first about headcount: “You may recall, we guided last time where we said that overall headcount would likely be flat over the course of the year, where we were taking 300 non-agreement people out, but we would likely have to add some agreement folks that would offset it. We actually see now with John [Orr] in the room here a pathway for total headcount to be down around 2% by the time we end the year.”

“I’m not going to really be too critical of what I inherited, rather I saw a lot of things in flight that I’m able to leverage very quickly on. And, at the same time, the basics of railroading, the basics of giving a great service plan at the lowest cost in the safest way possible is the recipe. …”

– NS COO John Orr

Orr followed up: “[J]ust to add emphasis to that, as we get more productivity out of our yard and locals and more accuracy on our over the road transits and performance, we’ll see more people virtually come live and we would be able to have more availability and more crew flexibility. And, I have frozen all hiring from operations. There may be two or two critical paths like C&S where signals and communications, that’s a very specialized skill that we will need to continue to evolve as we bring our OT and IT and that kind of perspective into more into our safety plans. But, I would also say that it gets back to the basics. I’m not going to really be too critical of what I inherited, rather I saw a lot of things in flight that I’m able to leverage very quickly on. And, at the same time, the basics of railroading, the basics of giving a great service plan at the lowest cost in the safest way possible is the recipe and building out discipline around that, creating visibility, accountability and driving purpose, so that we improve these things is part of the challenge that I’ve laid out. And, that’s how we’re delivering short-term and mid-term. And, that’s what we’re going to continue to do.”

2024 Outlook

Looking ahead, NS executives provided these insights:

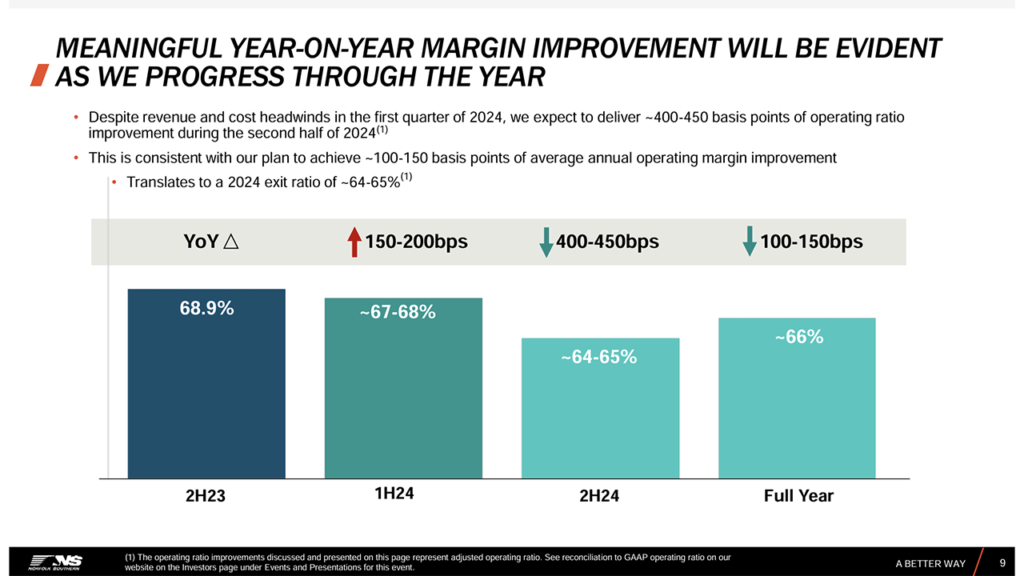

- Mark George, Executive Vice President and Chief Financial Officer: “As we turn to the balance of the year, we will see our margins improve materially from here. We are finally starting to see excess service costs unwind and they will accelerate downward in Q2. That trajectory along with the reduction in non-agreement headcount as well as other productivity initiatives leave us confident in a strong productivity story for Q2. We anticipate a modest seasonal volume lift sequentially, although there is some pressure to our coal business from the Baltimore Bridge disruption. Despite the port closure, we still believe we will be within the first half 67% to 68% OR guidance range assuming that the channel reopens at the beginning of June.”

