CP Rio Grande to Acquire SLRG Assets

Written by Marybeth Luczak, Executive Editor

Colorado Pacific Rio Grande Railroad (CP Rio Grande) filed a verified notice of exemption to acquire and operate the approximately 149-mile San Luis & Rio Grande Railroad (SLRG) in Colorado, according to the Surface Transportation Board (STB), which on Jan. 5 reported the transaction could be consummated on or after Jan. 19, 2023.

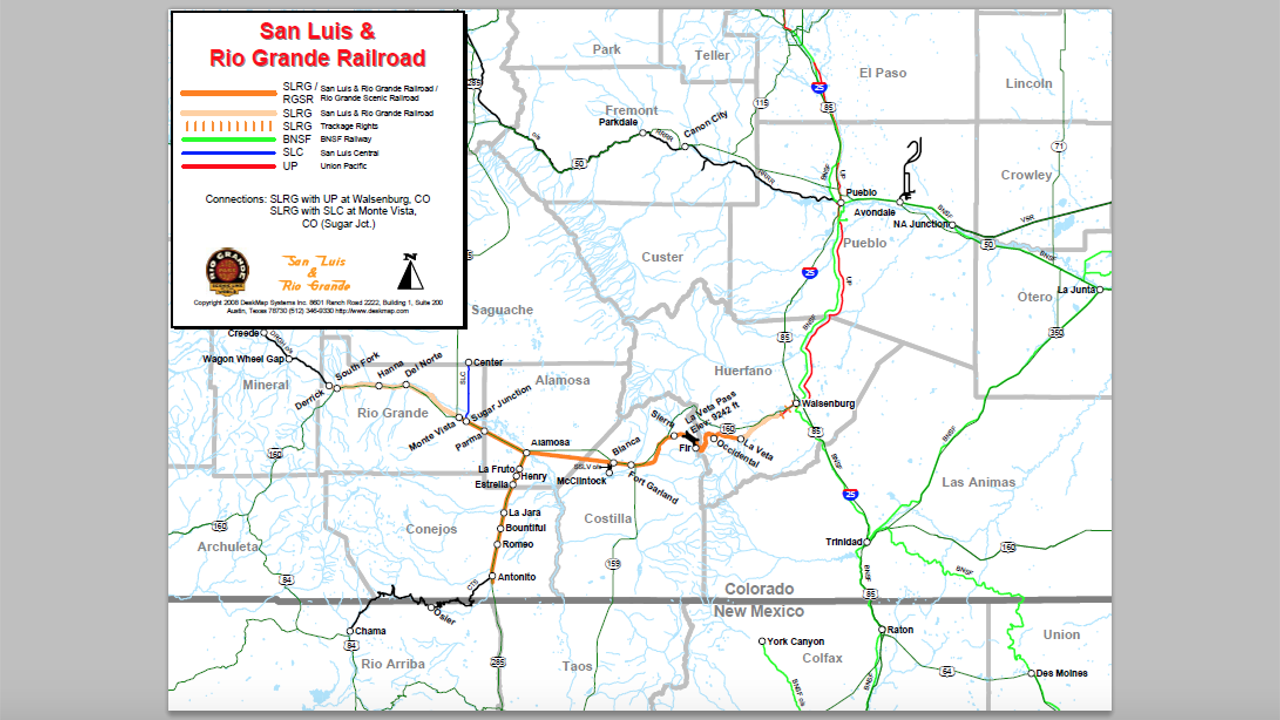

Not only will CP Rio Grande acquire approximately 119 miles of track between Derrick and Walsenburg (Alamosa Subdivision), some 30 miles of track between Alamosa and Antonito (Antonito Subdivision), and other assets, but also incidental trackage rights conveyed to SLRG by Union Pacific (UP) in the vicinity of Walsenburg, STB reported. (See STB decision below).

According to the verified notice, “the proposed transaction is the culmination of involuntary Chapter 11 bankruptcy proceedings before the United States Bankruptcy Court for the District of Colorado,” STB reported. “The verified notice states that, on November 17, 2022, KCVN LLC (KCVN) was the successful bidder at auction for substantially all the assets of SLRG, and an Asset Purchase Agreement was executed between SLRG and KCVN ‘or its permitted assignee.’ The verified notice further states that the Bankruptcy Court approved the sale to KCVN or its permitted assignee … on November 29, 2022. According to the verified notice, on December 19, 2022, KCVN assigned all of its rights in the Asset Purchase Agreement to CP Rio Grande**.”

Also interested in SLRG was OmniTRAX, which on Oct. 12, 2022, reported entering into a contract to purchase out of bankruptcy the assets of SLRG. The acquisition would have marked its 26th rail operation.

“After we announced our intent to purchase the San Luis and Rio Grande Railroad, additional parties came forward and expressed interest in the railroad,” OmniTRAX told Railway Age on Jan. 6. “The sale of this road ultimately went to auction where we were not the highest bidder.”

William A. Brandt Jr., SLRG’s Chapter 11 trustee, told the Valley Courier in September 2022 that a deal for the railroad’s sale to OmniTRAX “has been reached in principle, but the deal is still being negotiated.” According to the newspaper, the short line holding company’s offer was $5.75 million, but about $4 million would need to be spent paying back taxes. In June 2022, Brandt first reported his intention to sell substantially all SLRG assets via auction.

Serving the San Luis Valley in southern Colorado, SLRG was established in 1870. It traverses the La Veta Pass over the Sangre de Cristo Mountain range, and connects the eastern plains of Colorado to the San Luis Valley. SLRG hauls industrial, mineral and agricultural commodities, and maintains railcar storage facilities along its right-of-way with a storage capacity of more than 3,100 cars. Prior to the bankruptcy filing, it also operated passenger excursion trains over the La Veta Pass at an elevation of 9,400 feet.

STB wrote in its Jan. 5 decision that CP Rio Grande certifies that its projected annual revenues from the SLRG acquisition “will not exceed $5 million and will not result in CP Rio Grande becoming a Class II or Class I rail carrier. CP Rio Grande further certifies that the transaction involves an interchange commitment that would limit future interchange with a third-party carrier other than UP in Walsenburg Yard, and CP Rio Grande has provided additional information regarding the interchange commitment as required by 49 C.F.R. § 1150.33(h).”

** STB on Jan. 5 reported that “KCVN is the parent company of Colorado Pacific Railroad, LLC (CRX), a Class III carrier. CP Rio Grande is an independent entity that is not owned or controlled by KCVN. According to the verified notice, the intention is for CP Rio Grande to continue the operations of the SLRG separate and apart from KCVN and CRX.”