Crosstie Market Outlook

Written by Marybeth Luczak, Executive Editor

Pictured: Specialty Southern Yellow Pine bridge timbers (Dense Select Structural Grade, Kiln Dried to 25% MC) from Gross & Janes Company.

RAILWAY AGE, APRIL 2022 ISSUE: Suppliers cover today’s often challenging crosstie market—from the latest products, treatments and tools to sustainability and end-of-life planning.

While the crosstie industry faces continued pandemic- and weather-related supply chain challenges, 2021’s passage of the Infrastructure Investment and Jobs Act (IIJA) offers encouragement. To find out the impacts on projects for 2022 and beyond, Railway Age turned to the Railway Tie Association (RTA) and suppliers, which also provided a market outlook and the latest on products, treatments and tools.

RTA

RTA is forecasting the purchase of 18.669 million new wood crossties in 2022, comprising 14.230 million by the Class I railroads and 4.439 million by smaller markets. This is up 1.9% from 2021, when a total of 18.326 million crossties were purchased by Class I’s (14.230 million) and smaller markets (4.096 million).

RTA expects 2023 will see a 2.0% boost from 2022 estimates, with the purchase of 19.046 million ties, including 14.603 million by the Class I’s and 4.444 million by the smaller markets.

Wood maintains a 93%-plus market share for ties installed in North America, according to RTA, with concrete and steel and/or plastic/composite ties having about 6.5% and 0.5% shares, respectively.

RTA Executive Director Nathan E. Irby outlined the 2022 crosstie outlook for Railway Age. “Wood crosstie primary production is marginalized due to commodity pressures, labor inconsistencies, machinery/equipment (supply chain) shortages, Canadian tariffs, rising fuel prices and weather (seasonality) issues,” he reported. “To qualify each would require a dissertation, but the focal points are commodity pressure and shortages. Hardwood lumber for solid-wood flooring and pallet stock saw such high swings in pricing starting Q4 2020, and are just now showing signs of plateauing; they dominated sawmill production and left many crosstie purchasers wanting more for well over a year now. The pandemic-related supply chain shortages and labor inconsistencies continue to plague many sawmill producers to run efficient and full shifts. Raw material (log) supply is fair-to-good for most sawmills right now, but spring rains/bottomland flooding will likely cause some disruption in flow, albeit those being normal challenges.

“In summary, I see no significant increase in wood crosstie primary production in calendar-year 2022, yet I postulate there will be enough to go around. One factor keeping us from falling into a dreaded tie shortage is the end user, i.e. railroads. They are having some of the same labor inconsistencies/supply chain shortages (not to mention record-level inflation that may alter/lower capital budgets for the immediate future) and may not need as many ties because they simply cannot get them installed into track.”

As for IIJA’s impact with more federal dollars available for railroad infrastructure programs, Irby said that it will “certainly assist in providing some much-needed funding for maintenance of rail systems in various capacities, especially those that have been on the backburner for some time. Chuck Baker, President of the American Short Line and Regional Railroad Association, is actively connecting/observing municipalities and short line and regional railroads co-funding projects in piecemeal fashion that will get a host of things accomplished to improve rail systems in towns/cities and industrial leads.

“As for the Class I’s, they are keeping that information closely guarded for now, and as aforementioned, they are bearing their own burdens despite potential dollars available in the far future. As wood crosstie production hopefully realizes gains as other commodities soften and labor becomes more consistent, normalization of supply/demand is expected and much welcomed. That might catalyze a slight boost in above-normal annual demand due to railroad funding and their ability to act.”

Irby told Railway Age while railroad wood crosstie replacement programs (annualized) “are mostly flat from year to year with a variance, in general, of only a couple hundred thousand year to year, for main line track ties, yard ties and industrial leads,” bridge, road crossing panels and specialty ties “are in a near-constant state of high demand due to the low number of producers able to perform such tasks.”

This has accelerated recently, Irby reported, “due to a larger wood crosstie treater on the West Coast closing its doors and further shortening the list of approved suppliers the railroads can use. So, shrunken supply of switch-machine, signal ties, turnouts, and bridge timber producers, plus more roads seeking slightly increased demand for engineered wood products for such—compared with solid-sawn products—are all factors contributing to higher demand. Those suppliers with the ability to elevate and custom-machine wood into small-batch orders for bridges and road crossings will be busy for the foreseeable future.”

