PSR is Floundering. Is There a Silver Bullet? What Are the Next Steps?

Written by Jim Blaze, Contributing Editor

I have lived my life this way …

The rain washed out the tracks …

… ‘Can I find my way back again’?

Yes. With a little help from my friends

Here are my takeaways after considering the holistic context of the Surface Transportation Board’s April 26-27 “Urgent Issues in Freight Rail Service ” hearing. Which party boosted your level of confidence that they had the solution?

While this career-focused investigative reporter considerers the pros and cons offered in Washington D.C., I’m still trying to root for the rail freight growth and recovery success. However, that’s hard to do. The railroads are not making a slam-dunk good case so far. More on that contrast below.

I have been publicly championing the idea of these STB hearings. All of them including the controversial reciprocal switching subject. Many of my colleagues and most of the railroad senior executives are on the other side. They sense a disaster of mega portions from likely STB-decision-mandated outcomes. Having the government politically order operational business changes is what they fear.

I do not sense that outcome at all.

My takeaway from listening to hours of all of the ZOOM-broadcast STB hearing is the opposite. I sense from the STB Commissioners individual and collective questions to those coming before them an opposite vibration. Most acknowledge they, too, are not sure of the role they should play. They inquire of each of the participants in their own body language and questions, “What else could you, the direct role players, be doing? What should we be doing? Tell us please, because you all including the railroads admit to a variety of serious service disruptions that are hammering shippers and receivers, to business model failures that are adding inefficiency and creating more inflationary outcomes to our nation’s railroad output.”

In the hearing room and across the Internet live was the chance to offer specifics that were strategic and worthy of tactics discussion. What I heard were mostly vague suggestions. In my world of a long career in rail economics and rail engineering, the answers back were mostly “sounds of silence.” I find that troubling and embarrassing as a railroad man.

Is the railroad-served economy getting kicked in the teeth? Yes, it is. The evidence presented by those suffering from rail service disruption was obvious in general business terms across multiple commodities. And with a subdued rebuttal, the railroads provided their ongoing song-and-dance series of excuses. I don’t recall any railroad testifying with metrics to bolster their assertion that everything is okay.

The users that depend upon the market-supply side of train and car movement of resources and commodities and various types of manufactured goods that increasingly include more retail items all agreed: Rail freight performance is poor. The railroads admitted that service is stumbling, “challenged.”

On the investor side, folks from Wall Street see the same thing in their alchemy, their deep-black-box accounting interpretations—formulas and graphs they use to watch the railroad corporate valuations and accounting results.

Everyone wants a set of solutions. But solutions offered by whom?

Shippers hope the STB has a magic bullet or two. The STB was certainly attentive, fully alert and engaged as listeners, asking good questions—yet appearing a bit nervous about making some future wrong move as an enforcement play.

Shippers admitted candidly that they are not in the business skills area of knowing how to get locomotives back into service, or train and then reallocate new train crew employees out along the networks. One shipper witness clearly pointed out that figuring out how to move locomotives and crew even that last mile into her plant wasn’t what her schooling and job prepared her to do. Instead, she’s more of a logistician for a specific commodity.

TWO DAYS OF PROBING

The core problems about service failure of PSR—a generalized railroad business model name for service largely now off-schedule and by no means precision delivered—are truly not in dispute among the parties. Clearly, the services provided today by whatever business model the railroads want to call it is badly broken. If not broken, then certainly somewhat crippled—not at the railroad shareholder level, but definitely at the service level.

As a reminder, this review is covering Class I railroads, all seven of them. Not any of the some-600 short lines were cited in this service melee as the source of the problem, although many short lines are hurt since they often deliver or pick up the last-mile/first-mile railcars.

Almost everyone testifying, no matter which party they represented, most often cited these service failures:

- Time failures to switch delivery of (or sometimes pick up) freight cars at the customer’s origin or destination location.

- Railroad crew shortages.

- Bunching of cars ordered or cars delivered, rather than having cars arriving as precisely requested or expected.

- Locomotive shortages.

There are also other manageable factors causing delays. They include:

- Network track structure with PSR trains now way too long to fit into passing sidings.