- Ed Elkins, Chief Marketing Officer: “We’ve seen fairly strong volume so far this month. We’re encouraged by that. Our customers are encouraged by the level of service that we’re delivering. And, to be clear, in intermodal, the level of service we’re delivering is the best in a generation, and it’s sustainable and it’s going to continue to be that way, and we’re earning trust from our customers to do that. We’re seeing very good response on the bid front for new volume converting from the highway, which we’re very encouraged by in intermodal. On the merchandise side, look, we spent the last six months building a sales conversion pipeline, which includes technology augmentation as well as institutional rigor, and we are going to deliver growth from the highway converting freight in the merchandise space that should be moving on Norfolk Southern. The capacity that John [Orr] has unlocked and we’re going to use to go out and get back the freight that should be ours.”

- John Orr, COO: “[A]ll across Canada, the U.S. and Mexico, I’ve been a change agent and an architect of PSR. I haven’t had the luxury of looking in the rearview mirror very often. And, so I don’t spend a lot of time looking at what could have been or what was rather than what the current situation is and how fast can we get to the desired state. Desired state is having closing the gap for sure, having an operation that is focused on asset management with speed and accuracy to reduce the cycle times, reduce the dwell times and drive out waste. So, that’s taking on an approach where it has a network overview. So, there’s a very strategic point of view on how do we create speed, accuracy by reducing dwell, increasing over the road performance, looking at long lead resources like locomotives and crews and how do we make them as productive as we can and then create resiliency and elasticity for network response like we’ve seen in Baltimore. And, then really look at our smart investments, how do we leverage those things, like capitalizing locomotive renewals, refurbishing locomotives that can be pushed off into the future because we’re creating our own locomotives by having them more productive. I think this is a natural evolution on some of the linear elements that were started in the past. Now, taking a non-multidimensional point of view on it, not focusing on one particular thing, but elevating the entire suite of operating efficiencies at the same time in tandem with one another, disciplined railroading, disciplined service, accurate handling of cars and reduction of waste and cost is really the plan. And, that will show in the form of yard operating plans, disciplined operations in terminals, disciplined and progressive ways of moving the train service plan into the meet the commercial needs of today. I am highly confident, highly confident that we’ll achieve the targets and we will do it in a way that’s sustainable and we will do it in a way that fosters growth and we are on the path today. We are well under way. So, that increases my confidence.”

- Alan Shaw, President and CEO: “Our strategy is designed to mirror the great success stories of the Canadian railroads, who have recognized that PSR is about more than tearing a railroad down to its studs and slashing costs regardless of the fallout. As our Board member, Claude Mongeau, demonstrated when he was CEO of Canadian National, a PSR operating model, when part of a customer-focused balanced strategy, can deliver top-tier revenue growth and a sub-60% operating ratio. John Orr was an integral part of Claude’s leadership team at CN and thus a perfect fit from Norfolk Southern as we turbocharge productivity in pursuit of industry competitive margins and top-tier earnings growth. Core to this are the men and women of Norfolk Southern. I’m incredibly proud of all they’ve done to progress the execution of our differentiated strategy. To my colleagues, thank you for everything you do for Norfolk Southern, our shareholders, our customers, and your fellow team members. Together, we are on a transformational journey to a safer, more profitable railroad, poised for growth with strong execution from an experienced leadership team.”

Following are more key slides from NS’s April 24 earnings presentation.

TD COWEN: ‘STRONG FOCUS ON OPERATIONS AHEAD OF SHAREHOLDER VOTE’

By Jason Seidl, Managing Director, Industrials – Airfreight and Surface Transportation, TD Cowen, and Railway Age Wall Street Contributing Editor