Irby said that research and development “is centered around extending tie service life in track.” RTA’s ongoing—since 2008—and collaborative industry research projects are monitoring crosstie treatment performance.

Railroads, too, are engaged in R&D. Irby reported they are:

• “Exploring crosstie railcar-type alterations to reduce human exposure during unloading at trackside.

• “Conducting small-scale, RFID tagging of individual crossties to track treatment, wood species performance, etc.

• “Employing track/crosstie mobile inspection vehicles that ride the rails and x-ray system components for wear and vulnerability.

• “Performing remedial treatments of high-value bridge and road crossings with pastes, plugs, rods, and combinations of each with secondary preservative delivery methods to extend service life of ties/timbers already in place.”

As for crosstie disposal, Irby explained that “the fundamental value proposition comes to play, as the age-old challenges of supply/demand, environmental regulations and chain-of-custody prevail.” Railroads’ two main options for used crosstie disposal are landfilling or grinding for cogeneration. “On the R&D side of the spectrum, many are working on the capture of the carbon content of wood and improving how used ties are processed to separate the preservatives from the wood,” Irby said. “Therein lies some potential harmony of lowering the environmental impact and a gain of a value-added product, but the extent of each and the embodied energy costs associated with them keep revealing ‘bad math’ until, perhaps, some new technology will emerge to right the equation. Environmental regulation will ultimately steer the outcome of used ties and how many go to where, and how quickly that has to happen.”

ARXADA (FORMERLY LONZA WOOD PROTECTION)

In 2021, Lonza Wood Protection was purchased by a private equity firm and branded as Arxada. The company is seeing high demand for all types of wood products, from paper to lumber to ties to poles, Industrial Specialist Tim Carey told Railway Age. “That demand is causing supply issues much like we have seen in other industries. On a positive note, even though wood products are sought with greater urgency than in the past, the supply is solid, and they are still a good value for all applications, including ties. Long term, we look to see a continued growth in the supply and use of treated wood products.”

Current Arxada projects include “maximizing treating efficiency and the supply of product for treated wood suppliers,” Carey reported. “We continue to monitor the performance of our Chemonite® ACZA and Chemonite® ACZA plus Borate ties as well as our creo-borate ties treated with our borate additive.”

Ties treated with Chemonite® ACZA continue to perform well, he said, “even in an environment in Southwest Florida that is so harsh that well-treated creosote ties only last five to seven years. Our last inspections of the Chemonite® ACZA ties were at eight years and they were still performing well.”

ENCORE RAIL SYSTEMS INC.

At Encore, customers continue to ask for quality, reliability and increased safety, according to Nick Delmonico, Director of Sales and Marketing. “Our ride-on equipment continues to be the safest tie plugging equipment on the market,” he told Railway Age. With continual upgrades, the company’s equipment maintains higher uptimes, resulting in greater reliability, he added.

Also important to customers: in-stock products. While the “supply chain has affected us all,” Delmonico said, “Encore has been able to leverage suppliers to ensure that our machine parts and EnduraPlug tie-plugging compound is in stock and ready to ship.” This is critical as railroad maintenance is up, with more work to come as spring approaches, he noted.

A new customer for Encore is CSX, which recently leased an Encore Ride-On Tie Plugging Machine.

What’s new in terms of R&D? The company is currently working on technology advancements to “better service our customers and allow for easier maintenance of our machines,” Delmonico reported. “More to come on this as we progress.”

FTS TOOLS LLC

In February 2022, Focused Technology Solutions Inc., a Marmon/Berkshire Hathaway company, agreed to a sales licensing deal with FTS Tools LLC. It has licensed the patents and trade marks of its battery-operated, railroad maintenance-of-way (m/w) tool line to FTS Tools LLC, a new company based in Lynchburg, Va., which will manufacture, distribute and sell the licensed products under the same brand. (Berkshire Hathaway does not own FTS Tools.) Hackettstown, N.J.-based Focused Technology Solutions will concentrate on product development.

FTS Tools LLC President Van Fry told Railway Age that it is “hard to keep our battery-operated tools on the shelf, especially with the high oil and gas prices. We are seeing an even faster push to go from the road and onto the rails. And with the hi-rail traffic, work crews can get on and off the tracks quicker with battery-operated tools as opposed to hydraulics tools.” The long-term outlook is strong, he said, “especially since Class I’s are looking to mandate the move to battery-operated tools.” Federal grants, he noted, will only enhance the progress of these tools.

