USDOT Releases Supply Chain Resiliency Action Plan (Updated)

Written by Marybeth Luczak, Executive Editor

U.S. Secretary of Transportation Pete Buttigieg

The U.S. Department of Transportation on Feb. 24 issued a report laying out steps the federal government, in partnership with Congress, states and private companies, can take to help boost supply chain resiliency across freight transportation modes, including rail.

Following Executive Order 14017, the 141-page Freight and Logistics Supply Chain Assessment report (download below) identifies and addresses current transportation supply chain vulnerabilities and challenges and recommends potential policy responses to “strengthen the resilience of the freight system and reduce impacts from future disruptions,” according to USDOT. It draws on lessons from the Biden Administration’s current efforts—including the Supply Chain Disruptions Task Force’s work to move ports toward 24/7 operations—as well as public and private outreach, with feedback from more than 400 industry, labor and other stakeholders. The report also highlights ways the Administration is leveraging new resources made available though the Bipartisan Infrastructure Law.

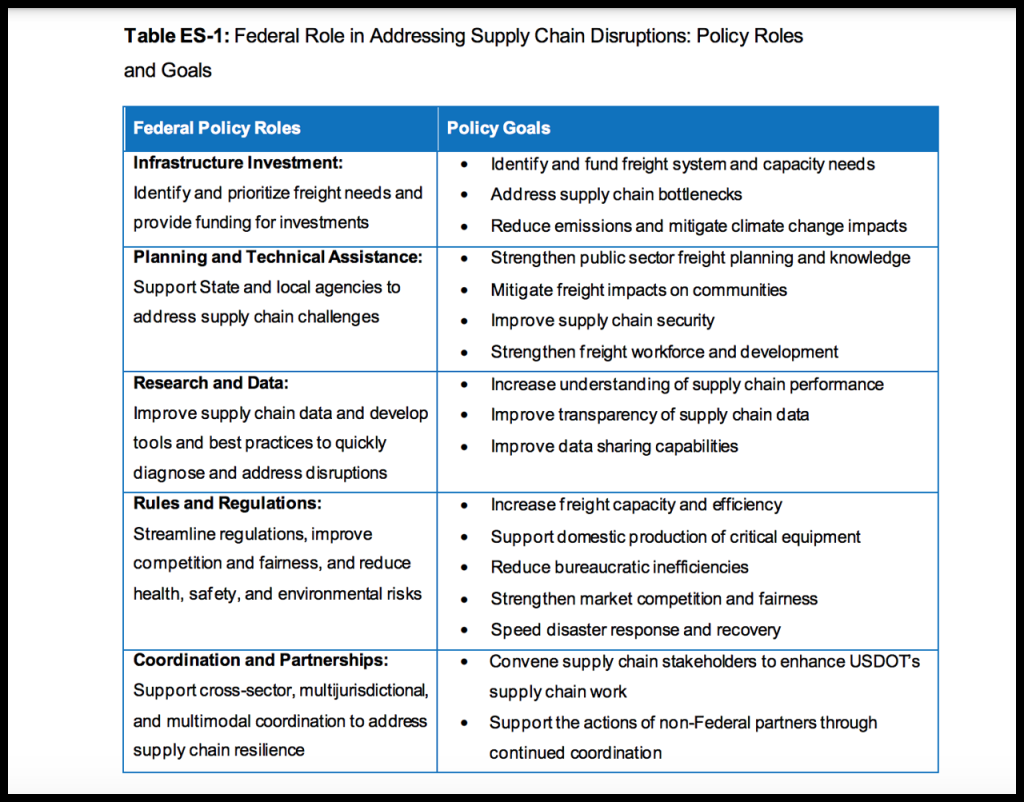

The report’s aim: to guide the USDOT’s work now and in the long term. Its recommended policy actions cover:

• Investing in freight infrastructure, such as ports, bridges and railroads, to enhance capacity and connectivity.

• Providing technical assistance to support the planning and coordination of freight investments and operations, and supporting workers employed in this sector.

• Improving data and research into supply chain performance.

• Strengthening and streamlining governance to improve efficiency, build the workforce, increase competitiveness, and reduce safety and environmental risks.