- Older yards, now with often more than 100-plus-years-old layout and footprints forced to find room for these PSR trains without a reconfiguration of the yard’s track and holding capabilities. Out of sync with today’s PSR favored, very long consists.

Railway Age readers have seen this before. Advance warnings from industrial engineering experts at the NEARS conference in Burlington, Vt. way back in the autumn of 2019 foretold some of these 2022 outcomes. Senior executives from CSX, NS, Union Pacific and BNSF attended that 2019 conference. They heard the warnings and saw the slides. Were they paying attention? Apparently not.

Professor Peter Swan was pretty clear. Railway Age published an October 2019 follow-up.

There was actually a good deal more of such history lessons that should have alerted all the different sectors of the rail freight community. A collective loss of railway service memory?

The Chicago severe winter weather around 2014 was mentioned. The negative impacts are still in the minds of today’s railroad sector generation. But most are too young to remember the previously discovered statistical relationship between railroad assets and service delivered. Here is my “old-timers’” technical view written up about three decades ago, when two different back-to-back megamerger melt downs occurred:

The Union Pacific/Southern Pacific merger saw similar rail failure performance in 1996-1997. This was followed within a few years by the Norfolk Southern and CSX customer service disruptions in the 1999-2001 timeline as they split up Conrail. There are technical reports on both traumatic service failure events.

Two different subject reports are located somewhere in the FRA Office of Policy files—unknown or forgotten by today’s FRA/DOT leadership. Authored by Zeta Tech Associates, they document what went wrong during those megamergers.

Guess what the primary reasons were? Yep, primarily a mixture of crew shortages, locomotive power hiccups and company integration post-merger problems—plus, older selected area and terminal track structure design standards including passing siding lengths. If we combine engineering with economic analysis, we have seen this before.

Translation: if you had certain rail network data, you could pretty well predict future service failures. Yes—almost three decades ago.

The UP/SP report was never publicly released. But it is shared U.S. government agency intellectual property. And the weekly FRA Zeta/Tech/Conrail post acquisition and service issues reports were shared directly with the then-young, new STB agency. All the reports were shared separately with UP, NS, CSX and the then-new Conrail Shared Assets company.

For those identified railroads, the warning signs of today’s 2022 failures were and are part of their current management team’s business history. Why my professional frustration? I was the project manager for both contracted Zeta Tech evaluations.

As railroads, Union Pacific, Norfolk Southern and CSX each had the chance to maintain that experience base as they morphed toward the new PSR model. Somewhere, somehow, there was a generational failure to communicate, to pass on between mentor and student what corporately was an intellectual piece of planning knowledge.

From my long career of examining such business process failures here and abroad, for railroaders or customers and regulators, the most important failure of this PSR-engaged generation is in this check list.

- Every business model pro forma outlook (projection or plan) needs a risk management reserve.

- Think of the reserve as your insurance policy.

- For accidents, it’s a liability reserve set by lawyers and actuaries.

- For service planning and resource allocation budgets, the carrier needs a reserve of crews, by location, and a selected reserve of locomotive power by commodity sectors, set for key lanes and by terminal geography.

I might not expect today’s CEO or Chairman of the Board to always know what those benchmark KPI’s (critical performance index or benchmark practices) are, but I would expect that intelligence to be shared among the Chief Financial, Marketing and Operating officers, and maybe Risk Manager and the head of Human Resources.

Please, all of you impacted: Don’t make this mistake again.

My message to the STB: Any mandated request for updated 2023 rail company service plans need to be vetted along these “reserves” target options. Having the railroads give you just a baseline series of numbers is frankly a bit risky given their performance failure on reserves planning of all types over the past few PSR years.

Harsh criticism? Yes, deserved in my research investigative opinion., and a mistake if I don’t spell that out.

Said less bluntly, we all learn more sometimes from evaluating our mistakes and adapting. Some call this the scientific method. That’s how we mature and improve, because we can stand the hard reviews. Remember that even Professor Swan optimistically believed that “customer benefits might be achieved later.” He refortified that premise at the NEARS 2022 meeting in Baltimore.