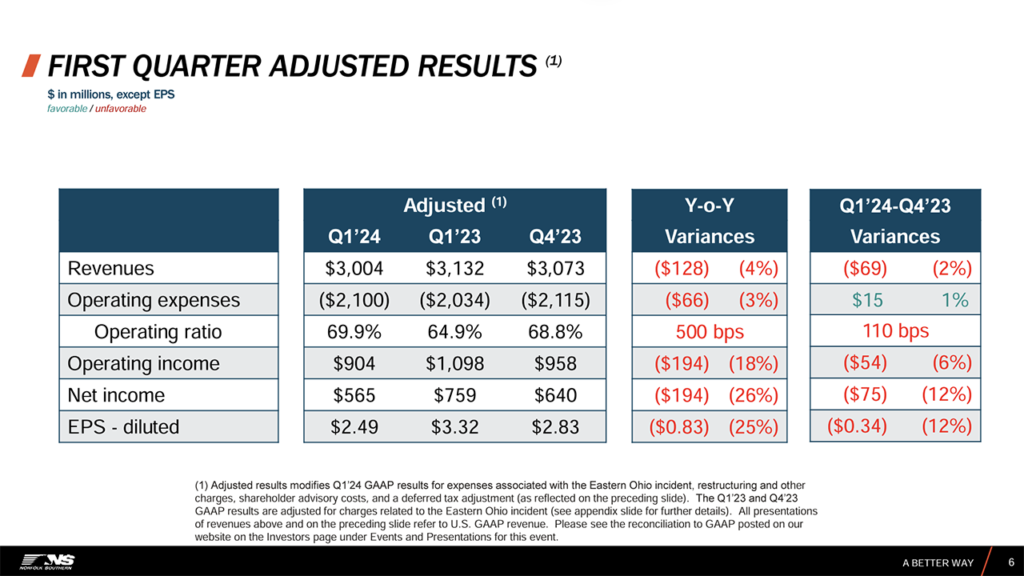

NS reported 1Q results, reinforcing its preliminary announcement which saw margin pressure to begin in the year. NSC is expected to see material OR improvement sequentially through the remainder as management focuses on operational improvements, cost initiatives, and volumes growth. Next catalyst should be outcome of ISS/Glass Lewis, expected late this week or early next week. $253 PT intact.

NS reported 1Q adj. EPS of $2.49 and adj. OR of 69.9% in line with last week’s preannouncement. Top line decline of 4% y/y was driven by soft coal and intermodal yield as well as lower fuel surcharge. Adj. OR deteriorated sequentially in line with guidance. Results exclude a large $592MM legal charge related to the Ohio derailment which settles claims related to the incident.

NS’s cost restructuring focus does not entail a major shift in revenue mix in our view. While NS recently shed ~15% of its low density intermodal lanes, these amounted to only 1% of revenues and, according to management, did not have the returns/outlook to continue to service. Within-intermodal mix should continue to pressure yield however due to stronger international volume and empty shipments +57% y/y arising from longer Red Sea-related ocean transit times. NSC sounded optimistic on continued pricing gains in merchandise (up 3% ex fuel in 1Q). Coal will be a headwind going forward on yield pressure and Baltimore outage impact ($50-$100MM per month). NSC does not see a significant Baltimore impact on 1H OR and assumes operations at the port resume in June.

Management reiterated 1H OR guide of 67%-68% which for 2Q assumes seasonal carload growth on the top line combined with cost savings primarily in comp and ben and modest fuel efficiency. 2H guide of 64%-65% is also intact with the new COO citing removal of 200 locomotives, a 2% y/y headcount reduction (prior guidance called for flat) and an increased focus on crew and yard productivity (recrews down 22%). NS started to draw down service-related costs in March (which amounted to $164MM for FY23) and expects full unwind by the end of 2Q. Looking further out NS’s COO added that “everything is on the table” when discussing the potential to drive efficiencies.

The ISS/Glass Lewis recommendation is expected to come either late this week or early next week and should be the next catalyst for the stock. We expect the outcome to give NS’s shareholders solid footing ahead of the shareholder vote on May 9. We continue to see the potential of not just a “winner takes all” scenario, as we acknowledge sound arguments on both sides of the table.

We adjust our 2024 EPS estimate to $11.95 from $12.10, and maintain our 2025 EPS estimate of $13.65. While we lowered yield estimates, we note strong QTD carloading trends for NS and management’s confidence in OR improvement over the next several years. Using our unchanged ’25 estimate and 16.5x multiple, our price target of $253 remains intact.

Further Insight

- Watch: NS Reports Ops, Safety Improvements

- Norfolk Southern’s Alan Shaw and John Orr: Rail Group on Air Podcast

- NS 1Q24 Prelim Results Reflect East Palestine Settlement

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)