• Partnering with stakeholders across the supply chain, including coordination with both the public and private sector.

Specifically, the report outlines 62 projects—rated on impact, cost and level of complexity—that USDOT and stakeholders could undertake. Among those related to rail:

• “Use funds provided under the Bipartisan Infrastructure Law (BIL) to invest in projects (including identified projects of national and regional

significance) that support supply chain resilience, promote domestic manufacturing, plan for future growth, and address intermodal and inland storage capacity needs while simultaneously reducing existing

environmental justice issues that freight infrastructure may create on adjacent communities.”

Among such actions:

— “Encourage short line railroads to submit rail bottleneck reduction projects for USDOT discretionary grant programs. Encourage and provide technical assistance to short line railroads to submit rail bottleneck removal projects for consideration under USDOT discretionary funding programs such as the Consolidated Rail Infrastructure and Safety Improvements (CRISI), Infrastructure for Rebuilding America (INFRA), and Rebuilding

American Infrastructure with Sustainability and Equity (RAISE) grants. Short line railroad priority projects include those to ensure short line

railroad infrastructure meets Class I network standards and receives other necessary upgrades to move increased freight volume and reduce bottlenecks on the nation’s rail networks.”

— “Continue to invest in rail projects that will support the nation’s supply chain. Projects that increase rail and container capacity at port facilities, such as increasing and lengthening sidings, support more efficient train movements, ease congestion, and reduce emissions.”

— “Target investment in intermodal freight connectors. Identify funding mechanisms to maintain and improve freight intermodal connectors, particularly those to port and rail facilities. Most of these facilities are locally owned, but regionally important. Many are in poor condition and contribute to performance challenges in first- and last-mile movements.”

— “Work with Class I railroads and short-line railroads to identify planned and proposed rail investments. Understanding how privately operated railroads are planning to make investments in their systems is essential for the U.S. Government to effectively allocate discretionary resources available under the BIL to projects that address multimodal supply chain

issues.”

— “Encourage State DOTs to include in their State Freight Plans all multimodal freight projects that expand intermodal capacity, and not just projects that are proposed to utilize National Highway Freight Program funding. Every State is required to develop a State Freight Plan that identifies key industries and freight needs for the State. These plans should include all planned freight projects and not just projects the State plans to use formula funding to complete.”

• “Coordinate with states, local governments, and port authorities, as well as federal partners such as the Department of Defense, to identify temporary solutions to ease congestion, such as “pop-up” intermodal yards.”

• “Work with Congress to update mandatory response authority for freight data collection. Ask Congress to modify 49 U.S.C. 6313 to require any entity involved in the supply chain (including companies, businesses, institutions, establishments, or organizations) that provides, supports, or consumes freight transportation services and is subject to surveys and censuses

authorized by Title 13, U.S.C. to be included in mandatory reporting.”

• “Invest in and facilitate the use of communications systems to provide visibility into the location of products or next loads for truckers, terminal managers, and/or beneficial cargo owners.”

• “Encourage greater standardization and foster interoperability of data among States and between the multimodal transportation networks and the private sector. Standardized data, end-to-end visibility, security, and privacy are all increasing concerns from supply chain practitioners. Real-time information that can be received, interpreted, and acted on by parties throughout a supply chain allows for efficiencies that can increase effective throughput capacity without new physical infrastructure.”

• “Support deployment of technology to track containers and chassis and coordinate with Customs and Border Protection on data collection efforts.”

• “Partner with Federal and non-Federal partners to collect data that describe flows of major commodities, raw ingredients, and finished products, and identify potential points of disruption, issues in common across sectors, reliance on transportation and other supply chain factors.”

• “Encourage the Surface Transportation Board (STB) to require railroad track owners to provide rights of way to passenger rail and to strengthen their obligations to treat other freight companies fairly.”

• “Promote, incentivize and facilitate alignment of operational hours at warehousing facilities, seaports, rail facilities, and intermodal transfer facilities, and other stakeholders, including labor, to help mitigate congestion. While coordinating with the relevant private stakeholders who control these processes, the federal government should take steps to ensure supply chain efforts align with and advance civil rights compliance.”