Yet, as Chairman Oberman pointed out, the railroads have significantly reduced their collective workforce: “During the past six years, the Class I’s collectively have reduced their workforce by 29%—that is about 45,000 employees cut from the payrolls. In my view, all of this has directly contributed to where we are today.” There is “the run,” the recovery pace hurdle. Without a reserve, and with reluctant return of trained employees, PSR is seriously handicapped.

WHAT OTHER FAILURE/CHALLENGES EVIDENCE IS MISSING?

Multiple shippers testified. I don’t have the space here to summarize each party’s testimony. Instead, allow me to elaborate on a few pros and cons, shortcomings and next-step challenges.

How did the shippers do? I’ll grade their presentations at about a B+. Why not an A grade? Because I am a tough but fair grader. I have some practice at teaching, or at least at mentoring. Here, I believe the shippers and receivers and the associations that often testified for them can step up their evidence game.

Shippers: As rail customers, don’t despair. Here my simple challenge to you: Your well-written statements as to your supply chain damages by the Class I’s failure to perform were descriptive with plenty of impact adjectives. But statistically a bit underwhelming. That’s because you did what railroad managers have over my long career expected to do. You pulled your punches too often. You took the STB and the audience right up to the edge of your dramatic presentation cliff‑and then left them with mostly adjectives and adverbial descriptions of the great harm caused. You failed to nail down your business loss and national economic harm business impact case. This is why I was underwhelmed. Maybe “disappointed” for you is a better assessment term.

You failed to specifically monetize the damages. You can correct that. You identified the broad target of holistic harm—but not the often-devastating party hit, thus, leaving the STB Commissioners to wonder, “Are these thousands of dollars per train harms, or more like thousands of dollars per delivered car harms to the customer market demand side?” That is the cliff hanger.

But it is not too late. Here is a more direct way of helping them visualize the harm to you, and the harm to your customers.

A new car cost maybe $120K or more. The old pre-PSR trips per year might have been 15. The railroads keep telling you you’d eventually benefit from improvements. Computer simulation models I have used in my long career suggested an 8% to 15% or greater utilization from advertised PSR improvements the railroads themselves expected. Not only did that not happen, now you’re getting negative utilization. Your return on freight car investment might be arguably less than 8%. Is that your cost of capital?

The current overall PSR railway returns as calculated on Wall Street for investors is closer to 14% or higher. You need to monetize that difference. Your return on your railcar fleet is below the modeled cost of capital allowed as a target by the STB for the railroad companies. That’s “Looney Tunes economics.” Somebody wake me up—please.

Please, forget the demurrage offset fight for just a moment. Capturing the financial loss of your expected carloads per year improvement (so far, a failure to achieve under PSR as expected) dwarfs any monetized drayage offset you are all seeking. Just a simple spreadsheet should summarize the loss of added annual revenue loads, and the improvement to your cost per owned or leased car and your supply chain warehouse/storage impact costs. As an economist, I’d suggest you upgrade and resubmit your body of evidence based upon the general impact percentage numbers you already have.

Think of it this way: Each added utilization trip you failed to receive represents a lost PSR benefit “damage claim.” Get aggressive. Monetize it as real economic damages against the railroad’s promised delivery and PSR customer benefits. This is your leverage for negotiation as well as for the STB relief you seek.

Example: What would a single day’s inability to supply coal for a day’s power cost a utility plant that right now has a PSR service failure of an only 10 days or fewer coal stockpile on hand? With perhaps as many as 20% of the plant sites for some members in that situation, you can estimate the monetary impact of each day’s revenue and profit loss. You can also estimate the “power loss event probability” change when a plant goes from a 40-day supply to just a ten-day supply. Why not? You have that data inside your organization. That data is the high ground in military terms during this digital age—but only if it’s used.

I’m pretty sure that witness John Ward (Executive Director, National Coal Transportation Association) could take the STB Board and the railroad audience members to an over-the-cliff presentation grabber with that added-value impact metric. Others who testified also could.

This is not a classical rate dispute. It is a new weapon for a service failure fight. The tools are there. Remember that the purpose here is to illuminate with open transparency—subject to cross examination of the argument reasonableness—what the harm calculation is, as a business complaint case.