The company has signed major contracts with two large transit agencies to outfit their crews and trucks with battery-operated tools, and Fry noted that several initiatives are in the pipeline. “We will be coming out with a few new developments,” including EclipEase and a “unique measuring device for rail,” he said.

GROSS & JANES COMPANY

Strong crosstie and switch tie demand will continue well into the next two years, Gross & Janes Company President Bill Behan told Railway Age. It will be fueled by infrastructure needs and lower overall production of crossties. “As an industry, we have not resumed pre-pandemic levels of production,” he said. “This short-fall continues today and may become a ‘new normal.’”

The company is currently working to improve its back-office procurement and payment process. “This includes same-day payment via ACH to sawmill providers and real-time inventory accounting,” Behan said. “To date, 96% of all crosstie purchases in seven U.S. States are paid via this new method.”

KOPPERS INC.

While 2021 saw record pricing and demand for hardwood lumber products, such as residential flooring and pallets, making it challenging for treaters to procure green ties, Koppers is seeing improvement heading into 2022, according to Melissa Skoko, Director of Marketing, Railroad Products and Services. “Lumber price, we believe, has peaked, and that should help us to be able to procure more ties,” she told Railway Age.

Skoko reported that creosote supply is expected to be tight, however. “The primary raw material that creosote is produced from is coal tar, a byproduct of the coking process in the steel industry,” she explained. “As the steel industry adds new capacity or replaces capacity, it is switching to a different technology—electric arc furnace—which does not use coke. Therefore, coal tar is projected to be in a limited supply, which means the supply of coal tar, and therefore creosote, will become challenging.” Koppers, however, produces creosote internally, so “we are really uniquely positioned to help maintain surety of supply,” she said.

Koppers is currently boosting capacity at its North Little Rock, Ark., tie treating facility, where it is transitioning to a new set of cylinders. The new equipment is expected to be operational by the end of the year.

NARSTCO

Senior Director of Sales and Marketing Matt Violin told Railway Age that NARSTCO continues to see “steady growth and acceptance” of steel ties and turnouts in North America. “Many customers are realizing the benefits of building their track with steel ties based on reduced ballast volumes, product availability, faster track construction and the use of recycled U.S. steel,” he reported. “Companies and project teams continue to push the importance of sustainability in their decision-making process, and many have recognized NARSTCO steel ties and turnouts as a perfect fit to support this initiative.”

Additionally, the company is seeing growth in projects supporting the petrochemical industry. “Port and intermodal growth will continue to be an area of focus for NARSTCO, especially with the emphasis on improving supply chains,” Violin said. “The North American automotive and steel industries are also poised for rapid growth with demand at an all-time high. We are also seeing an uptick in track rehabilitation projects for Class Is, short lines and private-industry track, where aging wood tie and turnout infrastructure is being replaced with long-lasting steel ties and turnouts. Lastly, transit projects continue to expand their operations and coverage with new maintenance facilities and layover yards, which are a perfect fit for steel ties in some areas.”

NARSTCO’s most recent development is an improved steel tie for concrete-encased track installations. “Many warehouses, terminals and car shops are designing concrete-encased track and incorporating this design into their standards,” Violin reported.

NISUS CORPORATION

Demand for Nisus’ QNAP copper naphthenate and Cellutreat liquid borate is up for 2022, according to Ken Laughlin, Divisional Vice President, Wood Preservation, who says continued growth in the railroad market is expected. Even though sawmill production has not increased, he told Railway Age, “housing continues with dramatic growth. Railroads will most likely be increasing m/w spending with the increase in funding from IIJA. Hopefully, the sawmills will be able to get the logs they need and keep pace with demand.

“The long-term outlook is excellent [for Nisus]. Our BTX treatment product is increasing every day, and we are seeing volumes increasing in the utility pole market.” Short-term, the company is concerned with the price of diesel fuel and “how it will affect both the railroads and our treaters,” Laughlin said.

