GATX 4Q23: ‘Excellent Financial Results’

Written by Carolina Worrell, Senior Editor

“GATX achieved excellent financial results in the fourth quarter, resulting in a very strong year in terms of net earnings, earnings per share and investment volume," said GATX President and CEO Robert C. Lyons.

Chicago-based GATX Corp. has reported fourth-quarter 2023 net income of $66.0 million, or $1.81 per diluted share, compared with fourth-quarter 2022’s $48.4 million, or $1.36 per diluted share. For full-year 2023, net income was $259.2 million, or $7.12 per diluted share, versus the prior year’s $155.9 million, or $4.35 per diluted share.

The railcar lessor noted that fourth-quarter 2023 results included “a net positive impact from tax adjustments and other items of $0.07 per diluted share” compared with fourth-quarter 2022’s “net negative impact from tax adjustments and other items of $0.18 per diluted share.” Additionally, the 2023 full-year results include “net positive impacts from tax adjustments and other items of $0.05 per diluted share” compared with full-year 2023’s “net negative impact from tax adjustments and other items of $1.72 per diluted share.”

“GATX achieved excellent financial results in the fourth quarter, resulting in a very strong year in terms of net earnings, earnings per share and investment volume,” said GATX President and CEO Robert C. Lyons. “The railcar leasing environment in North America remains solid. In 2023, we capitalized on the favorable market conditions by successfully increasing renewal lease rates while extending lease terms. This strategy enabled us to continue locking in high-quality, long-term committed cash ow. The renewal lease rate change of GATX’s Lease Price Index was positive 33.5% for the quarter, with an average renewal term of 65 months. Furthermore, we identified opportunities to invest in attractive markets while also optimizing our fleet by selling railcars into an active secondary market. For the full year, Rail North America’s investment volume was $977 million, while remarketing income was $112 million.

“Rail International also performed well as it maintained solid fleet utilization at year end and continued to experience increases in renewal lease rates compared to expiring rates for most railcar types. Both Rail Europe and Rail India progressed against their goal of growing and diversifying their fleets. In particular, Rail India had record investment volume in 2023 and increased its fleet size by over 2,900 new railcars.

“In Portfolio Management, the Rolls-Royce and Partners Finance affiliates outperformed our original expectation due to the strong recovery in global passenger air travel. Demand for engines within the RRPF portfolio was very strong, and revenues from GATX wholly owned engines exceeded our expectations for the year. Historically, global air travel has been extremely resilient through economic cycles and macro shocks, and this resiliency was proven once again as air travel continues its strong recovery from pandemic-era lows.

“In 2023, we executed our strategy to invest in attractive leasing assets across our global businesses. In addition to successfully placing deliveries of new railcars under our supply agreements in North America, we identified incremental opportunities to acquire over 2,300 railcars for $324 million. In Rail International, we invested over $380 million and added a combined total of over 4,600 new railcars in Europe and India. In Portfolio Management, we increased our direct investment in aircraft spare engines by acquiring 10 engines for over $260 million. Overall, our full-year investment volume exceeded $1.6 billion,” said Lyons.

Rail North America

GATX reported a segment profit of $66.7 million in fourth-quarter 2023, compared to $83.5 million in fourth-quarter 2022. For full-year 2023, segment profit was $307.3 million, compared to $321.3 million in full-year 2022.

Lower fourth-quarter and full-year 2023 segment profit was “primarily driven by higher maintenance expense due to higher repair volume and higher interest expense, partly offset by higher revenues,” according to GATX.

The wholly owned fleet comprised about110,500 cars, including more than 9,300 boxcars, as of Dec. 31. The following fleet statistics and performance discussion exclude the boxcar fleet.

- Fleet utilization was 99.3% at the end of the fourth quarter, compared to 99.3% at the end of the prior quarter and 99.5% at 2022 year-end, GATX said.

- During the fourth quarter, the renewal lease rate change of the GATX Lease Price Index (LPI) was positive 33.5%, compared to positive 33.4% in the prior quarter and positive 24.4% in the fourth quarter of 2022. The average lease renewal term for railcars included in the LPI during the fourth quarter was 65 months, compared to 65 months in the prior quarter and 52 months in the fourth quarter of 2022. The 2023 fourth-quarter renewal success rate was 87.1%, compared to 83.6% in the prior quarter and 85.7% in the fourth quarter of 2022.

Rail International

For fourth-quarter 2023, segment profit was $34.4 million, compared to $18.2 million in fourth-quarter 2022. Full-year segment profit was $113.4 million in 2023, compared to $85.9 million in 2022.

Full-year 2023 results include “a net positive impact of $0.3 million from tax adjustments and other items.” Additionally, 2022 fourth-quarter and full-year results include “net negative impacts of $3.8 million and $14.6 million, respectfully, from tax adjustments and other items.”

Results in 2023 were “favorably impacted by more railcars on lease,” GATX reported.

As of Dec. 31, 2022, GATX Rail Europe’s (GRE) fleet consisted of more than 29,200 cars and utilization was 95.9%, compared to 96.0% at the end of the prior quarter and 99.3% at 2022 year-end.

Portfolio Management

GATX reported segment profit of $31.3 million in fourth-quarter 2023, compared to segment profit of $23.1 million in fourth-quarter 2022.

Fourth-quarter 2023 and 2022 results include “net negative impacts of $2.6 million and $2.8 million, respectively, from tax Adjustments and other items,” GATX reported. Full-year 2023 segment profit was $106.4 million, compared to $14.7 million in 2022. Full-year 2023 and 2022 results include “net negative impacts of $4.0 million and $49.6 million, respectively, from tax adjustments and other items.”

