Wabtec 1Q23: ‘Strong Start to 2023’

Written by Carolina Worrell, Senior Editor

“The Wabtec team delivered a strong start to 2023 demonstrating continued momentum across both our Freight and Transit segments supporting a double-digit percentage increase in earnings per share,” said President and CEO Rafael Santana, who noted during an April 26 earnings report that the company “remained resilient in the face of considerable macro-economic challenges by focusing on operational excellence as we continued to deliver for our customers and shareholders.”

For first-quarter 2023, Wabtec reported GAAP earnings per diluted share of $0.93, up 16.3% compared to the prior-year period’s $0.80. Adjusted earnings per diluted share were $1.28, up 13.3% compared to the prior-year period’s $1.13.

“The underlying business fundamentals strengthened in the first quarter despite a challenging environment,” said Santana.

According to Wabtec, sales came in at $2.19 billion, growing 13.9% from the $1.93 billion posted during the same quarter last year. The company attributed this to “significantly higher Freight segment sales and increased Transit segment sales.” On a constant currency basis, consolidated sales were up 16.8%.

GAAP operating margin was slightly higher than prior year at 12.6%; adjusted operating margin was slightly lower at 16.4%. Both increased from 2022 “due to higher sales, partially offset by higher interest expense,” Wabtec reported.

At March 31, 2023, multi-year backlog was $425 million lower than at March 31, 2022, Wabtec said. Excluding unfavorable foreign currency exchange, the multi-year backlog decreased $101 million, down 0.4%. At March 31, 2023, the company’s 12-month backlog was $294 million higher than at March 31, 2022.

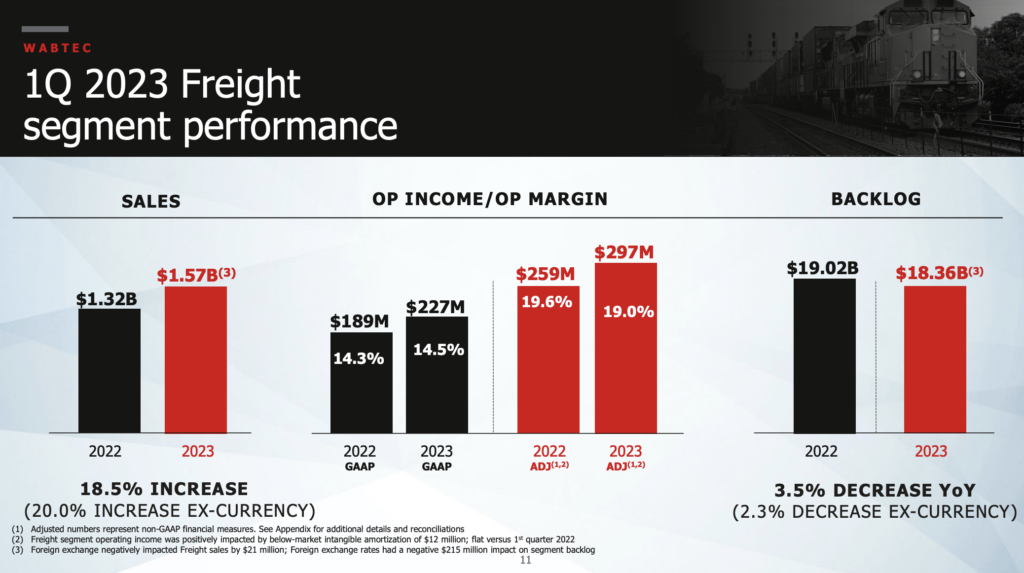

Freight segment sales for first-quarter 2023 were up across all product lines, with “very strong growth in Equipment, Components and Digital Intelligence,” according to Wabtec. On a constant currency basis, Freight segment sales were up 20.0%.

“Both GAAP and adjusted operating margins benefited from higher sales and operational efficiencies, offset by unfavorable sales mix between business groups and higher next generation product development costs in our Digital Intelligence business,” Wabtec reported.