And for others besides coal, the same logic of monetizing the specifics of business case examples applies. Take the argument and the cost allocation impact numbers “home” in front of this opportune STB audience. Don’t expect them to cement all of the logic together on their own. STB right now lacks the broad staff skills. They need you to help start this investigative approach. Of course, check with your lawyers. I’m an economist, not an attorney.

Like the classic hocket movie line (Miracle, 2004, about the 1980 U.S. Olympic squad), “This is your time.” You decide. How important is rebalancing to you? The expense? A few spreadsheet templates. This is not a $100K added business case preparation effort. Remember your advantage. Internally, each of you at harm’s risk has the internal data to create this pro forma. Think of it. You, not the railroads, have the critical data. Because they know very little about your business logistics.

Again, in military terms, hit the “enemy” with an unexpected superior weapon and attack approach. Play to your database strengths. Chemicals, agriculture and others, get to use this market impact thrust too. It’s not just about coal. Take the level down to the carload and days of inventory value. PSR was advertised to be car-focused rather than train-focused. So, call them out on those analytical terms. Find your leverage and use it.

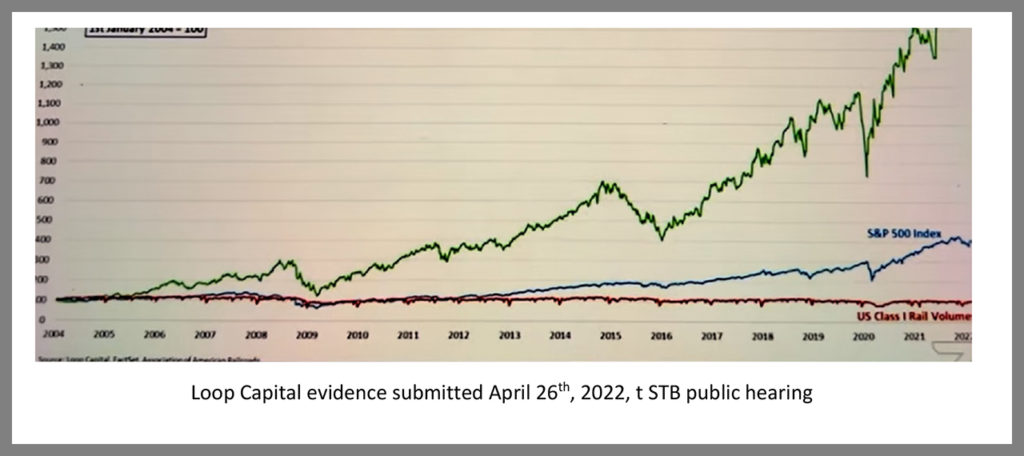

To Wall Street, thanks for the wow moment. Two speakers on April 26 from JP Morgan and Loop Capital Markets really got my attention and analytic juices flowing. Sparked by their slides, here’s my takeaway on the financial review aspects.

These two speakers confirmed that about the longest-range tolerance for waiting for big returns on stocks is about two years. Pushing it beyond three to four years was what I heard as being the current investor waiting maximum. Really? Let’s consider the issue as an engineer with an economics or financial interest.

What I learned from engineering is that most new CAPEX-function-improved investment projects have a service life of 30 to 40 years for railcars, 25 to 40-plus years for locomotives, and about 35 to 50 years for roadbed (track, ties, etc.).Of course, those numbers vary on things like axle loading, L/V wheel contact resultant forces, curved tracks vs. tangent, and even surfacing work per 40 MGTs (million gross tons) per year.

But cutting to the chase, most added or betterment improvement capitalized functions do not have a two- to four-year cycle. Not even close—unless you’re talking about used rail and equipment and residual valuations and amounts not yet depreciated. Then you can calculate shorter return periods. Or you can use the value of train operating time spreadsheets that folks like me create to calculate delay times, cost per train-hour and similar values. Use that data to identify how train delays impact costs, even inside a PSR railroad.