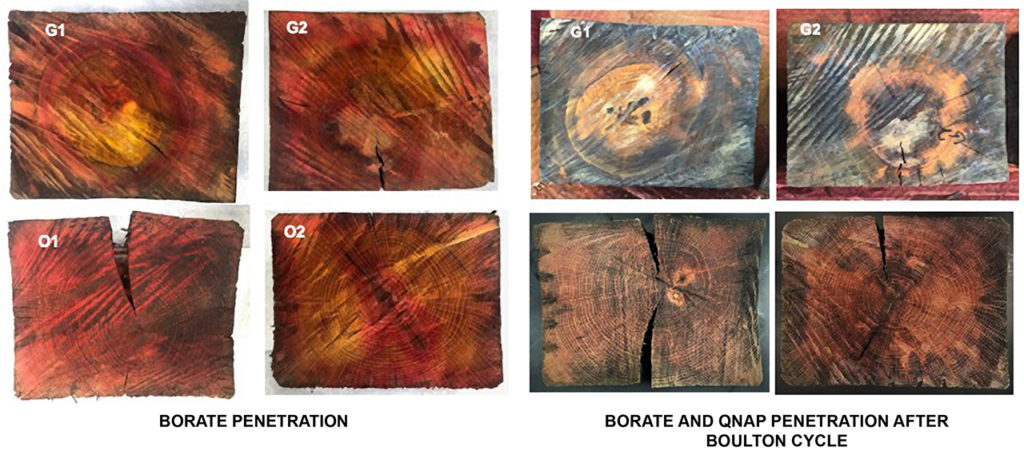

What are customers asking for? “BTX treatment for bridge ties is by far our most requested product,” Laughlin reported. “The ability to dual-treat green bridge ties enables railroads to get the same protection they do for dual-treated crossties. Most Class I railroads are specifying QNAP copper naphthenate on all their bridge ties.”

Nisus continues to test an accelerated diffusion process “to enable the borate treatment of crossing timbers and switch ties, helping to extend the life of those products,” Laughlin said. Additionally, it has been researching, extracting and reusing preservatives from ties at end of life. “We have also conducted promising research on tie degradation and gasification, which produces energy by superheating ties without oxygen,” he said.

STELLA-JONES CORPORATION

“At Stella-Jones, we are facing the same challenges as most industrial markets in the U.S. post COVID-19,” Vice President, Railway Tie Marketing George Caric told Railway Age. “We have labor shortages affecting our plant production [and] operating costs increases due to higher prices being paid for green crossties and all the components needed to produce crossties. The good news is that the demand for our products is very strong. This is due to the demand for rail transportation, which is fueling growth projects, as well as plenty of grant money being made available to regional and short line customers to promote infrastructure improvements.

“We have seen a decline in crosstie production due to the same issues facing all industries in 2022: shortage of workers, higher fuel prices, and, in our industry, record storms and bad weather across our tie production regions.”

Areas of demand, Caric said, are “bridge ties, as the railroads have started to focus on the conditions of their bridges,” and “Borate-treated ties to extend the life of the tie.”

TIETEK GLOBAL LLC

Demand remains strong for TieTek Global’s engineered polymer composite crossties, switch ties, bridge ties, crossing ties and custom profiles, according to President Linda Thomas, and the company continues to increase production capacity. TieTek’s crossties, she said, “demonstrate strong performance and extended service life in high-decay areas and severe environments such as tunnels, bridges, bridge approaches and grade crossings.”

Long term, TieTek composite tie usage will grow “substantially year-over-year as our customer base realizes the true value of purchasing and installing a sustainable composite tie with exponential tie life compared with alternative products with higher life-cycle costs,” she told Railway Age. “TieTek ties can be interspersed with treated wood ties using standard production equipment or installed in new construction to reduce and eventually eliminate on-going tie replacement costs. TieTek ties, which are manufactured using 80% high-grade recycled materials, are recyclable if mechanically damaged or at the end of their useful life. This helps companies address corporate sustainability goals.”

VOESTALPINE RAILWAY SYSTEMS NORTRAK

“The Class I railroads added significant infrastructure prior to 2017, resulting in considerable latent capacity compared with current traffic levels,” John Stout, Vice President of Rail Fixation Systems, told Railway Age. “While Nortrak doesn’t expect many new expansion projects, the company is seeing an increase in orders for its concrete Keyway Tie from railroads looking to inject the benefits of concrete into wood tie territory. In the longer term, especially in the transit segment, Nortrak expects a modest recovery in crosstie demand driven by the infrastructure bill, beginning later in 2023.”

