Cowen: 2Q22 Shipper Surveys Say …

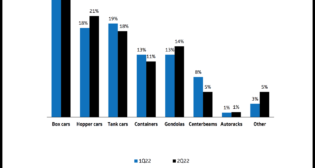

According to Cowen and Company’s recently conducted second-quarter 2022 Rail Equipment and Rail Shipper Surveys, the outlook for railcar orders is positive, and rail shipping rates will continue to increase. Details follow, plus insights on the Class I railroads, ahead of earnings.