• “Harmonize the appropriate roles of the STB, Federal Maritime Commission and DOT with respect to regulating and providing oversight for the freight and logistics industry. Look for opportunities to consolidate relevant authorities to improve transparency, access to data, and standardize reporting, including considering STB regulatory oversight of intermodal freight movements.”

• “Explore standardization of 53-foot marine container sizes for international trade to support more efficient movement of goods.”

• “Improve last-mile access to freight-oriented developments, use of near-dock cargo handling facilities, land-use strategies to support warehousing in appropriate locations, and goods movement integration into Smart Streets/Complete Streets development to increase safety.”

“The Administration’s foresight in calling for this report a year ago is a reflection of our commitment to addressing these [supply chain] disruptions,” USDOT Transportation Secretary Pete Buttigieg wrote in the report’s Foreward. “And the recommendations in this report form a crucial roadmap to help prioritize our investment decisions as we work to implement the historic infrastructure law.

“This report, which reflects feedback from more than 400 industry, labor, and other stakeholders, identifies key policy recommendations across five areas: infrastructure investment, planning and technical assistance, research and data, rules and regulations, and coordination and partnerships. These policy recommendations are meant not only to address the current disruptions, but to help us plan for the future and are designed to stand the test of time, by building modern supply chains that can withstand future disruptions, strengthen our economy, and keep goods moving―affordably―to American families.

“This is not a partisan issue; we all benefit from having food on the table and goods on the shelves. And we all play a role in improving our supply chains. Solving these issues requires a wide range of public and private sector partners. Americans will depend on Congressional action to update our laws and provide funding for needed investments, like those authorized in the Bipartisan Infrastructure Law. Federal, state, and local agencies must design and implement new policies and programs. And private companies and organized labor must work together to find fair solutions and ensure goods make it through each link in our supply chain to reach the places where they are needed most.”

Industry Response

| The Association of American Railroads (AAR) President and CEO Ian Jefferies issued the following statement on the report: “The Biden administration deserves credit for an extensive review of the U.S. supply chain, which by definition is vast and complex. Freight railroads have and will continue to invest large sums of their own capital into the rail system to maintain the nation’s top-rated infrastructure and safely and efficiently serve customers. As we noted to the U.S. Department of Transportation in previous comments, freight railroads operated throughout the pandemic—24/7—weathering the economic downturn without federal assistance. While railroads experienced some challenges in moving goods, many of those were due to external forces discussed in the report, such as workforce and chassis shortages and insufficient warehouse capacity. “The report’s discussion and policy recommendations directed at the U.S. freight rail sector[*], however, raise concerns that powerful special interests are coopting logistics challenges created by the pandemic to obtain below market rates and pad their own profit lines. Make no mistake: the recommendation for federal regulators to impose new economic regulations is at direct odds with the stated goals of this report to increase freight fluidity and would also lead to freight diversion away from railroads that would hinder the White House’s other stated goal of reducing carbon emissions. The current push at the Surface Transportation Board to impose “reciprocal switching” regulation would create inefficiencies, inhibit investment and in turn make rail transportation less competitive. “Freight railroads submitted extensive comments to the DOT’s request for information to help develop this report, so it is unfortunate the report ignores those suggestions and comments and instead focuses on matters that would actually disrupt the fluidity of supply chains. A wide array of stakeholders—including labor, passenger rail, environmentalists and state and local leaders—recently outlined to the STB why economic re-regulation of rail will not improve the network, but instead do little more than appease the rent seeking interests of the chemical sector and its allied shipper interests. The administration should disregard misleading data analysis and heed these real-world concerns to ensure that its policy agenda is consistent with its topline goals to increase freight fluidity, spur investment and reduce the environmental impact of the supply chain.” |