Higher 2023 fourth-quarter and full-year segment profit was “predominately driven by stronger operating performance and higher remarketing income at the Rolls-Royce and Partners Finance affiliates,” according to GATX. “Increased earnings from GATX Engine Leasing, the Company’s wholly owned engine portfolio, also contributed to higher segment profit in 2023.”

2024 Outlook

“For 2024, we expect Rail North America’s segment profit to increase, driven by higher lease revenue as we continue to add new railcars to the fleet and renew expiring leases at higher lease rates across many car types,” said Lyons. “We also anticipate higher segment profit in Rail International due to more railcars on lease at higher lease rates. In Portfolio Management, we anticipate robust demand for aircraft spare engines, which should result in another year of strong earnings from RRPF and our wholly owned engines.

“Over the past several years, GATX has made disciplined investments that position us well for the future, and we will continue to look for opportunities to invest prudently across our global businesses. We remain intensely focused on generating attractive risk-adjusted returns for our shareholders. Based on our current outlook, we expect 2024 earnings to be in the range of $7.30–$7.70 per diluted share, which would represent another strong year for GATX,” Lyons concluded.

More information can be found through GATX Investor Relations.

TD COWEN INSIGHT: ‘Strong Results and Guidance’

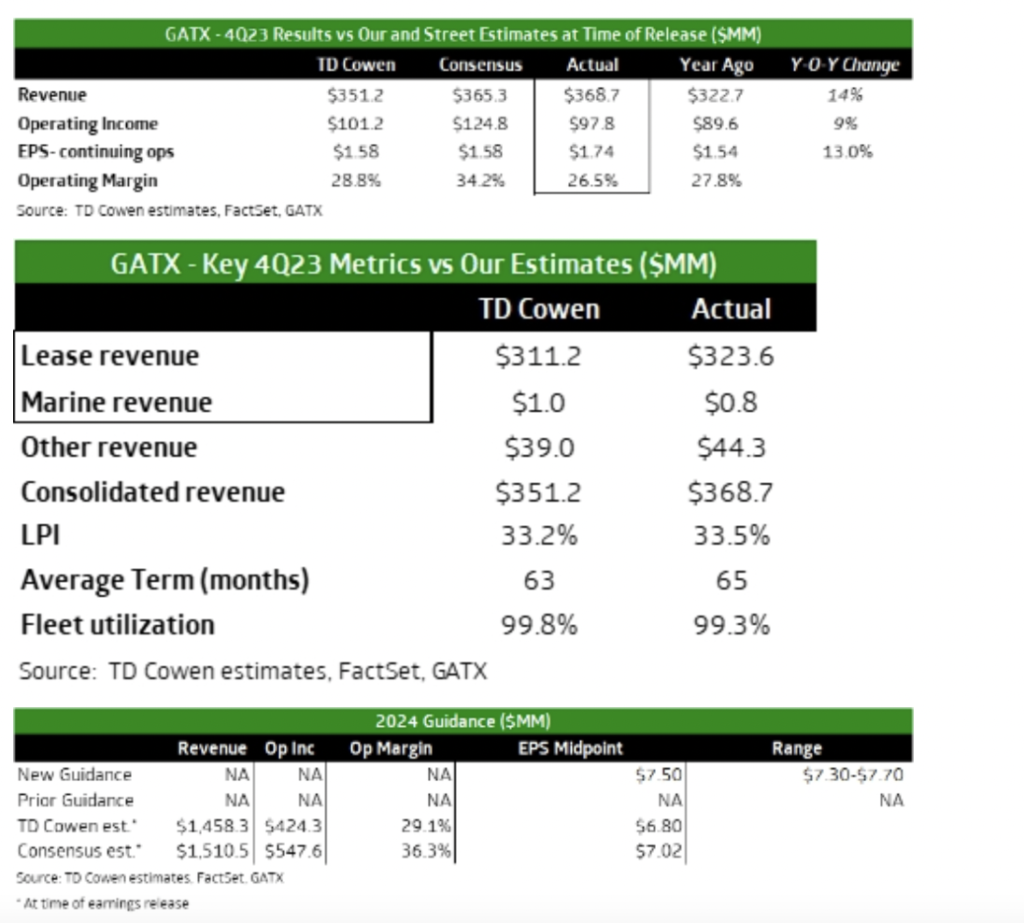

“Utilization, LPI, and terms remained high and renewal success rate improved sequentially. Guidance commentary better than expected, implying 6% growth at the midpoint,” reported TD Cowen OEM Transportation Analyst Matt Elkott.

TD Cowen’s Key Takeaways:

- “FY24 EPS guidance midpoint is $7.50 compared to our estimate of $6.80 and consensus of $7.02. The guidance midpoint implies ~6% growth y/y.

- “FY23 EPS of $7.06 beat our estimate of $6.95 and revenue of $1,411 beat our estimate of $1,393MM as well.

- “The renewal success rate was 87.1% in 4Q23 vs 83.6% in 3Q23 and 85.7% in 4Q22. LPI was 33.5% in 4Q23 vs 33.4% in 3Q23 and 24.4% in 4Q22.

![“This record growth [in fiscal year 2024’s third quarter] is a direct result of our innovative logistic solutions during supply chain disruptions as shippers focus on diversifying their trade lanes,” Port NOLA President and CEO and New Orleans Public Belt (NOPB) CEO Brandy D. Christian said during a May 2 announcement (Port NOLA Photograph)](https://www.railwayage.com/wp-content/uploads/2024/05/portnola-315x168.png)