Did you know that a single freight train delay cost per hour ranges from arguably $250 an hour to more than $1,200, depending upon the train characteristics? Such knowledge is a weapon when negotiating for rates, restitution, and even for friendly joint ventures. Learn about the how’s and the why’s, and shippers can negotiate into a higher leveraged discussion with railroad managers. Looking for such engineering-based yet translatable economics is a weapons-enabling process. Focusing solely upon rates can be a strategic mistake.

In my enthusiasm for rebalancing the customer/rail provider debate structure, I digressed. To recover, allow me to introduce the “Blaze Outstanding STB Hearing Award.” Please, humor me.

After reviewing all presenter slides, in my opinion the best slide award goes to Rick Paterson, Managing Director of Loop Capital Markets. Here are the visual keys to his slide graph.

- The green soaring trend line up toward the highest level in the right top corner is the S&P Rail Index.

- The lower, blue upward slope trend line is the S&P 500 Index.

- The period is 2004 to early 2022.

- The lower-level red line identifies a very low U.S. Class I rail volume growth rate, an overall slightly negative slope-per year average. This is an indication of lost market share.

This one image offers a lot to strategically consider, particularly if the extreme upward S&P Rail Index line slop now falters and drops.

I also picked Paterson because of his overall simple but to-the-point answers about the time necessary in practical terms to rebuild rail freight workforce levels. The timeline is a clear “drag factor.” His quick and short answer to the Commissioners about recovery time and investor patience were the economic highlights always to be remembered going forward. How refreshingly direct and simple, yet, causing a shudder in my brain and my heart. Not good new either tactically or strategically.

Takeaway from this: PSR has not taken the railroads onto a slope toward continuous improvement and prosperity. Wall Street is in some ways a betting parlor. So my questions to Paterson and others are these:

- What are the odds at a recovery and a growth in rail out toward 2030 =/> (equal to or greater than) 2.5% or GDP growth per year? Long term buy and hold, like Warren did for BNSF?

- What are the odds that by 2030, the unchanged PSR model takes us to less than a negative 1.5% to negative 2% growth rate by 2035 (period average)?

Stock and railroad debt investors need to at least consider these two different outcomes.

FROM WALL STREET TO WASHINGTON D.C.

Of the honorable STB Commissioners, I ask the following:

What’s your decision criteria about challenging your oversight aspects about the same long-term year-2035 target, given those two above railroad freight growth outcomes?

What does the command-and-control investor position and returns expectations (if true as presented before you) mean to the national good we all expected to receive from the railroad sector? How does this change your role, if at all? Do you require new legislative direction from Congress? Or are you comfortable with your present tools and authority?

If you see at a high confidence level that rail traffic’s share will continue to be negative, then how might that rail participation drop impact the choices you make this year, for this changing calculated national good? For the customers?

Ladies and gentlemen of the jury (and judgment), you have a very tough policy and ruling task before you. In your favor, I see you have been asking penetrating questions. I hear in your voices and see in your eyes “concern” and admitted uncertainty. I for one applaud your intellectual courage. You collectively are different than the Commissioners I have seen before. Good luck.

Here is the part where I offer my experience-based suggestions as you all search for a balanced set of changes to at least test.

First, a disclosure: I own no railroad or trucking or other competitive-mode freight carrier shares. Yet emotionally, I’d like the railroads to grow at least in market relevance if not actual volume share. Railway Age readers by now pretty well know the basis upon which I judge the contrarian SWOT aspects of railways: Strengths and Weaknesses in line with Opportunities & Threats

As a reminder, I was a “fed” with USRA, challenged to recuse somehow the seven failing bankrupt railways in the 1970s that eventually became Conrail, Declared by the courts as un-reorganizable on conventional financial grounds. I feel your uncertainty today. But if not you, then who?