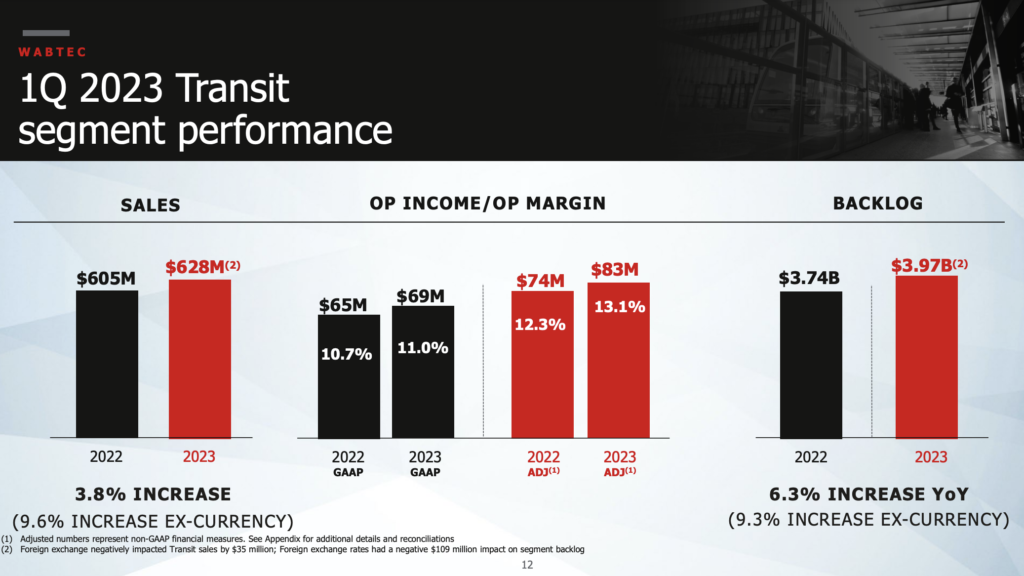

For first-quarter 2023, Transit segment sales were up “due to strong aftermarket sales partially offset by unfavorable foreign currency exchange.” On a constant currency basis, Transit segment sales were up 9.6%. GAAP and adjusted operating margins were up “as a result of higher sales and Integration 2.0 savings,” Wabtec reported.

According to Wabtec, for first-quarter 2023, cash used for operations was $25 million versus cash provided from operations of $161 million in the year ago period “due primarily to higher working capital.”

At the end of the quarter, Wabtec had cash, cash equivalents and restricted cash of $417 million and total debt of $4.16 billion. At March 31, 2023 the Wabtec’s total available liquidity was $2.01 billion, which includes cash, cash equivalents and restricted cash plus $1.59 billion available under current credit facilities.

During the first quarter, Wabtec repurchased $178 million of shares and raised the regular quarterly common dividend by 13% to 17 cents per share.

2023 Outlook

Wabtec said its financial guidance “continues with sales expected to be in a range of $8.7 billion to $9.0 billion and adjusted earnings per diluted share to be in a range of $5.15 to $5.55.

“For full year 2023, Wabtec expects strong cash flow generation with operating cash flow conversion of greater than 90%.”

“Looking forward, Wabtec is well-positioned to navigate the current economic environment, and we remain confident in our ability to execute against our strategic growth plans as we deliver for our customers. Our differentiated portfolio of products and technologies, expansive global installed base, and multi-year backlog position us to remain highly resilient and drive long-term profitable growth for our shareholders,” Santana added.

The Wabtec website provides more earnings details.

TD Cowen Insight: Strong Results; Guidance Affirmed; Backlog Solid

“Wabtec reported a top-to-bottom beat to our and consensus estimates,” reported TD Cowen OEM Transportation Analyst Matt Elkott. “It maintained FY23 guidance despite macro uncertainty, and management noted that underlying business fundamentals strengthened in the first quarter despite a challenging environment.”

TD Cowen’s Key Takeaways:

- “1Q23 adjusted EPS of $1.28 beat our and the consensus estimates of $1.25 and $1.19, respectively. Adjusted operating income of $360.0 MM compared to our and consensus estimates of $345.6MM and $326.9MM, respectively.

- “Management noted that underlying business fundamentals strengthened in the first quarter despite a challenging environment. We look to gain more insight into this on the earnings call.

- “The company guided for EPS of $5.15 to $5.55, with a $5.35 midpoint, unchanged from the prior guidance (Consensus $5.38, TD Cowen $5.55). It guided for revenue of $8,700 MM to $9,000 MM, with an $8,850 MM midpoint, also unchanged from prior guidance (Consensus $8,882MM, TD Cowen $8,824 MM).

- “The backlog remains strong. 12-Month Backlog in 1Q23 was up 2.5% sequentially and up 4.4% y/y. The Total Backlog in 1Q23 was down 0.3% sequentially and down 2% y/y, however excluding unfavorable foreign currency exchange it was down 0.4% y/y.

- “Freight sales were up across all product lines, with very strong growth in Equipment, Components and Digital Intelligence. The company noted that, on a constant currency basis, freight sales were up 20.0%. The company indicated that operating margins benefited from higher sales and operational efficiencies, offset by unfavorable sales mix between business groups and higher next generation product development costs in Digital Intelligence business.

- “WAB noted that transit sales were up due to strong aftermarket sales partially offset by unfavorable foreign currency exchange. On a constant currency basis, transit sales were up 9.6%. Operating margins were up as a result of higher sales and Integration 2.0 savings.”