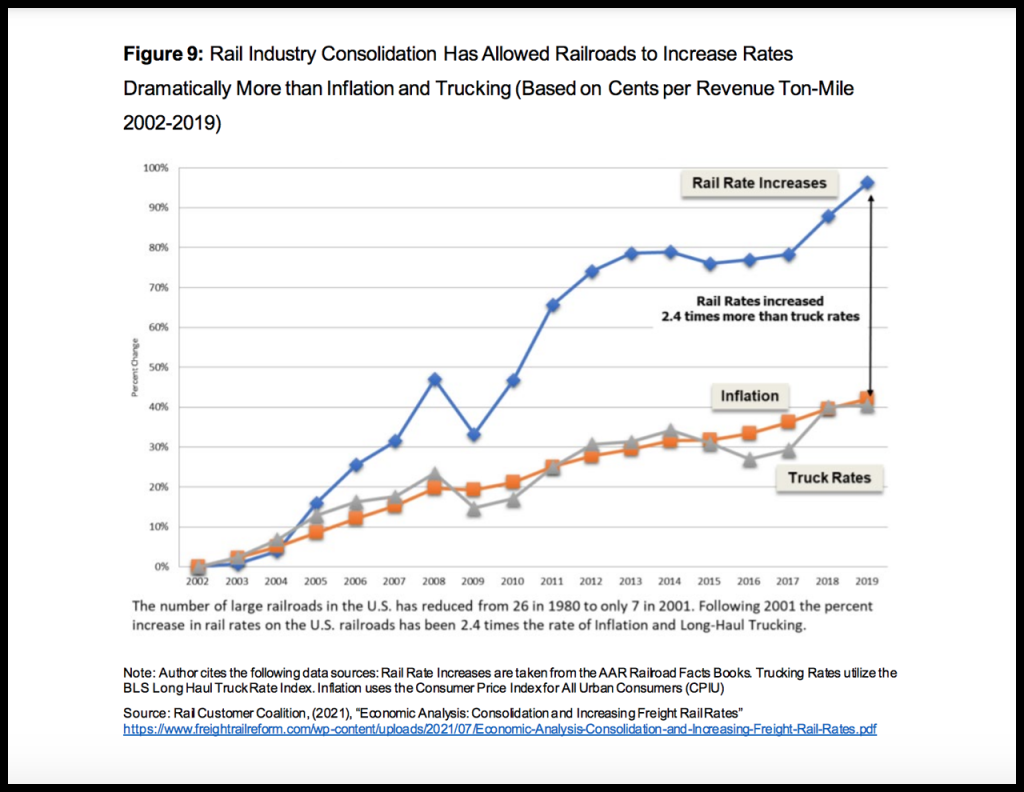

* Editor’s Note: AAR’s Jefferies refers to the following text and chart from the USDOT report. AAR provided it to Railway Age.

On p. 22 (under “2.7 Industry Consolidation”):

“U.S. freight rail has also seen significant consolidation in the past several decades. Congress largely deregulated the rail industry in 1980 under the Staggers Act, due in part to concerns about the long-term economic stability of the 26 Class I railroads that existed at the time. Initially, rail shipping rates dropped quickly. However, subsequent mergers among carriers in the 1980s and 1990s left just seven Class I railroads by 2001. Today, across much of the country, Class I railroads have few competitors within the geographies they serve. One analysis by a rail industry advocacy group indicates that rail shippers are bearing the financial burden of railroad consolidation (Figure 9). Between 2002 and 2019, long-distance trucking rates increased by 40 percent, at a similar rate to economy-wide inflation, while rail rates increased 96 percent, and non-competitive revenue has increased 230 percent on average since 2004.”

On p. 47 (under 3.10 Regulations and Unfair Business Practices):

“Government regulations can play an important role in protecting public safety and the environment and in ensuring fairness for workers and consumers. To the extent that those regulations affect the efficient delivery of freight, the development of new infrastructure, and the adoption of new freight technologies, they may have (often unintended) consequences for freight and logistics system resilience. This observation demonstrates the need to coordinate and weigh those interests from a regulatory perspective. In other cases, existing regulations may need to be strengthened to address competition (such as economic regulation of railroads or ocean carriers) or other marketplace issues that are only revealed when the system is under extreme supply and demand pressures. Due to the patchwork of international, Federal, State, and local authorities, regulatory requirements and policies across modes, sectors, and jurisdictions also may not be aligned, resulting in confusion and delays. In some cases, short-term disruptions may warrant temporary suspension or enhancement of certain policies or regulations until the challenges at hand can be resolved, allowing for a return to the status quo.”