Customers regularly request cost-effective products with shorter lead times and consistent on-time deliveries, Stout reported, noting that more recently, shareholders and the public have been insisting that they ensure sustainability as well. “Nortrak has addressed the first request by establishing a vertically integrated supply chain including various machining centers and trackwork plants, but also including its own domestic manganese and ductile iron foundry in Decatur, Ill., with plastics molding for rail pads and insulators, along with a dedicated concrete products factory in Cheyenne, Wyo.,” Stout said. “In the past year, Nortrak has addressed the second request by certifying all its operating facilities to [environmental management standard] ISO 14001:2015.”

The company is currently providing turnouts, crossovers, double crossovers, crossings and slip switches on concrete ties and direct fixation for the Los Angeles (Calif.) Division 20 project. Additionally, in San Francisco Nortrak is involved in Phase 2 of the BART (Bay Area Rapid Transit) Hayward Maintenance Complex project, which requires concrete ties, fastening components, turnouts, rail and switch machines, and site preparation and project management.

VOSSLOH TIE TECHNOLOGIES (VTT)/ROCLA CONCRETE TIE INC.

VTT/Rocla Concrete Tie has been producing and supplying ties from its new Canadian plant, which offers heavy-haul, transit and industrial concrete ties and has the capacity to produce more than 250,000 concrete ties per year.

“The Canadian transit and industrial rail market continues to grow as customers are choosing a more cost-efficient, sustainable and longer-lasting product that withstands the demanding Canadian environment year round over traditional ties,” the company told Railway Age. “We have seen a significant reduction in track-outage time when concrete ties have been installed in areas that are prone to flooding and wildfires. Additionally, with the market fluctuations in steel and timber, concrete ties have been the least volatile of all crosstie types in regards to price changes, remaining the lowest upfront and installed cost for new track construction.”

VTT/Rocla Concrete Tie has been producing concrete ties fixed with Under Tie Pads (UTPs). “The demand continues to grow each year as testing data taken over the past several years has shown that concrete ties paired with UTPs drastically expands the life-cycle cost of the ties, ballast and track super structure,” the company said.

WILVACO

Wilvaco provides crosstie repair materials to all Class I railroads, which have continued to follow their annual m/w programs, according to Vice President-Performance Products Division Rob Loomis. “While we haven’t seen any real change due to global or political conditions, I do know there is a significant impact from inflation to gas prices on everybody,” he told Railway Age. COVID’s impact remains, but it won’t be as significant this year since materials availability has improved, Loomis noted. Inflated raw material costs also remain: “After 27 years of being in this business, I suspect we have reached a new plateau of costs. I don’t see them going down, and if they do, we will pass the reduced costs on to our customers.” In the long term, IIJA “will definitely be positive for the Class I’s,” Loomis said. “We’re a little downstream, but hopefully we’ll benefit for the work that we provide them.”

Wilvaco is working most often now on waterproofing bridge decks and performing structural repairs to bridges, including bearing pad repairs. Last year, it introduced Spike Fast IJ-30, an insulated joint repair material that cures in place to isolate the signal and ensure it does not shunt between rails. “It saves railroads time,” Loomis said. “They can quickly and easily make the repair and schedule it for a permanent repair in the future.”

OMAHA TRACK

For Omaha Track, tie disposal has been static, and the company has been pursuing new opportunities for disposal, according to President Jeff Peterson. The company is looking into a new process in which ties are ground for an end-user fuel source—different from cogeneration power-plant fuel, the consumers of which are diminishing—he told Railway Age.

Additionally, the company is advocating the use of second-hand ties in landscaping. “The ties are of value,” Peterson explained, “because A) you’re taking this repurposed wood product, which is mostly carbon, that homeowners and contractors can use to offset [the cost] of other building materials, such as concrete blocks that have a pretty substantial carbon footprint. And B) reuse sequesters that [crosstie] carbon for another 50 years, in some instances.”

As long as the creosote-treated ties are used responsibly, he said, they can serve a new purpose—in walls, for instance. (Peterson said the company does not recommend installing second-hand ties in raised gardens or sandboxes or using them near livestock, however.)

“We see this as a more environmentally responsible way to manage some of these second-hand ties,” Peterson said. “Some railroads demand that you destroy the ties, and others have been become more lenient on repurposed use. But we are actively marketing and petitioning the railroads to see these second-hand repurposing opportunities as an environmental benefit.”