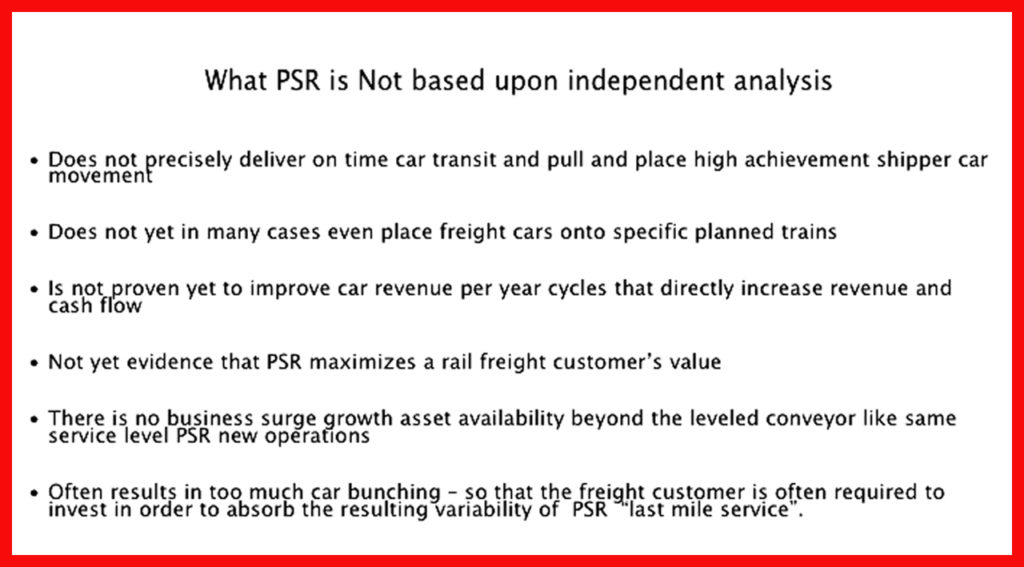

Take the leadership challenge. Start with a simple check, a simple question with a yes or no answer: Did the railroad literature that promoted PSR customer benefits deliver?

This is what the railroads have published as PSR promises that their shippers could expect: Expect a more accurate transportation plan and consistent rail service, better meeting your customers’ expectations and reducing supply chain variability, because of better PSR shipper reliability. PSR will improve the utilization of your railcars, and your other assets. PSR will deliver to you reduced transit times. PSR managers will now follow the cars’ productivity rather than just the trains. This is taken right off a still-active, never-retracted Class I railroad PSR internet-promoted marketing campaign.

STB Commissioners: Now, everyone’s anticipating some kind of oversight action on your part. There is no place to hide.

As well, here is a suggestion about executing a faster T&E labor recovery, where you as the STB might play an integrating role among several players. It’s just an idea to be explored:

In your position, I’d turn to those that in the past answered a similar emergency call. The old-timers would have backfilled ASAP at bonus payments for at least a short-term hire-back to those with the necessary critical T&E skills most recently fired and thus still typically “territory and safety procedures qualified.” How? Offer them relocation and tax avoidance compensation to return urgently back to work if the execution hurdles prove to be a problem under Railroad Retirement procedures or under FRA safety guidelines and oversight procedures.

I’d use a message like “Please come back to help your old customers. They need you.” That actually might key folks up faster than overcoming the pain of previous quick corporate rejection in recent years. It’s not about “helping the railroad that might have unfairly axed you.”

In this case, the STB might have to plead the case with FRA for refresher training waivers and with Treasury for any tax penalty waivers for a public emergency

Class I railroads: Your advertising and promotions primarily fed your investors, both debt and equity. There is nothing illegal or unethical here, but for too long you seemed to ignore evidence from your own operational simulations groups and from published technical literature as to what the shipper benefits might actually turn out to be (or not to be) and how to get them without disrupting shareholder returns. Those very few of you who honestly publish trip performance scorecards have shown two important things. First, you did start to improve delivery satisfaction from the low- to mid-60% of the carload movement times toward a high-70% to low-80% on-time range.

BRAVO! But there has been no continuous quality improvement. You have slipped back into a more-pedestrian 25% to 30% or higher failure to deliver cars on time. Here is the likely litmus test: Your own operational research assessment staffs would acknowledge that carload best-of-class expected performance should be in the 88% to maybe 94% range. That should be your carload target.

Intermodal performance would be higher. Conrail’s historic benchmark for intermodal of 98%-plus for premium UPS service is the mark to match, if not beat. CSX and NS, you have Conrail’s corporate genes. “No excuses accepted” is my challenge to your generation.

During the STB testimony, none of the Class I railroad executives—only one of whom, Jim Foote of CSX, was a CEO, which STB Member Robert Primus said was “disappointing and disheartening,” a possible indication that “they’re not taking this seriously”—denied the failures. There were railroad exhibits suggesting small graduating classes of new hires. But not one railroad suggested that the Wall Street observers’ expected up-to-18-month practical workforce recovery timeline was wrong. Before the STB makes any judgment, the nature of openness in this proceeding suggests that the critical component of any Class I work plan comes down to the reserves level that a Board of Directors will accept in management’s annual and quarterly plan. Please, candidly reveal your reserve calculations. Rebuild your credibility at the technical level. That should be your immediate recovery plan. You are continuing to lose market share as shippers and receivers shift to the highways. You never denied this during the STB hearings, did you?

PSR hasn’t yet proven its future business case shift mode. As evaluated by others like Oliver Wyman, you—the Class I’s—since 2006 have had a near-120-million train-miles of annual freight capacity upon which to grow traffic volume and market share. But there was zero evidence given to the STB that you are getting the “pivot to growth” job done.

During the next few weeks, how would you bolster your business case? Will you even consider doing that, with evidence, rather than just bold assertions? Show us the pro formas. Experienced strategic planning hands like me know you have them as worst-to-best cases. This is a chanced to reclaim the credibility high ground. Will you seize this moment?

Shippers and Receivers: You are so close to slam-dunking your business harm case. You have so far provided data pieces that are fundamental building blocks of the modern-age digital message business case. Those volumes you can turn into supply chain metrics. Those data metrics are the building blocks to create simple spreadsheets of the most critical values (Key Performance Indicators, KPIs, in business language). The next-level report with your collection of KPIs, laid out in a nice and simple visual way, allows you to see internally in this case how well or poorly the railroad is doing—and what you were expecting as the benchmark best practice deliver PSR on-time car performance.

Ask yourself and the STB: Will you be satisfied moving from about 75% on-time same-day carload last-mile placement to at best maybe 88% to 94%? Do you have any confidence you can get to where you need with your primary carrier?

From those KPI index and best-of-class targets, calculate a simple spreadsheet of dollars per impact numbers as your new STB exhibit. That’s your pro forma benefit vs. corporate loss basis. This is not hard to do. Will you? Or will you instead ride out the hand you delivered with adverbs and adjective descriptors? What simple monetized impact enhancements would bolster your case? This not too complex. You just have to engage the national economic impact direct role interest of the Commissioners. I heard them asking you for it. Will you deliver the answers?

To the Board of Directors at each PSR Class I: You each have a personal stake in these hearings. Failures have been occurring during your watch. That doesn’t reflect well on your CV. And it’s pretty easy for the world to identify you. You might consider stepping up your collective role in discovering a balanced solution.

Boards don’t just represent shareholders. There is a whole culture involving your employees and core customers affected by decisions over which you have the primary broad oversight mission role. It only takes a simple majority or perhaps just a hard charging few on a Board to get the three to maybe five senior executives of a PSR railroad’s insiders group’s attention. Leading change doesn’t require outside corporate raiders like hedge funds and other “activist” investors. In short, what is your legacy going to be regarding PSR? Assume that you do care, who among you might have the courage and statesmanship, the love of railroading, to speak up?

Independent railway economist and Railway Age Contributing Editor Jim Blaze has been in the railroad industry for more than 40 years. Trained in logistics, he served seven years with the Illinois DOT as a Chicago long-range freight planner and almost two years with the USRA technical staff in Washington, D.C. Jim then spent 21 years with Conrail in cross-functional strategic roles from branch line economics to mergers, IT, logistics, and corporate change. He followed this with 20 years of international consulting at rail engineering firm Zeta-Tech Associated. Jim is a Magna Cum Laude Graduate of St Anselm’s College with a master’s degree from the University of Chicago. Married with six children, he lives outside of Philadelphia. “This column reflects my continued passion for the future of railroading as a competitive industry,” says Jim. “Only by occasionally challenging our institutions can we probe for better quality and performance. My opinions are my own, independent of Railway Age. As always, contrary business opinions are welcome.”